Question: Can you please answer A and B? 12-1 Magee Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, and ships them

Can you please answer A and B?

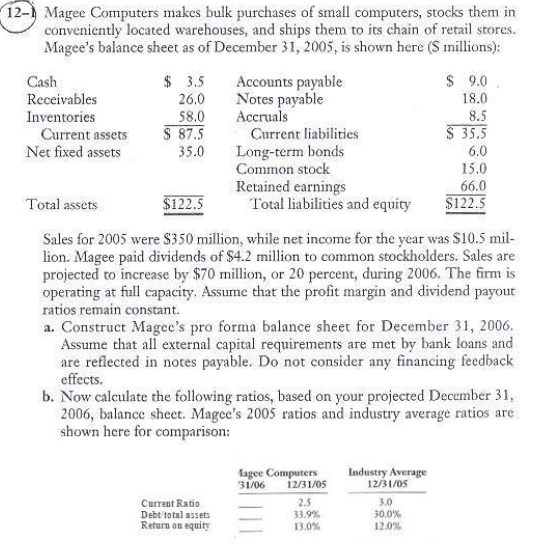

12-1 Magee Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, and ships them to its chain of retail stores. Magee's balance sheet as of December 31, 2005, is shown here (S millions): $ 3.5 Accounts payable $ 9.0 18.0 Receivables Inventories 26.0 Notes payable 58.0 Accruals 35.5 6.0 15.0 66.0 l'otal liabilities and equity $122.5 Current assetsS 87.5Current liabilities Net fixed assets 35.0 Long-term bonds Common stock Retained earnings Total assets Sales for 2005 were $350 million, while net income for the year was S10.5 mil e paid dividends of $4.2 million to common stockholders. Sales are projected to increase by $70 miion, or 20 percent, during 2006. The firm is operating at full capacity. Assume that the profit margin and dividend payout lion. Mage ratios remain constant. a. Construct Magee's pro forma balance sheet for December 31, 2006 Assume that all external capital requirements are met by bank loans and are reflected in notes payable. Do not consider any financing feedback effects. b. Now calculate the following ratios, based on your projected December 31, 2006, balance sheet. Magee's 200S ratios and industry average ratios are shown here for comparison: Industry Average lagee Computers 31/06 231/0S Current Ratio Debt total assets Return on equity 33.9% 13.0% 3.0 30.0% 12.0% 12-1 Magee Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, and ships them to its chain of retail stores. Magee's balance sheet as of December 31, 2005, is shown here (S millions): $ 3.5 Accounts payable $ 9.0 18.0 Receivables Inventories 26.0 Notes payable 58.0 Accruals 35.5 6.0 15.0 66.0 l'otal liabilities and equity $122.5 Current assetsS 87.5Current liabilities Net fixed assets 35.0 Long-term bonds Common stock Retained earnings Total assets Sales for 2005 were $350 million, while net income for the year was S10.5 mil e paid dividends of $4.2 million to common stockholders. Sales are projected to increase by $70 miion, or 20 percent, during 2006. The firm is operating at full capacity. Assume that the profit margin and dividend payout lion. Mage ratios remain constant. a. Construct Magee's pro forma balance sheet for December 31, 2006 Assume that all external capital requirements are met by bank loans and are reflected in notes payable. Do not consider any financing feedback effects. b. Now calculate the following ratios, based on your projected December 31, 2006, balance sheet. Magee's 200S ratios and industry average ratios are shown here for comparison: Industry Average lagee Computers 31/06 231/0S Current Ratio Debt total assets Return on equity 33.9% 13.0% 3.0 30.0% 12.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts