Question: Can you help with solution to problem EX 17-13 below? Chapter 17: Financial Statement Analysis inventory once an order is received. Selected financial information for

Can you help with solution to problem EX 17-13 below?

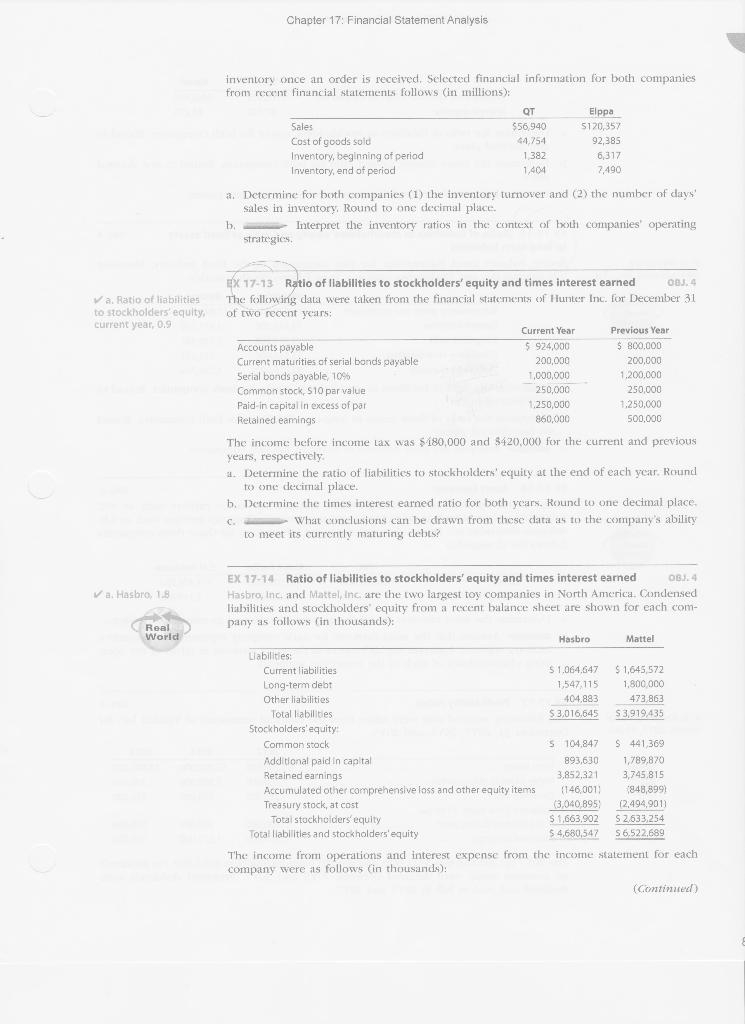

Chapter 17: Financial Statement Analysis inventory once an order is received. Selected financial information for both companies from recent financial statements follows (in millions): Q Elppa Sales $56,940 $120,357 Cost of goods sold 44,754 92,385 Inventory, beginning of period 1.382 6,317 Inventory, end of period 1,404 7.490 a. Determine for both companies (1) the inventory turnover and (2) the number of days' sales in inventory, Round to onc decimal place. b. Interpret the inventory ratios in the context of both companies' operating strategies. a. Ratio of liabilities to stockholders' equity, current year, 0.9 EX 17-13 Ratio of liabilities to stockholders' equity and times interest earned OBJ. 4 The following data were taken from the financial statements of Hunter Inc. for December 31 of two recent years: Current Year Previous Year Accounts payable $ 924,000 $ 800,000 Current maturities of serial bonds payable 200,000 200,000 Serial bonds payable, 10% 1,000,000 1,200,000 Common stock, 510 par value 250,000 250,000 Paid-in capital in excess of par 1,250,000 1.250.000 Relained eamings 860,000 500,000 The income before income tax was $180,000 and $420,000 for the current and previous years, respectively 2. Determine the ratio of liabilities to stockholders' equity at the end of each year. Round to one decimal place. b. Determine the times interest earned ratio for both years. Round to one decimal place, What conclusions can be drawn from these data as to the company's ability to meet its currently maturing debts? a. Hasbro, 1.8 Real World EX 17-14 Ratio of liabilities to stockholders' equity and times interest earned OBJ. 4 Hasbro, Inc and Mattel, Inc. are the two largest toy companies in North America. Condensed liabilities and stockholders' equity from a recent balance sheet are shown for each com- pany as follows (in thousands): Hasbro Mattel Liabilities: Current liabilities $ 1,064,647 $ 1.645,572 Long-term debt 1,547,115 1,800,000 Other liabilities 404.883 473,863 Total liabilities $ 3,016,645 $3,919,435 Stockholders'equity: Common stock $ 104,847 $441,369 Additional paid in capital 893,630 1,789,870 Retained earnings 3,852,321 3,745,815 Accumulated other comprehensive loss and other equity items (146,001) (848,899) Treasury stock, at cost (3,040,895) (2,494,901) Total stockholders' equity $ 1,663,902 S2,633,254 Total llabilities and stockholders'equity $ 4,680,547 S6,522,689 The income from operations and interest expense from the income statement for each company were as follows (in thousands): (Continued)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts