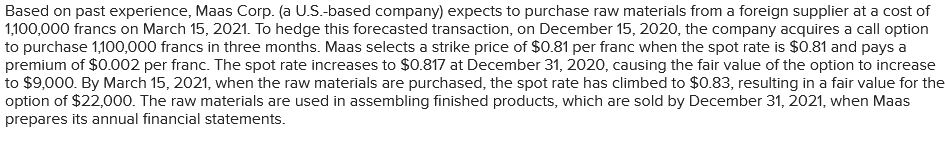

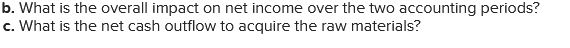

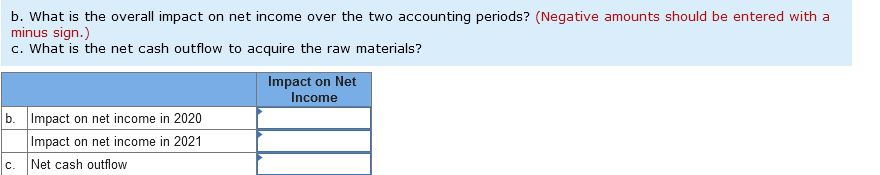

Question: Can you help with this? Based on past experience, Maas Corp. {a U.S.based company} expects to purchase raw materials from a foreign supplier at a

Can you help with this?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock