Question: Can you help with this accounting exercise? Please, read instructions carefully before answering and use expanded accounting equaton (Excel Table). Remember, excel table to answer.

Can you help with this accounting exercise?

Please, read instructions carefully before answering and use expanded accounting equaton (Excel Table).

Remember, excel table to answer.

Thank you.

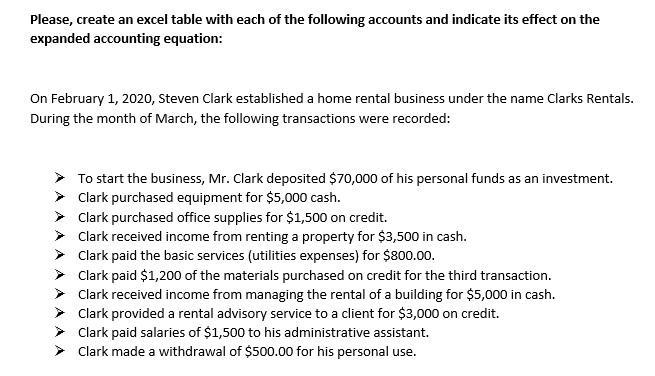

Please, create an excel table with each of the following accounts and indicate its effect on the expanded accounting equation: On February 1, 2020, Steven Clark established a home rental business under the name Clarks Rentals. During the month of March, the following transactions were recorded: To start the business, Mr. Clark deposited $70,000 of his personal funds as an investment. Clark purchased equipment for $5,000 cash. Clark purchased office supplies for $1,500 on credit. Clark received income from renting a property for $3,500 in cash. Clark paid the basic services (utilities expenses) for $800.00. Clark paid $1,200 of the materials purchased on credit for the third transaction. Clark received income from managing the rental of a building for $5,000 in cash. Clark provided a rental advisory service to a client for $3,000 on credit. Clark paid salaries of $1,500 to his administrative assistant. > Clark made a withdrawal of $500.00 for his personal use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts