Question: can you please explain hot to do it ( corporate finance) weighted of A = 0.5 and weighted averege of B= 0.5 Consider a three-factor

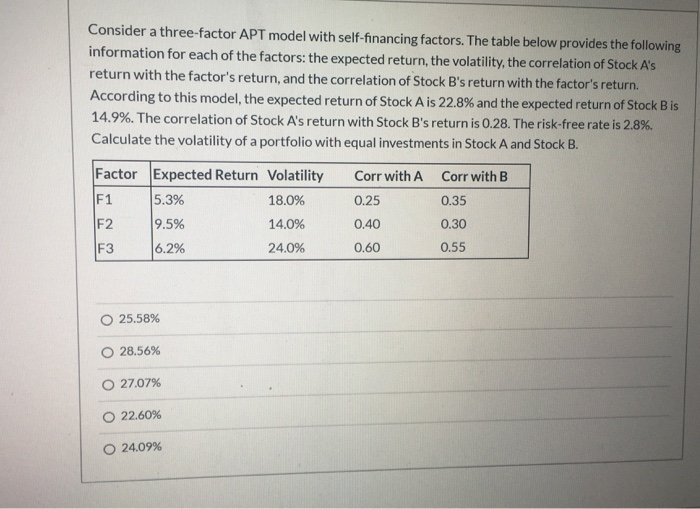

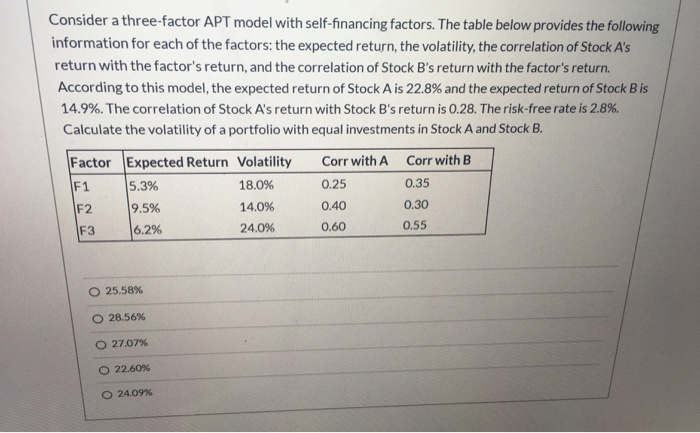

Consider a three-factor APT model with self-financing factors. The table below provides the following information for each of the factors: the expected return, the volatility, the correlation of Stock A's return with the factor's return, and the correlation of Stock B's return with the factor's return. According to this model, the expected return of Stock Ais 22.8% and the expected return of Stock Bis 14.9%. The correlation of Stock A's return with Stock B's return is 0.28. The risk-free rate is 2.8%. Calculate the volatility of a portfolio with equal investments in Stock A and Stock B. Factor Expected Return Volatility Corr with A Corr with B 5.3% 18.0% 0.25 0.35 9.5% 14.0% 0.40 0.30 6.2% 24.0% 0.60 0.55 F1 O 25.58% O 28.56% O 27.07% o 22.60% O 24.09% Consider a three-factor APT model with self-financing factors. The table below provides the following information for each of the factors: the expected return, the volatility, the correlation of Stock A's return with the factor's return, and the correlation of Stock B's return with the factor's return. According to this model, the expected return of Stock Ais 22.8% and the expected return of Stock Bis 14.9%. The correlation of Stock A's return with Stock B's return is 0.28. The risk-free rate is 2.8%. Calculate the volatility of a portfolio with equal investments in Stock A and Stock B. Factor F1 Expected Return Volatility 5.3% 18.0% 19.5% 14.0% 24.0% Corr with A 0.25 0.40 0.60 Corr with B 0.35 0.30 0.55 6.2% 25.58% 28.56% 27.07% 22.60% 24.09% Consider a three-factor APT model with self-financing factors. The table below provides the following information for each of the factors: the expected return, the volatility, the correlation of Stock A's return with the factor's return, and the correlation of Stock B's return with the factor's return. According to this model, the expected return of Stock Ais 22.8% and the expected return of Stock Bis 14.9%. The correlation of Stock A's return with Stock B's return is 0.28. The risk-free rate is 2.8%. Calculate the volatility of a portfolio with equal investments in Stock A and Stock B. Factor Expected Return Volatility Corr with A Corr with B 5.3% 18.0% 0.25 0.35 9.5% 14.0% 0.40 0.30 6.2% 24.0% 0.60 0.55 F1 O 25.58% O 28.56% O 27.07% o 22.60% O 24.09% Consider a three-factor APT model with self-financing factors. The table below provides the following information for each of the factors: the expected return, the volatility, the correlation of Stock A's return with the factor's return, and the correlation of Stock B's return with the factor's return. According to this model, the expected return of Stock Ais 22.8% and the expected return of Stock Bis 14.9%. The correlation of Stock A's return with Stock B's return is 0.28. The risk-free rate is 2.8%. Calculate the volatility of a portfolio with equal investments in Stock A and Stock B. Factor F1 Expected Return Volatility 5.3% 18.0% 19.5% 14.0% 24.0% Corr with A 0.25 0.40 0.60 Corr with B 0.35 0.30 0.55 6.2% 25.58% 28.56% 27.07% 22.60% 24.09%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts