Question: can you please calculating(using Excel) the difference COVID 19 cause in 2018 and 2020. using the infor given please. yes inflows I have to use

can you please calculating(using Excel) the difference COVID 19 cause in 2018 and 2020. using the infor given please.

yes inflows

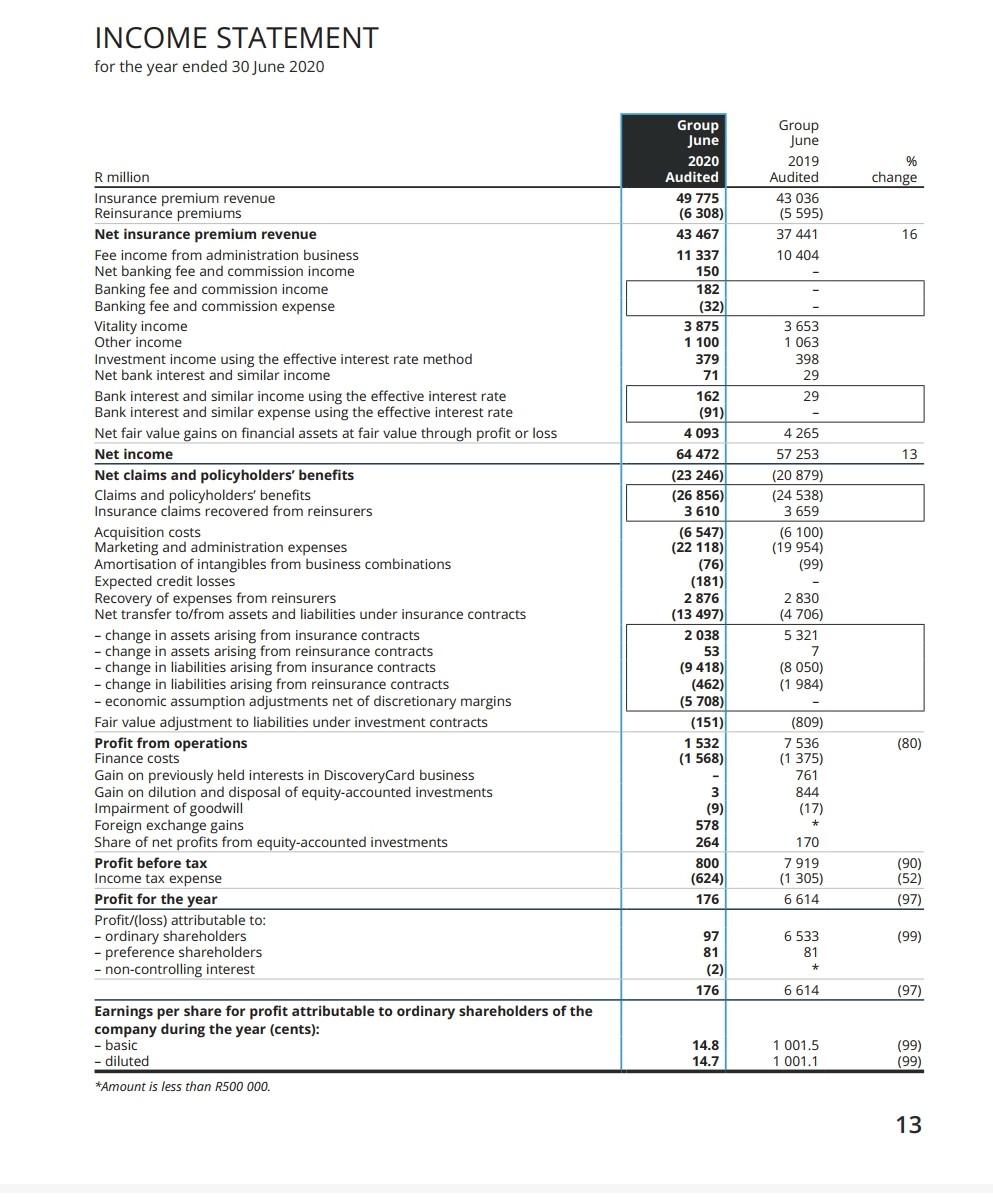

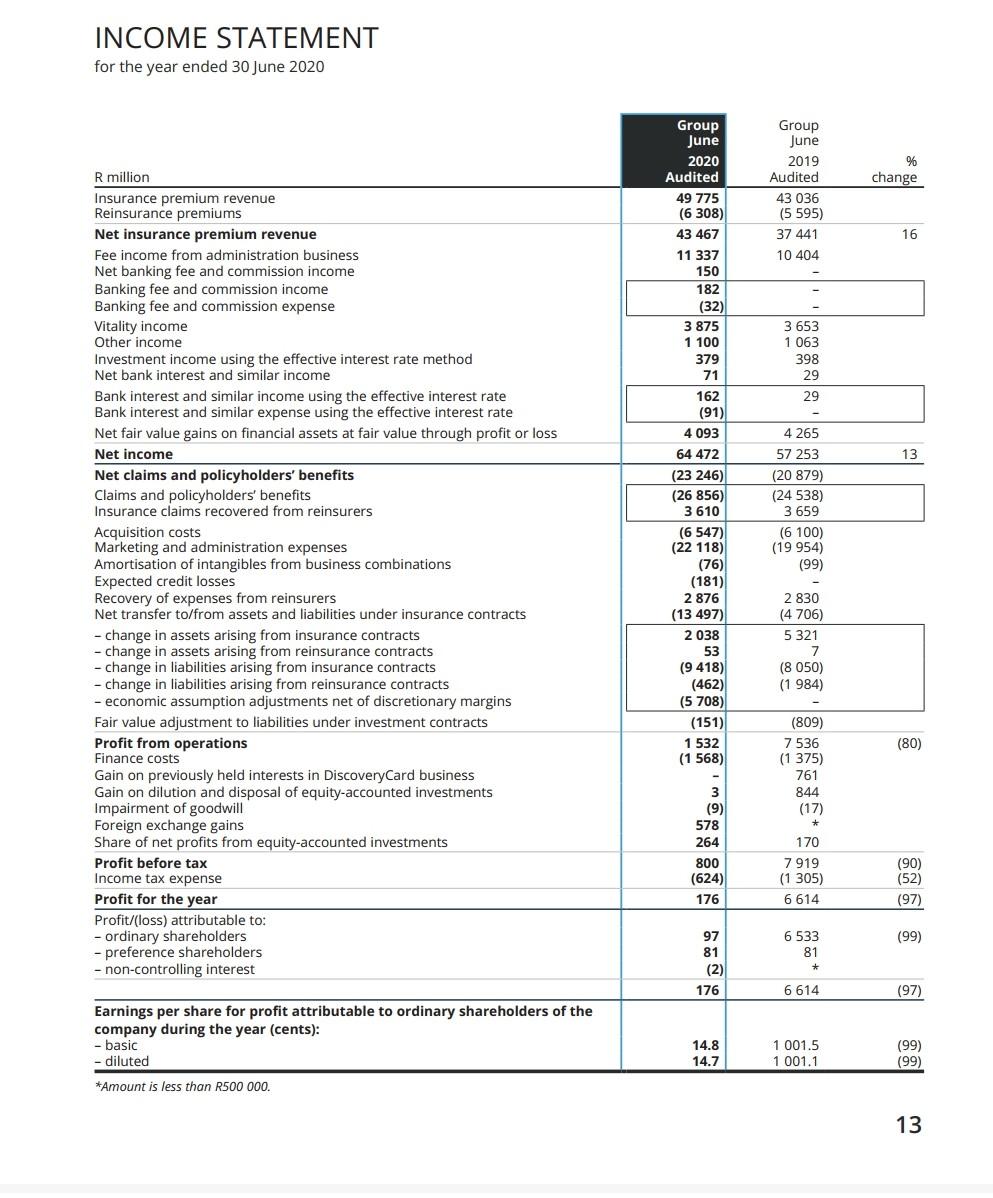

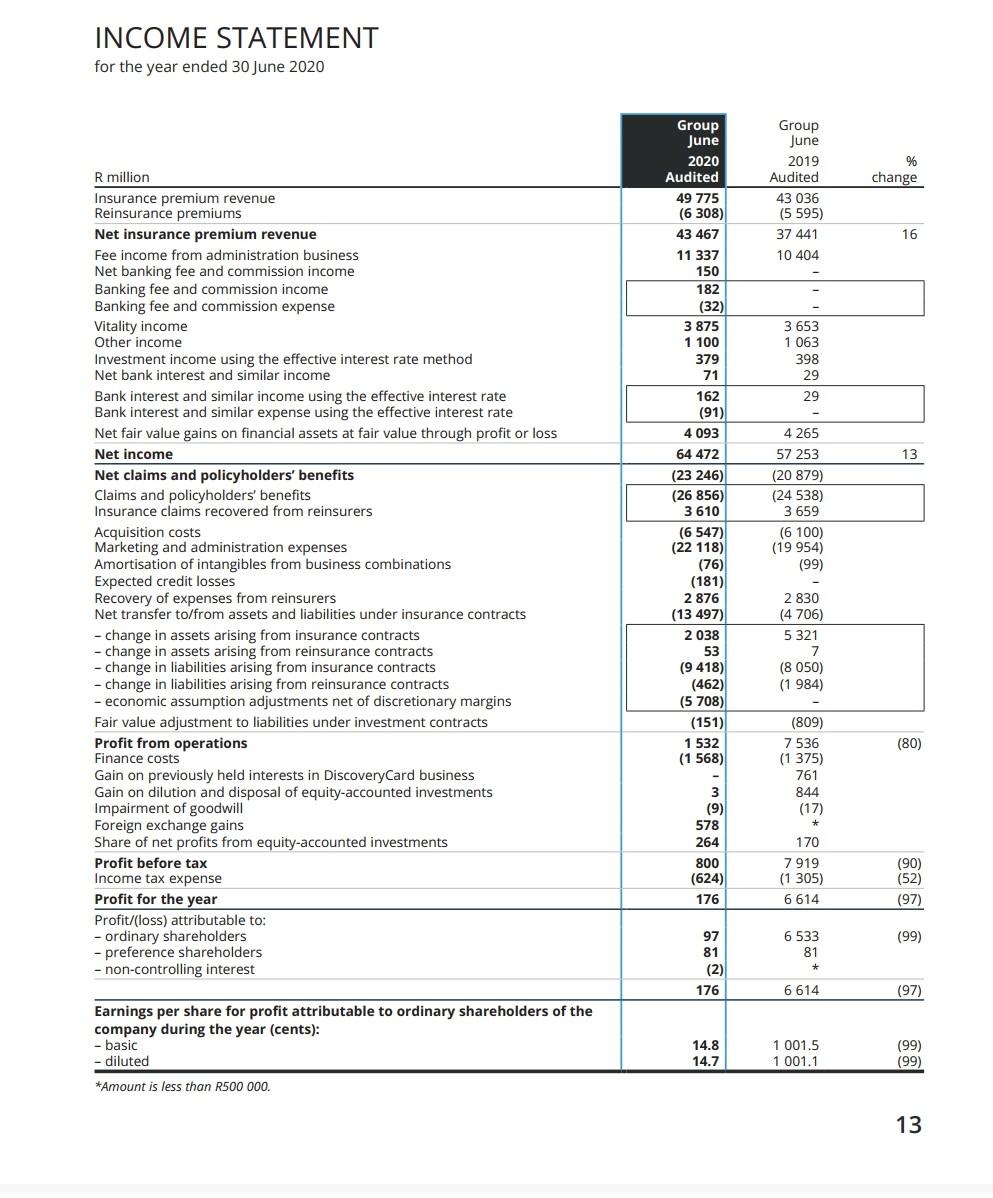

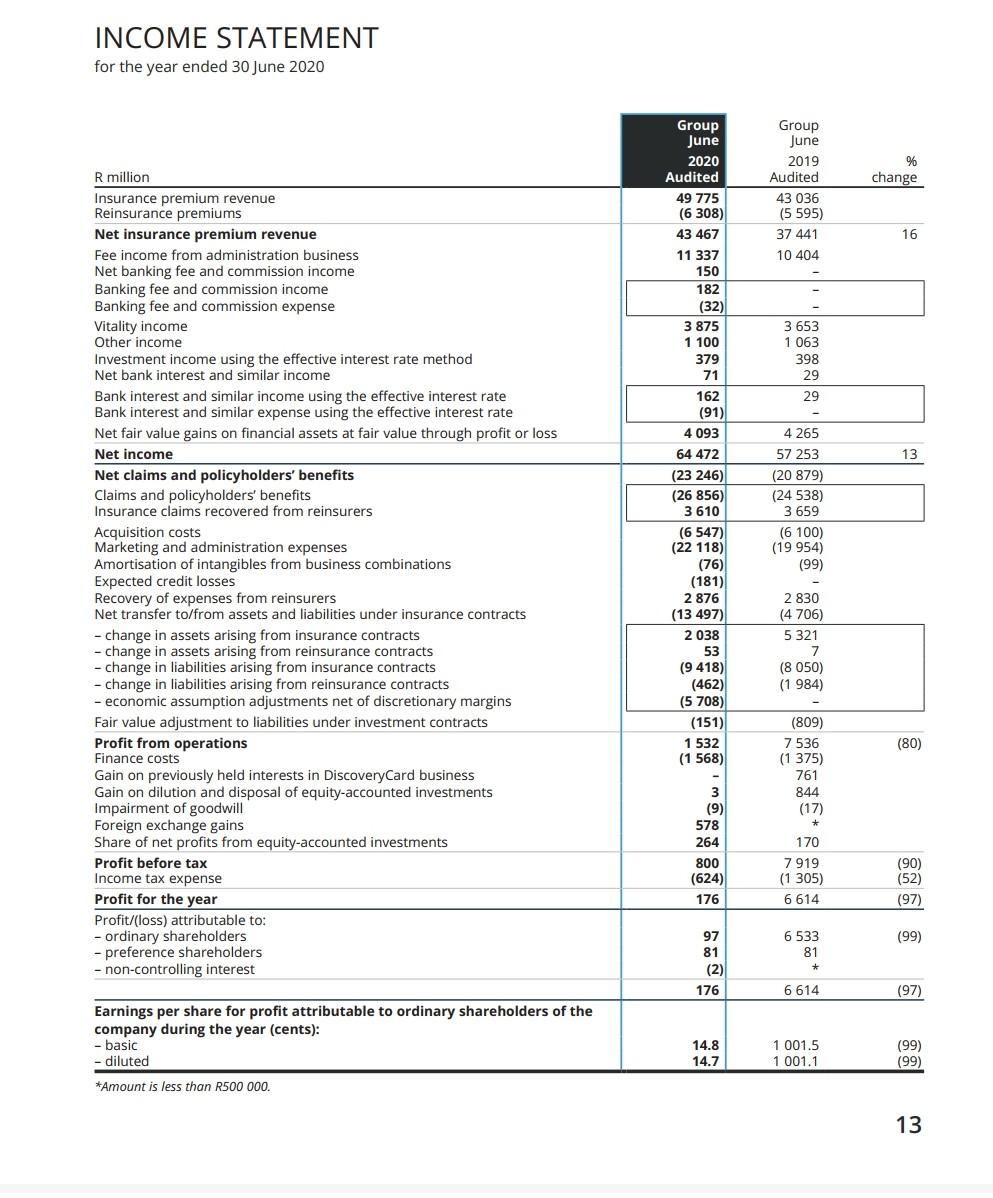

I have to use this 2 financial statements 2018and 2020 to see what is the difference. what changed from 2018 to 2020, did COVID affect the company finances or not? I don't know if I make sense

answering this question

INCOME STATEMENT for the year ended 30 June 2020 Group June 2019 % change Audited 43 036 (5 595) 37 441 10 404 16 3 653 1 063 398 29 29 Group June 2020 Audited 49 775 (6 308) 43 467 11 337 150 182 (32) 3 875 1 100 379 71 162 (91) 4093 64 472 (23 246) (26 856) 3610 (6 547) (22 118) (76) (181) 2 876 (13 497) 2 038 53 (9 418) (462) (5 708) (151) 1 532 (1 568) R million Insurance premium revenue Reinsurance premiums Net insurance premium revenue Fee income from administration business Net banking fee and commission income Banking fee and commission income Banking fee and commission expense Vitality income Other income Investment income using the effective interest rate method Net bank interest and similar income Bank interest and similar income using the effective interest rate Bank interest and similar expense using the effective interest rate Net fair value gains on financial assets at fair value through profit or loss Net income Net claims and policyholders' benefits Claims and policyholders' benefits Insurance claims recovered from reinsurers Acquisition costs Marketing and administration expenses Amortisation of intangibles from business combinations Expected credit losses Recovery of expenses from reinsurers Net transfer to/from assets and liabilities under insurance contracts - change in assets arising from insurance contracts - change in assets arising from reinsurance contracts - change in liabilities arising from insurance contracts - change in liabilities arising from reinsurance contracts - economic assumption adjustments net of discretionary margins Fair value adjustment to liabilities under investment contracts Profit from operations Finance costs Gain on previously held interests in Discovery Card business Gain on dilution and disposal of equity-accounted investments Impairment of goodwill Foreign exchange gains Share of net profits from equity-accounted investments Profit before tax Income tax expense Profit for the year Profit/(loss) attributable to: - ordinary shareholders - preference shareholders - non-controlling interest 13 4 265 57 253 (20 879) (24 538) 3 659 (6 100) (19 954) (99) 2830 (4 706) 5 321 7 (8 050) (1 984) (80) (809) 7 536 (1 375) 761 844 (17) * 3 (9) 578 264 800 (624) 176 170 7 919 (1 305) 6 614 (90) (52) (97) 97 (99) 81 (2) 176 6 533 81 * 6 614 (97) Earnings per share for profit attributable to ordinary shareholders of the company during the year (cents): - basic - diluted *Amount is less than R500 000. * 14.8 14.7 1 001.5 1 001.1 (99) (99) 13 INCOME STATEMENT for the year ended 30 June 2020 Group June 2019 % change Audited 43 036 (5 595) 37 441 10 404 16 3 653 1 063 398 29 29 Group June 2020 Audited 49 775 (6 308) 43 467 11 337 150 182 (32) 3 875 1 100 379 71 162 (91) 4093 64 472 (23 246) (26 856) 3610 (6 547) (22 118) (76) (181) 2 876 (13 497) 2 038 53 (9 418) (462) (5 708) (151) 1 532 (1 568) R million Insurance premium revenue Reinsurance premiums Net insurance premium revenue Fee income from administration business Net banking fee and commission income Banking fee and commission income Banking fee and commission expense Vitality income Other income Investment income using the effective interest rate method Net bank interest and similar income Bank interest and similar income using the effective interest rate Bank interest and similar expense using the effective interest rate Net fair value gains on financial assets at fair value through profit or loss Net income Net claims and policyholders' benefits Claims and policyholders' benefits Insurance claims recovered from reinsurers Acquisition costs Marketing and administration expenses Amortisation of intangibles from business combinations Expected credit losses Recovery of expenses from reinsurers Net transfer to/from assets and liabilities under insurance contracts - change in assets arising from insurance contracts - change in assets arising from reinsurance contracts - change in liabilities arising from insurance contracts - change in liabilities arising from reinsurance contracts - economic assumption adjustments net of discretionary margins Fair value adjustment to liabilities under investment contracts Profit from operations Finance costs Gain on previously held interests in Discovery Card business Gain on dilution and disposal of equity-accounted investments Impairment of goodwill Foreign exchange gains Share of net profits from equity-accounted investments Profit before tax Income tax expense Profit for the year Profit/(loss) attributable to: - ordinary shareholders - preference shareholders - non-controlling interest 13 4 265 57 253 (20 879) (24 538) 3 659 (6 100) (19 954) (99) 2830 (4 706) 5 321 7 (8 050) (1 984) (80) (809) 7 536 (1 375) 761 844 (17) * 3 (9) 578 264 800 (624) 176 170 7 919 (1 305) 6 614 (90) (52) (97) 97 (99) 81 (2) 176 6 533 81 * 6 614 (97) Earnings per share for profit attributable to ordinary shareholders of the company during the year (cents): - basic - diluted *Amount is less than R500 000. * 14.8 14.7 1 001.5 1 001.1 (99) (99) 13 INCOME STATEMENT for the year ended 30 June 2020 Group June 2019 % change Audited 43 036 (5 595) 37 441 10 404 16 3 653 1 063 398 29 29 Group June 2020 Audited 49 775 (6 308) 43 467 11 337 150 182 (32) 3 875 1 100 379 71 162 (91) 4093 64 472 (23 246) (26 856) 3610 (6 547) (22 118) (76) (181) 2 876 (13 497) 2 038 53 (9 418) (462) (5 708) (151) 1 532 (1 568) R million Insurance premium revenue Reinsurance premiums Net insurance premium revenue Fee income from administration business Net banking fee and commission income Banking fee and commission income Banking fee and commission expense Vitality income Other income Investment income using the effective interest rate method Net bank interest and similar income Bank interest and similar income using the effective interest rate Bank interest and similar expense using the effective interest rate Net fair value gains on financial assets at fair value through profit or loss Net income Net claims and policyholders' benefits Claims and policyholders' benefits Insurance claims recovered from reinsurers Acquisition costs Marketing and administration expenses Amortisation of intangibles from business combinations Expected credit losses Recovery of expenses from reinsurers Net transfer to/from assets and liabilities under insurance contracts - change in assets arising from insurance contracts - change in assets arising from reinsurance contracts - change in liabilities arising from insurance contracts - change in liabilities arising from reinsurance contracts - economic assumption adjustments net of discretionary margins Fair value adjustment to liabilities under investment contracts Profit from operations Finance costs Gain on previously held interests in Discovery Card business Gain on dilution and disposal of equity-accounted investments Impairment of goodwill Foreign exchange gains Share of net profits from equity-accounted investments Profit before tax Income tax expense Profit for the year Profit/(loss) attributable to: - ordinary shareholders - preference shareholders - non-controlling interest 13 4 265 57 253 (20 879) (24 538) 3 659 (6 100) (19 954) (99) 2830 (4 706) 5 321 7 (8 050) (1 984) (80) (809) 7 536 (1 375) 761 844 (17) * 3 (9) 578 264 800 (624) 176 170 7 919 (1 305) 6 614 (90) (52) (97) 97 (99) 81 (2) 176 6 533 81 * 6 614 (97) Earnings per share for profit attributable to ordinary shareholders of the company during the year (cents): - basic - diluted *Amount is less than R500 000. * 14.8 14.7 1 001.5 1 001.1 (99) (99) 13 INCOME STATEMENT for the year ended 30 June 2020 Group June 2019 % change Audited 43 036 (5 595) 37 441 10 404 16 3 653 1 063 398 29 29 Group June 2020 Audited 49 775 (6 308) 43 467 11 337 150 182 (32) 3 875 1 100 379 71 162 (91) 4093 64 472 (23 246) (26 856) 3610 (6 547) (22 118) (76) (181) 2 876 (13 497) 2 038 53 (9 418) (462) (5 708) (151) 1 532 (1 568) R million Insurance premium revenue Reinsurance premiums Net insurance premium revenue Fee income from administration business Net banking fee and commission income Banking fee and commission income Banking fee and commission expense Vitality income Other income Investment income using the effective interest rate method Net bank interest and similar income Bank interest and similar income using the effective interest rate Bank interest and similar expense using the effective interest rate Net fair value gains on financial assets at fair value through profit or loss Net income Net claims and policyholders' benefits Claims and policyholders' benefits Insurance claims recovered from reinsurers Acquisition costs Marketing and administration expenses Amortisation of intangibles from business combinations Expected credit losses Recovery of expenses from reinsurers Net transfer to/from assets and liabilities under insurance contracts - change in assets arising from insurance contracts - change in assets arising from reinsurance contracts - change in liabilities arising from insurance contracts - change in liabilities arising from reinsurance contracts - economic assumption adjustments net of discretionary margins Fair value adjustment to liabilities under investment contracts Profit from operations Finance costs Gain on previously held interests in Discovery Card business Gain on dilution and disposal of equity-accounted investments Impairment of goodwill Foreign exchange gains Share of net profits from equity-accounted investments Profit before tax Income tax expense Profit for the year Profit/(loss) attributable to: - ordinary shareholders - preference shareholders - non-controlling interest 13 4 265 57 253 (20 879) (24 538) 3 659 (6 100) (19 954) (99) 2830 (4 706) 5 321 7 (8 050) (1 984) (80) (809) 7 536 (1 375) 761 844 (17) * 3 (9) 578 264 800 (624) 176 170 7 919 (1 305) 6 614 (90) (52) (97) 97 (99) 81 (2) 176 6 533 81 * 6 614 (97) Earnings per share for profit attributable to ordinary shareholders of the company during the year (cents): - basic - diluted *Amount is less than R500 000. * 14.8 14.7 1 001.5 1 001.1 (99) (99) 13 b. If you have access to the company's information, you may want to use their summary of the profits and loss account, the balance sheet, and the cash flow statement and report the figures over the last five years. c. Attend a Library session to be guided on referencing, writing, searches, etc. d. Search for, and summarise journal articles and other material related to your assignment (Remember always to include citations from your sources). e. Remember to read through the Graduate Attribute 6 rubric in section 21 of this learner guide before you start researching and writing your assignment report, as this rubric will be used to determine your competency in Graduate Attribute 6: Professional and Technical Communication. The department expects learners to demonstrate the: Understanding of nature and complexity of the accounting problems, in terms of required practices, tools and techniques; INCOME STATEMENT for the year ended 30 June 2020 Group June 2019 % change Audited 43 036 (5 595) 37 441 10 404 16 3 653 1 063 398 29 29 Group June 2020 Audited 49 775 (6 308) 43 467 11 337 150 182 (32) 3 875 1 100 379 71 162 (91) 4093 64 472 (23 246) (26 856) 3610 (6 547) (22 118) (76) (181) 2 876 (13 497) 2 038 53 (9 418) (462) (5 708) (151) 1 532 (1 568) R million Insurance premium revenue Reinsurance premiums Net insurance premium revenue Fee income from administration business Net banking fee and commission income Banking fee and commission income Banking fee and commission expense Vitality income Other income Investment income using the effective interest rate method Net bank interest and similar income Bank interest and similar income using the effective interest rate Bank interest and similar expense using the effective interest rate Net fair value gains on financial assets at fair value through profit or loss Net income Net claims and policyholders' benefits Claims and policyholders' benefits Insurance claims recovered from reinsurers Acquisition costs Marketing and administration expenses Amortisation of intangibles from business combinations Expected credit losses Recovery of expenses from reinsurers Net transfer to/from assets and liabilities under insurance contracts - change in assets arising from insurance contracts - change in assets arising from reinsurance contracts - change in liabilities arising from insurance contracts - change in liabilities arising from reinsurance contracts - economic assumption adjustments net of discretionary margins Fair value adjustment to liabilities under investment contracts Profit from operations Finance costs Gain on previously held interests in Discovery Card business Gain on dilution and disposal of equity-accounted investments Impairment of goodwill Foreign exchange gains Share of net profits from equity-accounted investments Profit before tax Income tax expense Profit for the year Profit/(loss) attributable to: - ordinary shareholders - preference shareholders - non-controlling interest 13 4 265 57 253 (20 879) (24 538) 3 659 (6 100) (19 954) (99) 2830 (4 706) 5 321 7 (8 050) (1 984) (80) (809) 7 536 (1 375) 761 844 (17) * 3 (9) 578 264 800 (624) 176 170 7 919 (1 305) 6 614 (90) (52) (97) 97 (99) 81 (2) 176 6 533 81 * 6 614 (97) Earnings per share for profit attributable to ordinary shareholders of the company during the year (cents): - basic - diluted *Amount is less than R500 000. * 14.8 14.7 1 001.5 1 001.1 (99) (99) 13 INCOME STATEMENT for the year ended 30 June 2020 Group June 2019 % change Audited 43 036 (5 595) 37 441 10 404 16 3 653 1 063 398 29 29 Group June 2020 Audited 49 775 (6 308) 43 467 11 337 150 182 (32) 3 875 1 100 379 71 162 (91) 4093 64 472 (23 246) (26 856) 3610 (6 547) (22 118) (76) (181) 2 876 (13 497) 2 038 53 (9 418) (462) (5 708) (151) 1 532 (1 568) R million Insurance premium revenue Reinsurance premiums Net insurance premium revenue Fee income from administration business Net banking fee and commission income Banking fee and commission income Banking fee and commission expense Vitality income Other income Investment income using the effective interest rate method Net bank interest and similar income Bank interest and similar income using the effective interest rate Bank interest and similar expense using the effective interest rate Net fair value gains on financial assets at fair value through profit or loss Net income Net claims and policyholders' benefits Claims and policyholders' benefits Insurance claims recovered from reinsurers Acquisition costs Marketing and administration expenses Amortisation of intangibles from business combinations Expected credit losses Recovery of expenses from reinsurers Net transfer to/from assets and liabilities under insurance contracts - change in assets arising from insurance contracts - change in assets arising from reinsurance contracts - change in liabilities arising from insurance contracts - change in liabilities arising from reinsurance contracts - economic assumption adjustments net of discretionary margins Fair value adjustment to liabilities under investment contracts Profit from operations Finance costs Gain on previously held interests in Discovery Card business Gain on dilution and disposal of equity-accounted investments Impairment of goodwill Foreign exchange gains Share of net profits from equity-accounted investments Profit before tax Income tax expense Profit for the year Profit/(loss) attributable to: - ordinary shareholders - preference shareholders - non-controlling interest 13 4 265 57 253 (20 879) (24 538) 3 659 (6 100) (19 954) (99) 2830 (4 706) 5 321 7 (8 050) (1 984) (80) (809) 7 536 (1 375) 761 844 (17) * 3 (9) 578 264 800 (624) 176 170 7 919 (1 305) 6 614 (90) (52) (97) 97 (99) 81 (2) 176 6 533 81 * 6 614 (97) Earnings per share for profit attributable to ordinary shareholders of the company during the year (cents): - basic - diluted *Amount is less than R500 000. * 14.8 14.7 1 001.5 1 001.1 (99) (99) 13 INCOME STATEMENT for the year ended 30 June 2020 Group June 2019 % change Audited 43 036 (5 595) 37 441 10 404 16 3 653 1 063 398 29 29 Group June 2020 Audited 49 775 (6 308) 43 467 11 337 150 182 (32) 3 875 1 100 379 71 162 (91) 4093 64 472 (23 246) (26 856) 3610 (6 547) (22 118) (76) (181) 2 876 (13 497) 2 038 53 (9 418) (462) (5 708) (151) 1 532 (1 568) R million Insurance premium revenue Reinsurance premiums Net insurance premium revenue Fee income from administration business Net banking fee and commission income Banking fee and commission income Banking fee and commission expense Vitality income Other income Investment income using the effective interest rate method Net bank interest and similar income Bank interest and similar income using the effective interest rate Bank interest and similar expense using the effective interest rate Net fair value gains on financial assets at fair value through profit or loss Net income Net claims and policyholders' benefits Claims and policyholders' benefits Insurance claims recovered from reinsurers Acquisition costs Marketing and administration expenses Amortisation of intangibles from business combinations Expected credit losses Recovery of expenses from reinsurers Net transfer to/from assets and liabilities under insurance contracts - change in assets arising from insurance contracts - change in assets arising from reinsurance contracts - change in liabilities arising from insurance contracts - change in liabilities arising from reinsurance contracts - economic assumption adjustments net of discretionary margins Fair value adjustment to liabilities under investment contracts Profit from operations Finance costs Gain on previously held interests in Discovery Card business Gain on dilution and disposal of equity-accounted investments Impairment of goodwill Foreign exchange gains Share of net profits from equity-accounted investments Profit before tax Income tax expense Profit for the year Profit/(loss) attributable to: - ordinary shareholders - preference shareholders - non-controlling interest 13 4 265 57 253 (20 879) (24 538) 3 659 (6 100) (19 954) (99) 2830 (4 706) 5 321 7 (8 050) (1 984) (80) (809) 7 536 (1 375) 761 844 (17) * 3 (9) 578 264 800 (624) 176 170 7 919 (1 305) 6 614 (90) (52) (97) 97 (99) 81 (2) 176 6 533 81 * 6 614 (97) Earnings per share for profit attributable to ordinary shareholders of the company during the year (cents): - basic - diluted *Amount is less than R500 000. * 14.8 14.7 1 001.5 1 001.1 (99) (99) 13 INCOME STATEMENT for the year ended 30 June 2020 Group June 2019 % change Audited 43 036 (5 595) 37 441 10 404 16 3 653 1 063 398 29 29 Group June 2020 Audited 49 775 (6 308) 43 467 11 337 150 182 (32) 3 875 1 100 379 71 162 (91) 4093 64 472 (23 246) (26 856) 3610 (6 547) (22 118) (76) (181) 2 876 (13 497) 2 038 53 (9 418) (462) (5 708) (151) 1 532 (1 568) R million Insurance premium revenue Reinsurance premiums Net insurance premium revenue Fee income from administration business Net banking fee and commission income Banking fee and commission income Banking fee and commission expense Vitality income Other income Investment income using the effective interest rate method Net bank interest and similar income Bank interest and similar income using the effective interest rate Bank interest and similar expense using the effective interest rate Net fair value gains on financial assets at fair value through profit or loss Net income Net claims and policyholders' benefits Claims and policyholders' benefits Insurance claims recovered from reinsurers Acquisition costs Marketing and administration expenses Amortisation of intangibles from business combinations Expected credit losses Recovery of expenses from reinsurers Net transfer to/from assets and liabilities under insurance contracts - change in assets arising from insurance contracts - change in assets arising from reinsurance contracts - change in liabilities arising from insurance contracts - change in liabilities arising from reinsurance contracts - economic assumption adjustments net of discretionary margins Fair value adjustment to liabilities under investment contracts Profit from operations Finance costs Gain on previously held interests in Discovery Card business Gain on dilution and disposal of equity-accounted investments Impairment of goodwill Foreign exchange gains Share of net profits from equity-accounted investments Profit before tax Income tax expense Profit for the year Profit/(loss) attributable to: - ordinary shareholders - preference shareholders - non-controlling interest 13 4 265 57 253 (20 879) (24 538) 3 659 (6 100) (19 954) (99) 2830 (4 706) 5 321 7 (8 050) (1 984) (80) (809) 7 536 (1 375) 761 844 (17) * 3 (9) 578 264 800 (624) 176 170 7 919 (1 305) 6 614 (90) (52) (97) 97 (99) 81 (2) 176 6 533 81 * 6 614 (97) Earnings per share for profit attributable to ordinary shareholders of the company during the year (cents): - basic - diluted *Amount is less than R500 000. * 14.8 14.7 1 001.5 1 001.1 (99) (99) 13 b. If you have access to the company's information, you may want to use their summary of the profits and loss account, the balance sheet, and the cash flow statement and report the figures over the last five years. c. Attend a Library session to be guided on referencing, writing, searches, etc. d. Search for, and summarise journal articles and other material related to your assignment (Remember always to include citations from your sources). e. Remember to read through the Graduate Attribute 6 rubric in section 21 of this learner guide before you start researching and writing your assignment report, as this rubric will be used to determine your competency in Graduate Attribute 6: Professional and Technical Communication. The department expects learners to demonstrate the: Understanding of nature and complexity of the accounting problems, in terms of required practices, tools and techniques

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts