Question: can you please answer B. Chapter 19 Corporate Organization Exercise Questions Kathy and Carl formed a corporation by each contributing an asset with a FMV

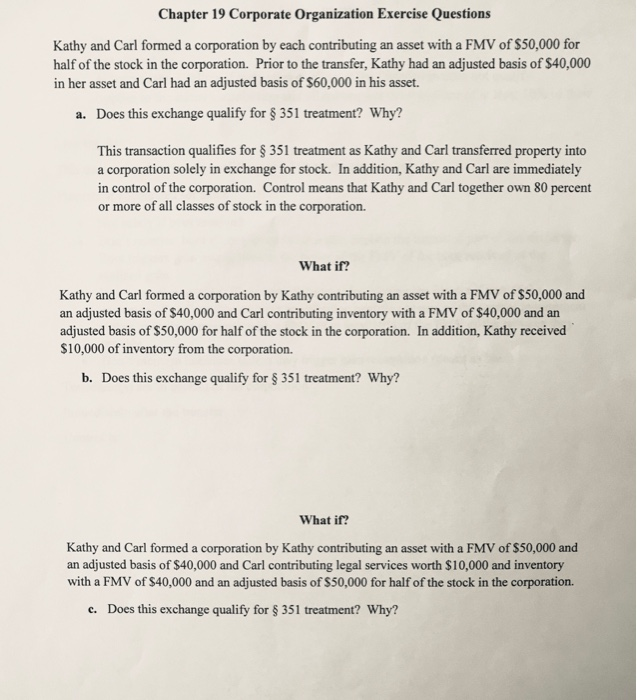

Chapter 19 Corporate Organization Exercise Questions Kathy and Carl formed a corporation by each contributing an asset with a FMV of $50,000 for half of the stock in the corporation. Prior to the transfer, Kathy had an adjusted basis of $40,000 in her asset and Carl had an adjusted basis of $60,000 in his asset. a. Does this exchange qualify for 351 treatment? Why? This transaction qualifies for S 351 treatment as Kathy and Carl transferred property into a corporation solely in exchange for stock. In addition, Kathy and Carl are immediately in control of the corporation. Control means that Kathy and Carl together own 80 percent or more of all classes of stock in the corporation. What if? Kathy and Carl formed a corporation by Kathy contributing an asset with a FMV of $50,000 and an adjusted basis of $40,000 and Carl contributing inventory with a FMV of $40,000 and an adjusted basis of $50,000 for half of the stock in the corporation. In addition, Kathy received $10,000 of inventory from the corporation. b. Does this exchange qualify for $ 351 treatment? Why? What if? Kathy and Carl formed a corporation by Kathy contributing an asset with a FMV of $50,000 and an adjusted basis of $40,000 and Carl contributing legal services worth $10,000 and inventory with a FMV of $40,000 and an adjusted basis of $50,000 for half of the stock in the corporation. c. Does this exchange qualify for $ 351 treatment? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts