Question: can you please answer the question a-c in excel formula gne tHan hormal 1: Data Table (Click on the icon located on the top-right corner

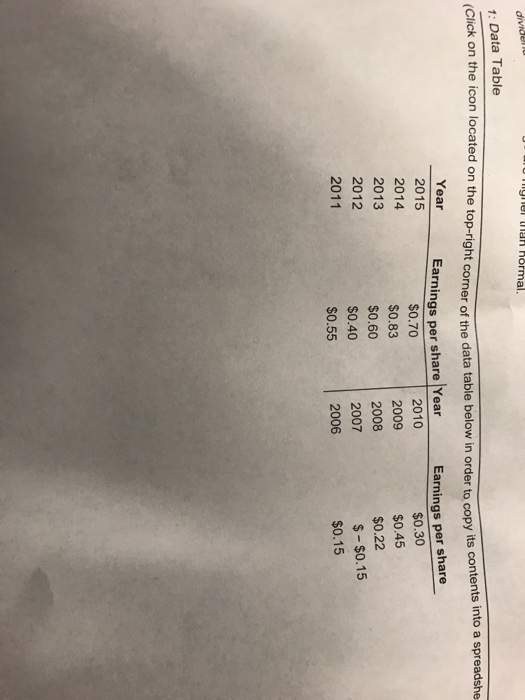

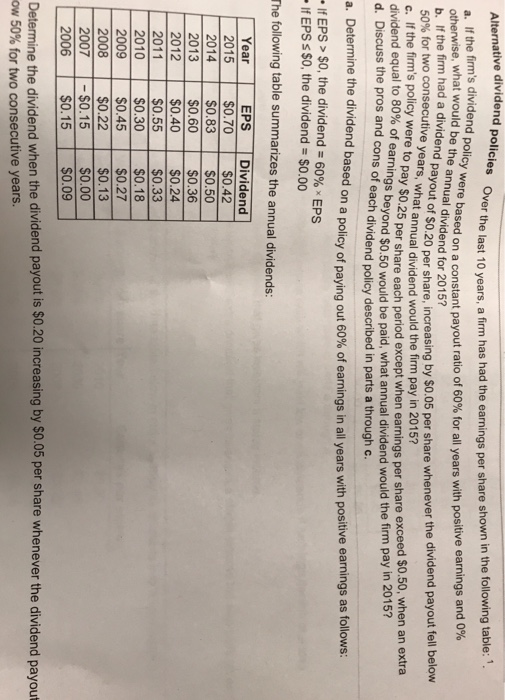

gne tHan hormal 1: Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its co Earnings per share $0.30 $0.45 $0.22 Earnings per share Year 2015 2014 2013 2012 2011 $0.70 $0.83 $0.60 $0.40 $0.55 2010 2009 2008 2007 2006 $- $0.15 $0.15 isOver the last 10 years, a firm has had the earnings per share shown in the following table: a. If the firm's dividend poli b. If the firm had a dividend pa se, what would be the annual dividend for 2015 were based on a constant payout ratio of 60% for all years with positive earnings and 0% S0.20 per share, increasing by $0.05 per share whenever the dividend payout fell below what annual dividend would the firm pay in 2015? payout of $ 50% for two consecutive ye firm's policy were to pay $O.25 per share each per 25 per share each period except when earnings per share exceed $0.50, when an extra beyond $0.50 would be paid, what annual dividend would the firm pay in 2015? each dividend policy described in parts a through c dividend equal to 80% of the seai earnings beyond $0.50 would be d. Discu a. Determine the dividend based If EPS> $0, the dividend 60%x on a policy of paying out 60% of earnings in all years with positive earnings as follows: EPS If EPS s $O, the dividend $0.00 The following table summarizes the annual dividends: Year EPS Dividend 2015 S0,70 $0.42 S0.50 2014 $0.83 2013 $0.60 0.36 2011 2010 2012 $0.40 S0.24 $0.55 $0.33 $0.18 $0.30 2009 $0.45 S0.27 2008 S0.22 $0.13 2007 $0.15 $0.00 $0.09 6 2006 $0.15 Determine the dividend when the dividend payout is $0.20 increasing by $0.05 per share whenever the dividend payout ow 50% for two consecutive years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts