Question: can you please answer these 4 multiple choice question! Thank youu Question 22 For 2020, Walrus Company reported net revenues, average total assets, and net

can you please answer these 4 multiple choice question! Thank youu

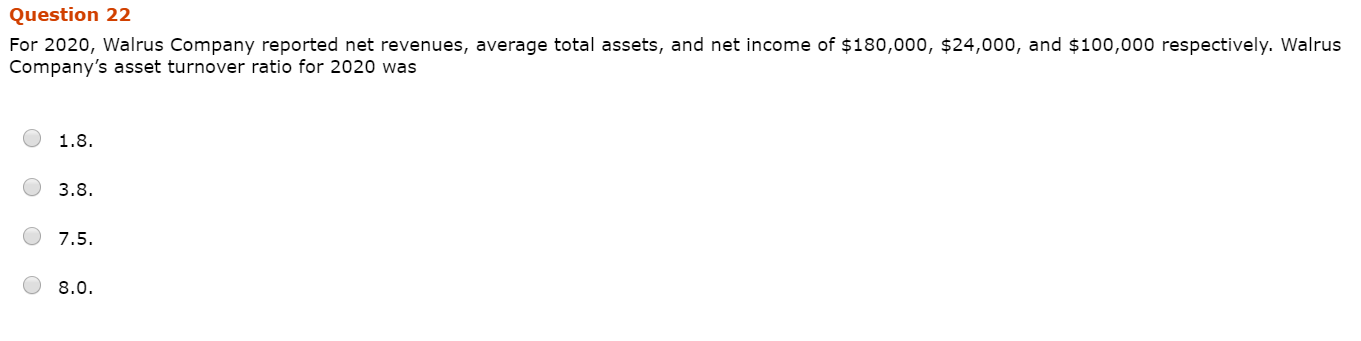

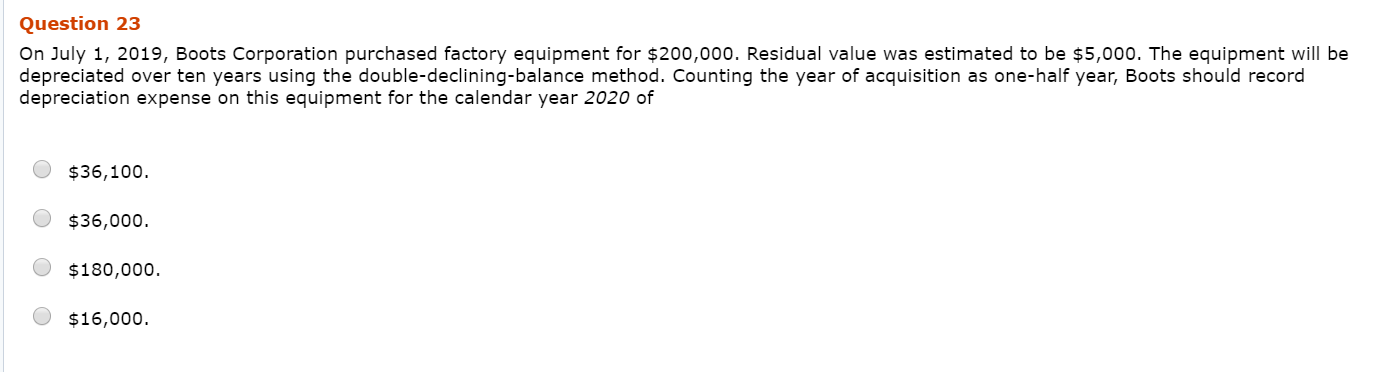

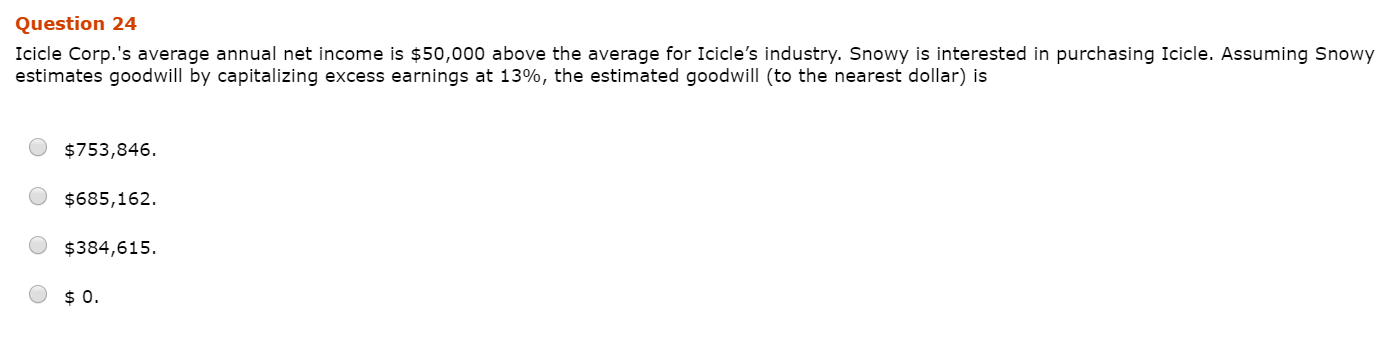

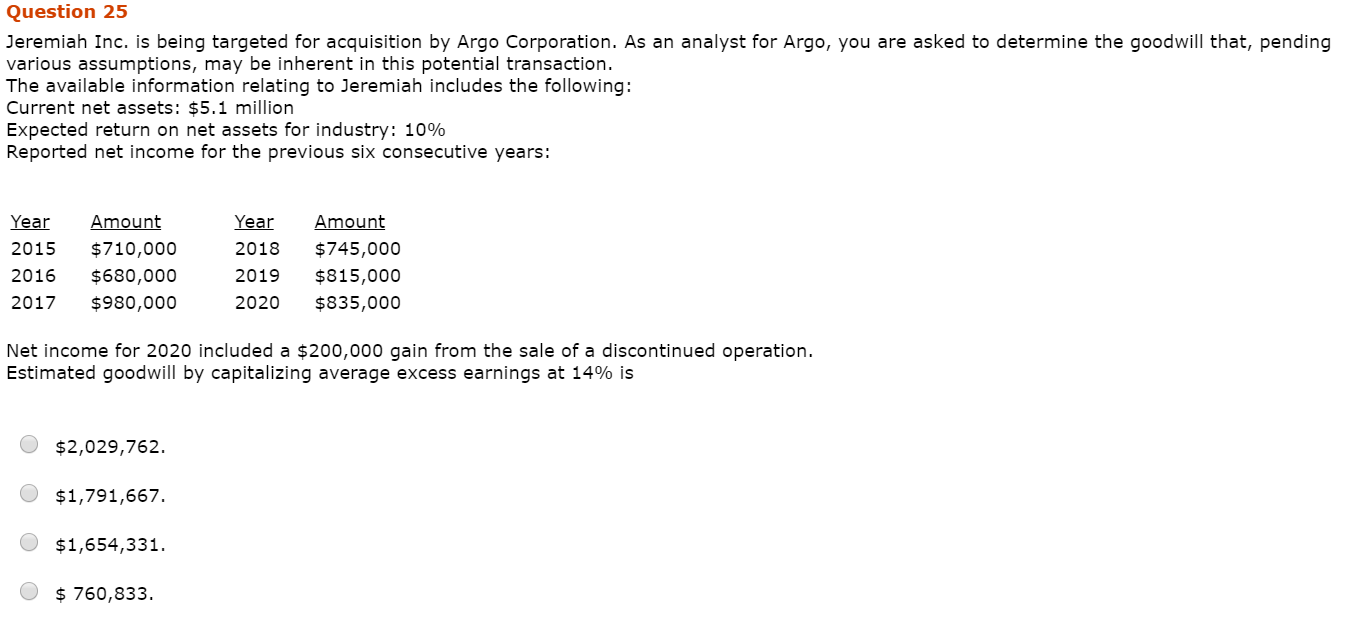

Question 22 For 2020, Walrus Company reported net revenues, average total assets, and net income of $180,000, $24,000, and $100,000 respectively. Walrus Company's asset turnover ratio for 2020 was Question 23 On July 1, 2019, Boots Corporation purchased factory equipment for $200,000. Residual value was estimated to be $5,000. The equipment will be depreciated over ten years using the double-declining-balance method. Counting the year of acquisition as one-half year, Boots should record depreciation expense on this equipment for the calendar year 2020 of O $36,100. $36,000 $180,000. $ 16,000. Question 24 Icicle Corp.'s average annual net income is $50,000 above the average for Icicle's industry. Snowy is interested in purchasing Icicle. Assuming Snowy estimates goodwill by capitalizing excess earnings at 13%, the estimated goodwill to the nearest dollar) is O $753,846. $685,162. $384,615. O $ 0. Question 25 Jeremiah Inc. is being targeted for acquisition by Argo Corporation. As an analyst for Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction. The available information relating to Jeremiah includes the following: Current net assets: $5.1 million Expected return on net assets for industry: 10% Reported net income for the previous six consecutive years: Year 2015 2016 2017 Amount $710,000 $680,000 $980,000 Year 2018 2019 2020 Amount $745,000 $815,000 $835,000 Net income for 2020 included a $200,000 gain from the sale of a discontinued operation. Estimated goodwill by capitalizing average excess earnings at 14% is O $2,029,762. $1,791,667. O $1,654,331. $ 760,833

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts