Question: Can you Please explain me this Problem? Thanks! QUESTION 3 52 Alpha Ltd. is a Canadian-controlled private corporation operating a small and development business, The

Can you Please explain me this Problem? Thanks!

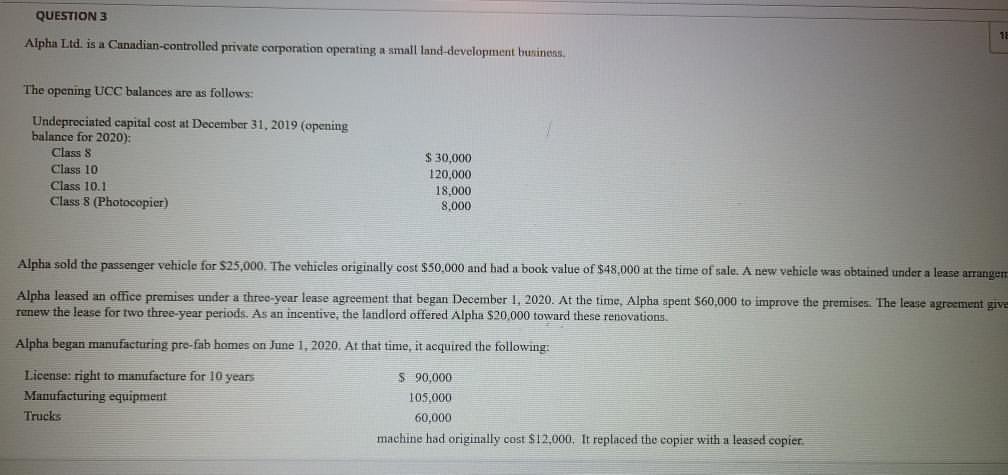

QUESTION 3 52 Alpha Ltd. is a Canadian-controlled private corporation operating a small and development business, The opening UCC balances are as follows: Undepreciated capital cost at December 31, 2019 (opening balance for 2020): Class 8 Class 10 Class 10.1 Class 8 (Photocopier) $ 30,000 120,000 18.000 8,000 Alpha sold the passenger vehicle for $25,000. The vehicles originally cost $50.000 and had a book value of $48.000 at the time of sale. A new vehicle was obtained under a lease arranger Alpha leased an office premises under a three-year lease agreement that began December 1, 2020. At the time, Alpha spent $60,000 to improve the premises. The lease agreement give mew the lease for two three-year periods. As an incentive, the landlord offered Alpha $20.000 toward these renovations Alpha began manufacturing pre-fab homes on June 1, 2020. At that time, it acquired the following: License: right to manufacture for 10 years Manufacturing equipment Trucks $ 90,000 105,000 60,000 machine had originally cost $12,000, It replaced the copier with a leased copier QUESTION 3 52 Alpha Ltd. is a Canadian-controlled private corporation operating a small and development business, The opening UCC balances are as follows: Undepreciated capital cost at December 31, 2019 (opening balance for 2020): Class 8 Class 10 Class 10.1 Class 8 (Photocopier) $ 30,000 120,000 18.000 8,000 Alpha sold the passenger vehicle for $25,000. The vehicles originally cost $50.000 and had a book value of $48.000 at the time of sale. A new vehicle was obtained under a lease arranger Alpha leased an office premises under a three-year lease agreement that began December 1, 2020. At the time, Alpha spent $60,000 to improve the premises. The lease agreement give mew the lease for two three-year periods. As an incentive, the landlord offered Alpha $20.000 toward these renovations Alpha began manufacturing pre-fab homes on June 1, 2020. At that time, it acquired the following: License: right to manufacture for 10 years Manufacturing equipment Trucks $ 90,000 105,000 60,000 machine had originally cost $12,000, It replaced the copier with a leased copier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts