Question: CAN YOU PLEASE DO IT IN EXCEL AND ALSO SHOW THE FORMULAS, THANK YOU! Bond Price Volatility, Duration and Convexity Answer the following questions using

CAN YOU PLEASE DO IT IN EXCEL AND ALSO SHOW THE FORMULAS, THANK YOU!

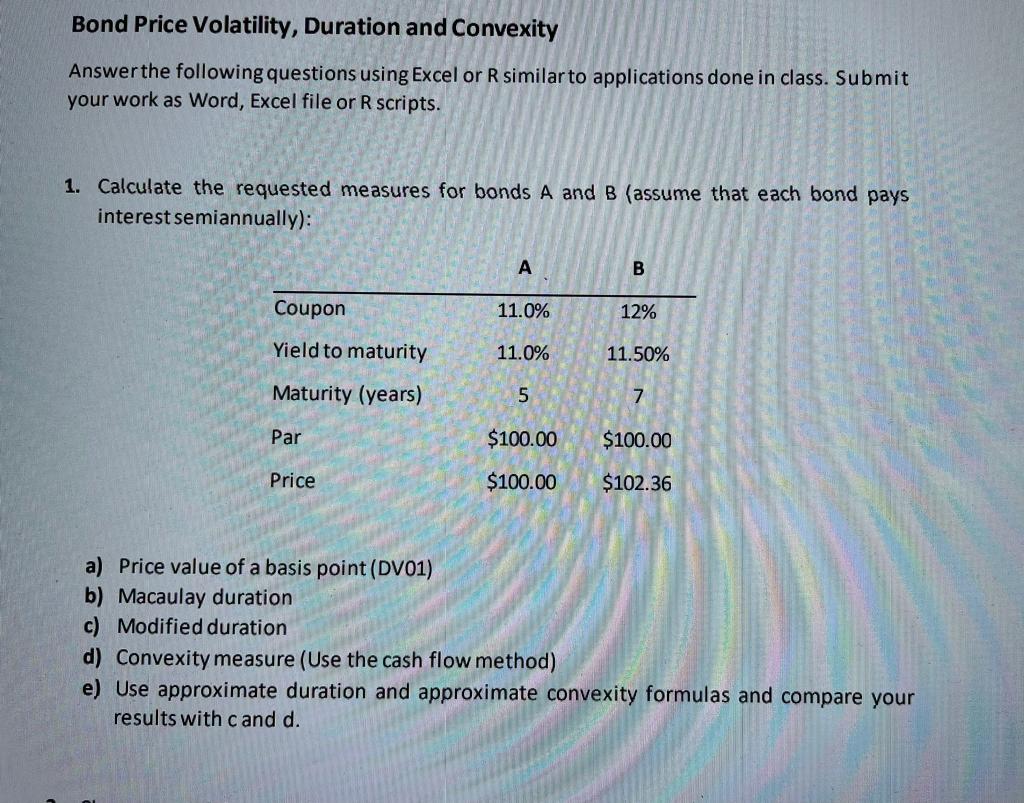

Bond Price Volatility, Duration and Convexity Answer the following questions using Excel or similar to applications done in class. Submit your work as Word, Excel file or R scripts. 1. Calculate the requested measures for bonds A and B (assume that each bond pays interest semiannually): B Coupon 11.0% 12% Yield to maturity 11.0% 11.50% Maturity (years) 5 7 Par $100.00 $100.00 Price $100.00 $102.36 a) Price value of a basis point (DV01) b) Macaulay duration c) Modified duration d) Convexity measure (Use the cash flow method) e) Use approximate duration and approximate convexity formulas and compare your results with cand d. Bond Price Volatility, Duration and Convexity Answer the following questions using Excel or similar to applications done in class. Submit your work as Word, Excel file or R scripts. 1. Calculate the requested measures for bonds A and B (assume that each bond pays interest semiannually): B Coupon 11.0% 12% Yield to maturity 11.0% 11.50% Maturity (years) 5 7 Par $100.00 $100.00 Price $100.00 $102.36 a) Price value of a basis point (DV01) b) Macaulay duration c) Modified duration d) Convexity measure (Use the cash flow method) e) Use approximate duration and approximate convexity formulas and compare your results with cand d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts