Question: can you please explain how did we come up with this answer and why did we multiply (.15-.06)(1.15)^2? thanks ! ABC common stock is expected

can you please explain how did we come up with this answer and why did we multiply (.15-.06)(1.15)^2?

can you please explain how did we come up with this answer and why did we multiply (.15-.06)(1.15)^2?

thanks !

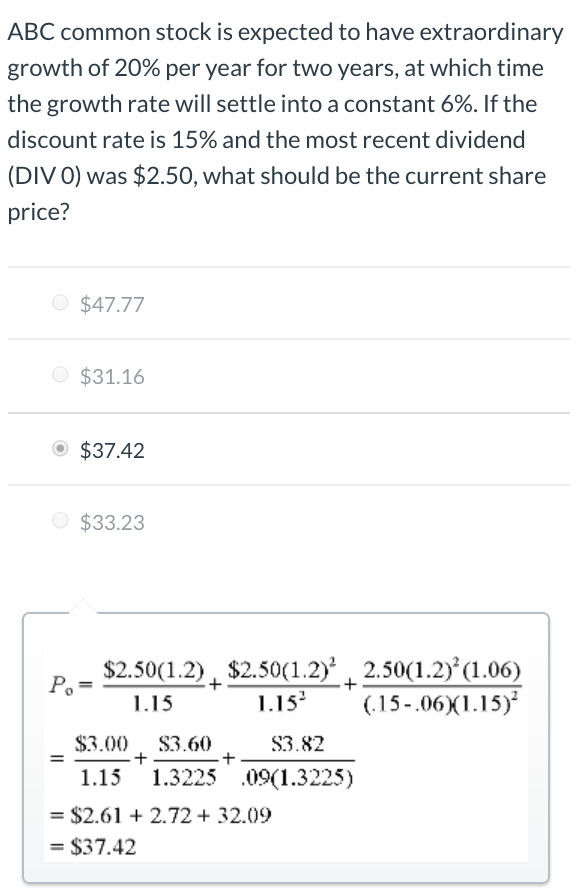

ABC common stock is expected to have extraordinary growth of 20% per year for two years, at which time the growth rate will settle into a constant 6%. If the discount rate is 15% and the most recent dividend (DIVO) was $2.50, what should be the current share price? $47.77 $31.16 $37.42 $33.23 + D $2.50(1.2) $2.50(1.2) 2.50(1.2)' (1.06) 1.15 1.15 1.15-06X1.15) $3.00 $3.60 $3.82 1.15 1.3225 09(1.3225) = $2.61 +2.72 + 32.09 = $37.42 + - +

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock