Question: can you please explain how to solve these two questions, step by step John Wall Inc. is launching a line of 2 branded items in

can you please explain how to solve these two questions, step by step

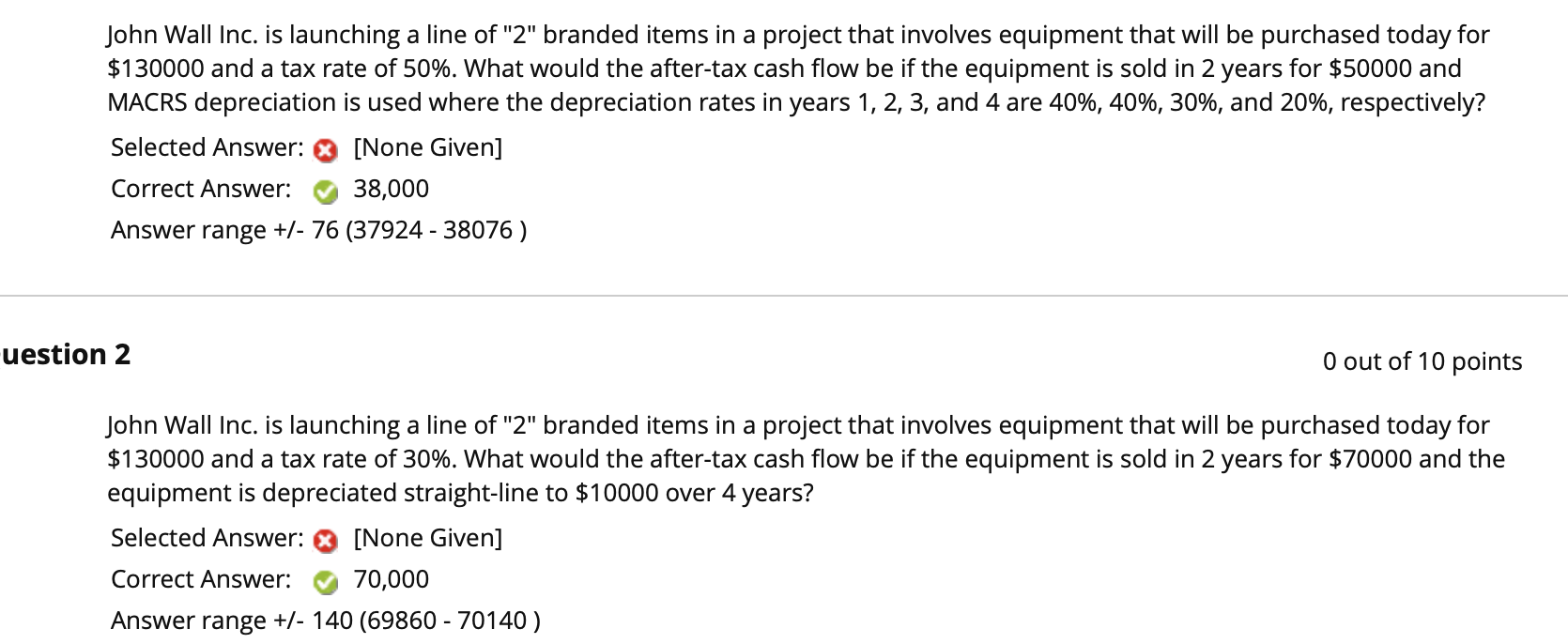

John Wall Inc. is launching a line of "2" branded items in a project that involves equipment that will be purchased today for $130000 and a tax rate of 50%. What would the after-tax cash flow be if the equipment is sold in 2 years for $50000 and MACRS depreciation is used where the depreciation rates in years 1, 2, 3, and 4 are 40%, 40%, 30%, and 20%, respectively? Selected Answer: [None Given] Correct Answer: 38,000 Answer range +/- 76 (37924 - 38076) uestion 2 O out of 10 points John Wall Inc. is launching a line of "2" branded items in a project that involves equipment that will be purchased today for $130000 and a tax rate of 30%. What would the after-tax cash flow be if the equipment is sold in 2 years for $70000 and the equipment is depreciated straight-line to $10000 over 4 years? Selected Answer: [None Given] Correct Answer: 70,000 Answer range +/- 140 (69860 - 70140)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts