Question: can you please answer all questions Question 5 (1 point) Empirical evidence confirms that investors become as they approach retirement. greedier more risk averse less

can you please answer all questions

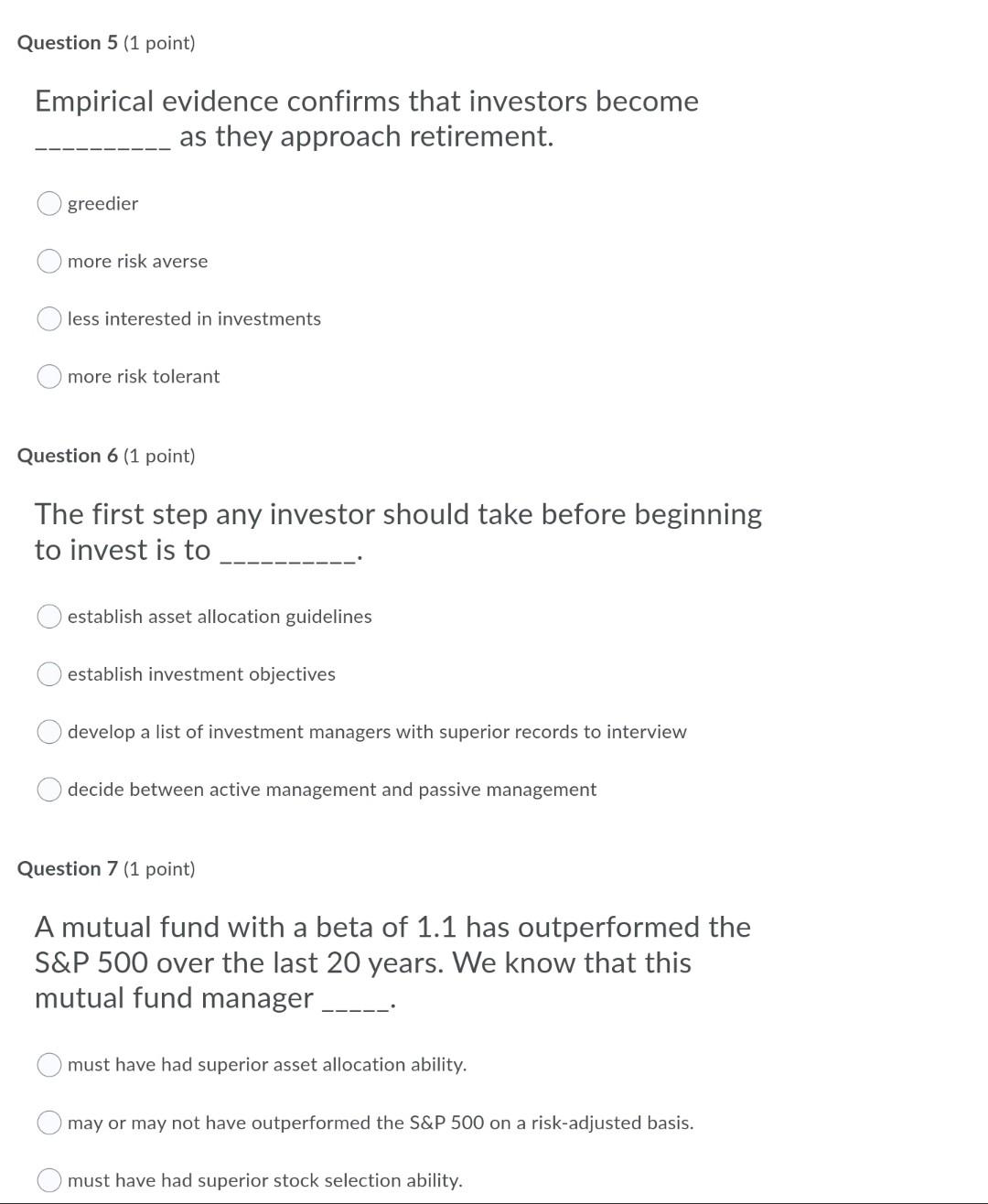

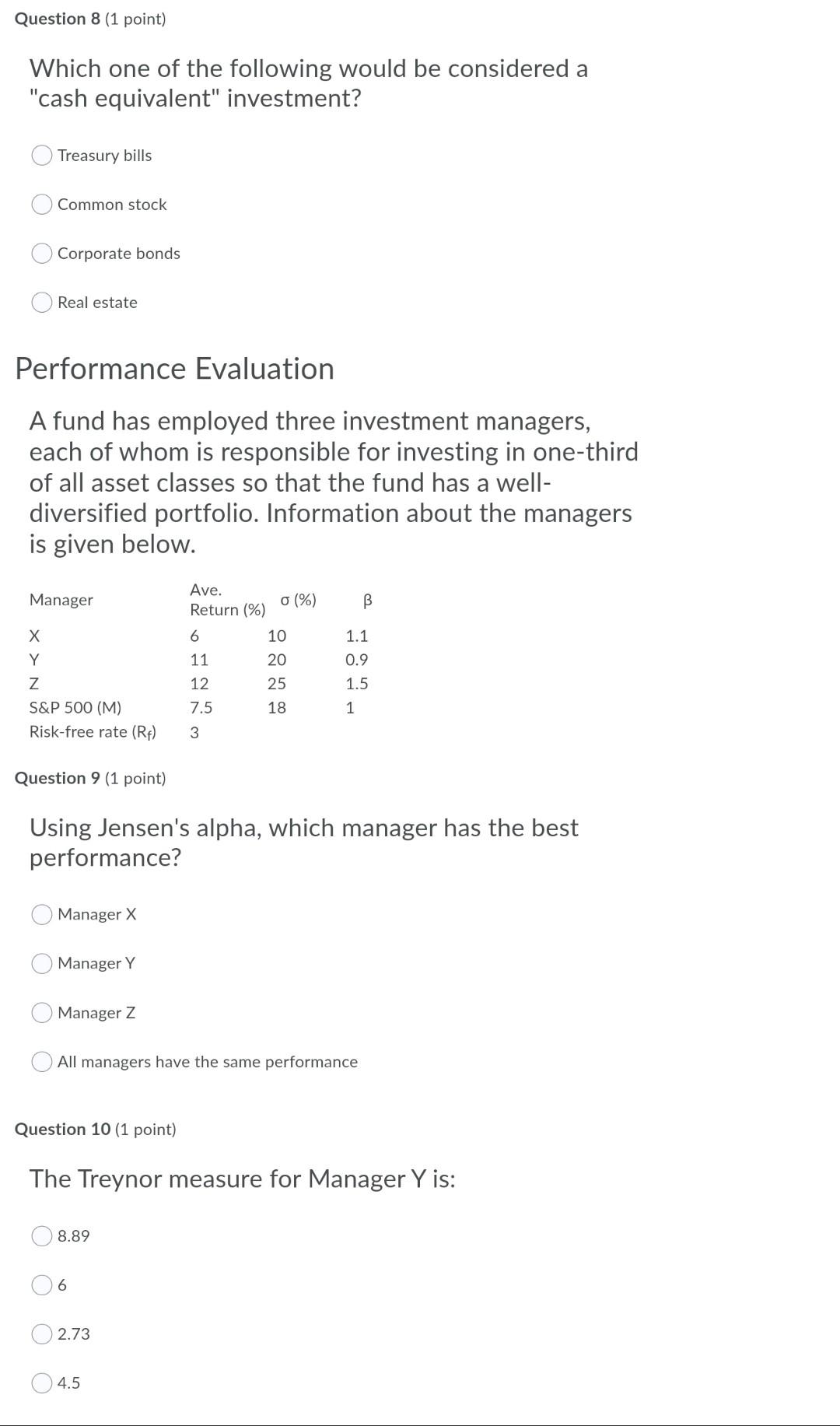

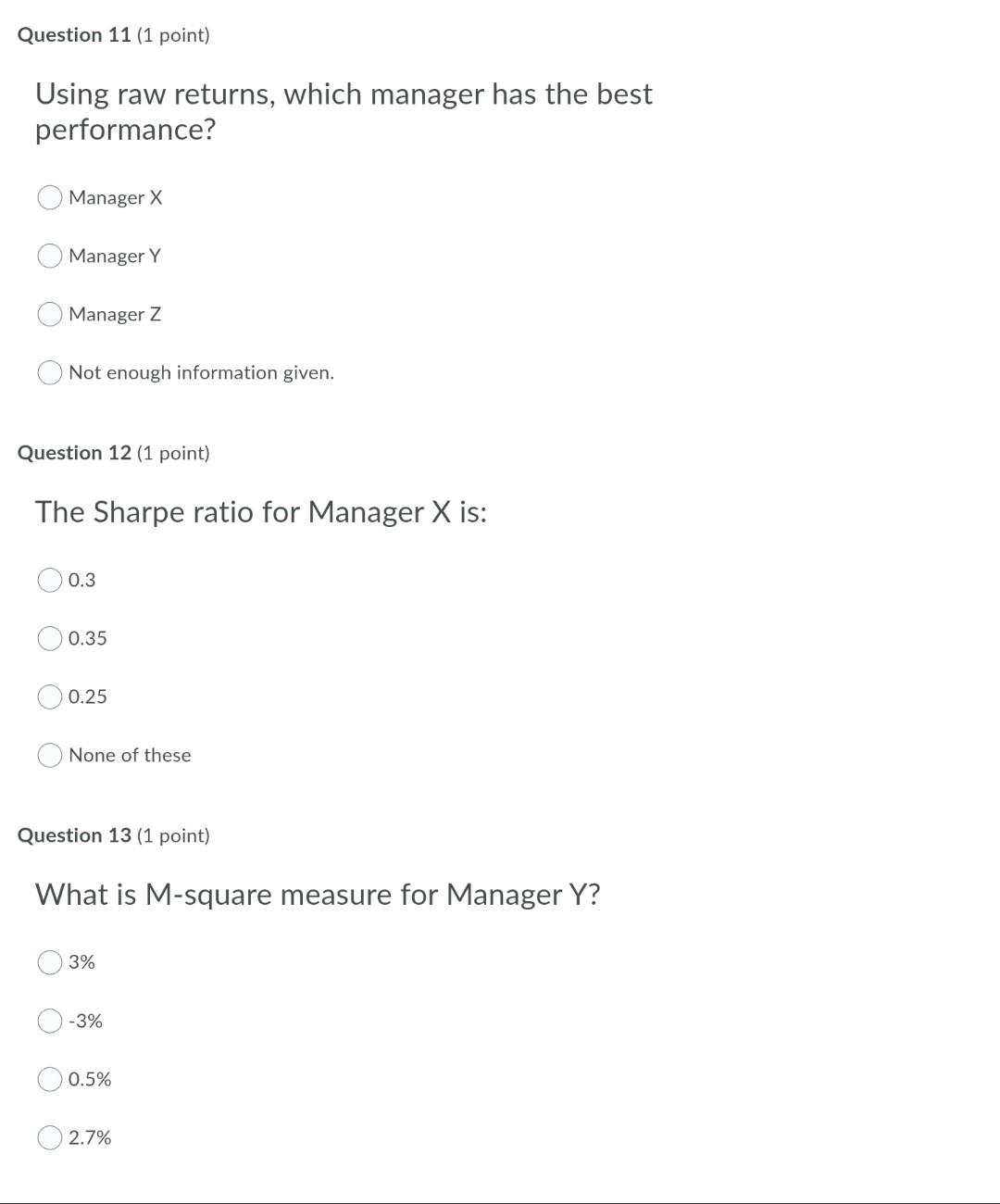

Question 5 (1 point) Empirical evidence confirms that investors become as they approach retirement. greedier more risk averse less interested in investments more risk tolerant Question 6 (1 point) The first step any investor should take before beginning to invest is to establish asset allocation guidelines establish investment objectives develop a list of investment managers with superior records to interview decide between active management and passive management Question 7 (1 point) A mutual fund with a beta of 1.1 has outperformed the S&P 500 over the last 20 years. We know that this mutual fund manager must have had superior asset allocation ability. may or may not have outperformed the S&P 500 on a risk-adjusted basis. must have had superior stock selection ability. Question 8 (1 point) Which one of the following would be considered a "cash equivalent" investment? Treasury bills Common stock Corporate bonds Real estate Performance Evaluation A fund has employed three investment managers, each of whom is responsible for investing in one-third of all asset classes so that the fund has a well- diversified portfolio. Information about the managers is given below. Manager B 1.1 Ave. 0 %) Return (%) 6 10 11 20 12 25 7.5 18 Y 0.9 1.5 Z S&P 500 (M) Risk-free rate (RF) 1 3 Question 9 (1 point) Using Jensen's alpha, which manager has the best performance? Manager X Manager Y Manager Z All managers have the same performance Question 10 (1 point) The Treynor measure for Manager Y is: 8.89 6 2.73 4.5 Question 11 (1 point) Using raw returns, which manager has the best performance? Manager X Manager Y Manager Z Not enough information given. Question 12 (1 point) The Sharpe ratio for Manager X is: 0.3 0.35 0.25 None of these Question 13 (1 point) What is M-square measure for Manager Y? 3% -3% 0.5% 2.7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts