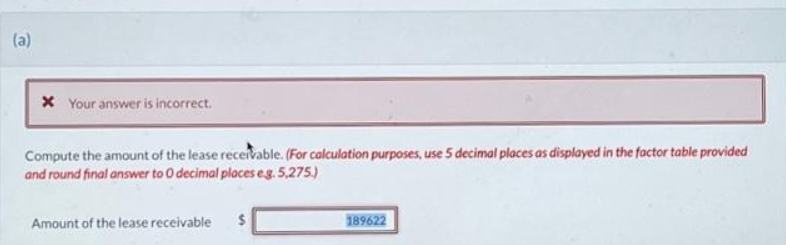

Question: Can you please explain why my answer has gone wrong? I took the correct PVAF, and this is the answer. How is it wrong?! Annual

Can you please explain why my answer has gone wrong? I took the correct PVAF, and this is the answer. How is it wrong?!

Annual Lease Payments = $30,536, Interest rate = 6% , 8 payments, starting beginning of each year (is this where i went wrong??). Purchase price = $124,000. Economic Life = 10 years

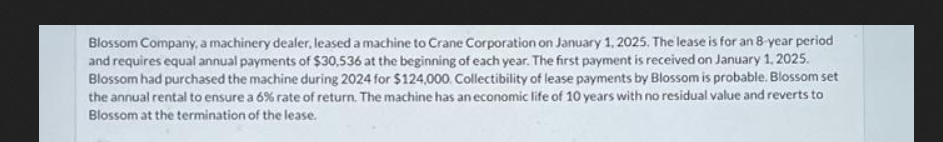

Blossom Company, a machinery dealer, leased a machine to Crane Corporation on January 1, 2025. The lease is for an 8 -year period and requires equal annual payments of $30,536 at the beginning of each year. The first payment is received on January 1,2025. Blossom had purchased the machine during 2024 for $124,000. Collectibility of lease payments by Blossom is probable. Blossom set the annual rental to ensure a 6% rate of return. The machine has an economic life of 10 years with no residual value and reverts to Blossom at the termination of the lease. Compute the amount of the lease receitable. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answer to 0 decimal ploces e 3.5,275.) Amount of the lease receivable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts