Question: can you please do all work in steps on a paper if possible Exercises: Parity conditions in real markets and financial markets EXERCISE 4 (Purchasing

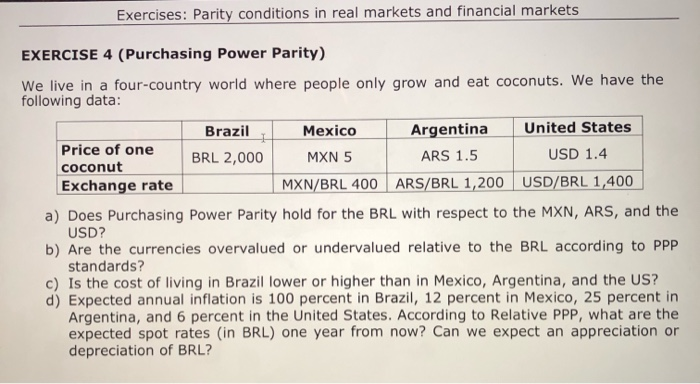

Exercises: Parity conditions in real markets and financial markets EXERCISE 4 (Purchasing Power Parity) We live in a four-country world where people only grow and eat coconuts. We have the following data: Brazil a Mexico Argentina United States Price of one BRL 2,000 MXN 5 ARS 1.5 USD 1.4 coconut Exchange rate MXN/BRL 400 ARS/BRL 1,200 USD/BRL 1,400 a) Does Purchasing Power Parity hold for the BRL with respect to the MXN, ARS, and the USD? b) Are the currencies overvalued or undervalued relative to the BRL according to PPP standards? c) Is the cost of living in Brazil lower or higher than in Mexico, Argentina, and the US? d) Expected annual inflation is 100 percent in Brazil, 12 percent in Mexico, 25 percent in Argentina, and 6 percent in the United States. According to Relative PPP, what are the expected spot rates (in BRL) one year from now? Can we expect an appreciation or depreciation of BRL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts