Question: .Can you please answer these three questions ers ely, en. 8. 8. (LO 6) AP Capital balances in the Alouette partnership are Trem- blay, Capital

.Can you please answer these three questions

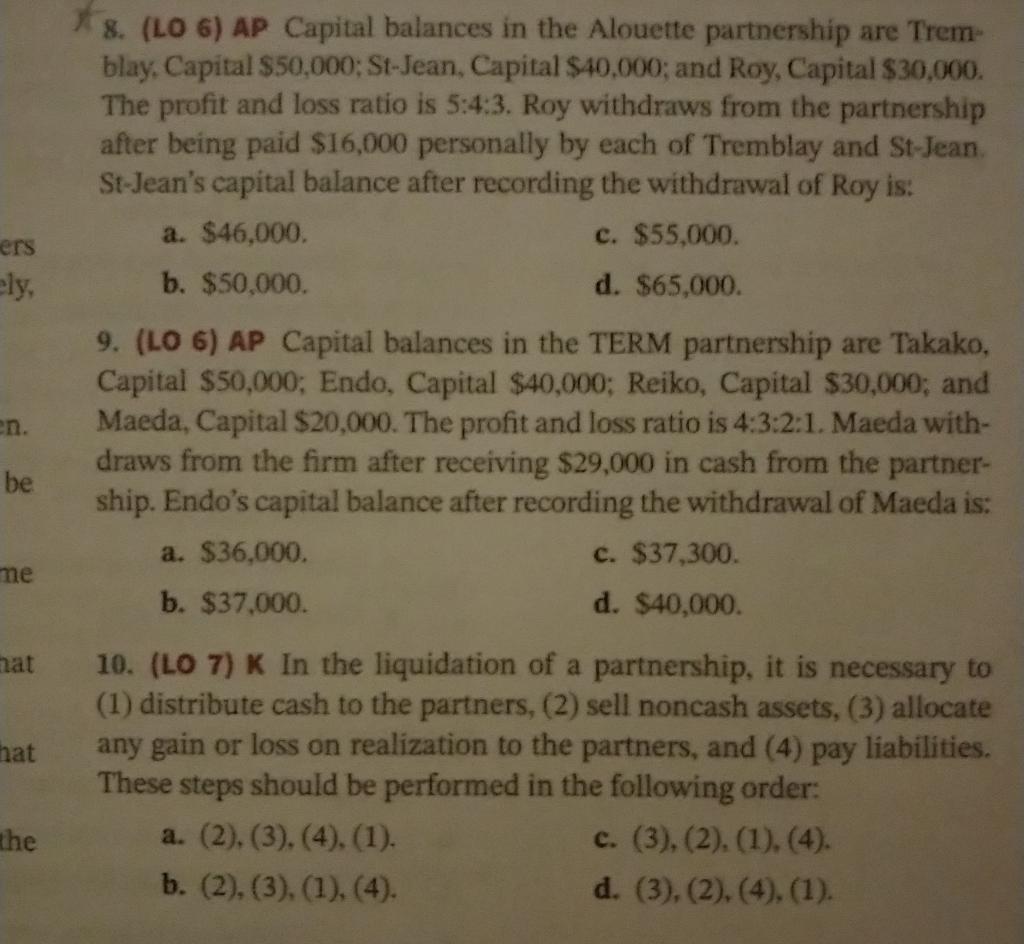

ers ely, en. 8. 8. (LO 6) AP Capital balances in the Alouette partnership are Trem- blay, Capital $50,000; St-Jean Capital $40,000; and Roy, Capital $30,000. The profit and loss ratio is 5:43. Roy withdraws from the partnership after being paid $16,000 personally by each of Tremblay and St-Jean. St-Jean's capital balance after recording the withdrawal of Roy is: a. $46,000 c. $55,000. b. $50,000. d. $65,000. 9. (LO 6) AP Capital balances in the TERM partnership are Takako, Capital $50,000: Endo, Capital $40,000: Reiko, Capital $30,000; and Maeda, Capital $20,000. The profit and loss ratio is 4:3:2:1. Maeda with- draws from the firm after receiving $29,000 in cash from the partner- ship. Endo's capital balance after recording the withdrawal of Maeda is: a. $36,000. c. $37,300. b. $37.000. d. $40,000 10. (LO 7) K In the liquidation of a partnership, it is necessary to (1) distribute cash to the partners, (2) sell noncash assets, (3) allocate any gain or loss on realization to the partners, and (4) pay liabilities. These steps should be performed in the following order: a. (2).(3). (4). (1). c. (3), (2). (1). (4). b. (2), (3). (1), (4) d. (3), (2), (4), (1). be me nat hat the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts