Question: Can you please explain #2. using the arbitrage table and what would be the arbitrage profits. Please do it step by step. On February 1st,

Can you please explain #2. using the arbitrage table and what would be the arbitrage profits. Please do it step by step.

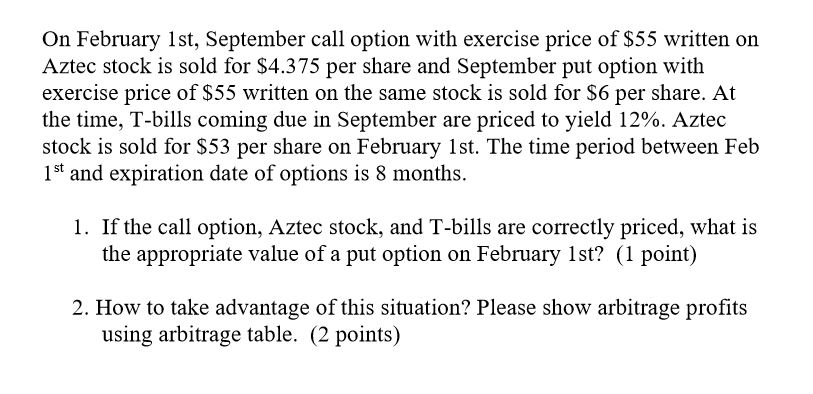

On February 1st, September call option with exercise price of $55 written on Aztec stock is sold for $4.375 per share and September put option with exercise price of $55 written on the same stock is sold for $6 per share. At the time, T-bills coming due in September are priced to yield 12%. Aztec stock is sold for $53 per share on February 1st. The time period between Feb 1st and expiration date of options is 8 months. 1. If the call option, Aztec stock, and T-bills are correctly priced, what is the appropriate value of a put option on February 1st? (1 point) 2. How to take advantage of this situation? Please show arbitrage profits using arbitrage table. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts