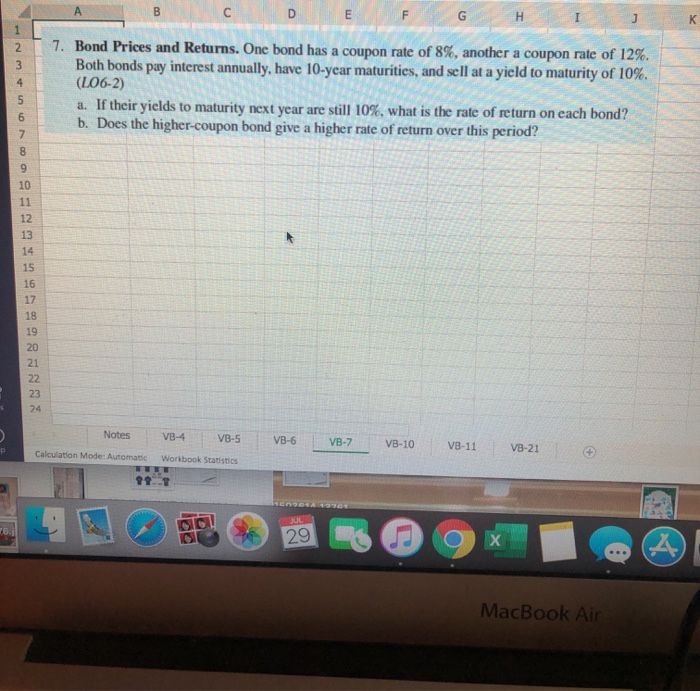

Question: can you help step-by-step so I can enter into Excel. B D m F H K 1 7. Bond Prices and Returns. One bond has

B D m F H K 1 7. Bond Prices and Returns. One bond has a coupon rate of 8%, another a coupon rate of 12%. Both bonds pay interest annually, have 10-year maturities, and sell at a yield to maturity of 10%. (L06-2) a. If their yields to maturity next year are still 10%, what is the rate of return on each bond? b. Does the higher-coupon bond give a higher rate of return over this period? 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 5 Notes VB-4 VB-5 VB-6 VB-7 VB-10 VB-11 P VB-21 Calculation Mode: Automatic Workbook Statistics 1921 76 29 MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts