Question: Can you please explain only the third column? Thank you! Rural Puza bought a used Ford delivery van on January 2, 2018, for $20.200 The

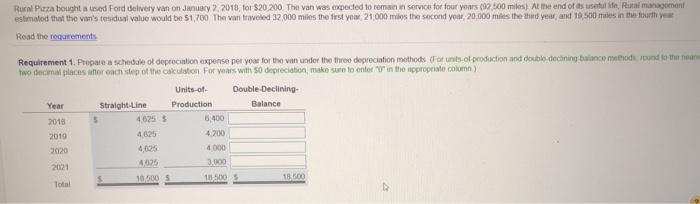

Rural Puza bought a used Ford delivery van on January 2, 2018, for $20.200 The van was expected to remain in service for four years (92.500 miles) At the end of its useful life, Rural management estimated that the vari's residual value would be $1,700 The van traveled 32,000 miles the first year 21,000 miles the second year 20,000 miles the third year, and 19.500 miles in the fourth year Read the requirements Requirement 1. Prepare a schedule of depreciation expense per year for the van under the three depreciation methods (For units of production and double declining balance methods, round to the neare two decimal places after each step of the calculation For years with $0 depreciation, make sure to enter "U" in the appropriate column) Units-of Double-Declining Year Straight-Line Production Balance 2018 5 4,625 $ 6,400 2010 4,625 4,200 2020 4.000 4,625 3,900 2021 18.500 5 18.500 5 18 500 Total 4625

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts