Question: can you please answer 1, 2, and 3 for me? thanks for your help. reful--files from the Internet can contain viruses. Unless you need to

can you please answer 1, 2, and 3 for me? thanks for your help.

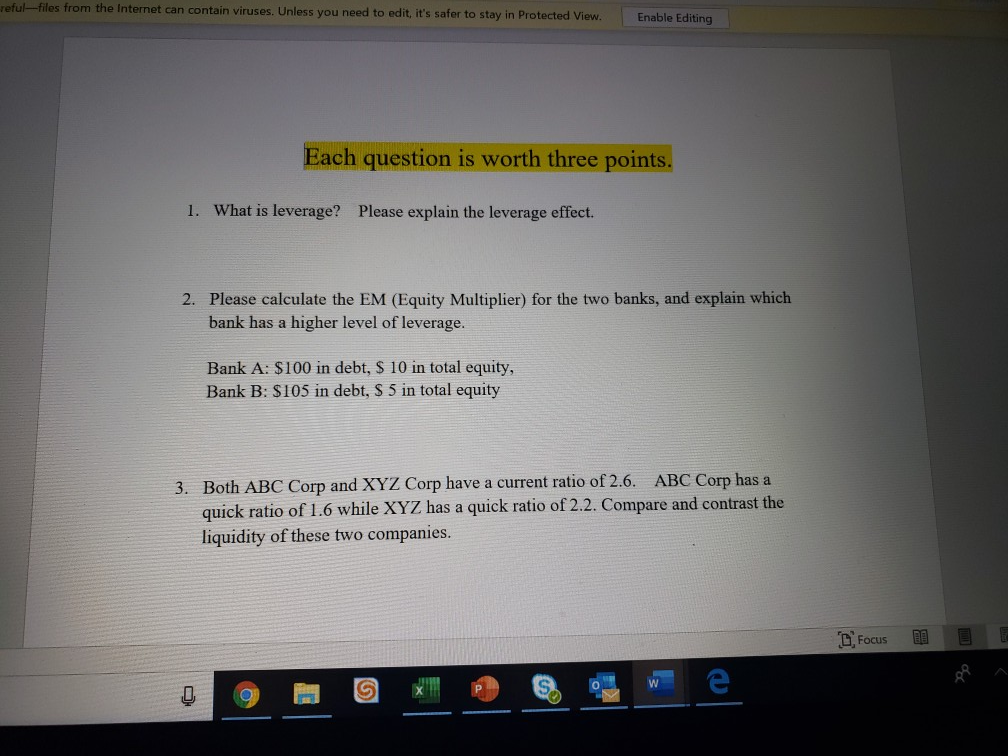

reful--files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View Enable Editing Each question is worth three points. 1. What is leverage? Please explain the leverage effect. 2. Please calculate the EM (Equity Multiplier) for the two banks, and explain which bank has a higher level of leverage. Bank A: $100 in debt, $ 10 in total equity, Bank B: $105 in debt, S 5 in total equity 3. Both ABC Corp and XYZ Corp have a current ratio of 2.6. ABC Corp has a quick ratio of 1.6 while XYZ has a quick ratio of 2.2. Compare and contrast the liquidity of these two companies. Focus E E E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts