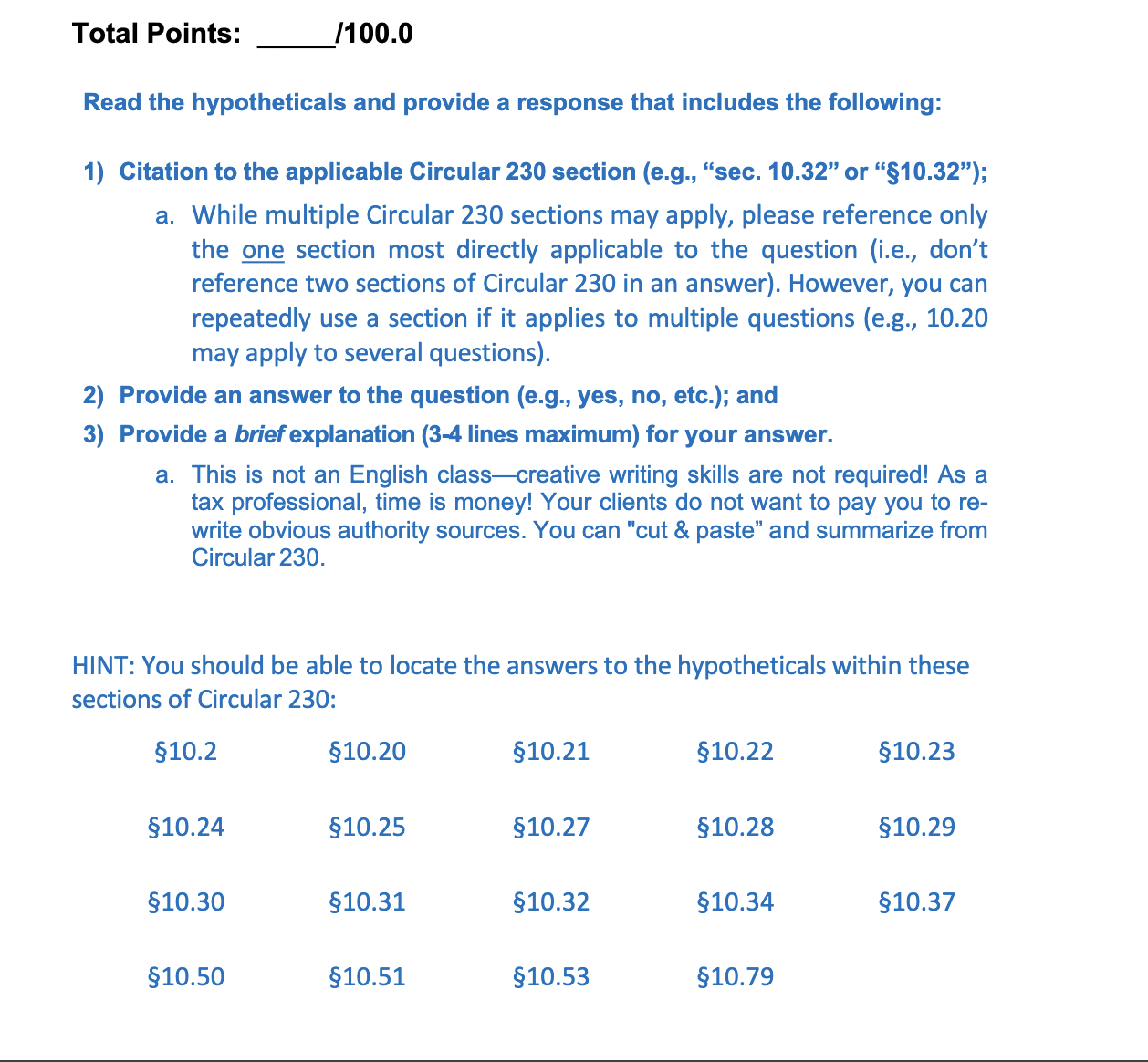

Question: Can you please ansewer those 10 questions below with simple and clear sentences. 1. John and Mary have been your client for years. You have

Can you please ansewer those 10 questions below with simple and clear sentences.

1. John and Mary have been your client for years. You have handled their individual tax returns, the tax returns for John's business, and their estate plan. John and Mary are going through a divorce and their 20XX married filing joint return has been selected for audit. You believe that Mary may qualify for "innocent spouse" relief, which is when the IRS relieves a taxpayer from paying additional taxes if their spouse understated taxes due on a joint tax return and the taxpayer didn't know about the errors. Under Circular 230, can you represent both John and Mary in the audit?

2. Sasha completed her client's tax return and gave him an invoice for the agreed-upon $800 tax return preparation fee. The client asks how long it took Sasha to prepare his return. When Sasha tells him it took about two hours, the client refuses to pay the $800 fee. Because an agreement cannot be reached between Sasha and the client over the fee amount, Sasha returns the client's records, but she refuses to give him the completed tax return. Under Circular 230, has Sasha violated her ethical duties?

3. Morgan is a registered tax return preparer. He receives an IRS request for certain records substantiating (proving) deductions taken on his new client's 20XX tax return. The client's 20XX tax return was prepared by the client's former tax return preparer, not by Morgan. Morgan doesn't have the requested records and believes the IRS made a mistake by sending the request to him instead of the client or his former tax return preparer. Based on this, Morgan ignores the IRS' request. Under Circular 230, is Morgan ignoring the IRS request for his client's records an ethical violation?

4. Your client, BIGG Business, discovers that certain employees' Forms W-2 underreported the employees' taxable income. The error is not discovered until May of the following tax year. Because of this error, BIGG Business's federal employment tax returns are also incorrect. Under Circular 230, what are your responsibilities to BIGG Business? 5. A CPA was disbarred from practicing before the IRS in 2020. Under Circular 230, can the CPA prepare returns in 2024?

6. Eugene, a CPA, who regularly prepares tax returns, publishes a list of his fees in a flyer. Eugene covers the local area with his flyers advertising that, for uncomplicated tax returns, his fee is $400. A note at the bottom of the flyer states, "Additional fees may apply in certain situations." Eugene prepares a tax return for a client. Since the taxpayer qualified for the earned income tax credit (EITC) and will be receiving a large refund, without discussing with the client, Eugene charged an additional $500 for completing the EITC form. Under Circular 230, has Eugene violated any ethical duties?

7. In preparing a client's tax return for this year, you discover the prior accountant made an error in calculating the taxpayer's net operating loss (NOL). The error results in the NOL carryforward to this year being overstated by $100,000. You inform your client of the error. The client still wants you to prepare this year's tax return using the incorrect $100,000 NOL carryforward amount. Under Circular 230, can you do what the client requests?

8. Your client is under audit by the IRS, and the Revenue Agent has issued an Information Document Request (IDR) requesting lots of documents. Your client gives you several documents, some of which you know are false, to give to the IRS in response to the IDR. Under Circular 230, can you give all of these documents to the IRS?

9. One of your former classmates, a CPA, is suspended from practice before the IRS for violations of Circular 230. Under Circular 230, may you hire that former classmate to assist you in a tax audit?

10. Deanna receives an Information Document Request (IDR) from the IRS for her books and records. Deanna picks up all the books and records from her accountant and gives them to her uncle for "safekeeping." You represent Deanna in the audit and you have filed Form 2848, Power of Attorney, with the IRS. The Revenue Agent has sent you a copy of the IDR. Under Circular 230, what are your duties regarding responding to the IDR?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts