Question: can you please do work in excel and share the file $ Owl Fomingo Style Detroit IN 0, TI 1 wes YOU 2.000 30 0

can you please do work in excel and share the file

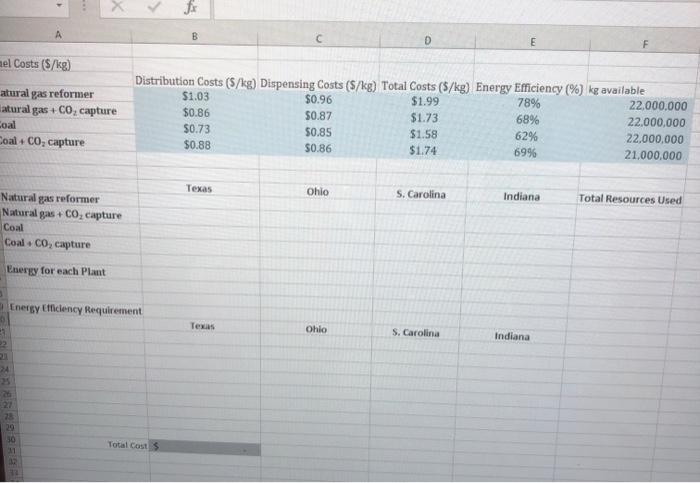

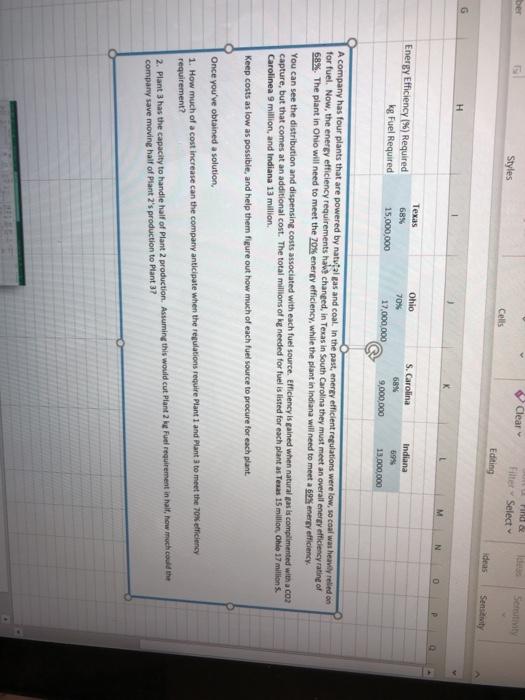

$ Owl Fomingo Style Detroit IN 0, TI 1 wes YOU 2.000 30 0 10 tes PRE ger .. 0. w B D E F mel Costs ($/kg) atural gas reformer latural gas +co, capture Distribution Costs (5/kg) Dispensing Costs (5/kg) Total Costs (5/kg) Energy Efficiency (%) kg available $1.03 $0.96 $1.99 78% 22.000.000 $0.86 $0.87 $1.73 68% 22,000,000 50.73 $0.85 $1.58 22.000.000 $0.88 $0.86 $1.74 6996 21,000,000 Coal CoalCO, capture 62% Texas Ohio S. Carolina Indiana Total Resources Used Natural gas reformer Natural gas +CO, capture Coal Coal. CO, capture Energy for each Plant Energy Efficiency Requirement Texas Ohio S. Carolina Indiana 2 24 25 28 29 30 Total Costs 32 Clear Find Styles Filter Select Cells Editing ideas Sense H N 0 P Energy Efficiency (%) Required kg Fuel Required Texas 68% 15,000,000 Ohio 70% 17 000 000 S. Carolina 68 Indiana 595 13 000 000 9,000,000 A company has four plants that are powered by natural gas and coal. In the past, energy efficient regulations were low, so coal was heavily relled on for fuel. Now, the energy efficiency requirements habit changed, in Texas in South Carolina they must meet an overall energy efficiency rating of 68%. The plant in Ohio will need to meet the 70% energy efficiency, while the plant in Indiana will need to meet a 59% energy efficiency. You can see the distribution and dispensing costs associated with each fuel source. Efficiency is gained when natural gas is complimented with a co capture, but that comes at an additional cost. The total millions of g needed for fuel is listed for each plantas Texas 15 million, Ohio 17 milions Carolinea 3 million and Indiana 13 million. Keep costs as low as possible, and help them figure out how much of each fuel source to procure for each plant Once you've obtained a solution 1. How much of a cost increase can the company anticipate when the regulations require Plant 1 and Plants to meet the 70% efficiency requirement? 2. Plant 3 has the capacity to handle half of Plant 2 production. Assuming this would cut Plant 2 kg Fuel requirement in half, how much could the company save moving half of Plant 2's production to Plant 3? $ Owl Fomingo Style Detroit IN 0, TI 1 wes YOU 2.000 30 0 10 tes PRE ger .. 0. w B D E F mel Costs ($/kg) atural gas reformer latural gas +co, capture Distribution Costs (5/kg) Dispensing Costs (5/kg) Total Costs (5/kg) Energy Efficiency (%) kg available $1.03 $0.96 $1.99 78% 22.000.000 $0.86 $0.87 $1.73 68% 22,000,000 50.73 $0.85 $1.58 22.000.000 $0.88 $0.86 $1.74 6996 21,000,000 Coal CoalCO, capture 62% Texas Ohio S. Carolina Indiana Total Resources Used Natural gas reformer Natural gas +CO, capture Coal Coal. CO, capture Energy for each Plant Energy Efficiency Requirement Texas Ohio S. Carolina Indiana 2 24 25 28 29 30 Total Costs 32 Clear Find Styles Filter Select Cells Editing ideas Sense H N 0 P Energy Efficiency (%) Required kg Fuel Required Texas 68% 15,000,000 Ohio 70% 17 000 000 S. Carolina 68 Indiana 595 13 000 000 9,000,000 A company has four plants that are powered by natural gas and coal. In the past, energy efficient regulations were low, so coal was heavily relled on for fuel. Now, the energy efficiency requirements habit changed, in Texas in South Carolina they must meet an overall energy efficiency rating of 68%. The plant in Ohio will need to meet the 70% energy efficiency, while the plant in Indiana will need to meet a 59% energy efficiency. You can see the distribution and dispensing costs associated with each fuel source. Efficiency is gained when natural gas is complimented with a co capture, but that comes at an additional cost. The total millions of g needed for fuel is listed for each plantas Texas 15 million, Ohio 17 milions Carolinea 3 million and Indiana 13 million. Keep costs as low as possible, and help them figure out how much of each fuel source to procure for each plant Once you've obtained a solution 1. How much of a cost increase can the company anticipate when the regulations require Plant 1 and Plants to meet the 70% efficiency requirement? 2. Plant 3 has the capacity to handle half of Plant 2 production. Assuming this would cut Plant 2 kg Fuel requirement in half, how much could the company save moving half of Plant 2's production to Plant 3

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock