Question: Can you please answer these two questions please. Thank you On 1 Aug 2018, Chelmer Ltd acquired an item of equipment at a purchase price

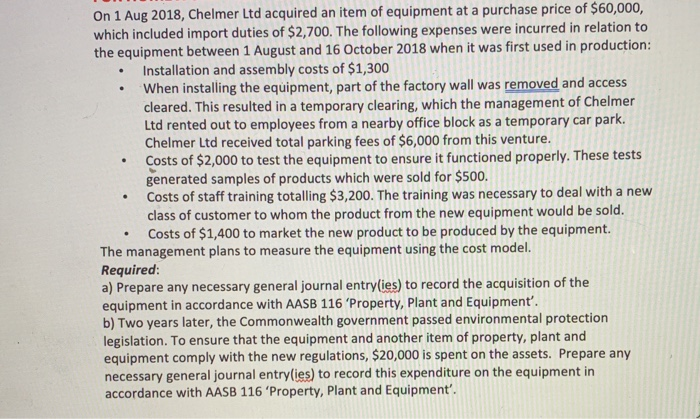

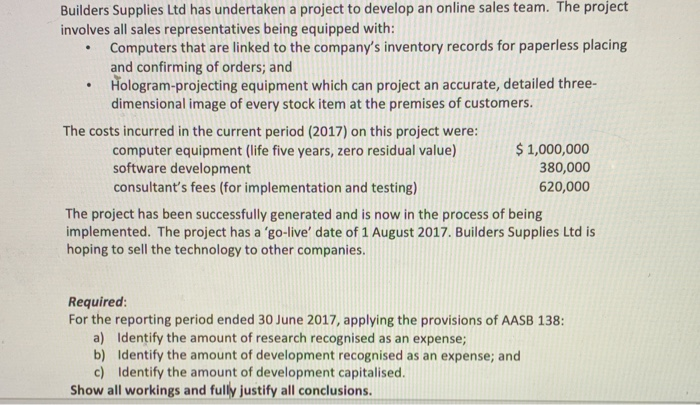

On 1 Aug 2018, Chelmer Ltd acquired an item of equipment at a purchase price of $60,000, which included import duties of $2,700. The following expenses were incurred in relation to the equipment between 1 August and 16 October 2018 when it was first used in production: Installation and assembly costs of $1,300 When installing the equipment, part of the factory wall was removed and access cleared. This resulted in a temporary clearing, which the management of Chelmer Ltd rented out to employees from a nearby office block as a temporary car park. Chelmer Ltd received total parking fees of $6,000 from this venture. Costs of $2,000 to test the equipment to ensure it functioned properly. These tests generated samples of products which were sold for $500. Costs of staff training totalling $3.200. The training was necessary to deal with a new class of customer to whom the product from the new equipment would be sold. Costs of $1,400 to market the new product to be produced by the equipment. The management plans to measure the equipment using the cost model. Required: a) Prepare any necessary general journal entry(ies) to record the acquisition of the equipment in accordance with AASB 116 'Property, plant and Equipment'. b) Two years later, the Commonwealth government passed environmental protection legislation. To ensure that the equipment and another item of property, plant and equipment comply with the new regulations, $20,000 is spent on the assets. Prepare any necessary general journal entry(ies) to record this expenditure on the equipment in accordance with AASB 116 'Property, Plant and Equipment'. Builders Supplies Ltd has undertaken a project to develop an online sales team. The project involves all sales representatives being equipped with: Computers that are linked to the company's inventory records for paperless placing and confirming of orders; and Hologram-projecting equipment which can project an accurate, detailed three- dimensional image of every stock item at the premises of customers. The costs incurred in the current period (2017) on this project were: computer equipment (life five years, zero residual value) $ 1,000,000 software development 380,000 consultant's fees (for implementation and testing) 620,000 The project has been successfully generated and is now in the process of being implemented. The project has a 'go-live' date of 1 August 2017. Builders Supplies Ltd is hoping to sell the technology to other companies. Required: For the reporting period ended 30 June 2017, applying the provisions of AASB 138: a) Identify the amount of research recognised as an expense; b) Identify the amount of development recognised as an expense; and c) Identify the amount of development capitalised. Show all workings and fully justify all conclusions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts