Question: can you please answer question three & four eBook Cornerstone Exercise 17.2 (Algorithmic) Keep-Or-Drop Decision, Alternatives, Relevant Costs Reshier Company makes three types of rug

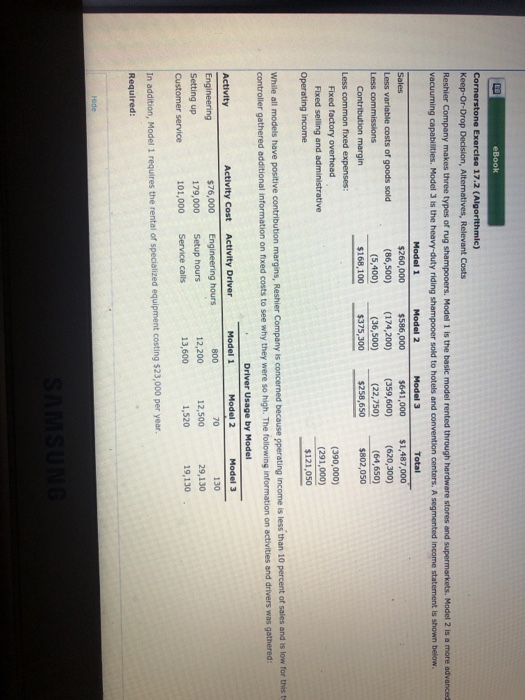

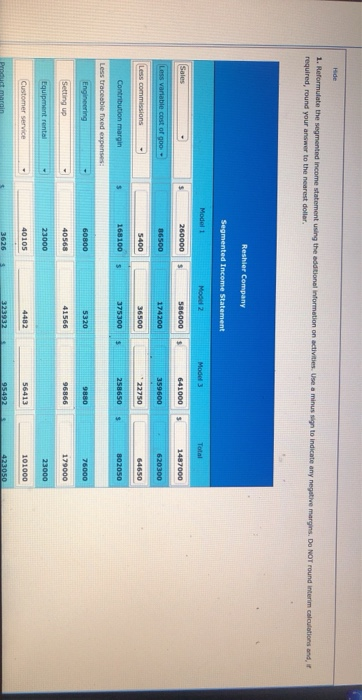

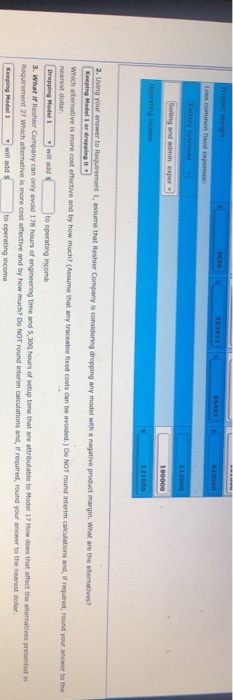

eBook Cornerstone Exercise 17.2 (Algorithmic) Keep-Or-Drop Decision, Alternatives, Relevant Costs Reshier Company makes three types of rug shampooers. Model 1 is the basic model rented through hardware stores and supermarkets. Model 2 is a more advance vacuuming capabilities. Model 3 is the heavy-duty riding shampooer sold to hotels and convention centers. A segmented income statement is shown below. Model 1 Model 2 Model 3 Total Sales $260,000 $586,000 5641,000 $1,487,000 Less variable costs of goods sold (86,500) (174,200) (359,600) (620,300) Les commissions (5,400) (36,500) (22,750) (64,650) Contribution margin $168,100 $375,300 $258,650 $802,050 Less common fixed expenses: Fixed factory overhead (390,000) Fixed selling and administrative (291,000) Operating income $121,050 While all models have positive contribution margins, Reshier Company is concerned because operating income is less than 10 percent of sales and is low for this controller gathered additional information on fixed costs to see why they were so high. The following information on activities and drivers was gathered: - Driver Usage by Model Activity Activity Cost Activity Driver Model 1 Model 2 Model 3 Engineering $76,000 Engineering hours 800 70 130 Setting up 179,000 Setup hours 12,200 12,500 29,130 Customer service 101,000 Service calls 13,600 1,520 19,130 In addition, Model 1 requires the rental of specialized equipment costing $23,000 per year. Required: 1. Heformulate the segmented income statement using the additional information on activities. Use a minus sign to indicate any negative margins. Do NOT round interim calculations and required, round your answer to the nearest dollar. Reshier Company Segmented Income Statement Model 3 260000 $ 586000 641000 1487000 Less variable cost of goo 86500 174200 359600 620300 55 commissions - 5400 36500 22750 64650 Contribution margin 168100 5 375300 $ 258650 $ 802050 Less traceable fixed expenses: Engineering 60800 5320 9880 76000 Setting up 40568 41566 96866 179000 23000 23000 40105 56413 101000 3626 A 93 423050 Les commented expenses 112000 Setting and admin. espero 190000 2. Using your answer to Requirement 1, assume that Reshier Company is considering dropping any model with a negative product margin. What are the sternatives? Keeping Model 1 or drept Which alternative is more cost effective and by how much? (Assume that any traceable foed costs can be avoided.) DO NOT round interim calculations and required, round your answer to the nearest dollar Dropping Model 1 will add to operating income 3. What if Reshier Company can only avaid 178 hours of engineering time and 5,300 hours of setup time that are attributable to Model 17 How does that affect the alternatives presented in Requirement 2? Which alternative is more cost effective and by how much? Do NOT round interim calculations and, if required, round your answer to the nearest dollar Keeping Modell will add to operating income eBook Cornerstone Exercise 17.2 (Algorithmic) Keep-Or-Drop Decision, Alternatives, Relevant Costs Reshier Company makes three types of rug shampooers. Model 1 is the basic model rented through hardware stores and supermarkets. Model 2 is a more advance vacuuming capabilities. Model 3 is the heavy-duty riding shampooer sold to hotels and convention centers. A segmented income statement is shown below. Model 1 Model 2 Model 3 Total Sales $260,000 $586,000 5641,000 $1,487,000 Less variable costs of goods sold (86,500) (174,200) (359,600) (620,300) Les commissions (5,400) (36,500) (22,750) (64,650) Contribution margin $168,100 $375,300 $258,650 $802,050 Less common fixed expenses: Fixed factory overhead (390,000) Fixed selling and administrative (291,000) Operating income $121,050 While all models have positive contribution margins, Reshier Company is concerned because operating income is less than 10 percent of sales and is low for this controller gathered additional information on fixed costs to see why they were so high. The following information on activities and drivers was gathered: - Driver Usage by Model Activity Activity Cost Activity Driver Model 1 Model 2 Model 3 Engineering $76,000 Engineering hours 800 70 130 Setting up 179,000 Setup hours 12,200 12,500 29,130 Customer service 101,000 Service calls 13,600 1,520 19,130 In addition, Model 1 requires the rental of specialized equipment costing $23,000 per year. Required: 1. Heformulate the segmented income statement using the additional information on activities. Use a minus sign to indicate any negative margins. Do NOT round interim calculations and required, round your answer to the nearest dollar. Reshier Company Segmented Income Statement Model 3 260000 $ 586000 641000 1487000 Less variable cost of goo 86500 174200 359600 620300 55 commissions - 5400 36500 22750 64650 Contribution margin 168100 5 375300 $ 258650 $ 802050 Less traceable fixed expenses: Engineering 60800 5320 9880 76000 Setting up 40568 41566 96866 179000 23000 23000 40105 56413 101000 3626 A 93 423050 Les commented expenses 112000 Setting and admin. espero 190000 2. Using your answer to Requirement 1, assume that Reshier Company is considering dropping any model with a negative product margin. What are the sternatives? Keeping Model 1 or drept Which alternative is more cost effective and by how much? (Assume that any traceable foed costs can be avoided.) DO NOT round interim calculations and required, round your answer to the nearest dollar Dropping Model 1 will add to operating income 3. What if Reshier Company can only avaid 178 hours of engineering time and 5,300 hours of setup time that are attributable to Model 17 How does that affect the alternatives presented in Requirement 2? Which alternative is more cost effective and by how much? Do NOT round interim calculations and, if required, round your answer to the nearest dollar Keeping Modell will add to operating income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts