Question: can you please break down the math for questions 10-12? correct answers are highlighted. The following option prices were observed in the Listed Options Quotations

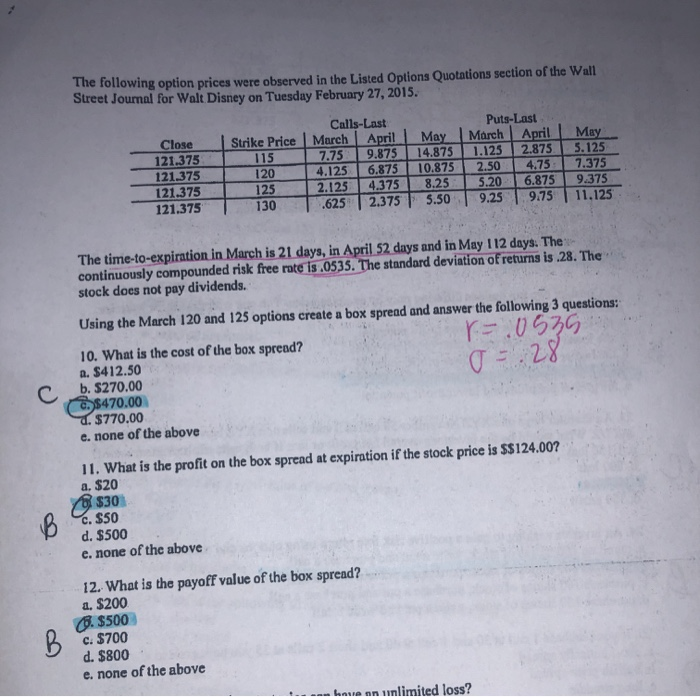

The following option prices were observed in the Listed Options Quotations section of the Wall Street Journal for Walt Disney on Tuesday February 27, 2015. Calls-Last Close Strike Price March April 121.375 115 7.75 9.875 121.375L 120 4.125 6.875 121.375 2.125 4.375 121.375 l 130 .625 2.375 May 14.875 10.875 8.25 5.50 Puts-Last March April 1.125 2.875 2.50 4.75 5.20 6.875 9.25 9.75 May 5.125 7.375 9.375 11.125 The time-to-expiration in March is 21 days, in April 52 days and in May 112 days. The continuously compounded risk free rate is .0535. The standard deviation of returns is .28. The stock does not pay dividends. o - 28 Using the March 120 and 125 options create a box spread and answer the following 3 questions: r. 0536 10. What is the cost of the box spread? a. $412.50 b. $270.00 . $470.00 3. $770.00 e. none of the above 11. What is the profit on the box spread at expiration if the stock price is $$124.00? a. $20 $30 c. $50 d. $500 e. none of the above 12. What is the payoff value of the box spread? a. $200 . $500 c. $700 d. $800 e. none of the above e an unlimited loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts