Question: Can you please explain this finance problem step by step as it will really help me out. thanks BCL Company is evaluating two mutually exclusive

Can you please explain this finance problem step by step as it will really help me out. thanks

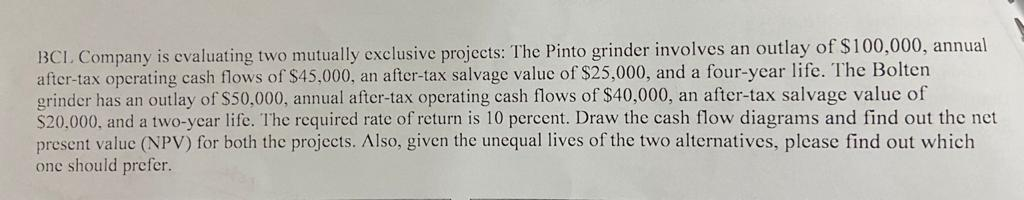

BCL Company is evaluating two mutually exclusive projects: The Pinto grinder involves an outlay of $100,000, annual after-tax operating cash flows of $45,000, an after-tax salvage value of $25,000, and a four-year life. The Bolten grinder has an outlay of $50,000, annual after-tax operating cash flows of $40,000, an after-tax salvage value of $20,000, and a two-year life. The required rate of return is 10 percent. Draw the cash flow diagrams and find out the net present value (NPV) for both the projects. Also, given the unequal lives of the two alternatives, please find out which one should prefer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts