Question: Can you please do both :) Jan. 6 Walla Walla Ltd. was incorporated as a private company on January 2, 2021, and is authorized to

Can you please do both :)

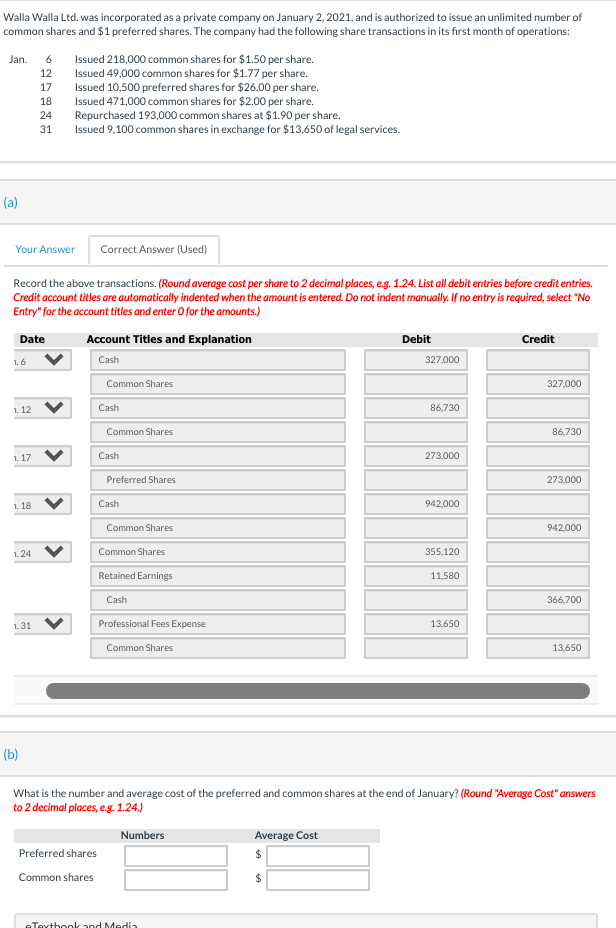

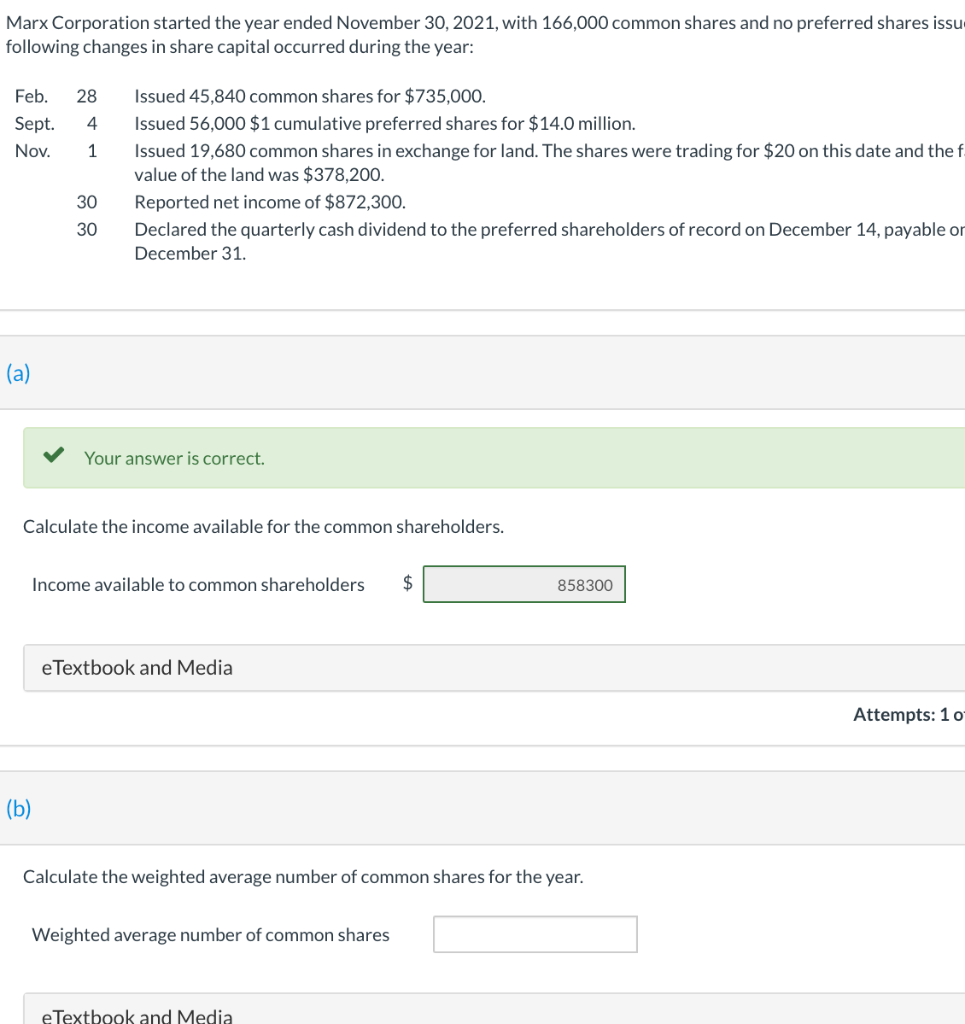

Jan. 6 Walla Walla Ltd. was incorporated as a private company on January 2, 2021, and is authorized to issue an unlimited number of common shares and $1 preferred shares. The company had the following share transactions in its first month of operations: Issued 218,000 common shares for $1.50 per share. 12 Issued 49,000 common shares for $1.77 per share. Issued 10,500 preferred shares for $26.00 per share. Issued 471,000 common shares for $2.00 per share. 24 Repurchased 193,000 common shares at $1.90 per share. Issued 9,100 common shares in exchange for $13,650 of legal services. 17 18 31 (a) Your Answer Correct Answer (Used) Record the above transactions. (Round average cost per share to 2 decimal places, eg. 1.24. List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Cash 327,000 Common Shares 1.6 327.000 1 12 Cash 86,730 Common Shares 86,730 1. 17 Cash 273,000 273.000 1. 18 942,000 Preferred Shares Cash Common Shares Common Shares Retained Earnings 942000 1.24 355.120 11.580 Cash 366,700 1.31 13,650 Professional Fees Expense Common Shares 13.650 (b) What is the number and average cost of the preferred and common shares at the end of January? (Round "Average Cost" answers to 2 decimal places, eg. 1.24.) Numbers Average Cost Preferred shares $ Common shares $ Textbook and Media Marx Corporation started the year ended November 30, 2021, with 166,000 common shares and no preferred shares issu following changes in share capital occurred during the year: Feb. 28 4 Sept. Nov. 1 Issued 45,840 common shares for $735,000. Issued 56,000 $1 cumulative preferred shares for $14.0 million. Issued 19,680 common shares in exchange for land. The shares were trading for $20 on this date and the f value of the land was $378,200. Reported net income of $872,300. Declared the quarterly cash dividend to the preferred shareholders of record on December 14, payable or December 31. 30 30 (a) Your answer is correct. Calculate the income available for the common shareholders. Income available to common shareholders $ 858300 e Textbook and Media Attempts: 10 (b) Calculate the weighted average number of common shares for the year. Weighted average number of common shares e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts