Question: can you please answer both question i will give thimbs up. Vaughn, Inc. had net sales in 2020 of $1,440,100. At December 31, 2020, before

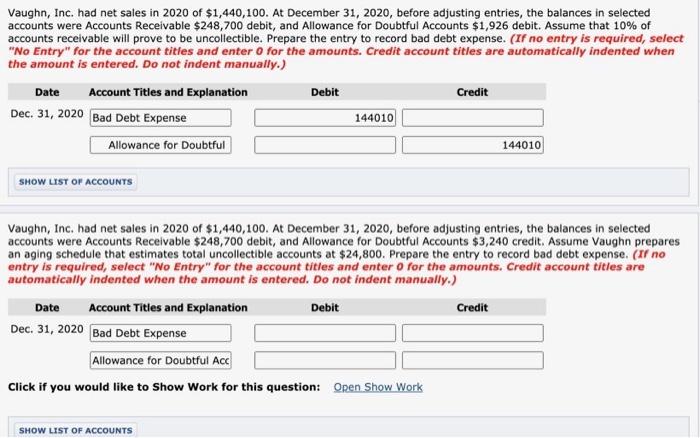

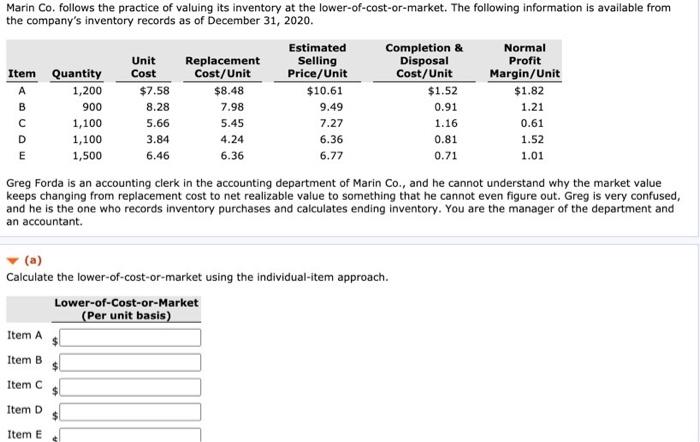

Vaughn, Inc. had net sales in 2020 of $1,440,100. At December 31, 2020, before adjusting entries, the balances in selected accounts were Accounts Receivable $248,700 debit, and Allowance for Doubtful Accounts $1,926 debit. Assume that 10% of accounts receivable will prove to be uncollectible. Prepare the entry to record bad debt expense. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Credit Dec. 31, 2020 Bad Debt Expense 144010 Allowance for Doubtful 144010 Debit SHOW LIST OF ACCOUNTS Vaughn, Inc. had net sales in 2020 of $1,440,100. At December 31, 2020, before adjusting entries, the balances in selected accounts were Accounts Receivable $248,700 debit, and Allowance for Doubtful Accounts $3,240 credit. Assume Vaughn prepares an aging schedule that estimates total uncollectible accounts at $24,800. Prepare the entry to record bad debt expense. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31, 2020 Bad Debt Expense Allowance for Doubtful Acc Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS Marin Co, follows the practice of valuing its inventory at the lower-of-cost-or-market. The following information is available from the company's inventory records as of December 31, 2020. Estimated Completion & Normal Unit Replacement Selling Disposal Profit Item Quantity Cost Cost/Unit Price/Unit Cost/Unit Margin/Unit A 1,200 $7.58 $8.48 $10.61 $1.52 $1.82 B 900 8.28 7.98 9.49 0.91 1.21 1,100 5.66 5.45 7.27 1.16 0.61 D 1,100 3.84 4.24 6.36 0.81 1.52 E 1,500 6.46 6.36 6.77 0.71 1.01 Greg Forda is an accounting clerk in the accounting department of Marin Co., and he cannot understand why the market value keeps changing from replacement cost to net realizable value to something that he cannot even figure out. Greg is very confused, and he is the one who records inventory purchases and calculates ending inventory. You are the manager of the department and an accountant. (a) Calculate the lower-of-cost-or-market using the individual-item approach. Lower-of-Cost-or-Market (Per unit basis) Item A Item B Item C Item D Item E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts