Question: can you please also explain how you solve the problem. The CDG Carlos, Dan, and Gail Partnership has decided to liquidate as of December 1,

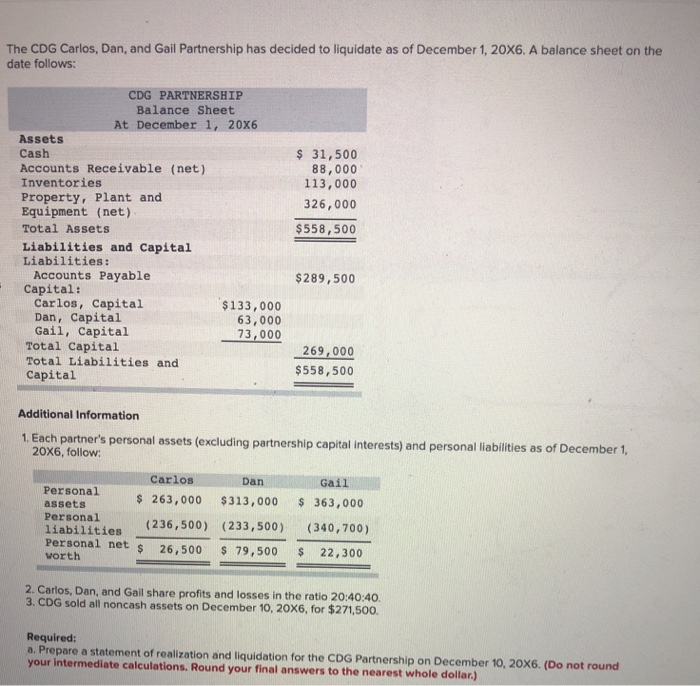

The CDG Carlos, Dan, and Gail Partnership has decided to liquidate as of December 1, 20X6. A balance sheet on the date follows: CDG PARTNERSHIP Balance Sheet At December 1, 20X6 Assets Cash Accounts Receivable (net) Inventories Property, plant and Equipment (net) Total Assets Liabilities and Capital Liabilities: Accounts Payable Capital: Carlos, Capital $133,000 Dan, Capital 63,000 Gail, Capital 73,000 Total Capital Total Liabilities and Capital $ 31,500 88,000 113,000 326,000 $558,500 $289,500 269,000 $558,500 Additional Information 1. Each partner's personal assets (excluding partnership capital interests) and personal liabilities as of December 1, 20X6, follow: Gail Carlos Dan Personal $ 263,000 $313,000 assets Personal liabilities (236,500) (233,500) Personal net $ 26,500 $ 79,500 worth $363,000 (340,700) $ 22,300 2. Carlos, Dan, and Gail share profits and losses in the ratio 20:40:40. 3. CDG sold all noncash assets on December 10, 20X6, for $271,500. Required: a. Prepare a statement of realization and liquidation for the CDG Partnership on December 10, 20X6. (Do not round your intermediate calculations. Round your final answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts