Question: Can you please do Part Comment on correlation? Comment on Correlation? DVN MRO LUV NVDA UAL 0.000836540 Mean daily return Variance of daily return Standard

Can you please do Part Comment on correlation?

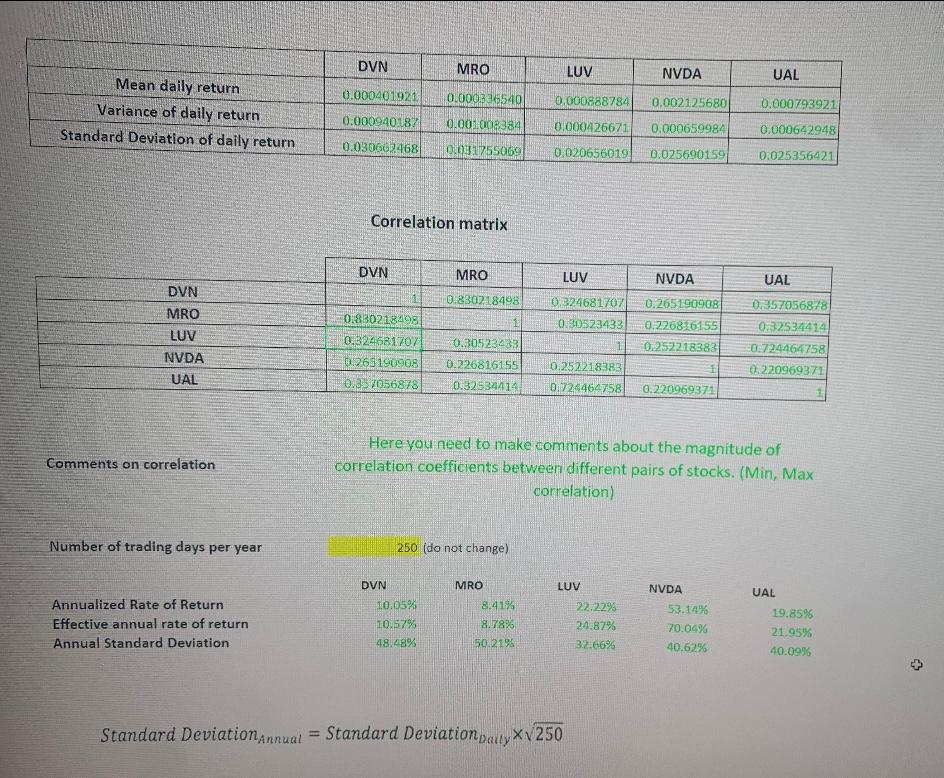

Comment on Correlation?

DVN MRO LUV NVDA UAL 0.000836540 Mean daily return Variance of daily return Standard Deviation of daily return 0.000888784 0.002125680 0.000793921 0.000401920 0.000940182 0.030602468 0.001008384 0.000426671 0.000659984 0.000642948 Q031755069 0,020656019 0.025690159 0.025356421 Correlation matrix DVN MRO LUV NVDA UAL 0.880218498 0.324681707 0.265190908 083021840S 0.30523433 0.2268161551 DVN MRO LUV NVDA UAL 0.30523433 0.324681707 0765190908 0.33056878 0.357056878 032534414 0:724464758 0.270969371 0.2522 183831 11 0.226816155 0.252218383 0.724464758 0.32534414 0.220969371 Comments on correlation Here you need to make comments about the magnitude of correlation coefficients between different pairs of stocks. (Min, Max correlation) Number of trading days per year 250 (do not change) DVN MRO LUV 10.05% Annualized Rate of Return Effective annual rate of return Annual Standard Deviation 8.4196 8.78% 50.21% 10.57% 48.48% NVDA 53.14% 70.0496 40.625 22.22% 24.87% 3.2.6625 UAL 19.85% 21.95% 40.09% 5 Standard Deviation Annual = Standard Deviation party XV 250 DVN MRO LUV NVDA UAL 0.000836540 Mean daily return Variance of daily return Standard Deviation of daily return 0.000888784 0.002125680 0.000793921 0.000401920 0.000940182 0.030602468 0.001008384 0.000426671 0.000659984 0.000642948 Q031755069 0,020656019 0.025690159 0.025356421 Correlation matrix DVN MRO LUV NVDA UAL 0.880218498 0.324681707 0.265190908 083021840S 0.30523433 0.2268161551 DVN MRO LUV NVDA UAL 0.30523433 0.324681707 0765190908 0.33056878 0.357056878 032534414 0:724464758 0.270969371 0.2522 183831 11 0.226816155 0.252218383 0.724464758 0.32534414 0.220969371 Comments on correlation Here you need to make comments about the magnitude of correlation coefficients between different pairs of stocks. (Min, Max correlation) Number of trading days per year 250 (do not change) DVN MRO LUV 10.05% Annualized Rate of Return Effective annual rate of return Annual Standard Deviation 8.4196 8.78% 50.21% 10.57% 48.48% NVDA 53.14% 70.0496 40.625 22.22% 24.87% 3.2.6625 UAL 19.85% 21.95% 40.09% 5 Standard Deviation Annual = Standard Deviation party XV 250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts