Question: Can you help with this question, its for an adjusting journal entry. I provided all the information necesssary. Part 425 points a) Prepare the appropriate

Can you help with this question, its for an adjusting journal entry. I provided all the information necesssary.

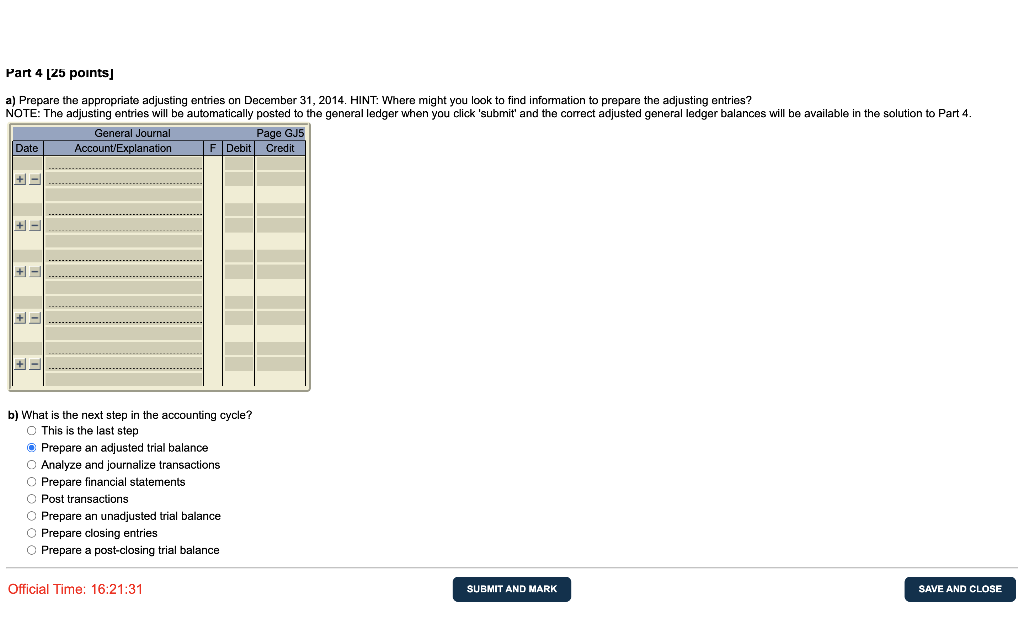

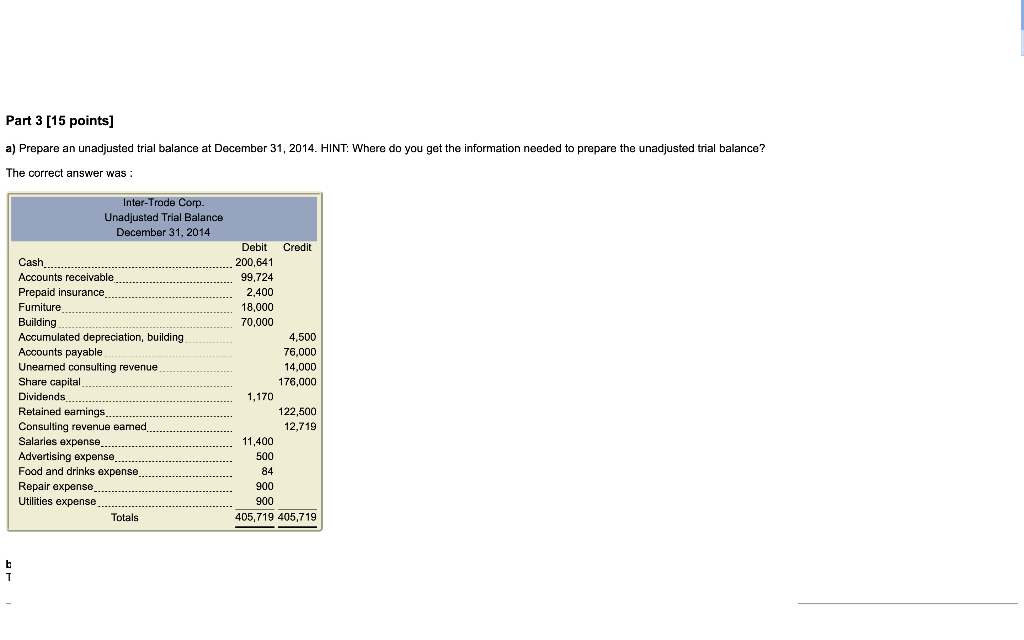

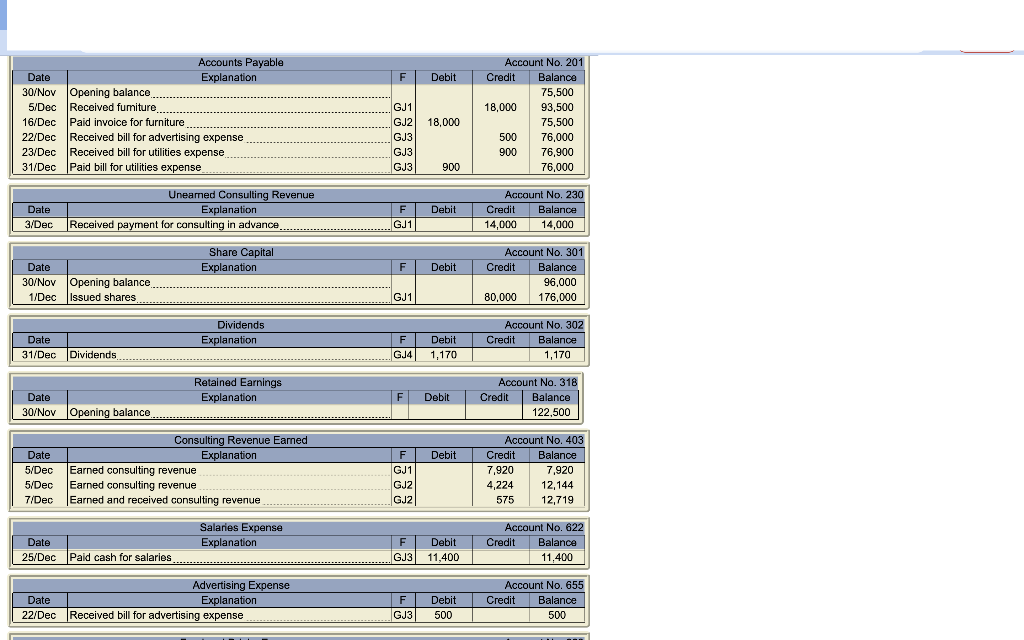

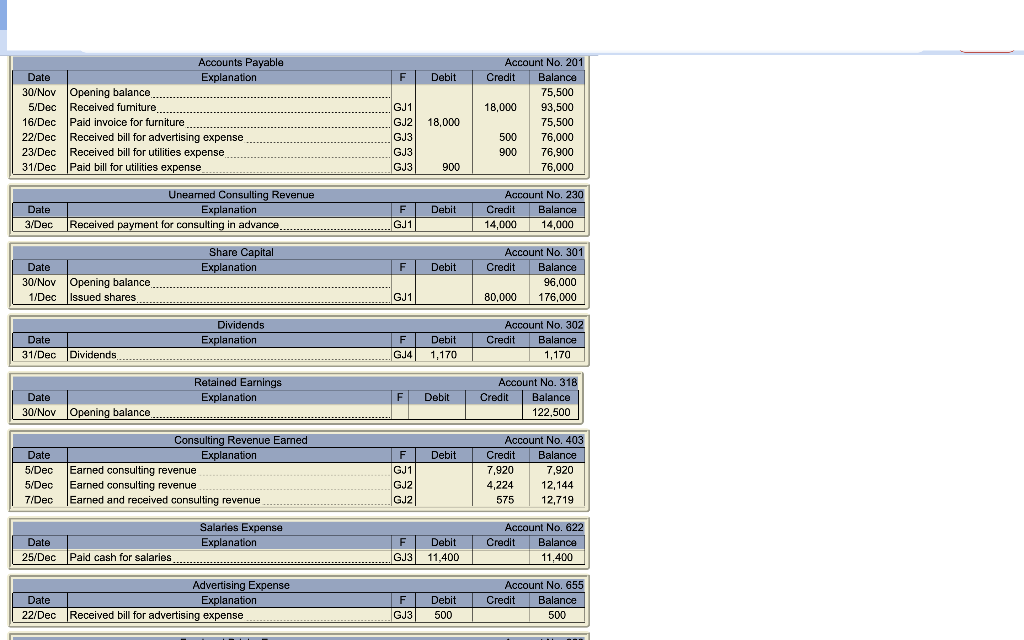

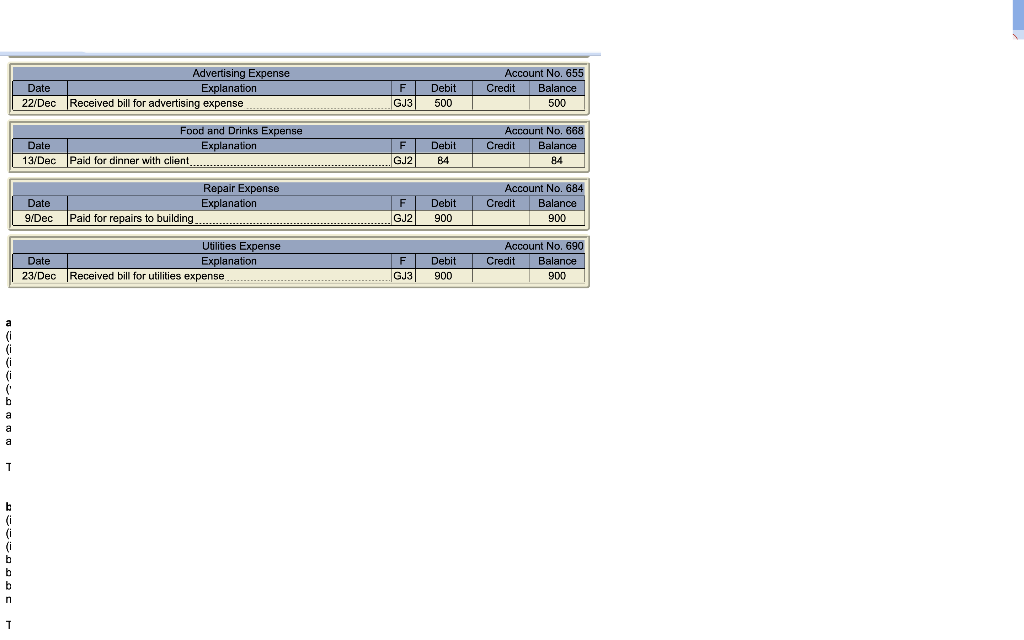

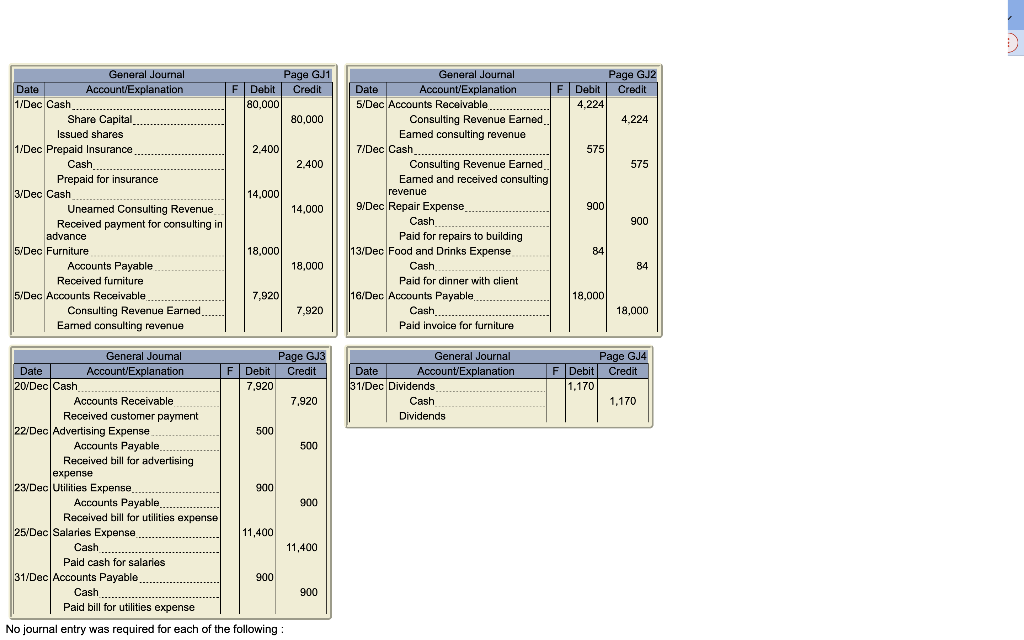

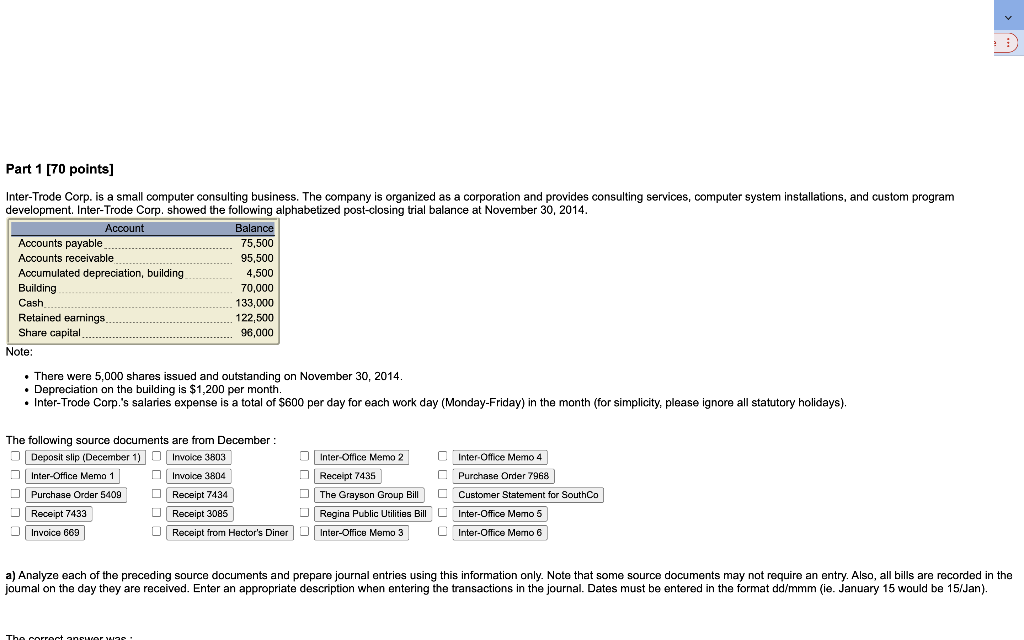

Part 425 points a) Prepare the appropriate adjusting entries on December 31, 2014. HINT: Where might you look to find information to prepare the adjusting entries? NOTE: The adjusting entries will be automatically posted to the general ledger when you click 'submit' and the correct adjusted general ledger balances will be available in the solution to Part 4. General Journal Page GJS Date Account/Explanation F Debit Credit + = + - += b) What is the next step in the accounting cycle? O This is the last step Prepare an adjusted trial balance O Analyze and journalize transactions O Prepare financial statements Post transactions O Prepare an unadjusted trial balance O Prepare closing entries O Prepare post-closing trial balance Official Time: 16:21:31 SUBMIT AND MARK SAVE AND CLOSE Part 3 [15 points] a) Prepare an unadjusted trial balance at December 31, 2014. HINT: Where do you get the information needed to prepare the unadjusted trial balance? The correct answer was: : Inter-Trade Corp. Unadjusted Trial Balance December 31, 2014 Cash Accounts receivable Prepaid insurance Furniture Building Accumulated depreciation, building Accounts payable Uneared consulting revenue Share capital Dividends. Retained earnings. Consulting revenue eamed Salaries expense.. Advertising expense Food and drinks expense Repair expense Utilities expense Totals Debit Credit 200,641 99,724 2.400 18,000 70,000 4,500 76,000 14.000 176,000 1,170 122,500 12,719 11,400 500 84 900 900 405,719 405,719 1 F F Debit Accounts Payable Date Explanation 30/Nov Opening balance 5/Dec Received fumiture 16/Dec Paid invoice for furniture 22/Dec Received bill for advertising expense 23/Dec Received bill for utilities expense 31/Dec Paid bill for utilities expense Account No. 201 Credit Balance 75,500 18,000 93,500 75,500 500 76,000 900 76,900 76,000 GJ1 GJ2 GJ3 GJ3 GJ3 18,000 900 Uneamed Consulting Revenue Explanation Received payment for consulting in advance Dale 3/Dec Debit F F GJ1 Account No. 230 Credit Balance 14,000 14,000 Share Capital Explanation F Debit Date 30/Nov Opening balance 1/Dec Issued shares Account No. 301 Credit Balance 96,000 80,000 176,000 GJ1 Dividends Explanation Date F GJ4 31/Dec Dividends Account No. 302 Credit Balance 1,170 Debit 1,170 Retained Earnings Explanation F Debit Date 30/Nov Opening balance Account No. 318 Credit Balance 122,500 Debit Date 5/Dec 5/Dec 7/Dec Consulting Revenue Earned Explanation Earned consulting revenue Earned consulting revenue Earned and received consulting revenue F F GJ1 GJ2 GJ2 Account No. 403 Credit Balance 7,920 7,920 4,224 12,144 575 12,719 Salaries Expense Explanation Date 25/Dec Paid cash for salaries F F GJ3 Debit 11,400 Account No. 622 Credit Balance 11,400 Advertising Expense Date Explanation 22/Dec Received bill for advertising expense F GJ3 Debit 500 Account No. 655 Credit Balance 500 F F Debit Accounts Payable Date Explanation 30/Nov Opening balance 5/Dec Received fumiture 16/Dec Paid invoice for furniture 22/Dec Received bill for advertising expense 23/Dec Received bill for utilities expense 31/Dec Paid bill for utilities expense Account No. 201 Credit Balance 75,500 18,000 93,500 75,500 500 76,000 900 76,900 76,000 GJ1 GJ2 GJ3 GJ3 GJ3 18,000 900 Uneamed Consulting Revenue Explanation Received payment for consulting in advance Dale 3/Dec Debit F F GJ1 Account No. 230 Credit Balance 14,000 14,000 Share Capital Explanation F Debit Date 30/Nov Opening balance 1/Dec Issued shares Account No. 301 Credit Balance 96,000 80,000 176,000 GJ1 Dividends Explanation Date F GJ4 31/Dec Dividends Account No. 302 Credit Balance 1,170 Debit 1,170 Retained Earnings Explanation F Debit Date 30/Nov Opening balance Account No. 318 Credit Balance 122,500 Debit Date 5/Dec 5/Dec 7/Dec Consulting Revenue Earned Explanation Earned consulting revenue Earned consulting revenue Earned and received consulting revenue F F GJ1 GJ2 GJ2 Account No. 403 Credit Balance 7,920 7,920 4,224 12,144 575 12,719 Salaries Expense Explanation Date 25/Dec Paid cash for salaries F F GJ3 Debit 11,400 Account No. 622 Credit Balance 11,400 Advertising Expense Date Explanation 22/Dec Received bill for advertising expense F GJ3 Debit 500 Account No. 655 Credit Balance 500 Advertising Expense Date Explanation 22/Dec Received bill for advertising expense F F GJ3 Debit 500 Account No. 655 Credit Balance 500 Date Food and Drinks Expense Explanation Paid for dinner with client................ F Debit B4 Account No. 668 Credit Balance 84 13/Dec GJ2 Date 9/Dec Repair Expense Explanation Paid for repairs to building. F GJ2 Debit 900 Account No. 684 Credit Balance 900 Utilities Expense Date Explanation 23/Dec Received bill for utilities expense F GJ3 Debit 900 Account No. 690 Credit Balance 900 i b a a a a T T b b n T Page GJ2 F Debit Credit Page Gj1 F Debit Credit 80,000 80,000 4,224 4.224 2.400 5751 2.400 575 14.000 General Journal Date Account/Explanation 1/Dec Cash Share Capital Issued shares 1/Dec Prepaid Insurance Cash Prepaid for insurance 3/Dec Cash Uneamed Consulting Revenue Received payment for consulting in advance 5/Dec Furniture Accounts Payable Received furniture 5/Dec Accounts Receivable Consulting Revenue Earned Earned consulting revenue General Journal Date Account/Explanation 5/Dec Accounts Receivable Consulting Revenue Earned. Eamed consulting revenue 7/Dec Cash Consulting Revenue Earned Earned and received consulting revenue 9/Dec Repair Expense Cash Paid for repairs to building 13/Dec Food and Drinks Expense Cash Paid for dinner with client 16/Dec Accounts Payable Cash Paid invoice for furniture 14,000 900 900 18,000 84 18,000 84 7,920 18,000 7,920 18,000 General Journal Date Account/Explanation 31/Dec Dividends Cash Dividends Page GJ4 F F Debit Credit 1,170 1,170 General Joumal Page GJ3 Date Account/Explanation F F Debit Credit 20/Dec Cash 7.920 Accounts Receivable 7,920 Received customer payment 22/Dec Advertising Expense 500 Accounts Payable 500 Received bill for advertising expense 23/Dec Utilities Expense 900 Accounts Payable 900 Received bill for utilities expense 25/Dec/Salaries Expense........ 11,400 Cash 11,400 Paid cash for salaries 31/Dec Accounts Payable 900 Cash 900 Paid bill for utilities expense No journal entry was required for each of the following: Part 1 [70 points] Inter-Trode Corp. is a small computer consulting business. The company is organized as a corporation and provides consulting services, computer system installations, and custom program development. Inter-Trode Corp. showed the following alphabetized post-closing trial balance at November 30, 2014. Account Balance Accounts payable 75,500 Accounts receivable 95,500 Accumulated depreciation, building 4,500 Building 70,000 Cash 133,000 Retained earnings 122,500 Share capital 96,000 Note: There were 5,000 shares issued and outstanding on November 30, 2014. Depreciation on the building is $1,200 per month. Inter-Trode Corp.'s salaries expense is a total of $600 per day for each work day (Monday-Friday) in the month (for simplicity, please ignore all statutory holidays). The following source documents are from December : Deposit slip (December 1) 0 Invoice 3803 ) O 2 Inter-Office Memo 2 O Inter-Office Memo 4 4 Inter-Office Memo 1 0 Invoice 3804 Receipt 7435 Purchase Order 7968 Purchase Order 5409 D Receipt 7434 The Grayson Group Bill O Customer Statement for Southco Receipt 7433 O Receipt 3085 O Regina Public Utilities Bill D Inter-Office Memo 5 Invoice 669 O Receipt from Hector's Diner Inter-Office Memo 3 -3 O Inter-Office Momo 6 a) Analyze each of the preceding source documents and prepare journal entries using this information only. Note that some source documents may not require an entry. Also, all bills are recorded in the joumal on the day they are received. Enter an appropriate description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (ie. January 15 would be 15/Jan). Tho corrort anrur. Part 425 points a) Prepare the appropriate adjusting entries on December 31, 2014. HINT: Where might you look to find information to prepare the adjusting entries? NOTE: The adjusting entries will be automatically posted to the general ledger when you click 'submit' and the correct adjusted general ledger balances will be available in the solution to Part 4. General Journal Page GJS Date Account/Explanation F Debit Credit + = + - += b) What is the next step in the accounting cycle? O This is the last step Prepare an adjusted trial balance O Analyze and journalize transactions O Prepare financial statements Post transactions O Prepare an unadjusted trial balance O Prepare closing entries O Prepare post-closing trial balance Official Time: 16:21:31 SUBMIT AND MARK SAVE AND CLOSE Part 3 [15 points] a) Prepare an unadjusted trial balance at December 31, 2014. HINT: Where do you get the information needed to prepare the unadjusted trial balance? The correct answer was: : Inter-Trade Corp. Unadjusted Trial Balance December 31, 2014 Cash Accounts receivable Prepaid insurance Furniture Building Accumulated depreciation, building Accounts payable Uneared consulting revenue Share capital Dividends. Retained earnings. Consulting revenue eamed Salaries expense.. Advertising expense Food and drinks expense Repair expense Utilities expense Totals Debit Credit 200,641 99,724 2.400 18,000 70,000 4,500 76,000 14.000 176,000 1,170 122,500 12,719 11,400 500 84 900 900 405,719 405,719 1 F F Debit Accounts Payable Date Explanation 30/Nov Opening balance 5/Dec Received fumiture 16/Dec Paid invoice for furniture 22/Dec Received bill for advertising expense 23/Dec Received bill for utilities expense 31/Dec Paid bill for utilities expense Account No. 201 Credit Balance 75,500 18,000 93,500 75,500 500 76,000 900 76,900 76,000 GJ1 GJ2 GJ3 GJ3 GJ3 18,000 900 Uneamed Consulting Revenue Explanation Received payment for consulting in advance Dale 3/Dec Debit F F GJ1 Account No. 230 Credit Balance 14,000 14,000 Share Capital Explanation F Debit Date 30/Nov Opening balance 1/Dec Issued shares Account No. 301 Credit Balance 96,000 80,000 176,000 GJ1 Dividends Explanation Date F GJ4 31/Dec Dividends Account No. 302 Credit Balance 1,170 Debit 1,170 Retained Earnings Explanation F Debit Date 30/Nov Opening balance Account No. 318 Credit Balance 122,500 Debit Date 5/Dec 5/Dec 7/Dec Consulting Revenue Earned Explanation Earned consulting revenue Earned consulting revenue Earned and received consulting revenue F F GJ1 GJ2 GJ2 Account No. 403 Credit Balance 7,920 7,920 4,224 12,144 575 12,719 Salaries Expense Explanation Date 25/Dec Paid cash for salaries F F GJ3 Debit 11,400 Account No. 622 Credit Balance 11,400 Advertising Expense Date Explanation 22/Dec Received bill for advertising expense F GJ3 Debit 500 Account No. 655 Credit Balance 500 F F Debit Accounts Payable Date Explanation 30/Nov Opening balance 5/Dec Received fumiture 16/Dec Paid invoice for furniture 22/Dec Received bill for advertising expense 23/Dec Received bill for utilities expense 31/Dec Paid bill for utilities expense Account No. 201 Credit Balance 75,500 18,000 93,500 75,500 500 76,000 900 76,900 76,000 GJ1 GJ2 GJ3 GJ3 GJ3 18,000 900 Uneamed Consulting Revenue Explanation Received payment for consulting in advance Dale 3/Dec Debit F F GJ1 Account No. 230 Credit Balance 14,000 14,000 Share Capital Explanation F Debit Date 30/Nov Opening balance 1/Dec Issued shares Account No. 301 Credit Balance 96,000 80,000 176,000 GJ1 Dividends Explanation Date F GJ4 31/Dec Dividends Account No. 302 Credit Balance 1,170 Debit 1,170 Retained Earnings Explanation F Debit Date 30/Nov Opening balance Account No. 318 Credit Balance 122,500 Debit Date 5/Dec 5/Dec 7/Dec Consulting Revenue Earned Explanation Earned consulting revenue Earned consulting revenue Earned and received consulting revenue F F GJ1 GJ2 GJ2 Account No. 403 Credit Balance 7,920 7,920 4,224 12,144 575 12,719 Salaries Expense Explanation Date 25/Dec Paid cash for salaries F F GJ3 Debit 11,400 Account No. 622 Credit Balance 11,400 Advertising Expense Date Explanation 22/Dec Received bill for advertising expense F GJ3 Debit 500 Account No. 655 Credit Balance 500 Advertising Expense Date Explanation 22/Dec Received bill for advertising expense F F GJ3 Debit 500 Account No. 655 Credit Balance 500 Date Food and Drinks Expense Explanation Paid for dinner with client................ F Debit B4 Account No. 668 Credit Balance 84 13/Dec GJ2 Date 9/Dec Repair Expense Explanation Paid for repairs to building. F GJ2 Debit 900 Account No. 684 Credit Balance 900 Utilities Expense Date Explanation 23/Dec Received bill for utilities expense F GJ3 Debit 900 Account No. 690 Credit Balance 900 i b a a a a T T b b n T Page GJ2 F Debit Credit Page Gj1 F Debit Credit 80,000 80,000 4,224 4.224 2.400 5751 2.400 575 14.000 General Journal Date Account/Explanation 1/Dec Cash Share Capital Issued shares 1/Dec Prepaid Insurance Cash Prepaid for insurance 3/Dec Cash Uneamed Consulting Revenue Received payment for consulting in advance 5/Dec Furniture Accounts Payable Received furniture 5/Dec Accounts Receivable Consulting Revenue Earned Earned consulting revenue General Journal Date Account/Explanation 5/Dec Accounts Receivable Consulting Revenue Earned. Eamed consulting revenue 7/Dec Cash Consulting Revenue Earned Earned and received consulting revenue 9/Dec Repair Expense Cash Paid for repairs to building 13/Dec Food and Drinks Expense Cash Paid for dinner with client 16/Dec Accounts Payable Cash Paid invoice for furniture 14,000 900 900 18,000 84 18,000 84 7,920 18,000 7,920 18,000 General Journal Date Account/Explanation 31/Dec Dividends Cash Dividends Page GJ4 F F Debit Credit 1,170 1,170 General Joumal Page GJ3 Date Account/Explanation F F Debit Credit 20/Dec Cash 7.920 Accounts Receivable 7,920 Received customer payment 22/Dec Advertising Expense 500 Accounts Payable 500 Received bill for advertising expense 23/Dec Utilities Expense 900 Accounts Payable 900 Received bill for utilities expense 25/Dec/Salaries Expense........ 11,400 Cash 11,400 Paid cash for salaries 31/Dec Accounts Payable 900 Cash 900 Paid bill for utilities expense No journal entry was required for each of the following: Part 1 [70 points] Inter-Trode Corp. is a small computer consulting business. The company is organized as a corporation and provides consulting services, computer system installations, and custom program development. Inter-Trode Corp. showed the following alphabetized post-closing trial balance at November 30, 2014. Account Balance Accounts payable 75,500 Accounts receivable 95,500 Accumulated depreciation, building 4,500 Building 70,000 Cash 133,000 Retained earnings 122,500 Share capital 96,000 Note: There were 5,000 shares issued and outstanding on November 30, 2014. Depreciation on the building is $1,200 per month. Inter-Trode Corp.'s salaries expense is a total of $600 per day for each work day (Monday-Friday) in the month (for simplicity, please ignore all statutory holidays). The following source documents are from December : Deposit slip (December 1) 0 Invoice 3803 ) O 2 Inter-Office Memo 2 O Inter-Office Memo 4 4 Inter-Office Memo 1 0 Invoice 3804 Receipt 7435 Purchase Order 7968 Purchase Order 5409 D Receipt 7434 The Grayson Group Bill O Customer Statement for Southco Receipt 7433 O Receipt 3085 O Regina Public Utilities Bill D Inter-Office Memo 5 Invoice 669 O Receipt from Hector's Diner Inter-Office Memo 3 -3 O Inter-Office Momo 6 a) Analyze each of the preceding source documents and prepare journal entries using this information only. Note that some source documents may not require an entry. Also, all bills are recorded in the joumal on the day they are received. Enter an appropriate description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (ie. January 15 would be 15/Jan). Tho corrort anrur

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts