Question: CAN YOU PLEASE EXPLAIN HOW TO SOLVE THIS PROBLEM. AND HOW TO CALCULATE DCF AND CDCF PLEASE!!!! 7) Machinery Manufacturing Company is considering a three-year

CAN YOU PLEASE EXPLAIN HOW TO SOLVE THIS PROBLEM.

AND HOW TO CALCULATE DCF AND CDCF PLEASE!!!!

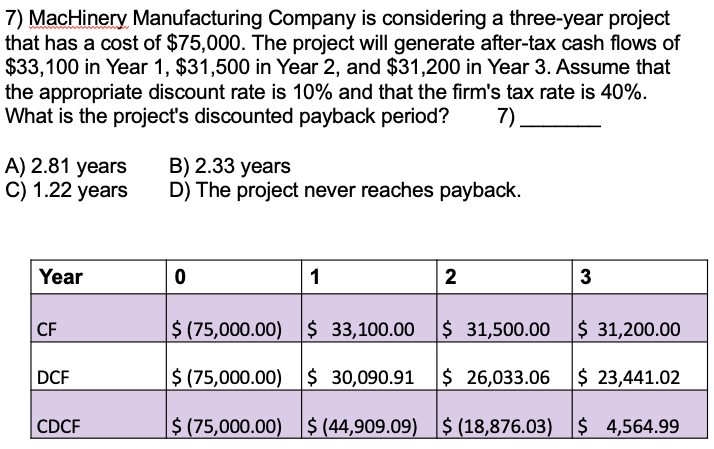

7) Machinery Manufacturing Company is considering a three-year project that has a cost of $75,000. The project will generate after-tax cash flows of $33,100 in Year 1, $31,500 in Year 2, and $31,200 in Year 3. Assume that the appropriate discount rate is 10% and that the firm's tax rate is 40%. What is the project's discounted payback period? 7) _ A) 2.81 years C) 1.22 years B) 2.33 years D) The project never reaches payback. Year CE 1 2 3 $ 175,000.00) $ 33,100.00 $ 31,500.00 $ 31,200.00 $ (75,000.00) $ 30,090.91 $ 26,033.06 $ 23,441.02 $ (75,000.00) $ (44,909.09) $ (18,876.03) $ 4,564.99 DCF CDCF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts