Question: can you please answer this i dont have much time Question 3 a) Find the current bond price (assume the face value of 100): 1.

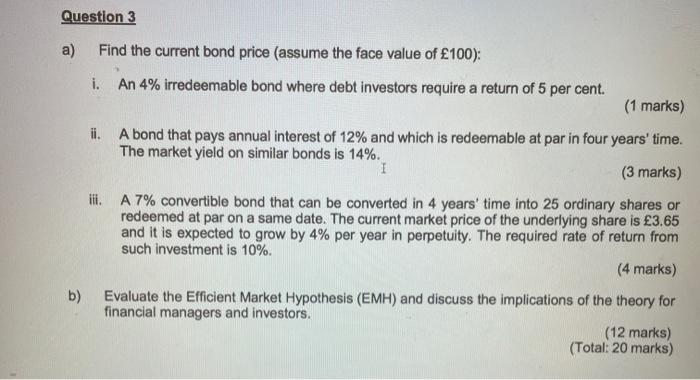

Question 3 a) Find the current bond price (assume the face value of 100): 1. An 4% irredeemable bond where debt investors require a return of 5 per cent. (1 marks) ii. A bond that pays annual interest of 12% and which is redeemable at par in four years' time. The market yield on similar bonds is 14%. I (3 marks) ii. A 7% convertible bond that can be converted in 4 years' time into 25 ordinary shares or redeemed at par on a same date. The current market price of the underlying share is 3.65 and it is expected to grow by 4% per year in perpetuity. The required rate of return from such investment is 10%. (4 marks) Evaluate the Efficient Market Hypothesis (EMH) and discuss the implications of the theory for financial managers and investors. (12 marks) (Total: 20 marks) b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts