Question: can you help with this instead? unsle - age Layout Formulas Data Review View Developer Help Comments -Files from the Internet can contain viruses. Unless

can you help with this instead?

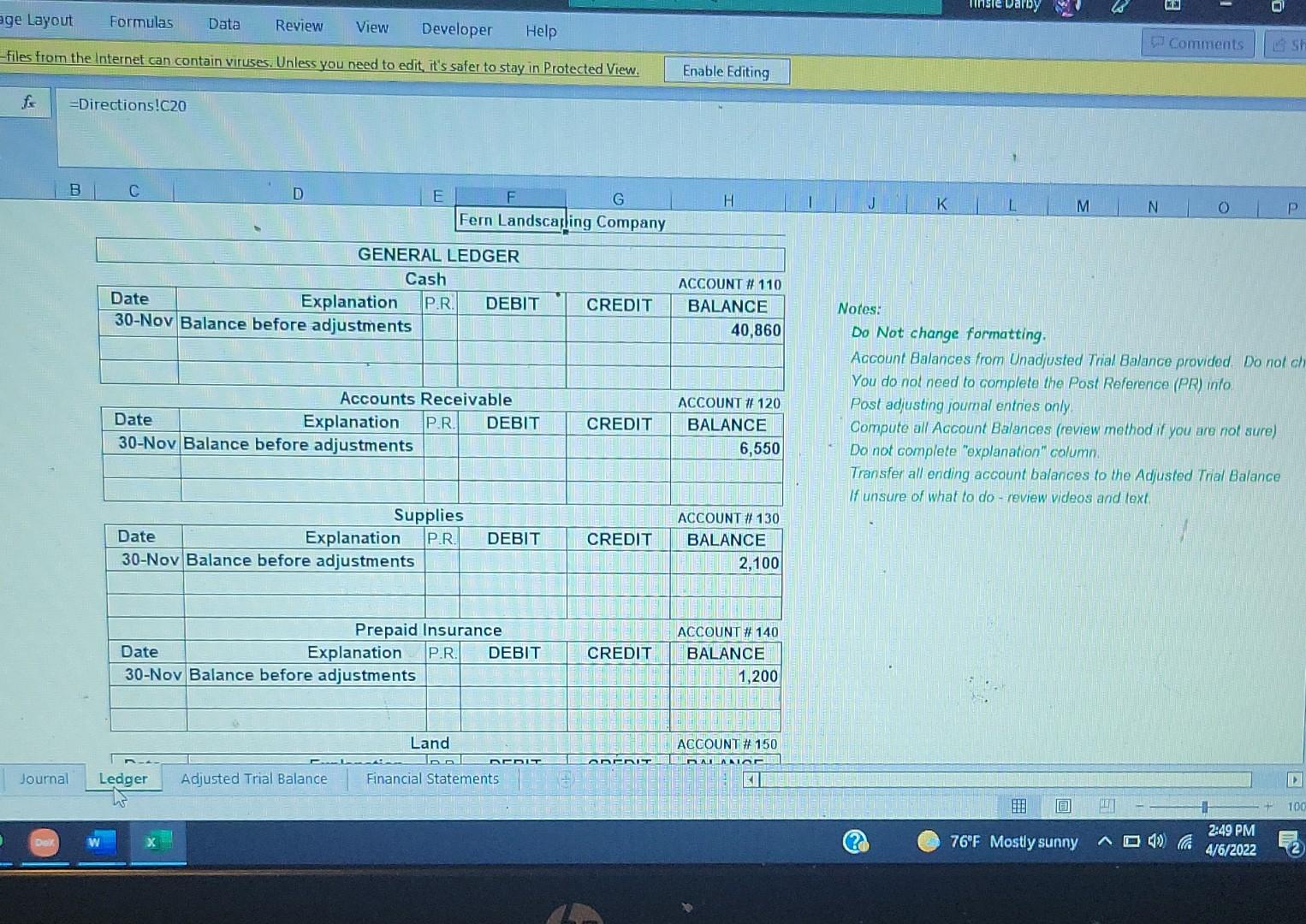

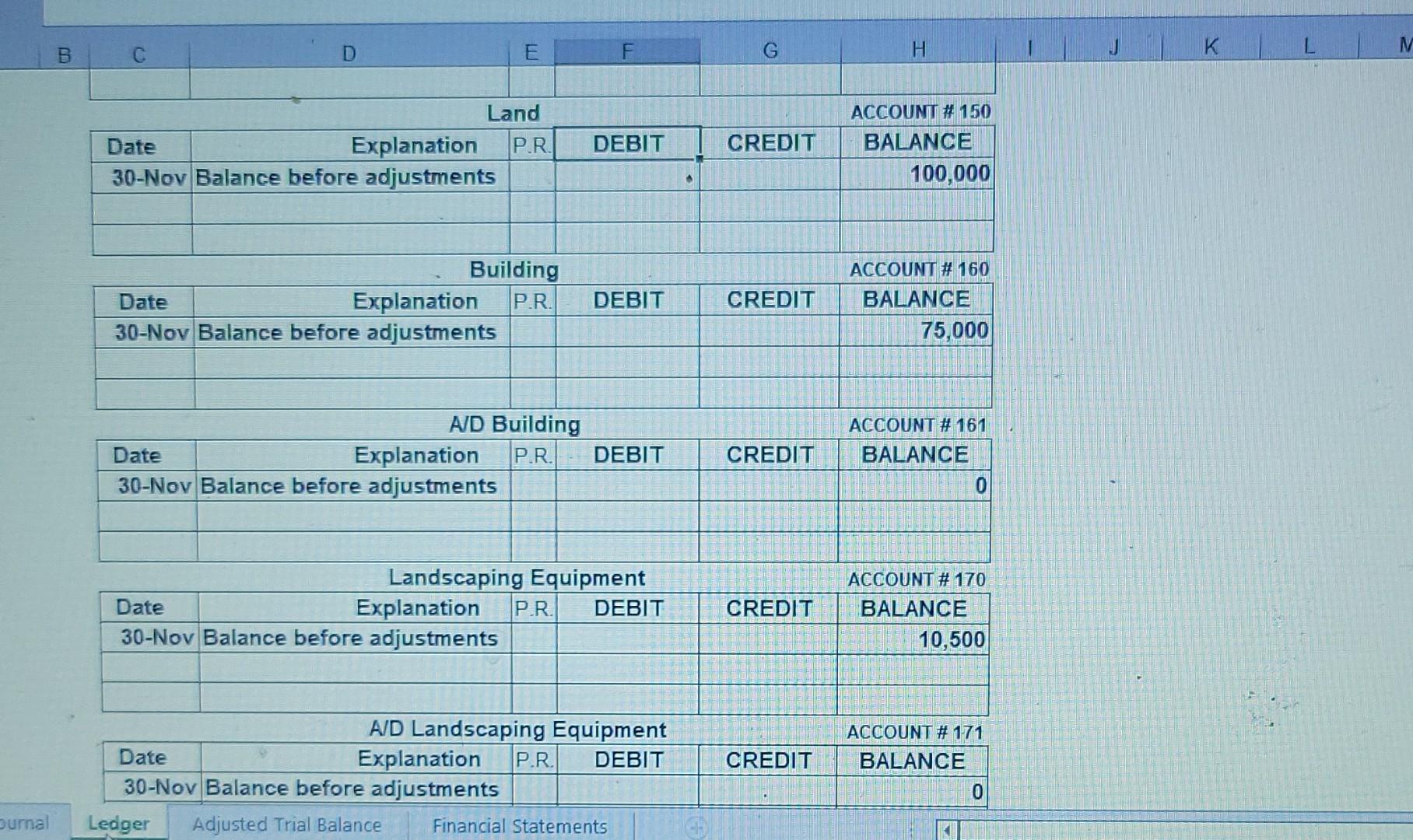

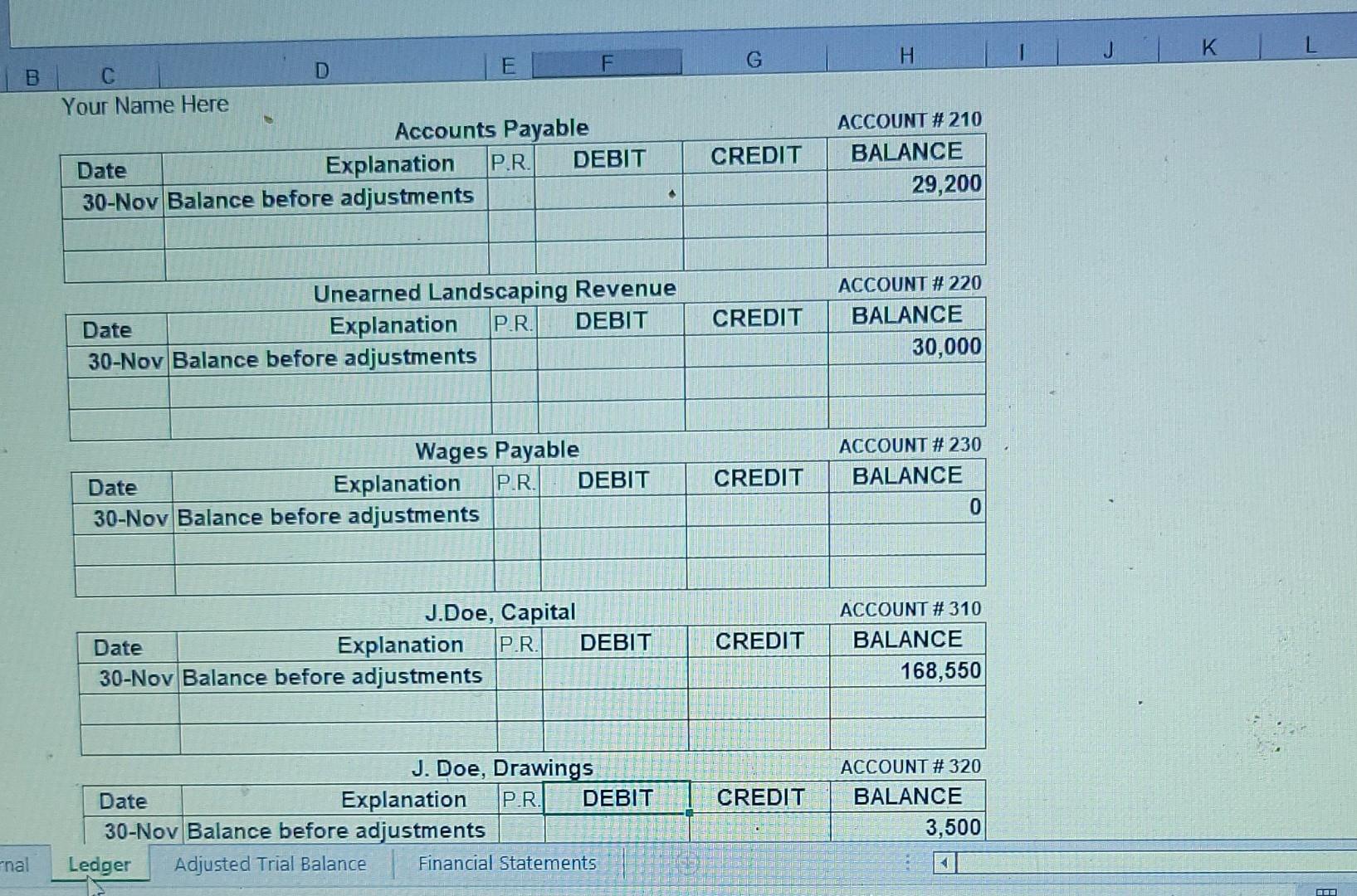

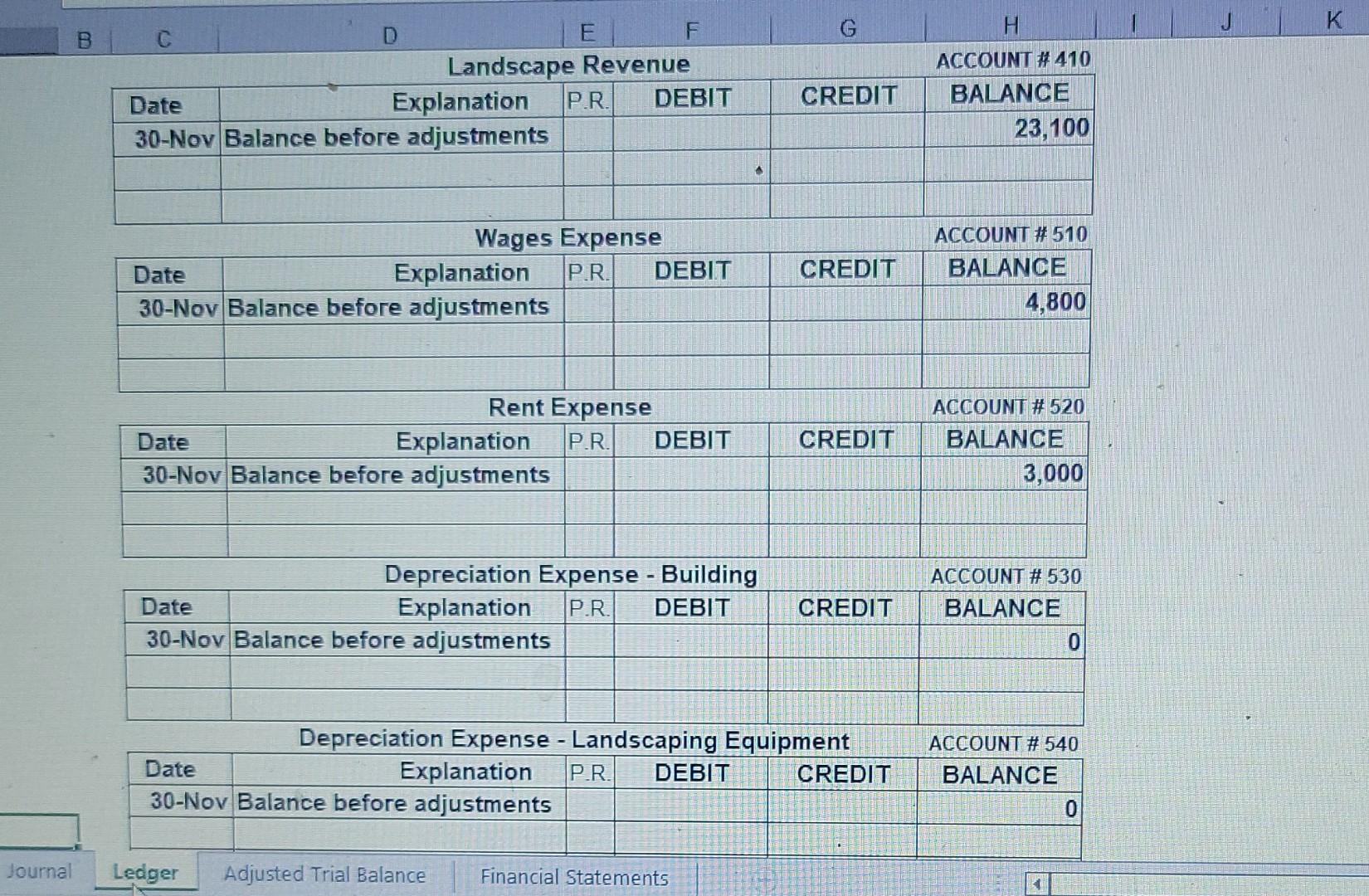

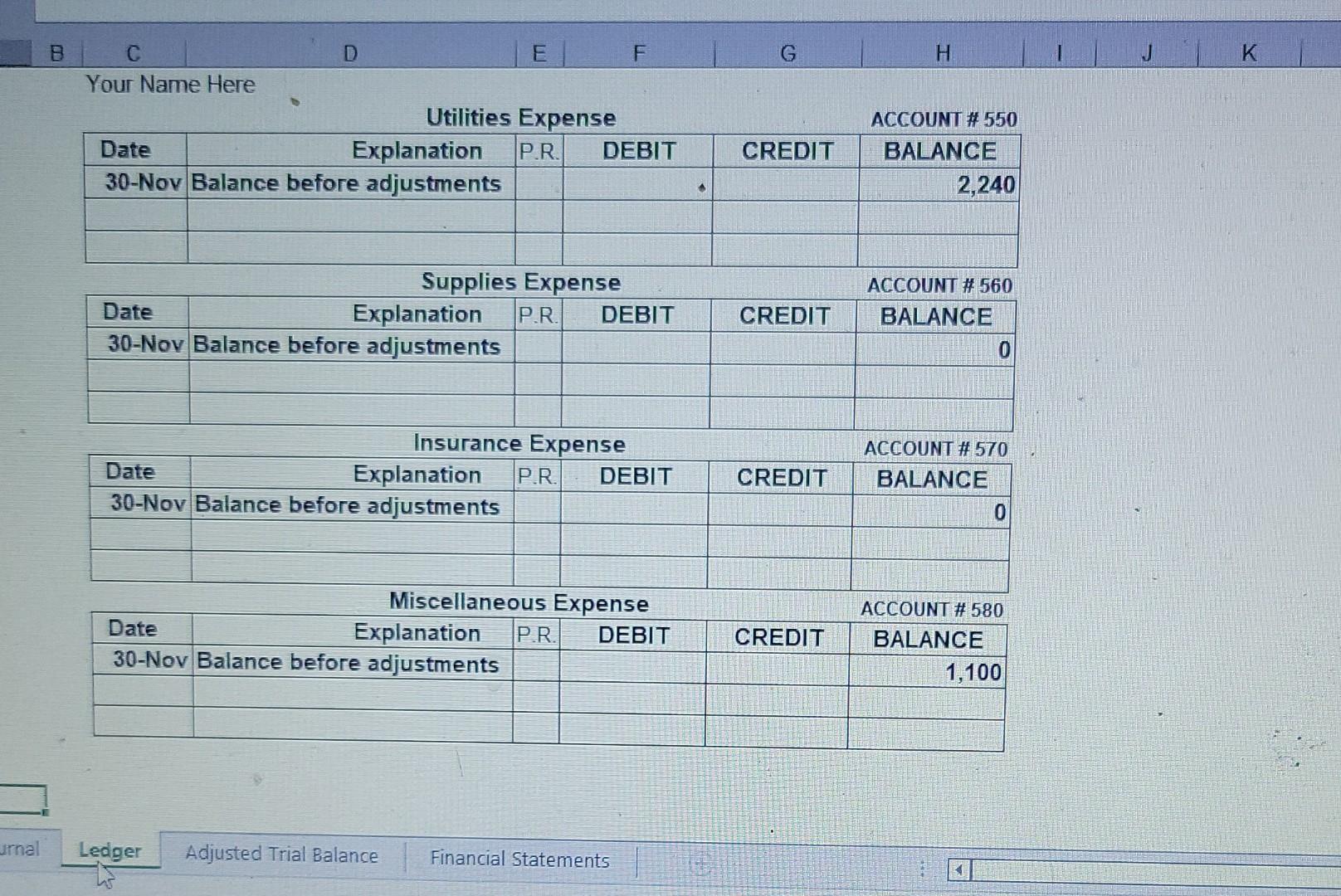

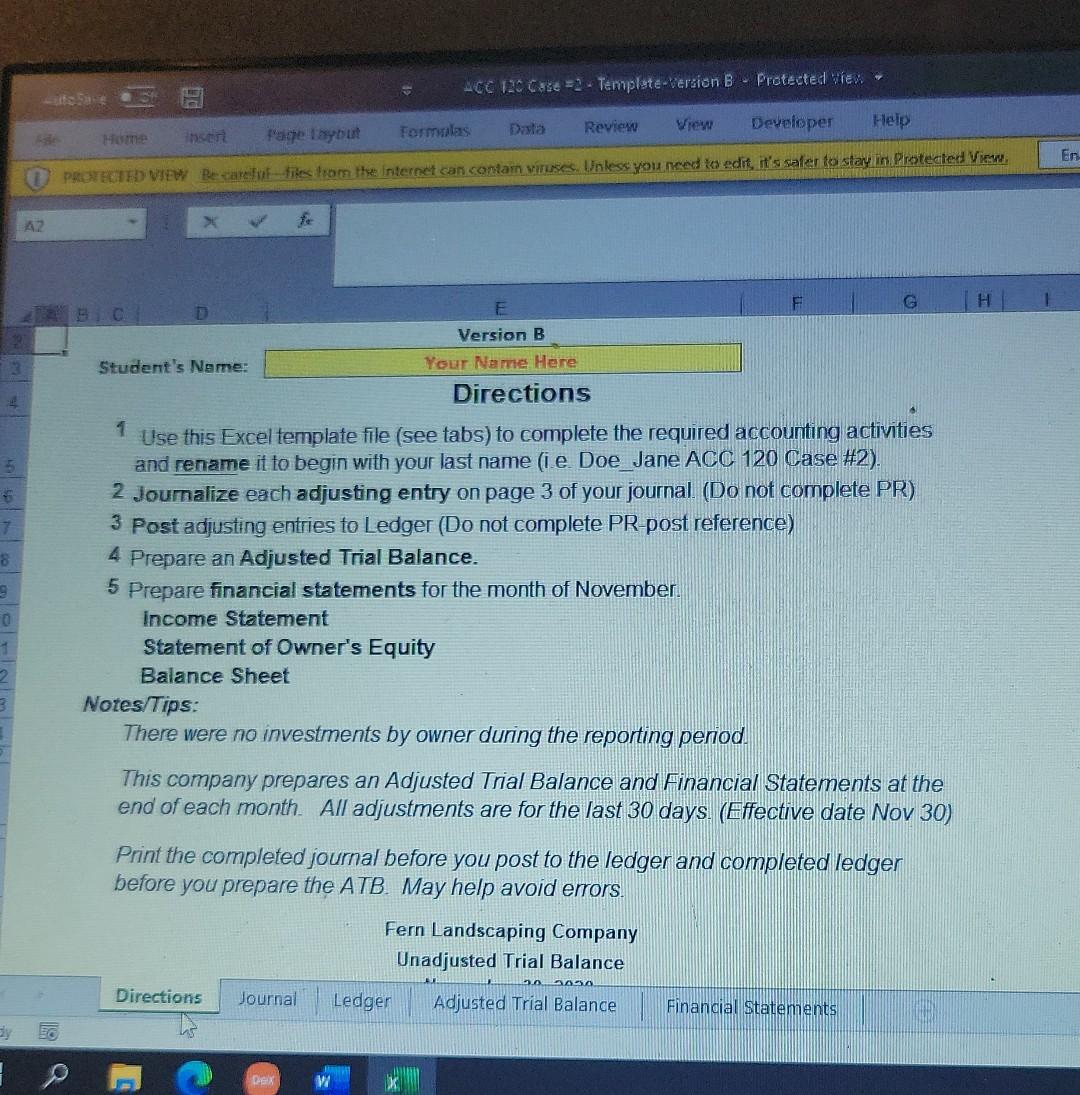

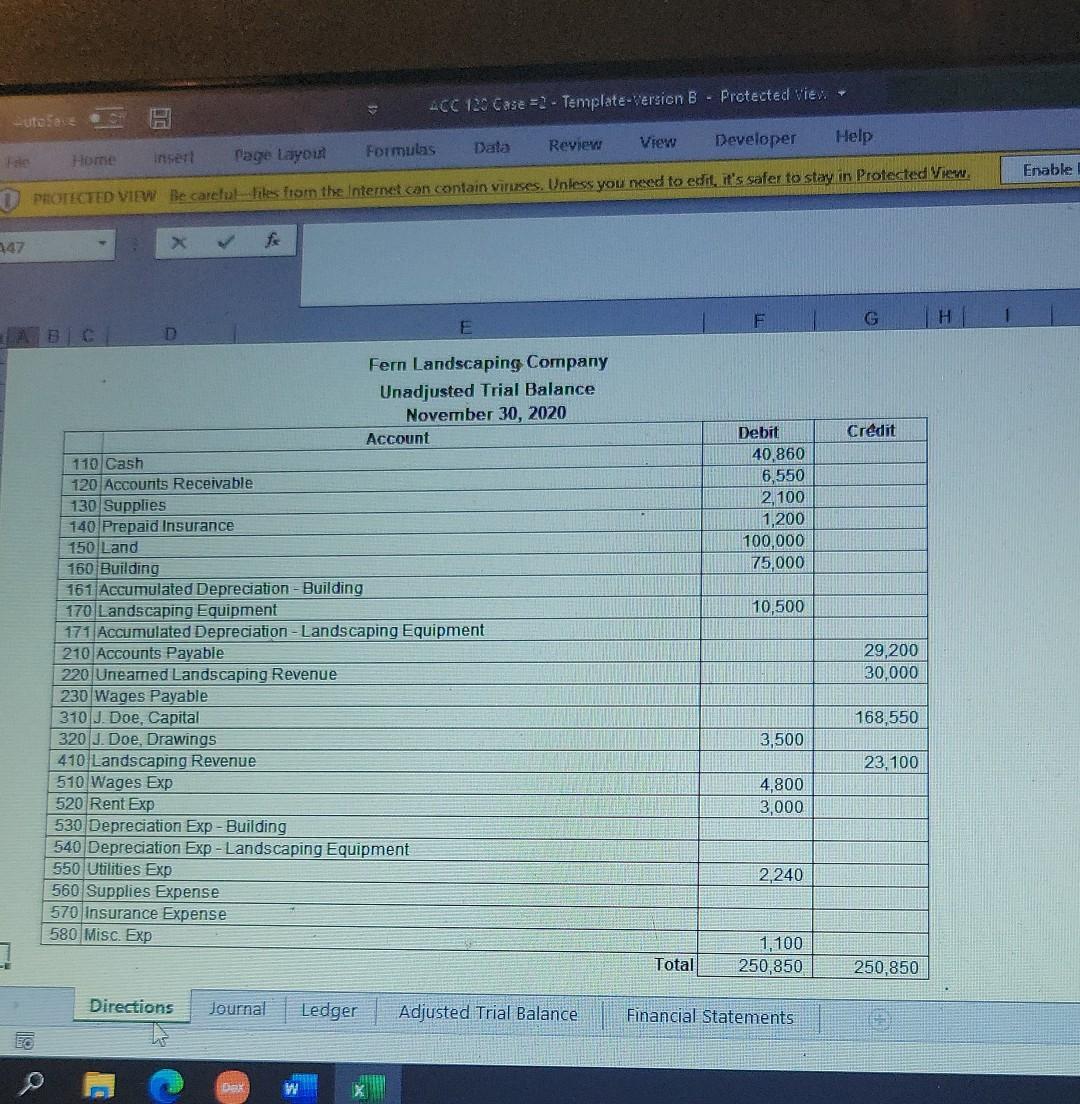

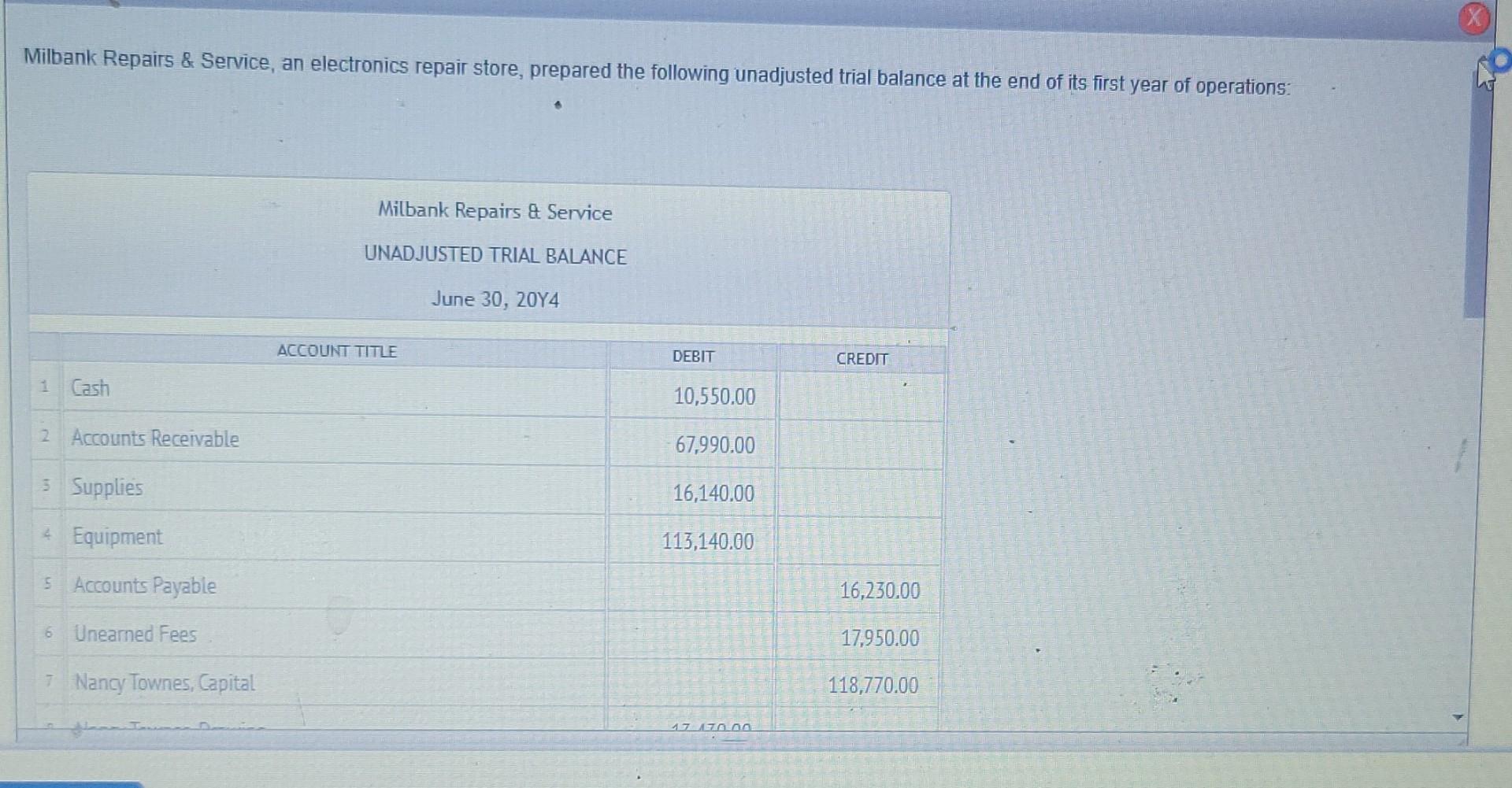

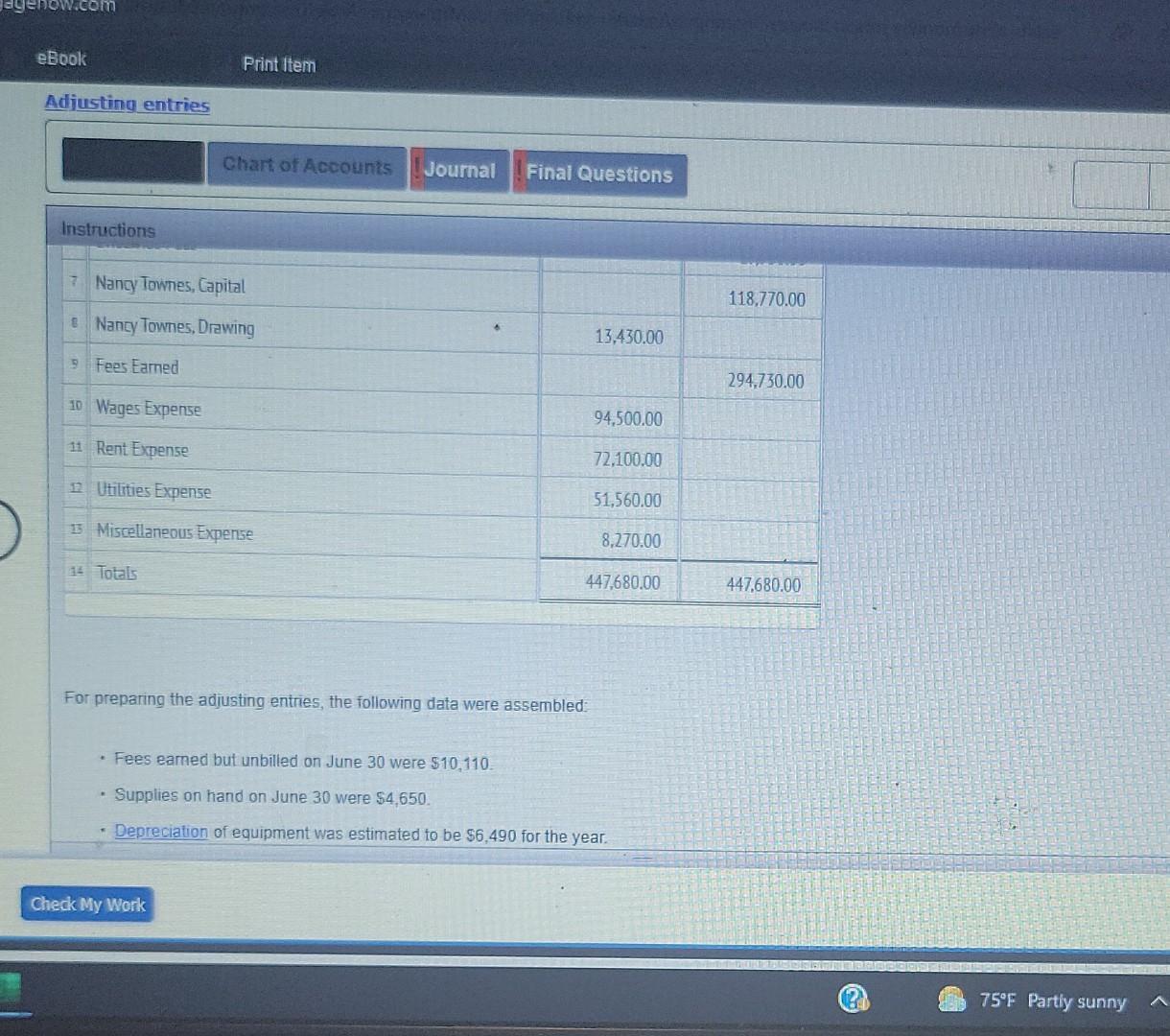

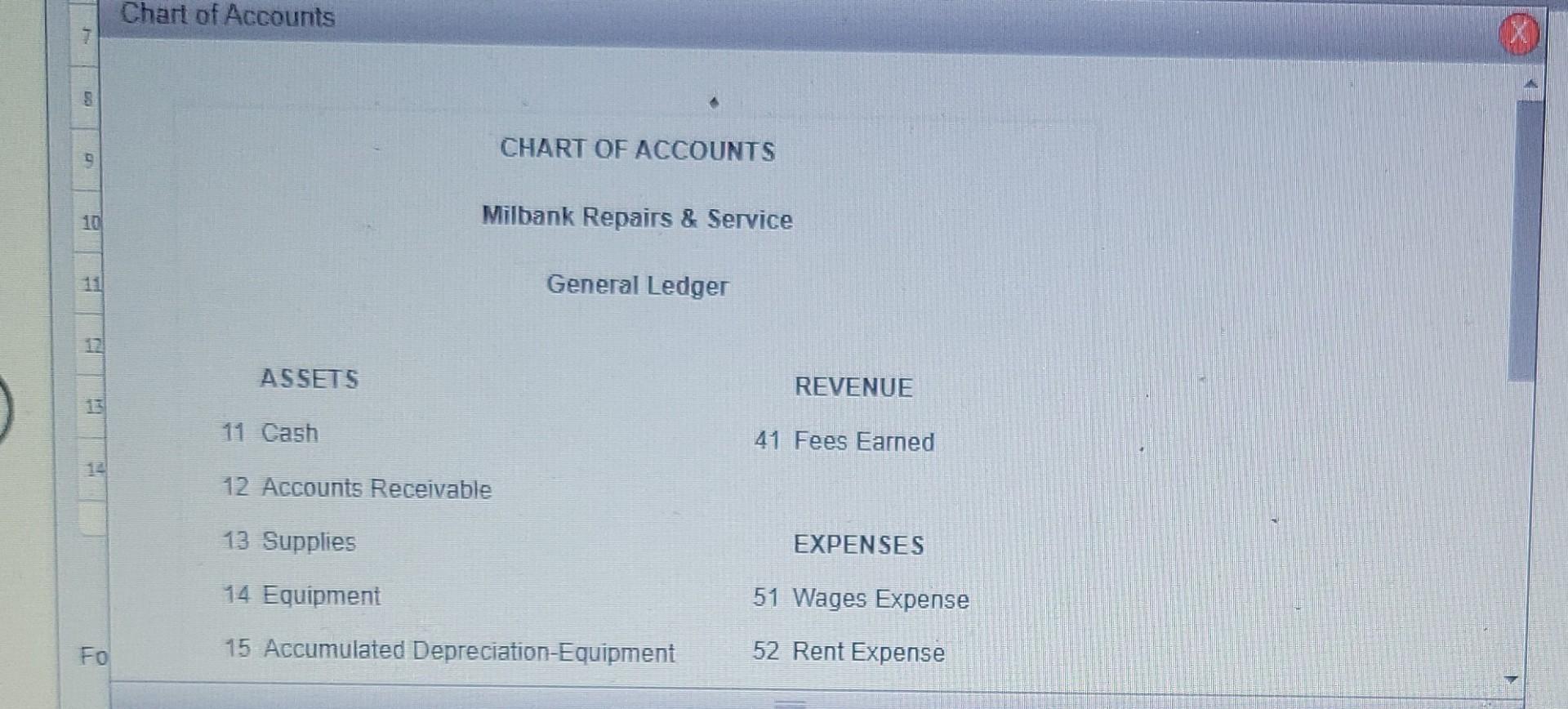

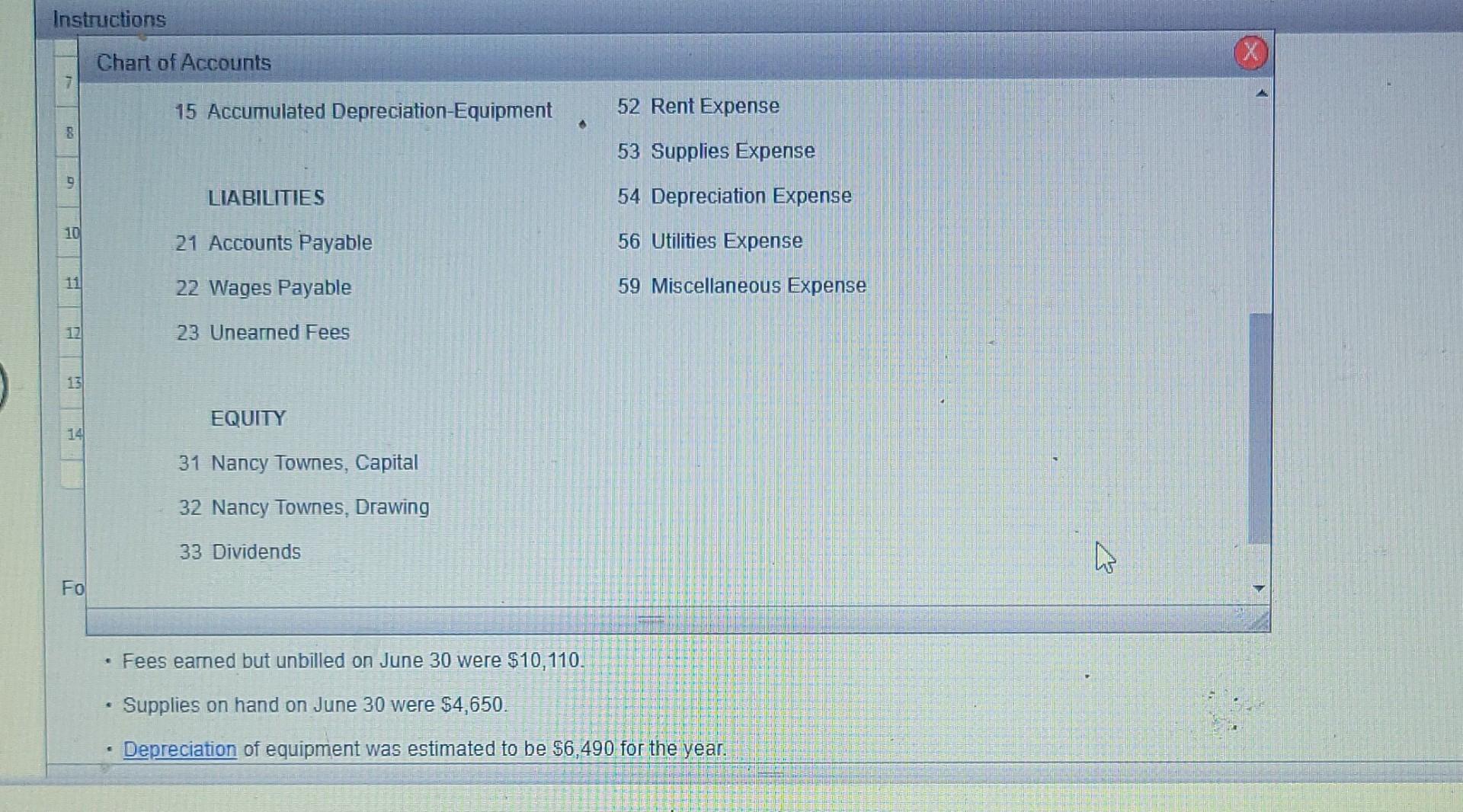

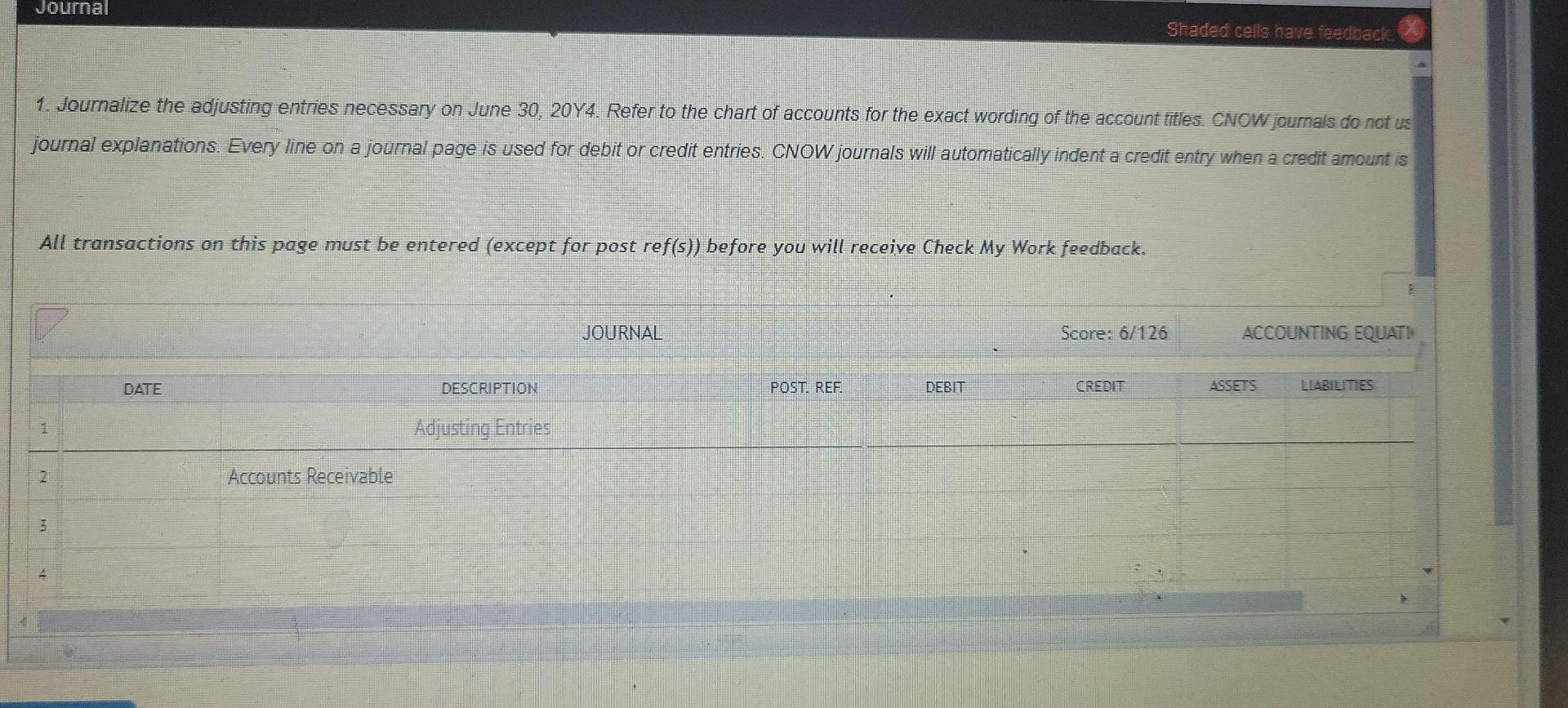

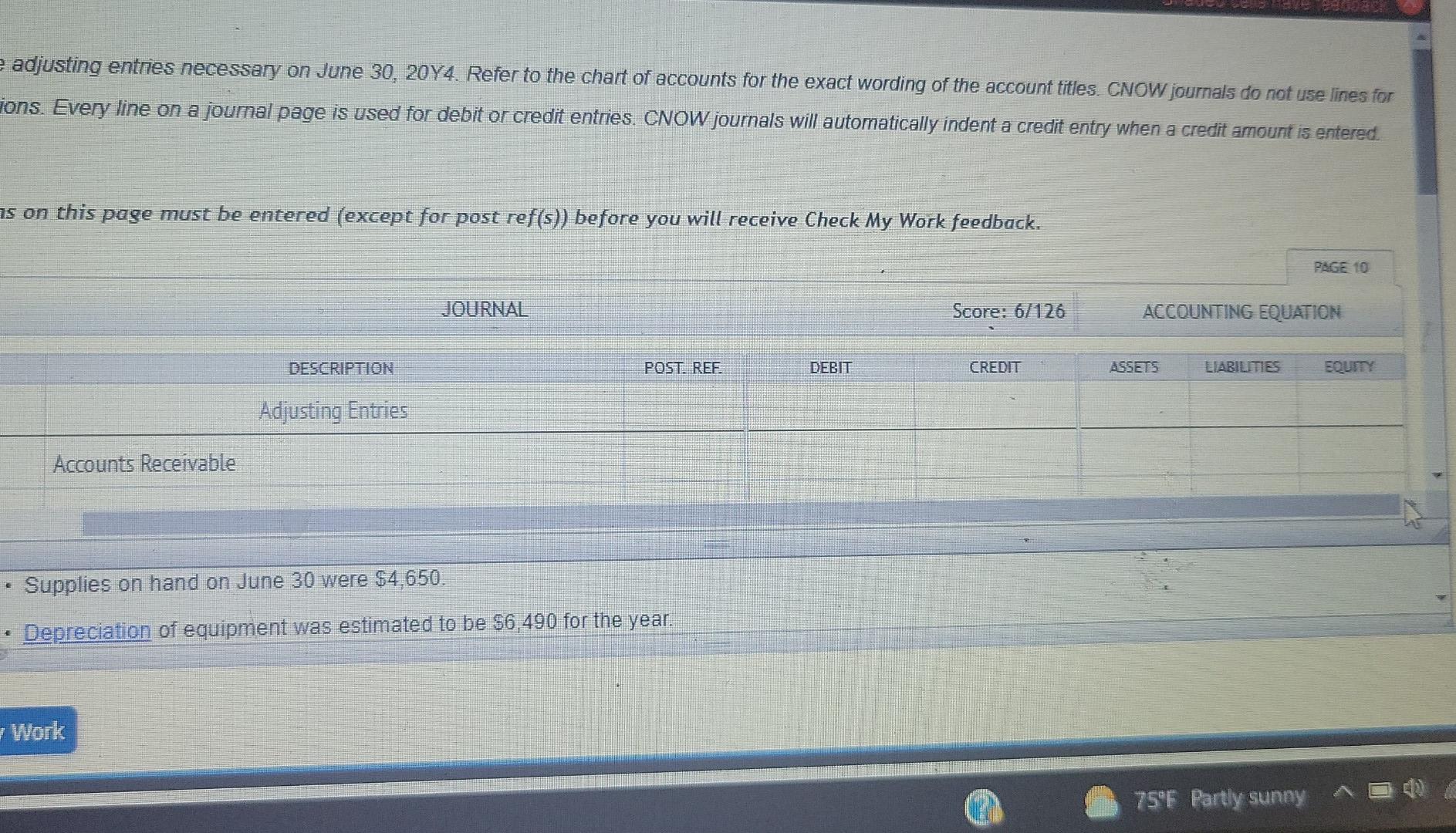

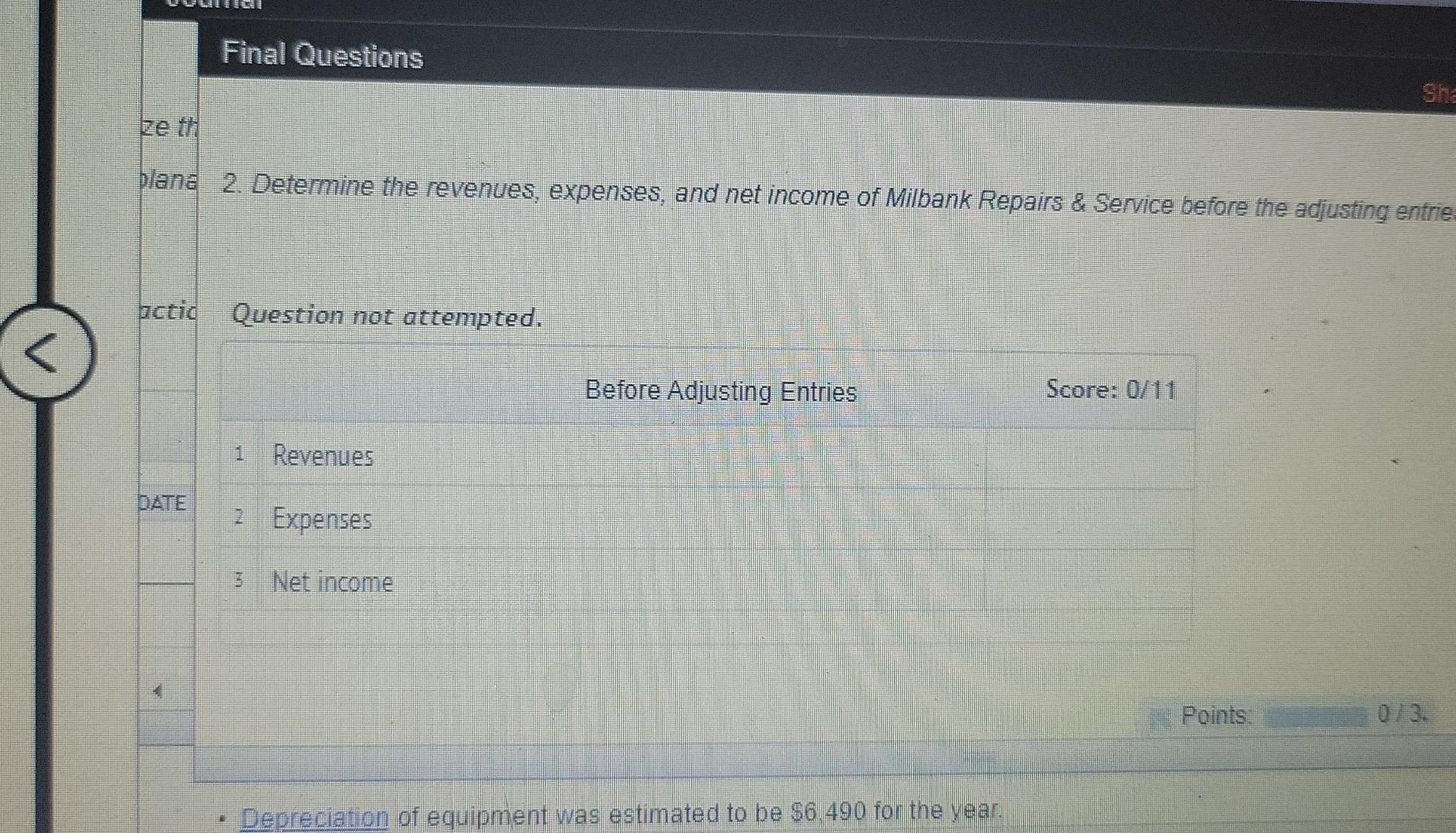

unsle - age Layout Formulas Data Review View Developer Help Comments -Files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing Directions!C20 D EF G Fern Landscaping Company . J K M N O P GENERAL LEDGER Cash Date Explanation P.R DEBIT 30-Nov Balance before adjustments CREDIT ACCOUNT # 110 BALANCE 40,860 Accounts Receivable Date Explanation P.R DEBIT 30-Nov Balance before adjustments Notes: Do Not change formatting. Account Balances from Unadjusted Trial Balance provided Do not ch You do not need to complete the Post Reference (PR) into Post adjusting journal entres only Compute all Account Balances (review method if you are not sure) Do not complete "explanation" column Transfer all ending account balances the Adjusted Trial Balance If unsure of what to do - review videos and text ACCOUNT # 120 BALANCE 6,550 CREDIT Supplies Date Explanation 30-Nov Balance before adjustments P.R. DEBIT CREDIT ACCOUNT # 130 BALANCE 2,100 Prepaid Insurance Date Explanation P.R. DEBIT 30-Nov Balance before adjustments CREDIT ACCOUNT # 140 BALANCE 1,200 ACCOUNT # 150 Land ani DEDIT Financial Statements ann RANNO Journal Ledger Adjusted Trial Balance 100 W ? 76F Mostly sunny ^ ( a 2:49 PM 4/6/2022 D E G M KIL H Land Date Explanation PR 30-Nov Balance before adjustments DEBIT CREDIT ACCOUNT # 150 BALANCE 100,000 . Building Date Explanation PR 30-Nov Balance before adjustments DEBIT CREDIT ACCOUNT # 160 BALANCE 75,000 A/D Building Date Explanation P.R. 30-Nov Balance before adjustments ACCOUNT # 161 BALANCE DEBIT CREDIT 0 Landscaping Equipment Date Explanation PR DEBIT 30-Nov Balance before adjustments CREDIT ACCOUNT # 170 BALANCE 10,500 P.R. ACCOUNT # 171 BALANCE CREDIT A/D Landscaping Equipment Date Explanation DEBIT 30-Nov Balance before adjustments Ledger Adjusted Trial Balance Financial Statements 0 ournal L H D E F Your Name Here Accounts Payable Date Explanation PR. DEBIT 30-Nov Balance before adjustments CREDIT ACCOUNT # 210 BALANCE 29,200 CREDIT Unearned Landscaping Revenue Date Explanation PR DEBIT 30-Nov Balance before adjustments ACCOUNT # 220 BALANCE 30,000 Wages Payable Date Explanation PR DEBIT 30-Nov Balance before adjustments CREDIT ACCOUNT # 230 BALANCE 0 J.Doe, Capital Date Explanation P.R. DEBIT 30-Nov Balance before adjustments CREDIT ACCOUNT # 310 BALANCE 168,550 CREDIT J. Doe, Drawings Date Explanation P.R. DEBIT 30-Nov Balance before adjustments Ledger Adjusted Trial Balance Financial Statements ACCOUNT # 320 BALANCE 3,500 nal NOO G K D F Landscape Revenue Date Explanation PR DEBIT 30-Nov Balance before adjustments H ACCOUNT #410 BALANCE 23,100 CREDIT Wages Expense Date Explanation P.R. DEBIT 30-Nov Balance before adjustments CREDIT ACCOUNT #510 BALANCE 4,800 Rent Expense Date Explanation P.R DEBIT 30-Nov Balance before adjustments CREDIT ACCOUNT # 520 BALANCE 3,000 Depreciation Expense - Building Date Explanation P.R. DEBIT 30-Nov Balance before adjustments CREDIT ACCOUNT # 530 BALANCE 0 Depreciation Expense - Landscaping Equipment Date Explanation PR DEBIT CREDIT 30-Nov Balance before adjustments ACCOUNT # 540 BALANCE 0 Journal Ledger Adjusted Trial Balance Financial Statements . K D E F Your Name Here Utilities Expense Date Explanation PR DEBIT 30-Nov Balance before adjustments CREDIT ACCOUNT # 550 BALANCE 2,240 Supplies Expense Date Explanation P.R. DEBIT 30-Nov Balance before adjustments ACCOUNT # 560 BALANCE CREDIT 0 Insurance Expense Date Explanation DEBIT 30-Nov Balance before adjustments ACCOUNT # 570 BALANCE PR CREDIT 0 Miscellaneous Expense Date Explanation PR DEBIT 30-Nov Balance before adjustments CREDIT ACCOUNT # 580 BALANCE 1,100 urnal Ledger Adjusted Trial Balance Financial Statements ACC 120 Cat = ? - Templete version B - Protected wie Review Data View Formalas Developer Help Home insert Page Thybut U PROTECTED VIEW Be care files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View A2 G H 1 5 8 BC D Version B Student's Name: Your Name Here Directions 1 Use this Excel template file (see tabs) to complete the required accounting activities and rename it to begin with your last name (ie. Doe_Jane ACO 120 Case #2) 2 Journalize each adjusting entry on page 3 of your journal. (Do not complete PR) 3 Post adjusting entries to Ledger (Do not complete PR-post reference) 4 Prepare an Adjusted Trial Balance. 5 Prepare financial statements for the month of November Income Statement Statement of Owner's Equity Balance Sheet Notes Tips: There were no investments by owner during the reporting penod. This company prepares an Adjusted Tral Balance and Financial Statements at the end of each month. All adjustments are for the last 30 days. (Effective date Nov 30) 9 0 1 Print the completed journal before you post to the ledger and completed ledger before you prepare the ATB. May help avoid errors. Fern Landscaping Company Unadjusted Trial Balance 09 Directions Journal Ledger Adjusted Trial Balance Financial Statements I DE ACC 130 Case Template-version B - Protected View - ute oss B Data Review View Developer Help Formulas Horne Insert Page Layout Enable PROTECTED VIEW Be careful files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View 47 F G HI 1 E D BC Fern Landscaping Company Unadjusted Trial Balance November 30, 2020 Account Credit Debit 40,860 6,550 2,100 1,200 100,000 75,000 10,500 29,200 30,000 110 Cash 120 Accounts Receivable 130 Supplies 140 Prepaid Insurance 150 Land 160 Building 161 Accumulated Depreciation - Building 170 Landscaping Equipment 171 Accumulated Depreciation - Landscaping Equipment 210 Accounts Payable 220 Uneamed Landscaping Revenue 230 Wages Payable 310 J. Doe, Capital 320 J. Doe. Drawings 410 Landscaping Revenue 510 Wages Exp 520 Rent Exp 530 Depreciation Exp - Building 540 Depreciation Exp - Landscaping Equipment 550 Utilities Exp 560 Supplies Expense 570 Insurance Expense 580 Misc. Exp 168,550 3,500 23.100 4,800 3,000 2,240 7 Total 1,100 250,850 250,850 Directions Journal Ledger Adjusted Trial Balance Financial Statements EC p D W Milbank Repairs & Service, an electronics repair store, prepared the following unadjusted trial balance at the end of its first year of operations: Milbank Repairs & Service UNADJUSTED TRIAL BALANCE June 30, 2014 ACCOUNT TITLE DEBIT CREDIT 1 Cash 10,550.00 2 Accounts Receivable 67,990.00 5 Supplies 16,140.00 4 Equipment 113,140.00 5 Accounts Payable 16,230.00 6 Unearned Fees 17,950.00 7 Nancy Townes, Capital 118,770.00 173.EZAAG eBook Print Item Adjusting entries Chart of Accounts Journal Final Questions Instructions 7 Nancy Townes, Capital 118.770.00 Nancy Townes, Drawing 13,430.00 Fees Eamed 294,730.00 10 Wages Expense 94,500.00 11 Rent Expense 72,100.00 1. Utilities Expense 51,560.00 1 Miscellaneous Expense 8,270.00 14 Totals 447,680.00 447,680.00 For preparing the adjusting entries, the following data were assembled: . Fees earned but unbilled on June 30 were $10,110 Supplies on hand on June 30 were $4.650. - Depreciation of equipment was estimated to be $6.490 for the year. Check My Work 75F Partly sunny Chart of Accounts D CHART OF ACCOUNTS 10 Milbank Repairs & Service General Ledger 1 ASSETS REVENUE 12 11 Cash 41 Fees Earned 12 Accounts Receivable 13 Supplies EXPENSES 14 Equipment 51 Wages Expense FO 15 Accumulated Depreciation-Equipment 52 Rent Expense Instructions X Chart of Accounts 15 Accumulated Depreciation Equipment 52 Rent Expense 8 53 Supplies Expense 9 LIABILITIES 54 Depreciation Expense 10 21 Accounts Payable 56 Utilities Expense 11 22 Wages Payable 59 Miscellaneous Expense 12 23 Unearned Fees 13 EQUITY 14 31 Nancy Townes, Capital 32 Nancy Townes, Drawing 33 Dividends / FO . Fees earned but unbilled on June 30 were $10,110. Supplies on hand on June 30 were $4,650. Depreciation of equipment was estimated to be $6,490 for the year. Journal Shaded cells have taedcack 1. Journalize the adjusting entries necessary on June 30, 2014. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not us journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is All transactions on this page must be entered (except for post ref(s)) before you will receive Check My Work feedback. JOURNAL Score: 6/126 ACCOUNTING EQUAT DATE DESCRIPTION POST. REF DEBIT CREDIT ASSETS LIABILITIES Adjusting Entries 2 Accounts Receivable 3 e adjusting entries necessary on June 30, 20Y4. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for Jons. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered is on this page must be entered (except for post ref(s)) before you will receive Check My Work feedback. PAGE 10 JOURNAL Score: 6/126 ACCOUNTING EQUATION DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY Adjusting Entries Accounts Receivable Supplies on hand on June 30 were $4,650. Depreciation of equipment was estimated to be $6.490 for the year. Work 75F Partly sunny Final Questions Sha ze blan 2. Determine the revenues, expenses, and net income of Milbank Repairs & Service before the adjusting entrie Question not attempted. Before Adjusting Entries Score: OHA Revenues DATE 2 Expenses 3 Net income Points Depreciation of equipment was estimated to be $6.490 for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts