Question: Can you please answer these two questions? Thanks Consider a project with the following data: accounting break-even quantity = 17,500 units; cash break-even quantity =

Can you please answer these two questions? Thanks

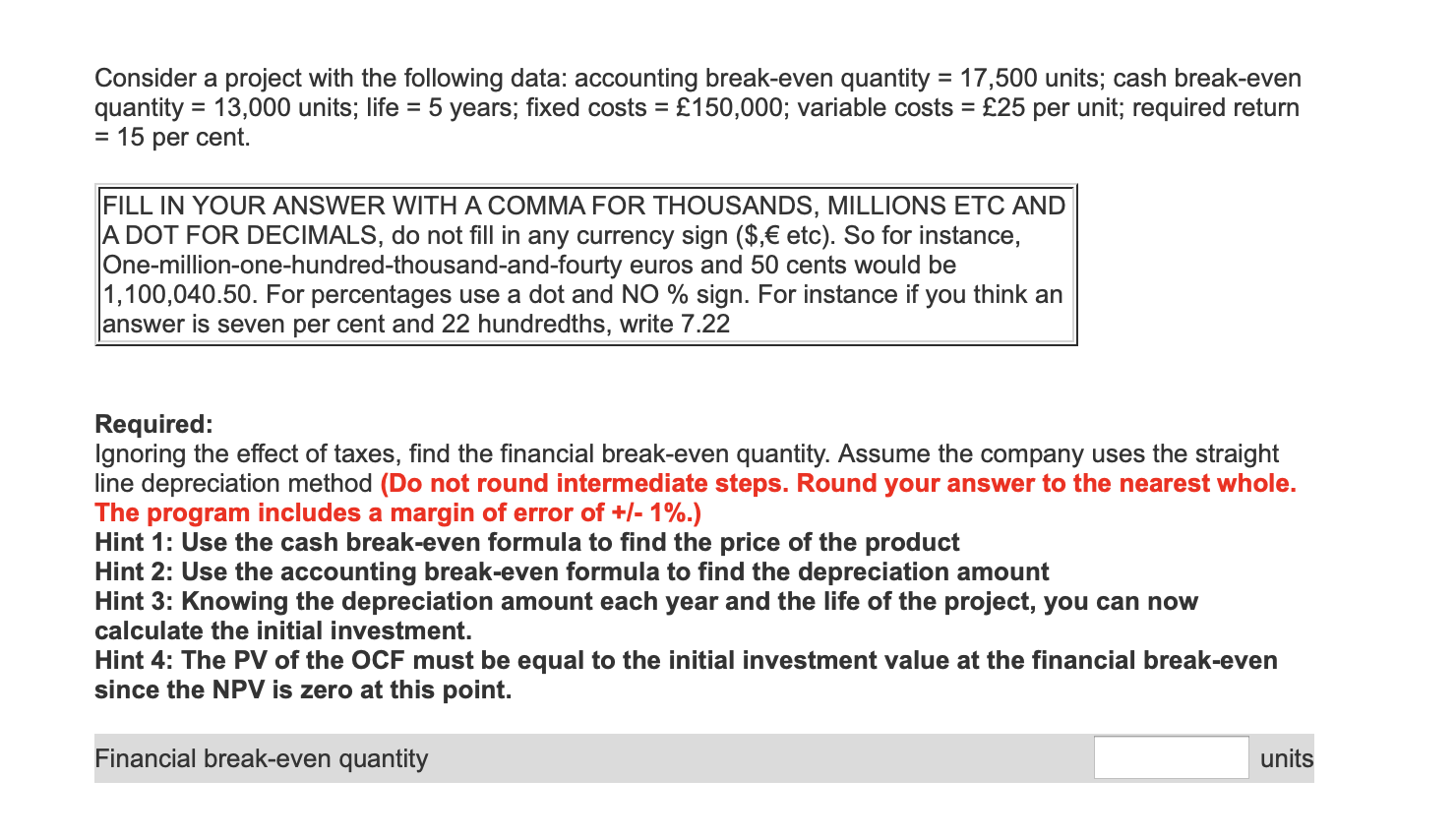

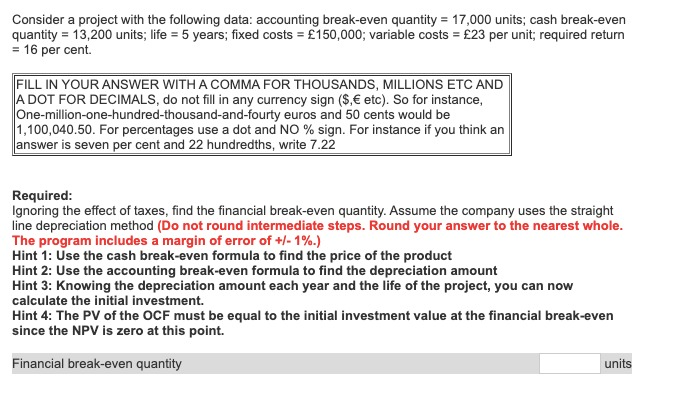

Consider a project with the following data: accounting break-even quantity = 17,500 units; cash break-even quantity = 13,000 units; life = 5 years; fixed costs = 150,000; variable costs = 25 per unit; required return = 15 per cent. FILL IN YOUR ANSWER WITH A COMMA FOR THOUSANDS, MILLIONS ETC AND A DOT FOR DECIMALS, do not fill in any currency sign ($, etc). So for instance, One-million-one-hundred-thousand-and-fourty euros and 50 cents would be 1,100,040.50. For percentages use a dot and NO % sign. For instance if you think an answer is seven per cent and 22 hundredths, write 7.22 Required: Ignoring the effect of taxes, find the financial break-even quantity. Assume the company uses the straight line depreciation method (Do not round intermediate steps. Round your answer to the nearest whole. The program includes a margin of error of +/- 1%.) Jse the cash break-even formula to find the price of the product Hint 2: Use the accounting break-even formula to find the depreciation amount Hint 3: Knowing the depreciation amount each year and the life of the project, you can now calculate the initial investment. Hint 4: The PV of the OCF must be equal to the initial investment value at the financial break-even since the NPV is zero at this point. Financial break-even quantity units Consider a project with the following data: accounting break-even quantity = 17,000 units; cash break-even quantity = 13,200 units; life = 5 years; fixed costs = 150,000; variable costs = 23 per unit; required return = 16 per cent. FILL IN YOUR ANSWER WITH A COMMA FOR THOUSANDS, MILLIONS ETC AND A DOT FOR DECIMALS, do not fill in any currency sign ($. etc). So for instance, One-million-one-hundred-thousand-and-fourty euros and 50 cents would be 1,100,040.50. For percentages use a dot and NO % sign. For instance if you think an answer is seven per cent and 22 hundredths, write 7.22 Required: Ignoring the effect of taxes, find the financial break-even quantity. Assume the company uses the straight line depreciation method (Do not round intermediate steps. Round your answer to the nearest whole. The program includes a margin of error of +/- 1%.) Hint 1: Use the cash break-even formula to find the price of the product Hint 2: Use the accounting break-even formula to find the depreciation amount Hint 3: Knowing the depreciation amount each year and the life of the project, you can now calculate the initial investment. Hint 4: The PV of the OCF must be equal to the initial investment value at the financial break-even since the NPV is zero at this point. Financial break-even quantity units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts