Question: can you help with part a,b and c ? 5. ABC rental car company purchased 10 new cars for a total cost of $200,000. The

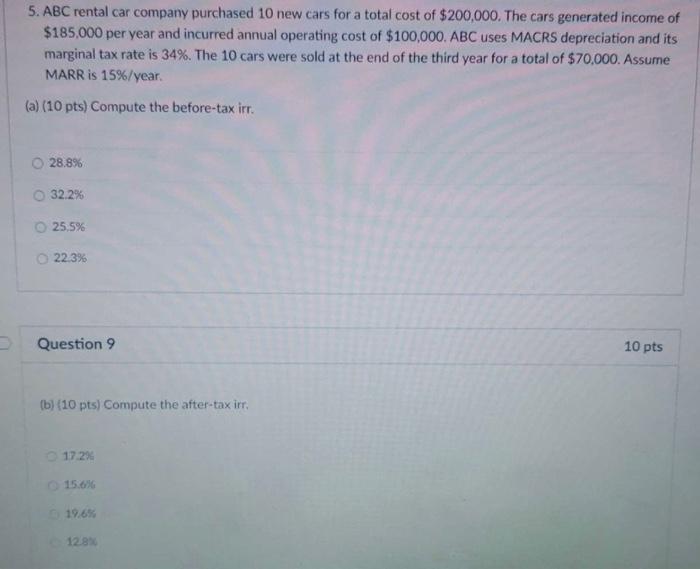

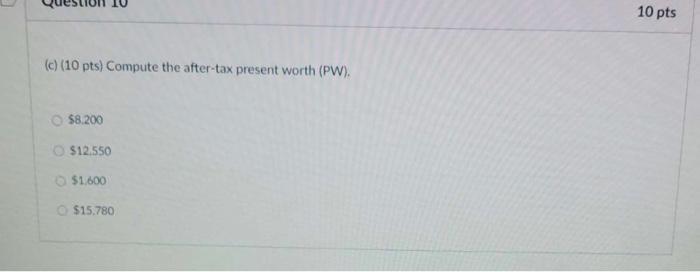

5. ABC rental car company purchased 10 new cars for a total cost of $200,000. The cars generated income of $185,000 per year and incurred annual operating cost of $100,000. ABC uses MACRS depreciation and its marginal tax rate is 34%. The 10 cars were sold at the end of the third year for a total of $70,000. Assume MARR is 15%/year. (a) (10 pts) Compute the before-tax irr. O 28.8% 32.2% 25,5% 22.3% Question 9 10 pts (b) (10 pts) Compute the after-tax irr, 17.2% 15.6% 19.65 128 10 pts (c) (10 pts) Compute the after-tax present worth (PW). $8.200 $12.550 $1,600 $15.780 5. ABC rental car company purchased 10 new cars for a total cost of $200,000. The cars generated income of $185,000 per year and incurred annual operating cost of $100,000. ABC uses MACRS depreciation and its marginal tax rate is 34%. The 10 cars were sold at the end of the third year for a total of $70,000. Assume MARR is 15%/year. (a) (10 pts) Compute the before-tax irr. O 28.8% 32.2% 25,5% 22.3% Question 9 10 pts (b) (10 pts) Compute the after-tax irr, 17.2% 15.6% 19.65 128 10 pts (c) (10 pts) Compute the after-tax present worth (PW). $8.200 $12.550 $1,600 $15.780

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts