Question: can you please fill out the from 5 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde X Income State X

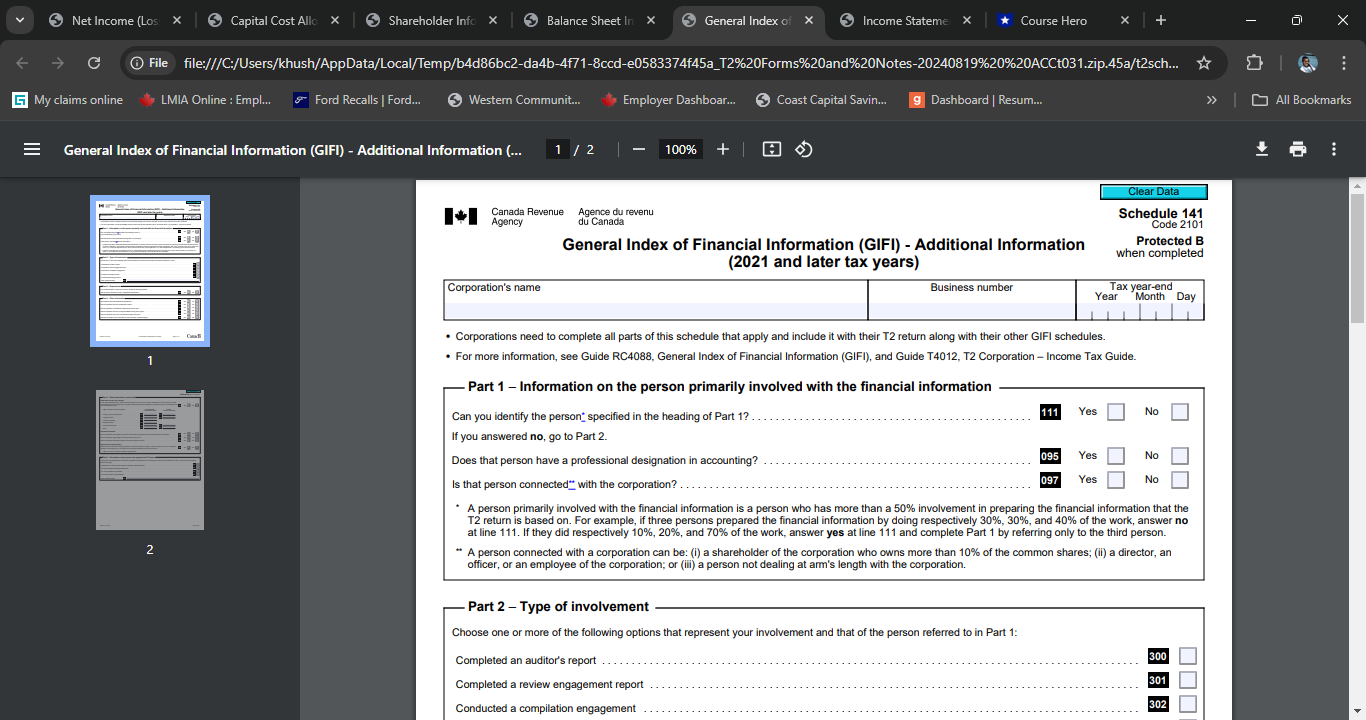

can you please fill out the from

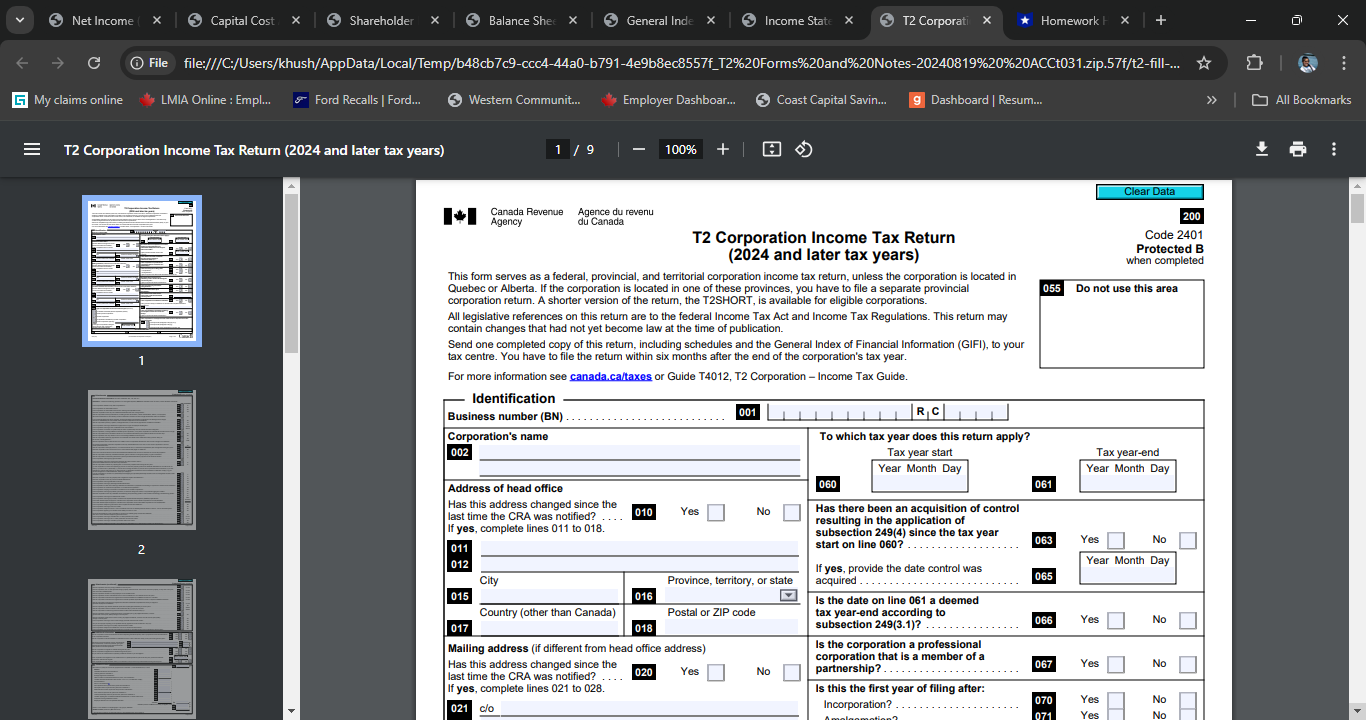

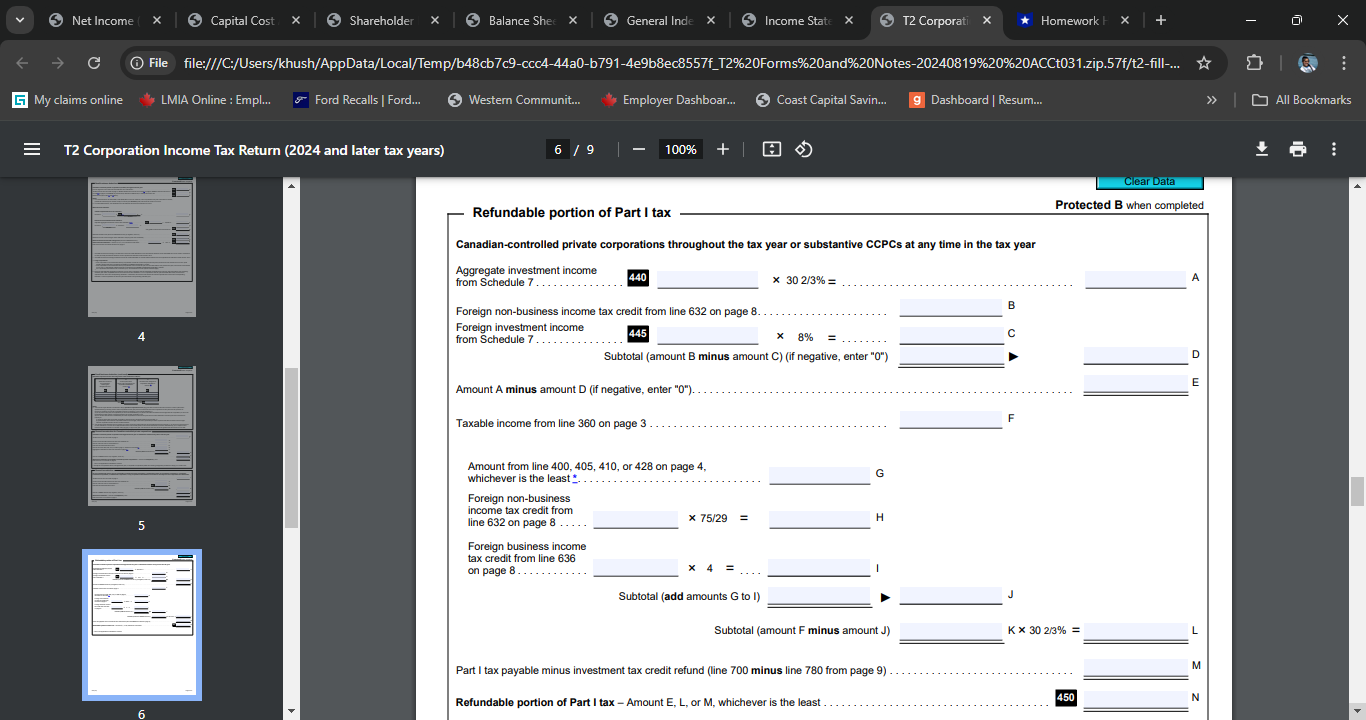

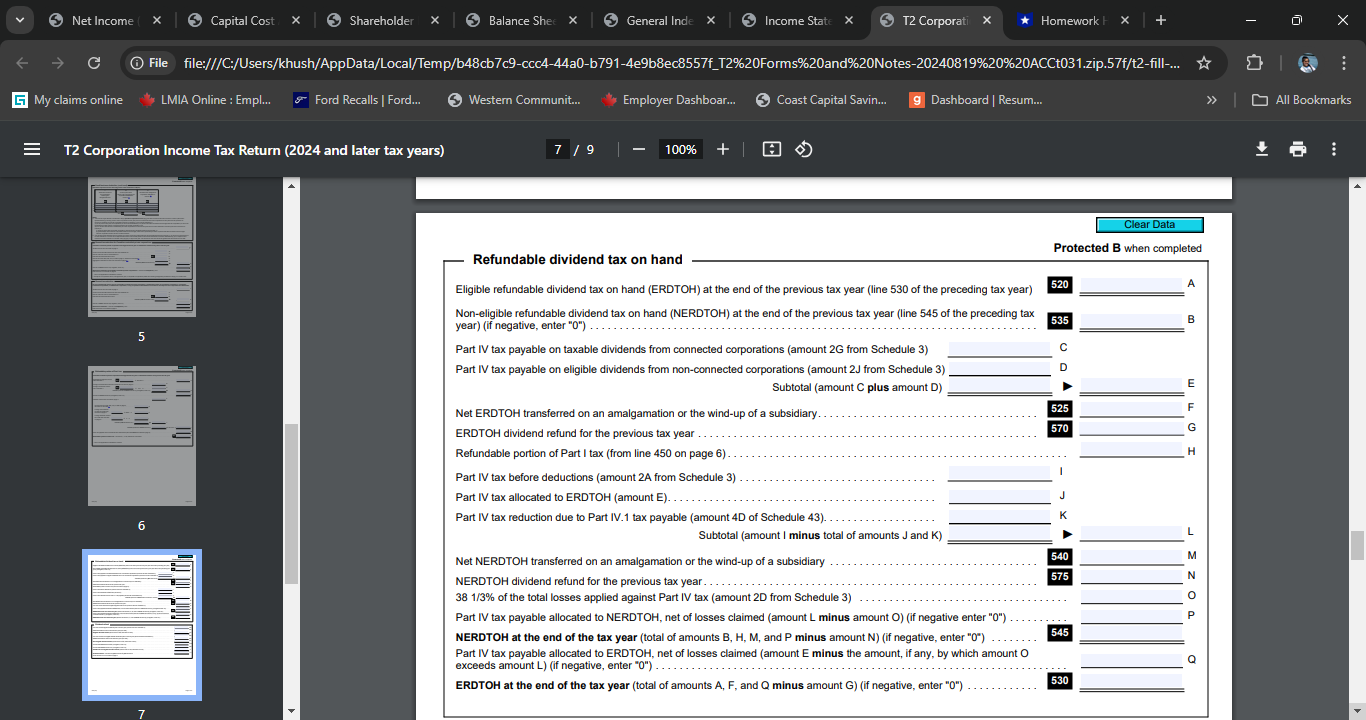

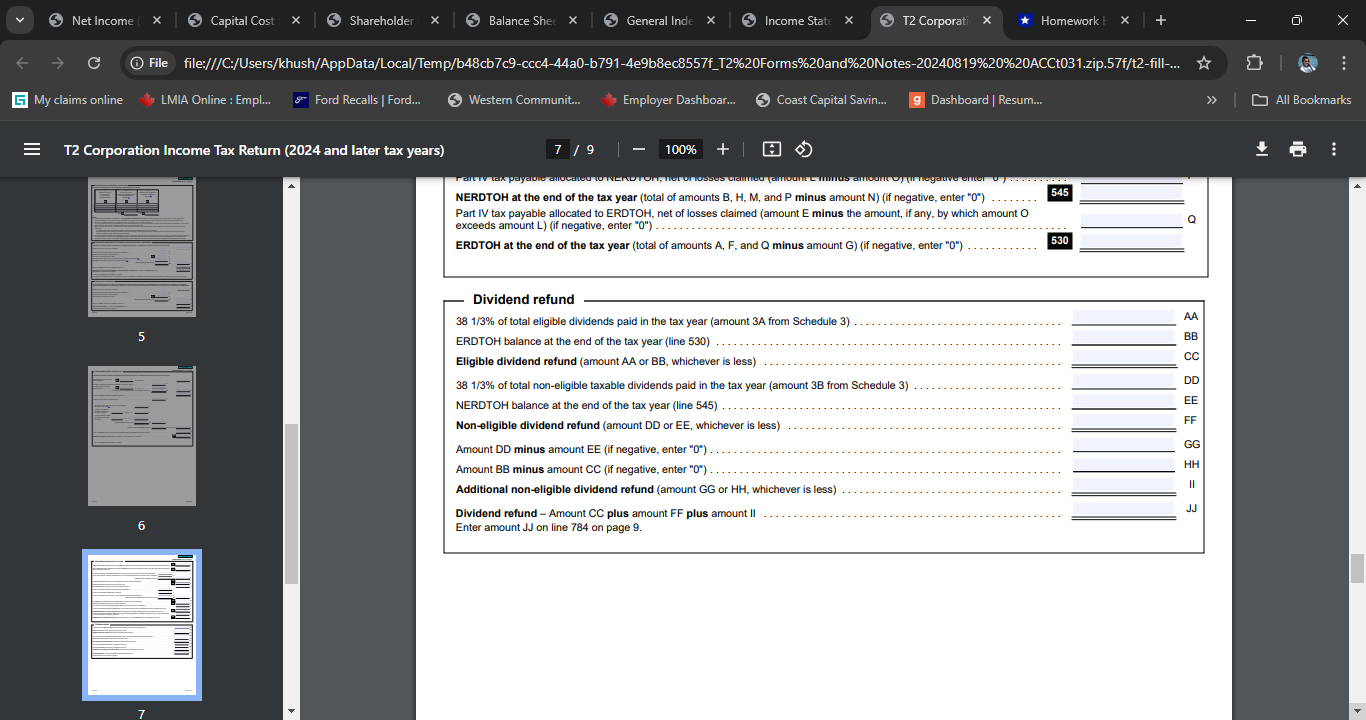

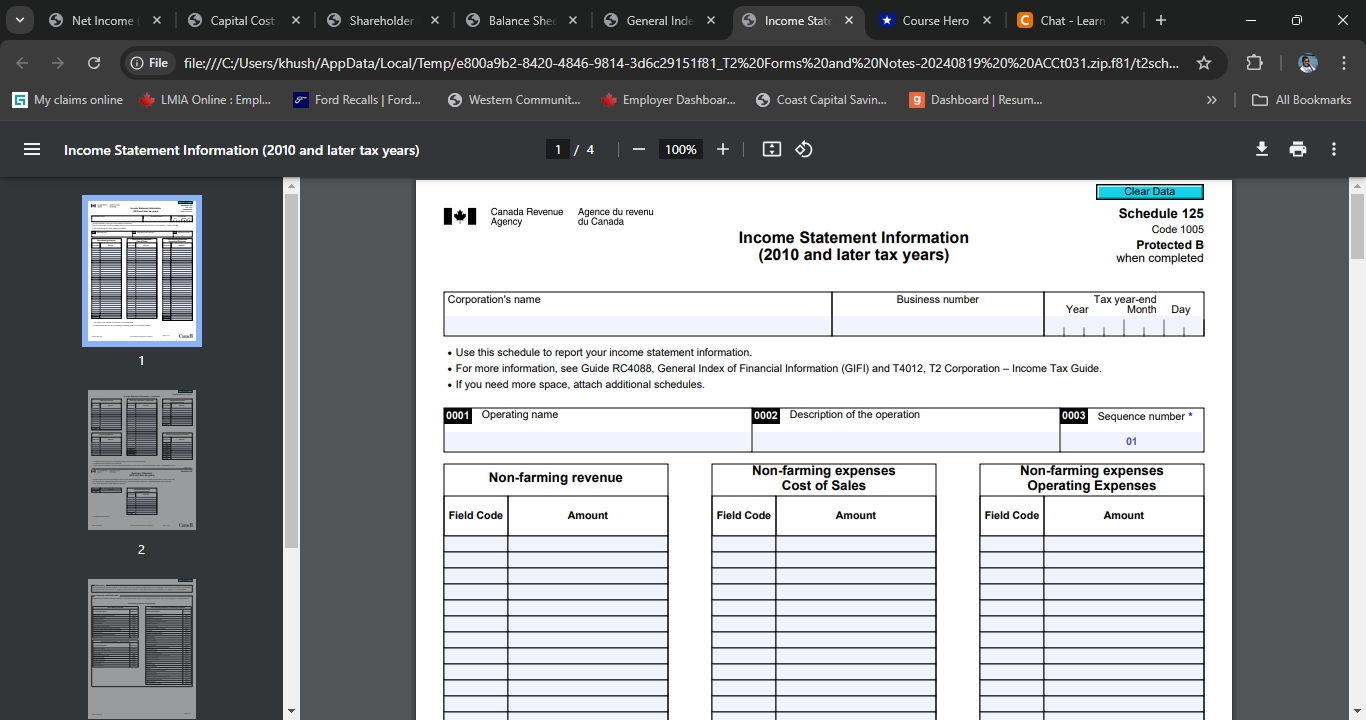

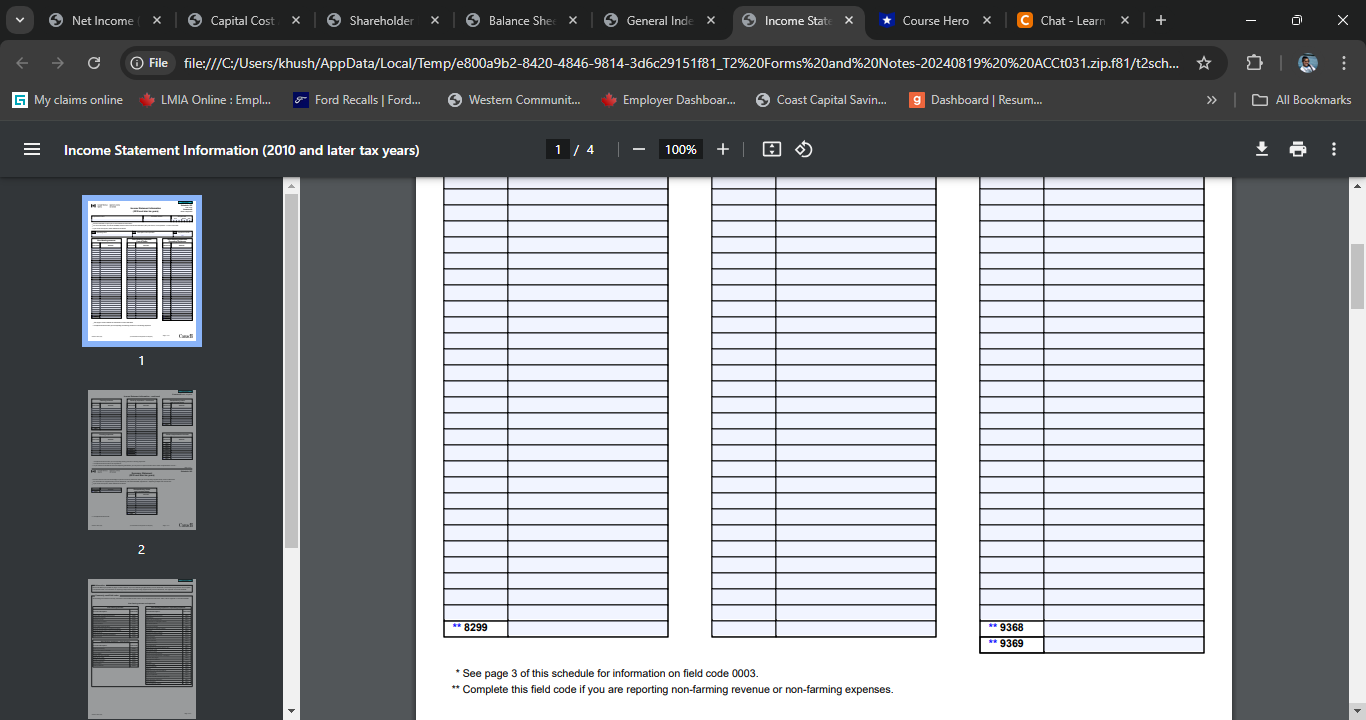

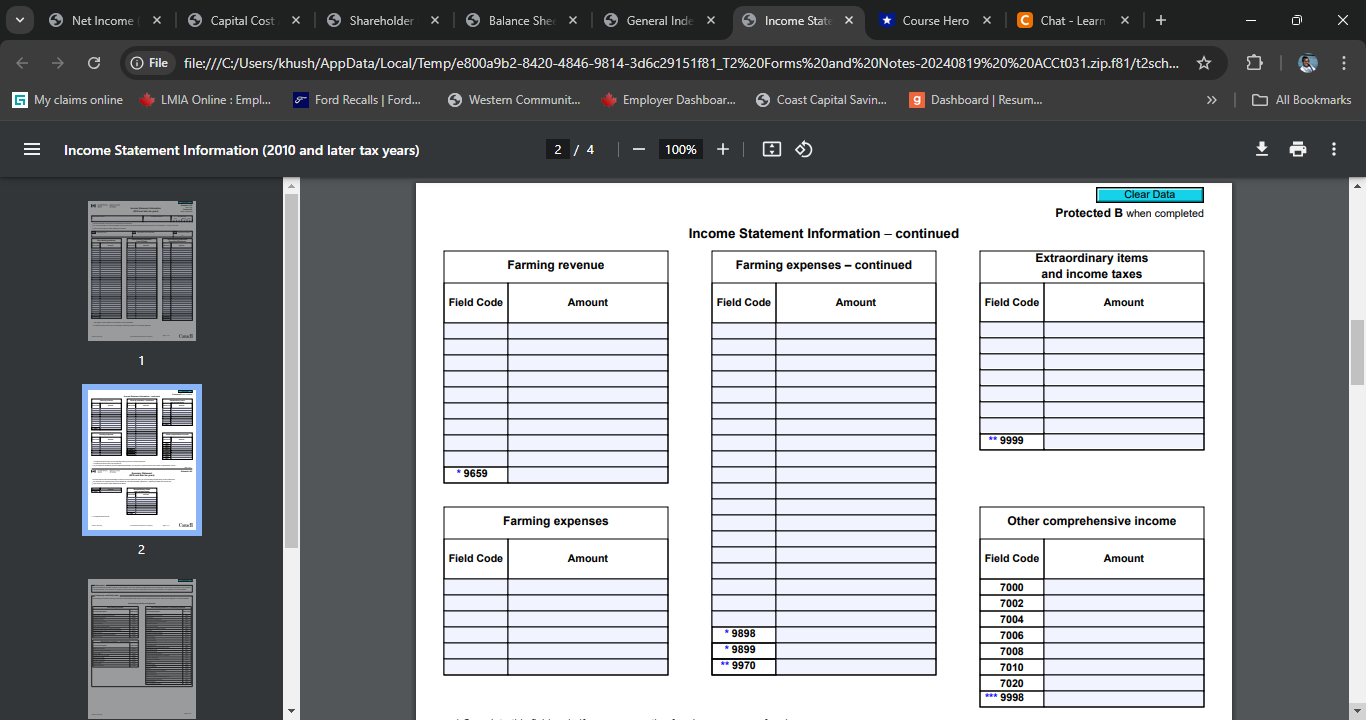

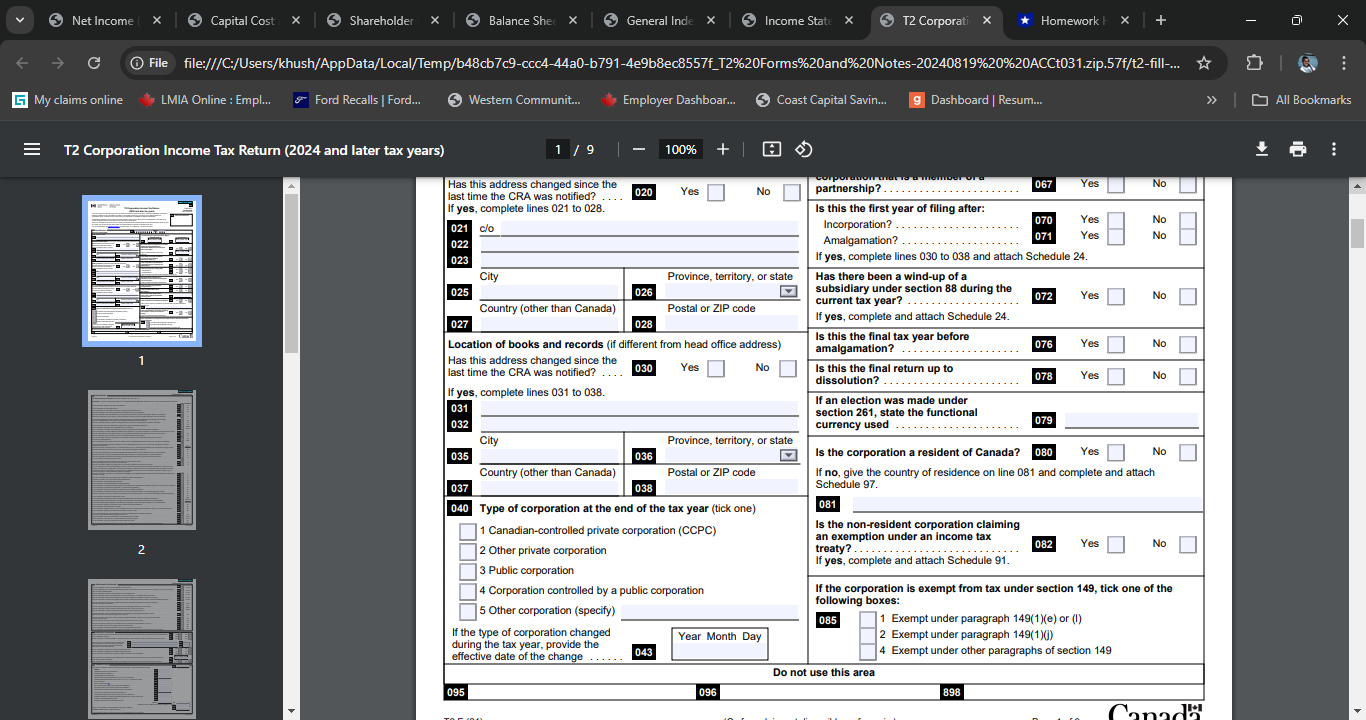

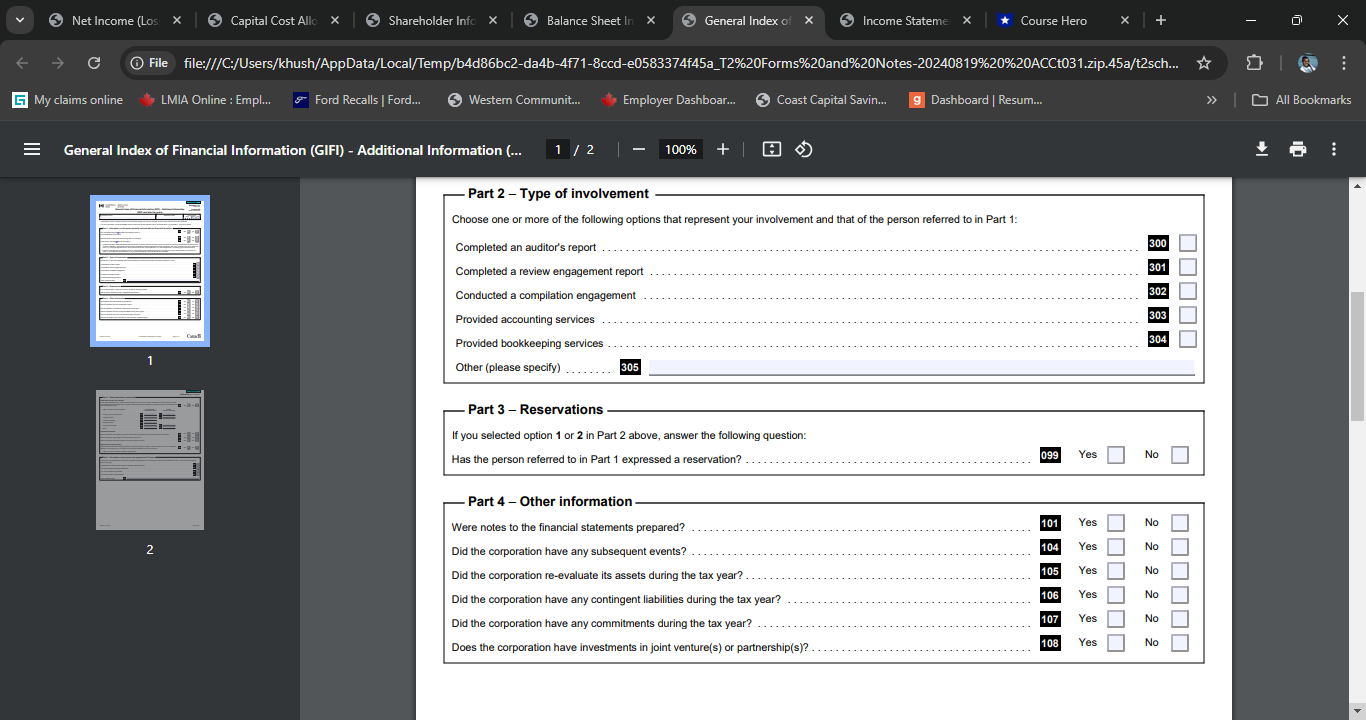

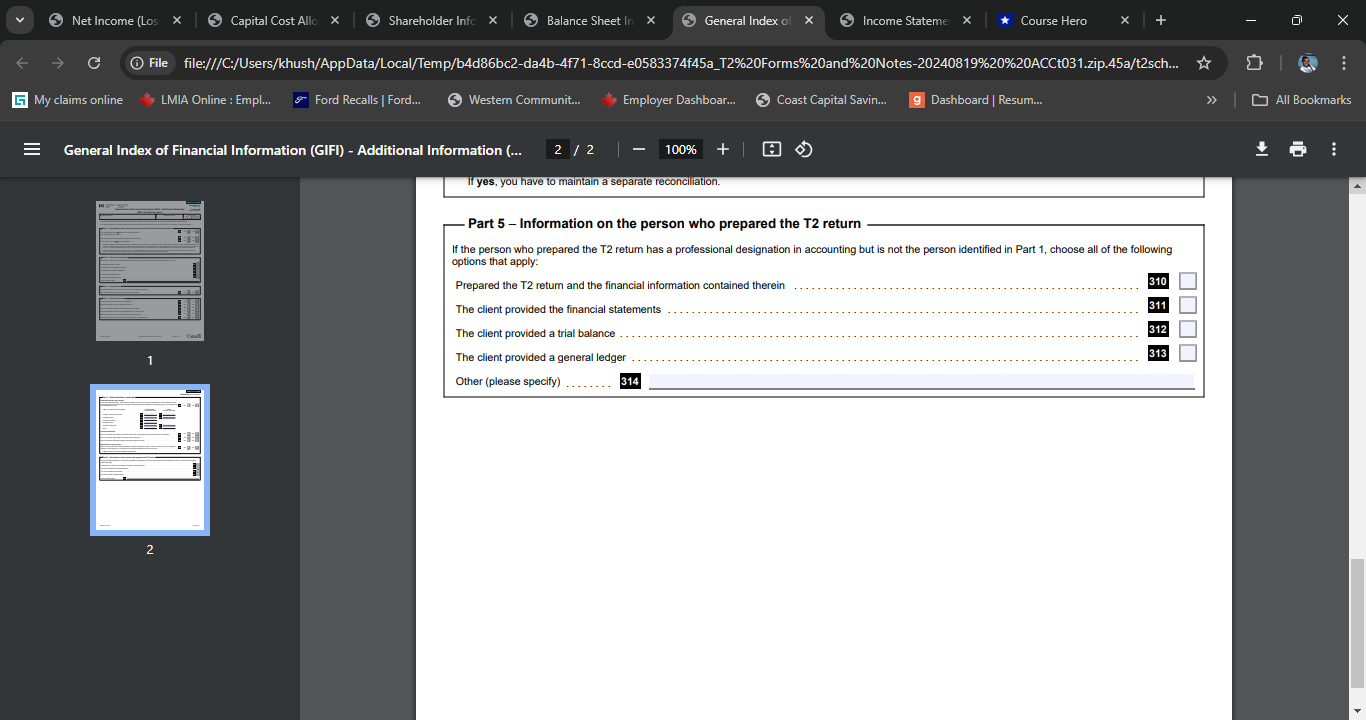

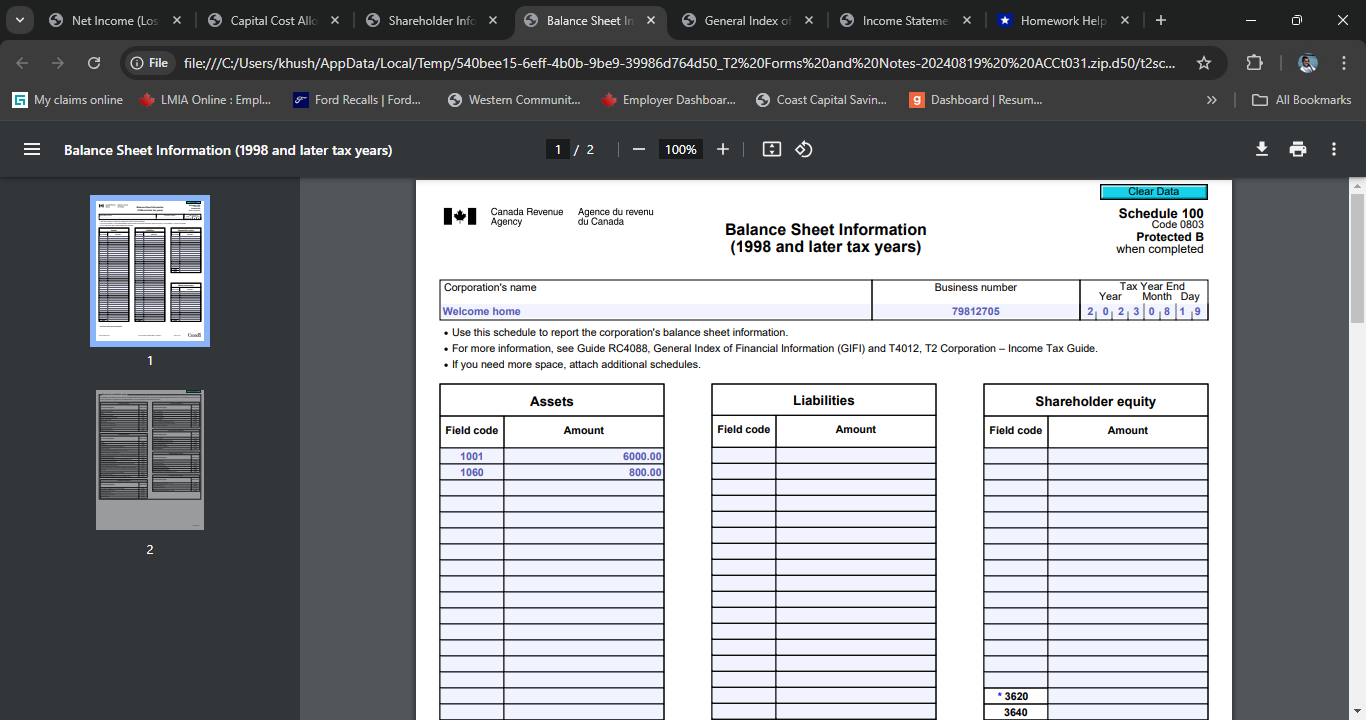

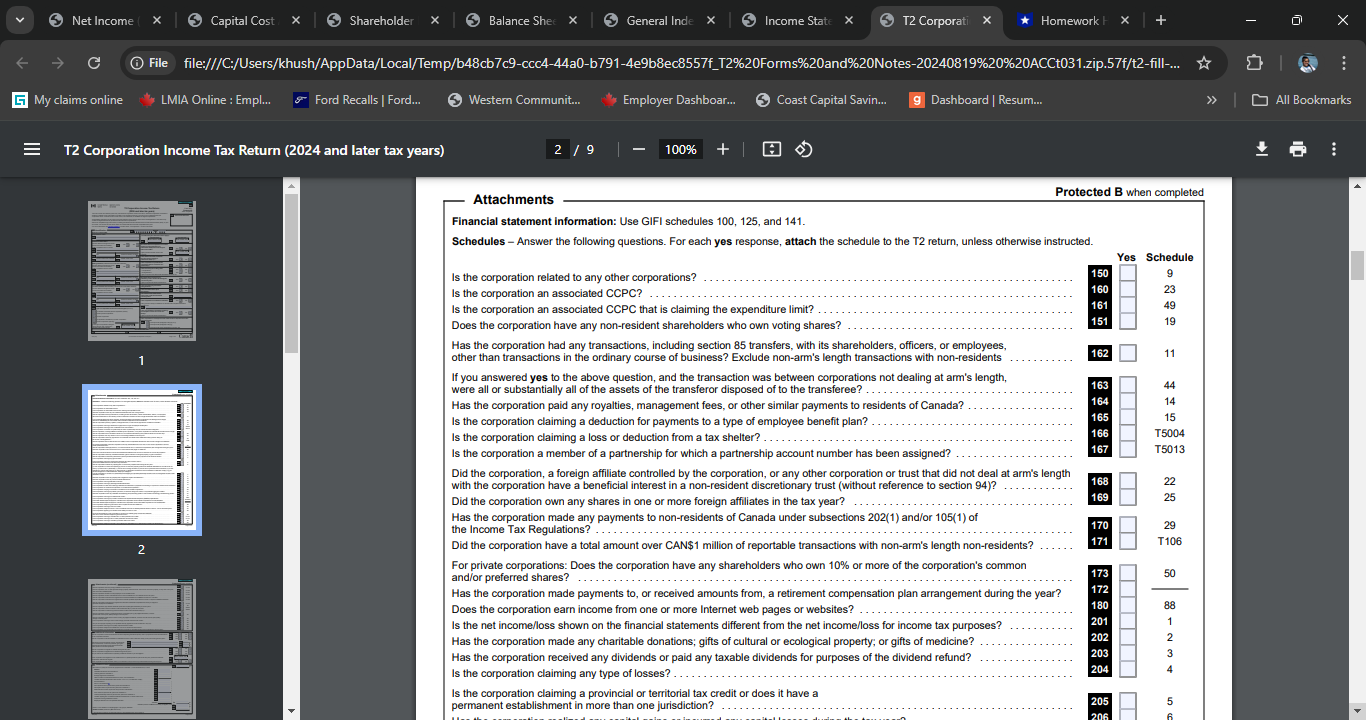

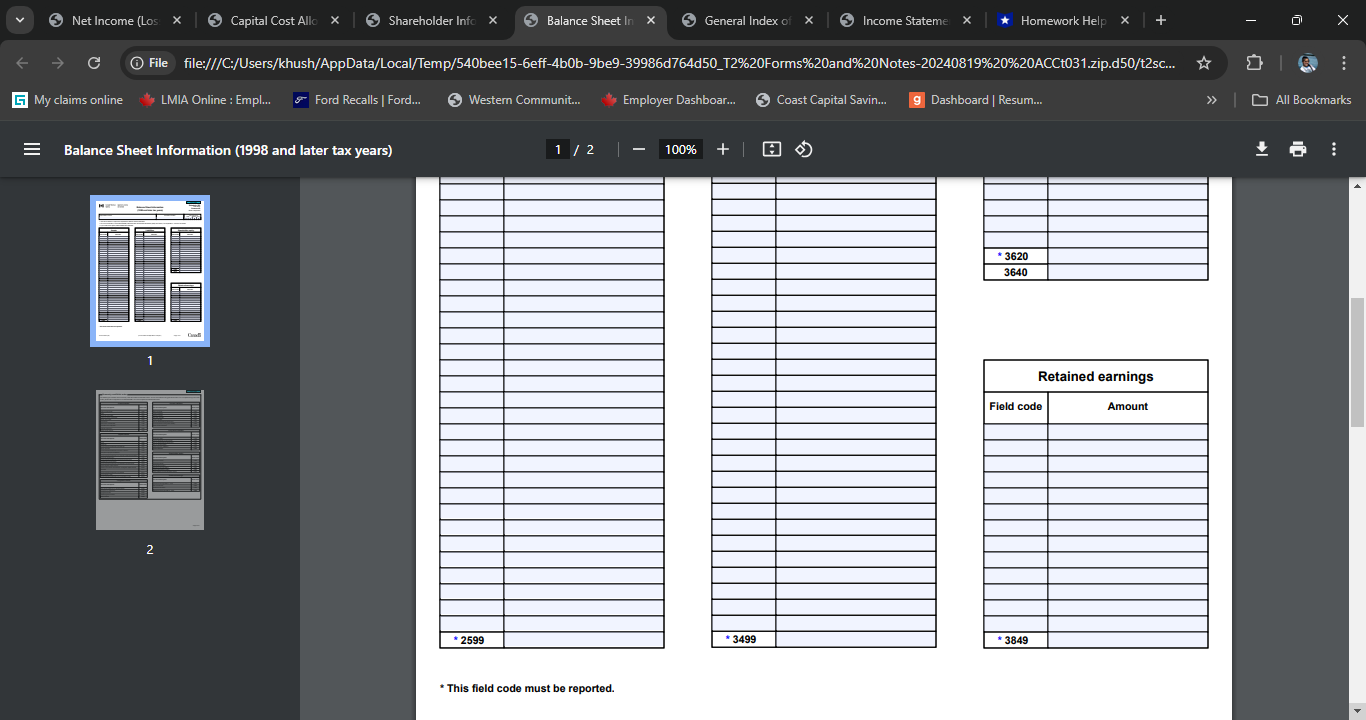

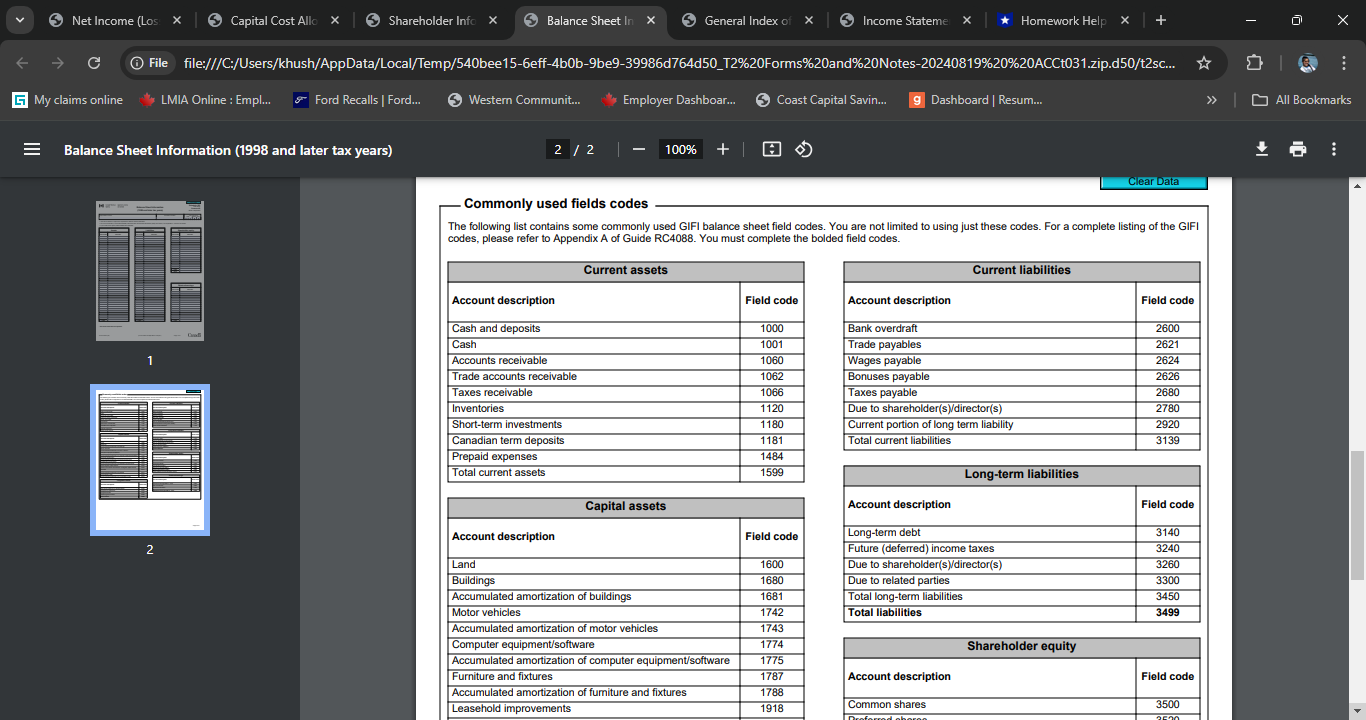

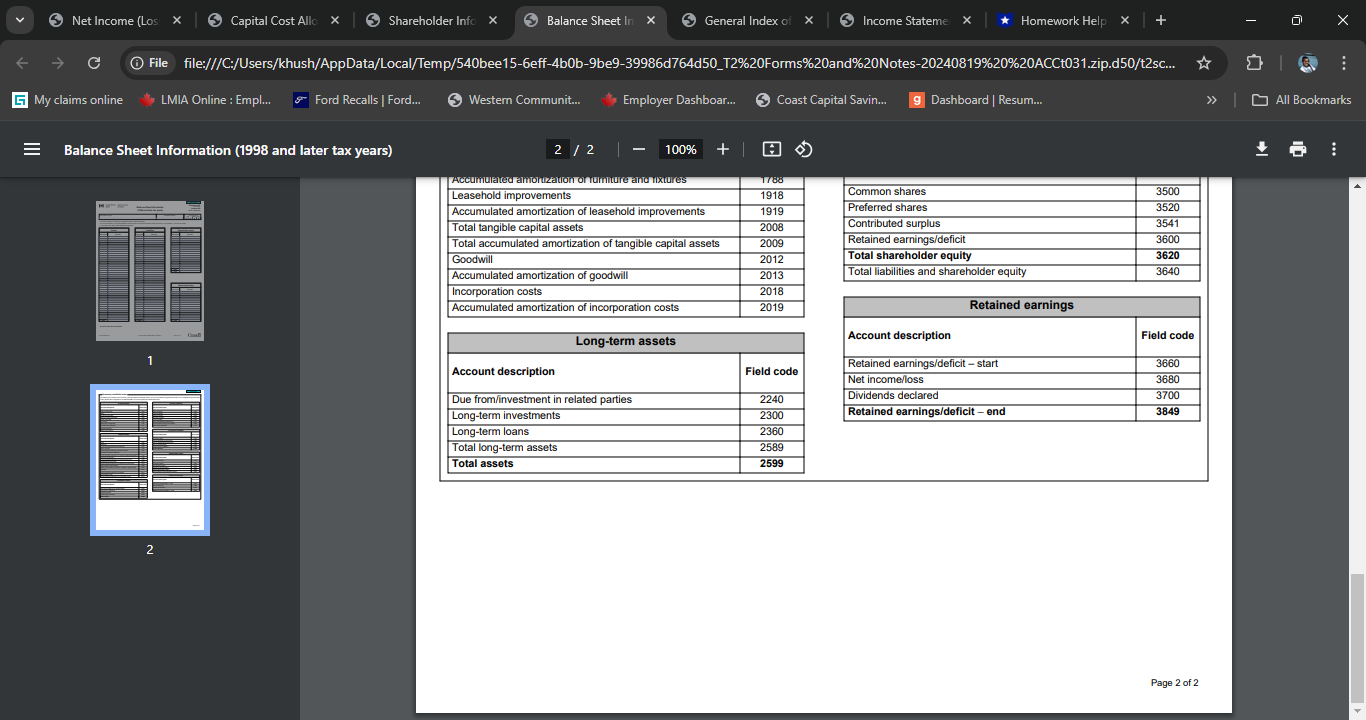

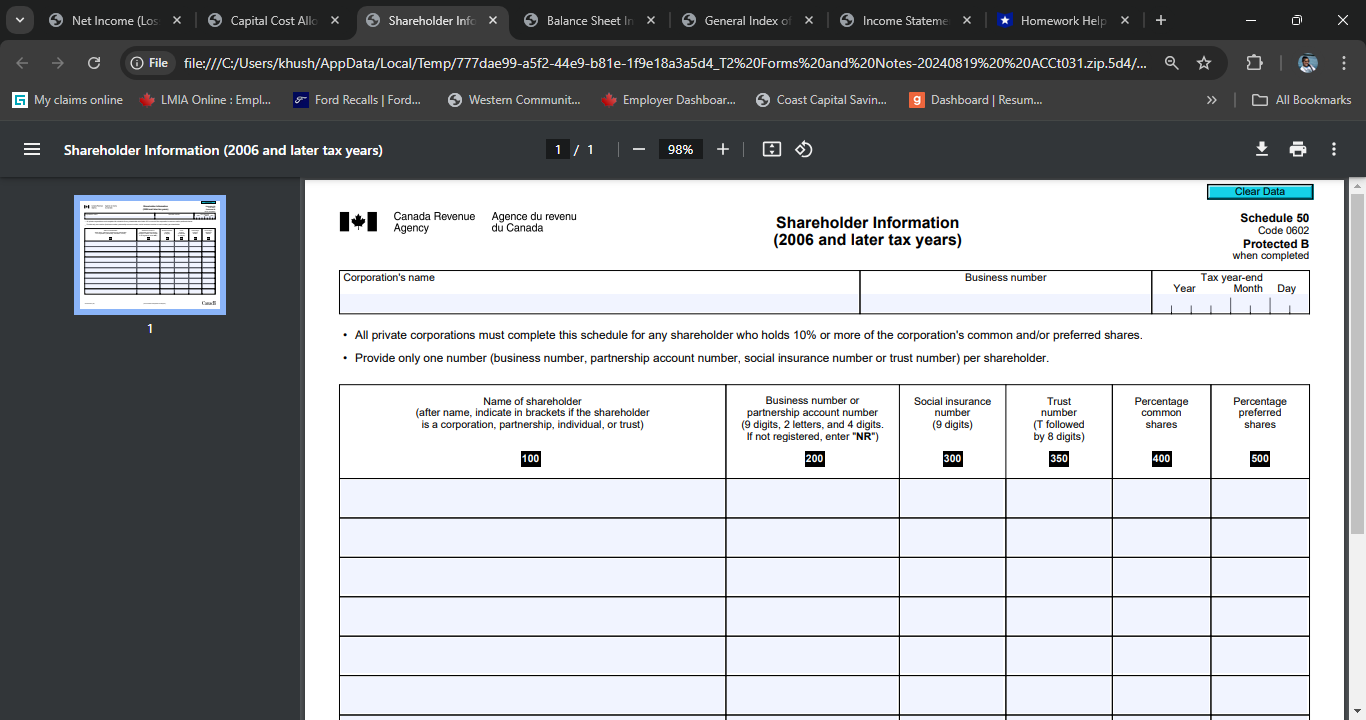

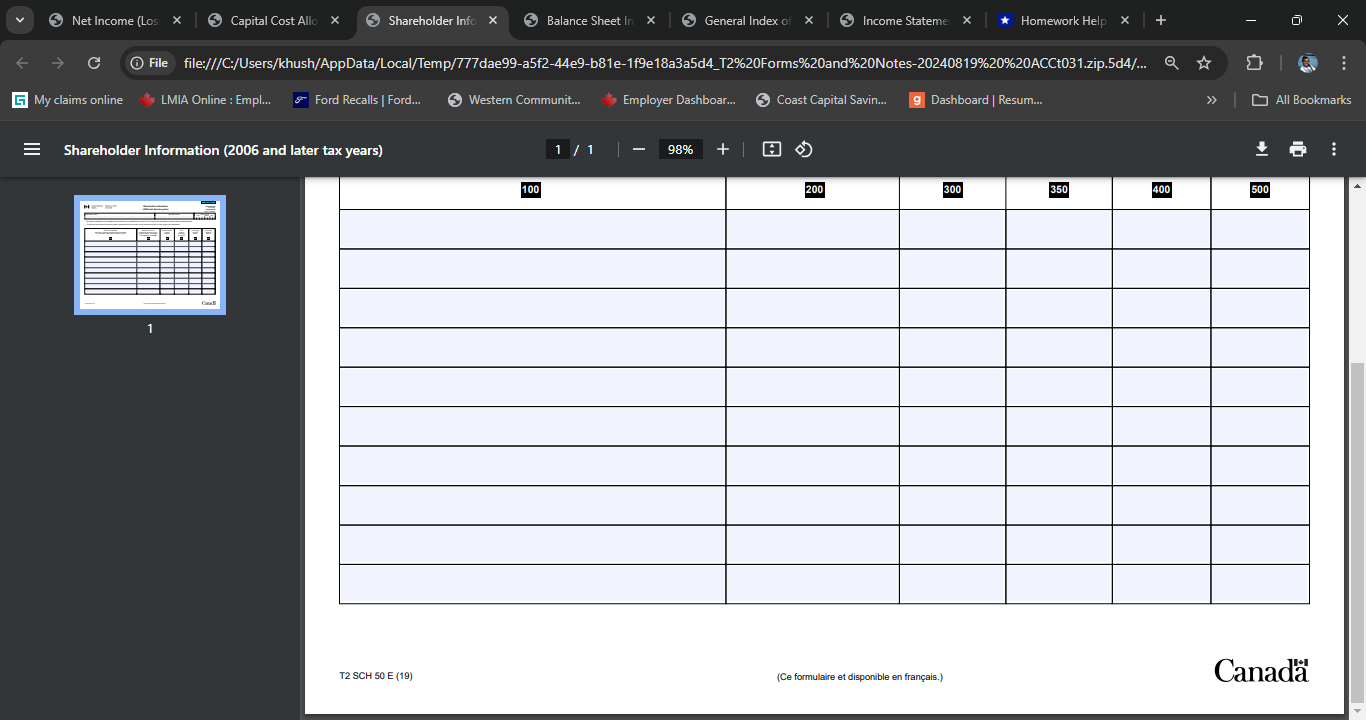

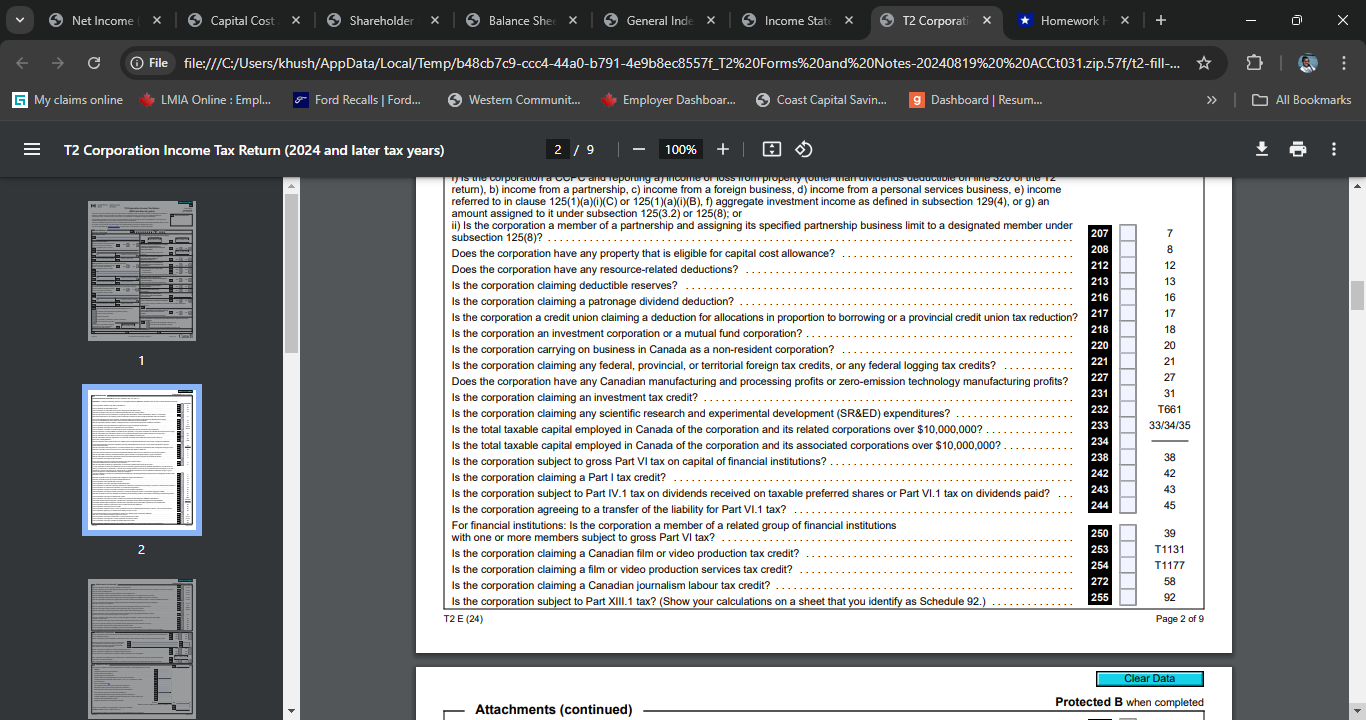

5 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde X Income State X T2 Corporati X * Homework | X + X C File file:///C:/Users/khush/AppData/Local/Temp/b48cb7c9-ccc4-44a0-b791-4e9b8ec8557f_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.57f/t2-fill-. My claims online LMIA Online : Emple.. Ford Recalls | Ford. Western Communit.. Employer Dashboar Coast Capital Savin.. 9 Dashboard | Resum.. > > All Bookmarks = T2 Corporation Income Tax Return (2024 and later tax years) 1 / 9 - 100% + ... Clear Data Canada Revenue Agence du revenu 200 Agency du Canada T2 Corporation Income Tax Return Code 2401 (2024 and later tax years) Protected B when completed This form serves as a federal, provincial, and territorial corporation income tax return, unless the corporation is located in Quebec or Alberta. If the corporation is located in one of these provinces, you have to file a separate provincial 055 Do not use this area corporation return. A shorter version of the return, the T2SHORT, is available for eligible corporations. All legislative references on this return are to the federal Income Tax Act and Income Tax Regulations. This return may contain changes that had not yet become law at the time of publication. Send one completed copy of this return, including schedules and the General Index of Financial Information (GIFI), to your tax centre. You have to file the return within six months after the end of the corporation's tax year. For more information see canada.ca/taxes or Guide T4012, T2 Corporation - Income Tax Guide. Identification Business number (BN) . . .. 001 1 R C ILL Corporation's name To which tax year does this return apply? 002 Tax year start Tax year-end Year Month Day Year Month Day Address of head office 060 061 Has this address changed since the last time the CRA was notified? . . . . 010 Yes No Has there been an acquisition of control resulting in the application of If yes, complete lines 011 to 018. subsection 249(4) since the tax year start on line 060? . . 063 Yes No 2 011 012 Year Month Day If yes, provide the date control was City Province, territory, or state acquired . . . . . 065 015 016 Is the date on line 061 a deemed Country (other than Canada) Postal or ZIP code tax year-end according to 017 subsection 249(3.1)? 066 Yes No 018 Mailing address (if different from head office address) Is the corporation a professional corporation that is a member of a Has this address changed since the partnership? . . .. 067 020 . . . . . . . . . Yes last time the CRA was notified? Yes No No If yes, complete lines 021 to 028. Is this the first year of filing after: 170 clo Incorporation? . Yes No 0215 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde X Income State X T2 Corporati X * Homework | X + X C File file:///C:/Users/khush/AppData/Local/Temp/b48cb7c9-ccc4-44a0-b791-4e9b8ec8557f_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.57f/t2-fill-. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum.. > > All Bookmarks = T2 Corporation Income Tax Return (2024 and later tax years) 6 /9 100% + Clear Data Protected B when completed Refundable portion of Part I tax Canadian-controlled private corporations throughout the tax year or substantive CCPCs at any time in the tax year Aggregate investment income from Schedule 7 . . . 440 x 30 2/3% = Foreign non-business income tax credit from line 632 on page 8. Foreign investment income from Schedule 7 . . . 445 x 8% = .. . Subtotal (amount B minus amount C) (if negative, enter "0") E Amount A minus amount D (if negative, enter "0"). . . . Taxable income from line 360 on page 3 . F Amount from line 400, 405, 410, or 428 on page 4, whichever is the least _. . G Foreign non-business income tax credit from line 632 on page 8 . . . . x 75/29 = H 5 Foreign business income tax credit from line 636 on page 8 . . . .. . . . . Subtotal (add amounts G to I) E Subtotal (amount F minus amount J) K x 30 2/3% = M Part I tax payable minus investment tax credit refund (line 700 minus line 780 from page 9) . . . .. 450 N Refundable portion of Part I tax - Amount E, L, or M, whichever is the least .5 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde X Income State X T2 Corporati X * Homework + X + X C File file:///C:/Users/khush/AppData/Local/Temp/b48cb7c9-ccc4-44a0-b791-4e9b8ec8557f_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.57f/t2-fill-. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboard. Coast Capital Savin.. 9 Dashboard | Resum.. > > All Bookmarks = T2 Corporation Income Tax Return (2024 and later tax years) 7/9 100% + Clear Data Protected B when completed Refundable dividend tax on hand Eligible refundable dividend tax on hand (ERDTOH) at the end of the previous tax year (line 530 of the preceding tax year) 520 Non-eligible refundable dividend tax on hand (NERDTOH) at the end of the previous tax year (line 545 of the preceding tax 535 B year) (if negative, enter "0") . . . 5 Part IV tax payable on taxable dividends from connected corporations (amount 2G from Schedule 3) C Part IV tax payable on eligible dividends from non-connected corporations (amount 2J from Schedule 3 D = = Subtotal (amount C plus amount D) m Net ERDTOH transferred on an amalgamation or the wind-up of a subsidiary. . . . 525 570 I On ERDTOH dividend refund for the previous tax year Refundable portion of Part I tax (from line 450 on page 6). . Part IV tax before deductions (amount 2A from Schedule 3) Part IV tax allocated to ERDTOH (amount E). Part IV tax reduction due to Part IV.1 tax payable (amount 4D of Schedule 43). . . . 6 Subtotal (amount I minus total of amounts J and K) Net NERDTOH transferred on an amalgamation or the wind-up of a subsidiary . .. 540 NERDTOH dividend refund for the previous tax year . . 575 DOZE 38 1/3% of the total losses applied against Part IV tax (amount 2D from Schedule 3) Part IV tax payable allocated to NERDTOH, net of losses claimed (amount L minus amount O) (if negative enter "0") . . . . . . . . . . NERDTOH at the end of the tax year (total of amounts B, H, M, and P minus amount N) (if negative, enter "0" ) . . . .... . 545 Part IV tax payable allocated to ERDTOH, net of losses claimed (amount E minus the amount, if any, by which amount O exceeds amount L) (if negative, enter "0") . . . - . . . . . . . ERDTOH at the end of the tax year (total of amounts A, F, and Q minus amount G) (if negative, enter "0") . . . . 5305 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde X Income State X T2 Corporati X * Homework + X + X C File file:///C:/Users/khush/AppData/Local/Temp/b48cb7c9-ccc4-44a0-b791-4e9b8ec8557f_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.57f/t2-fill-. My claims online LMIA Online : Emplord Recalls | Ford. Western Communit. Employer Dashboard. Coast Capital Savin. 9 Dashboard | Resum. > > All Bookmarks = T2 Corporation Income Tax Return (2024 and later tax years) 7 9 100% + . . . NERDTOH at the end of the tax year (total of amounts B, H, M, and P minus amount N) (if negative, enter "U") . . . ..... 545 Part IV tax payable allocated to ERDTOH, net of losses claimed (amount E minus the amount, if any, by which amount O exceeds amount L) (if negative, enter "0") . . . - . . . . . . . ERDTOH at the end of the tax year (total of amounts A, F, and Q minus amount G) (if negative, enter "0") . . . . . . . .. 530 Dividend refund 38 1/3% of total eligible dividends paid in the tax year (amount 3A from Schedule 3) . . .. 5 ERDTOH balance at the end of the tax year (line 530) Eligible dividend refund (amount AA or BB, whichever is less) SAM8 8 83 = = 38 1/3% of total non-eligible taxable dividends paid in the tax year (amount 3B from Schedule 3) NERDTOH balance at the end of the tax year (line 545) Non-eligible dividend refund (amount DD or EE, whichever is less) Amount DD minus amount EE (if negative, enter "0") . . .. HH Amount BB minus amount CC (if negative, enter "0") . ... Additional non-eligible dividend refund (amount GG or HH, whichever is less) JJ Dividend refund - Amount CC plus amount FF plus amount II 6 Enter amount JJ on line 784 on page 9.5 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde X Income State X T2 Corporati X * Homework | X + X C File file:///C:/Users/khush/AppData/Local/Temp/b48cb7c9-ccc4-44a0-b791-4e9b8ec8557f_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.57f/t2-fill-. My claims online LMIA Online : Emplord Recalls | Ford. Western Communit... Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum. > > All Bookmarks = T2 Corporation Income Tax Return (2024 and later tax years) 8 / 9 100% + Protected B when completed Part I tax Base amount Part I tax - Taxable income (from line 360 on page 3) multiplied by 38% . . . 550 Additional tax on personal services business income (section 123.5) Taxable income from a personal services business . 555 X 5% = 560 B Additional tax on banks and life insurers from Schedule 68 565 6 602 D Recapture of investment tax credit from Schedule 31 . . Calculation for the refundable tax on the Canadian-controlled private corporation's (CCPC) or substantive CCPC's investment income (if it was a CCPC throughout the tax year or a substantive CCPC at any time in the tax year) Aggregate investment income from line 440 on page 6 Taxable income from line 360 on page 3 Deduct: Amount from line 400, 405, 410, or 428 on page 4, whichever is the least . . .. Net amount (amount F minus amount G) 7 Refundable tax on CCPC's or substantive CCPC's investment income - 10 2/3% of whichever is less: amount E or amount H 604 Subtotal (add amounts A, B, C, D, and I) Deduct: Small business deduction from line 430 on page 4 . K Federal tax abatement 608 Manufacturing and processing profits deduction and zero-emission technology manufacturing deduction from Schedule 27 . 516 Investment corporation deduction . . 620 Taxed capital gains 624 Federal foreign non-business income tax credit from Schedule 21 . . 632 636 8 Federal foreign business income tax credit from Schedule 21 . . .5 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde X Income State X T2 Corporati X * Homework + X + X C File file:///C:/Users/khush/AppData/Local/Temp/b48cb7c9-ccc4-44a0-b791-4e9b8ec8557f_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.57f/t2-fill-. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit... Employer Dashboar Coast Capital Savin.. 9 Dashboard | Resum. > > All Bookmarks = T2 Corporation Income Tax Return (2024 and later tax years) 8 / 9 100% + Taxed capital gains 624 Federal foreign non-business income tax credit from Schedule 21 . 632 Federal foreign business income tax credit from Schedule 21 . . . 636 General tax reduction for CCPCs from amount I on page 5 538 General tax reduction from amount P on page 5 639 Federal logging tax credit from Schedule 21 . 640 Eligible Canadian bank deduction under section 125.21 . . .. 641 Federal qualifying environmental trust tax credit. 648 Investment tax credit from Schedule 31 652 6 Subtotal Part I tax payable - Amount J minus amount L Enter amount M on line 700 on page 9 * This is not applicable to substantive CCPCs. Privacy notice Personal information (including the SIN) is collected to administer or enforce the Income Tax Act and related programs and activities including administering tax, benefits, audit, compliance, and collection. The information collected may be used or disclosed for the purposes of other federal acts that provide for the imposition and collection of a tax or duty. It may also be disclosed to other federal, provincial, territorial, or foreign government institutions to the extent authorized by law. Failure to provide this information may result in paying interest or penalties, or in other actions. Under the Privacy Act, individuals have a right of protection, access to and correction of their personal information, or to file a complaint with the Privacy Commissioner of Canada regarding the 7 handling of their personal information. Refer to Personal Information Bank CRA PPU 047 on Information about Programs and Information Holdings at canada.ca/cra-information-about-programs. T2 E (24) Page 8 of 9 85 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde X Income State X T2 Corporati X * Homework + X + X C File file:///C:/Users/khush/AppData/Local/Temp/b48cb7c9-ccc4-44a0-b791-4e9b8ec8557f_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.57f/t2-fill-. My claims online LMIA Online : Emplord Recalls | Ford. Western Communit.. Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum. > > All Bookmarks = T2 Corporation Income Tax Return (2024 and later tax years) 9 /9 100% + Clear Data Protected B when completed Summary of tax and credits Federal tax Part I tax payable from amount M on page 8 700 Part II.2 tax payable from Schedule 56 705 Part III.1 tax payable from Schedule 55 710 Part IV tax payable from Schedule 3 712 Part IV.1 tax payable from Schedule 43 716 Part VI tax payable from Schedule 38 720 Part VI.1 tax payable from Schedule 43 724 Part VI.2 tax payable from Schedule 67 725 Part XIll.1 tax payable from Schedule 92. 727 Part XIV tax payable from Schedule 20 728 . . . . . . . . Total federal tax Add provincial or territorial tax: Provincial or territorial jurisdiction . . . . . . . . . . ; . . .- - 750 (if more than one jurisdiction, enter "multiple" and complete Schedule 5) Net provincial or territorial tax payable (except Quebec and Alberta) . 760 - . . . . . . . . . . . . ." 770 Deduct other credits: Total tax payable Investment tax credit refund from Schedule 31 780 8 Dividend refund from amount JJ on page 7. . .. 784 Federal capital gains refund from Schedule 18 788 Federal qualifying environmental trust tax credit refund . . . 792 Return of fuel charge proceeds to farmers tax credit from Schedule 63. 795 Canadian film or video production tax credit (Form T1131) 796 Film or video production services tax credit (Form T1177) 797 Canadian journalism labour tax credit from Schedule 58 798 Air quality improvement tax credit from Schedule 65 799 Tax withheld at source . 800 - . . . . . . . . Total payments on which tax has been withheld . . . . . 301 Provincial and territorial capital gains refund from Schedule 18 808 Provincial and territorial refundable tax credits from Schedule 5 812 9 8405 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde X Income State X T2 Corporati X * Homework + X + X C File file:///C:/Users/khush/AppData/Local/Temp/b48cb7c9-ccc4-44a0-b791-4e9b8ec8557f_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.57f/t2-fill-. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit... Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum. > > All Bookmarks = T2 Corporation Income Tax Return (2024 and later tax years) 9 / 9 100% + Total payments on which tax has been withheld . .. .. 801 Provincial and territorial capital gains refund from Schedule 18 808 Provincial and territorial refundable tax credits from Schedule 5 812 Tax instalments paid . 840 - . . . . . . . . . . . Total credits 890 Balance (amount A minus amount B) If the result is negative, you have a refund. If the result is positive, you have a balance owing. - Enter the amount below on whichever line applies. Generally, the CRA does not charge or refund a difference of $2 or less. Refund code 894 Refund Balance owing For information on how to enrol for direct deposit, go to canada.ca/cra-direct-deposit. For information on how to make your payment, go to canada.ca/payments. If the corporation is a Canadian-controlled private corporation throughout the tax year, does it qualify for the one-month extension of the date the balance of tax is due? . . 896 Yes No If this return was prepared by a tax preparer for a fee, provide their: EFILE number 920 925 RepID . . . . . . Certification 950 951 954 Last name First name Position, office, or rank 8 am an authorized signing officer of the corporation. I certify that I have examined this retum, including accompanying schedules and statements, and that the information given on this return is, to the best of my knowledge, correct and complete. I also certify that the method of calculating income for this tax year is consistent with that of the previous tax year except as specifically disclosed in a statement attached to this return. 955 956 Date (yyyy/mm/dd) Signature of the authorized signing officer of the corporation Telephone number Is the contact person the same as the authorized signing officer? If no, complete the information below 957 Yes No 958 959 Name of other authorized person Telephone number Language of correspondence - Langue de correspondance Indicate your language of correspondence by entering 1 for English or 2 for French. 990 9 Indiquez votre langue de correspondance en inscrivant 1 pour anglais ou 2 pour francais.5 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde 5 Income State X * Course Hero X C Chat - Learn X + X C File file:///C:/Users/khush/AppData/Local/Temp/e800a9b2-8420-4846-9814-3d6c2915181_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.f81/t2sch. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum.. > > All Bookmarks E Income Statement Information (2010 and later tax years) 1 4 100% + ... Clear Data Canada Revenue Agence du revenu Schedule 125 Agency du Canada Code 1005 Income Statement Information Protected B (2010 and later tax years) when completed Corporation's name Business number Tax year-end Year Month Day . Use this schedule to report your income statement information. . For more information, see Guide RC4088, General Index of Financial Information (GIFI) and T4012, T2 Corporation - Income Tax Guide. . If you need more space, attach additional schedules. 0001 Operating name 0002 Description of the operation 0003 Sequence number * 101 Non-farming revenue Non-farming expenses Non-farming expenses Cost of Sales Operating Expenses Field Code Amount Field Code Amount Field Code Amount 25 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde 5 Income State X * Course Hero X C Chat - Learn X + X C File file:///C:/Users/khush/AppData/Local/Temp/e800a962-8420-4846-9814-3d6c29151f81_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.f81/t2sch. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboar Coast Capital Savin.. 9 Dashboard | Resum. > > All Bookmarks E Income Statement Information (2010 and later tax years) 1 / 4 100% + 2 "# 8299 *#9368 *9369 * See page 3 of this schedule for information on field code 0003. * Complete this field code if you are reporting non-farming revenue or non-farming expenses.5 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde 5 Income State X * Course Hero X C Chat - Learn X + X C File file:///C:/Users/khush/AppData/Local/Temp/e800a9b2-8420-4846-9814-3d6c2915181_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.f81/t2sch. My claims online LMIA Online : Emple.. Ford Recalls | Ford.. Western Communit. Employer Dashboar Coast Capital Savin.. 9 Dashboard | Resum.. > > All Bookmarks E Income Statement Information (2010 and later tax years) 2/4 100% + Clear Data Protected B when completed Income Statement Information - continued Extraordinary items Farming revenue Farming expenses - continued and income taxes Field Code Amount Field Code Amount Field Code Amount *9999 *9659 Farming expenses Other comprehensive income 2 Field Code Amount Field Code Amount 7000 7002 7004 9898 7006 * 9899 7008 * 9970 7010 7020 ##* 99985 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde X Income State X T2 Corporati X * Homework + X + X C File file:///C:/Users/khush/AppData/Local/Temp/b48cb7c9-ccc4-44a0-b791-4e9b8ec8557f_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.57f/t2-fill-. My claims online LMIA Online : Emple.. Ford Recalls | Ford. Western Communit.. Employer Dashboard. Coast Capital Savin. 9 Dashboard | Resum. > > All Bookmarks = T2 Corporation Income Tax Return (2024 and later tax years) 1 / 9 100% + Has this address changed since the partnership? . . . . 067 Yes No Yes No - . . . . . . . . . . ." last time the CRA was notified? 020 If yes, complete lines 021 to 028. Is this the first year of filing after: clo Incorporation? . . 070 Yes No 021 071 Yes No 022 Amalgamation? 023 If yes, complete lines 030 to 038 and attach Schedule 24. City Province, territory, or state Has there been a wind-up of a 025 026 subsidiary under section 88 during the No current tax year? 072 Yes Country (other than Canada) Postal or ZIP code If yes, complete and attach Schedule 24. 027 028 Is this the final tax year before Location of books and records (if different from head office address) amalgamation? 076 Yes No - . . . . . . . . Has this address changed since the last time the CRA was notified? . .. 030 Yes No Is this the final return up to dissolution? . .. 078 Yes No If yes, complete lines 031 to 038. If an election was made under 031 section 261, state the functional currency used . . . . 079 032 City Province, territory, or state 035 036 Is the corporation a resident of Canada? 080 Yes No Country (other than Canada) Postal or ZIP code If no, give the country of residence on line 081 and complete and attach 037 038 Schedule 97. 040 Type of corporation at the end of the tax year (tick one) 081 1 Canadian-controlled private corporation (CCPC) Is the non-resident corporation claiming an exemption under an income tax 082 Yes No 2 2 Other private corporation treaty? . . . . . . . . . . . . . .;.; If yes, complete and attach Schedule 91. 3 Public corporation 4 Corporation controlled by a public corporation If the corporation is exempt from tax under section 149, tick one of the following boxes: 5 Other corporation (specify) 085 1 Exempt under paragraph 149(1)(e) or (1) If the type of corporation changed Year Month Day 2 Exempt under paragraph 149(1)() during the tax year, provide the 4 Exempt under other paragraphs of section 149 effective date of the change 043 Do not use this area 095 096 8985 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde 5 Income State X * Course Hero X C Chat - Learn X + X C File file:///C:/Users/khush/AppData/Local/Temp/e800a962-8420-4846-9814-3d6c2915181_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.f81/t2sch. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboard. Coast Capital Savin.. 9 Dashboard | Resum. > > All Bookmarks Income Statement Information (2010 and later tax years) 2/4 100% + * Complete this field code if you are reporting farming revenue or farming expenses. *Complete this field code for all corporations. **If you used the International Financial Reporting Standards, you may have to report amounts under "Other comprehensive income." Page 2 of 4 Canada Revenue Agence du revenu Schedule 140 Agency du Canada Summary Statement (2010 and later tax years) . Use this section of the schedule only to report the summary statement when you are submitting supplementary income statements. . For information on supplementary income statements, see Guide RC4088, Appendix B - Reporting multiple lines of business. . If you need more space, attach additional schedules. Field Code Amount Extraordinary items *##* 9970 and income taxes Field Code Amount 2 WA 9999 *#*Complete this field code. T2 SCH 140 E (23) (Ce formulaire est disponible en francais.) Page 1 of 1 Canada5 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde 5 Income State X * Course Hero X C Chat - Learn X + X C File file:///C:/Users/khush/AppData/Local/Temp/e800a9b2-8420-4846-9814-3d6c2915181_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.f81/t2sch. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboard. Coast Capital Savin. 9 Dashboard | Resum. > > All Bookmarks Income Statement Information (2010 and later tax years) 3 / 4 100% + Information Field code 0003 is pre-printed on page 1 of this schedule. If you are submitting supplementary income statements, cross out the pre-printed 01 and complete in sequential order. For information on reporting multiple lines of business using supplementary income statements, see Appendix B of Guide RC4088 Commonly used field codes The following list contains commonly used GIFI income statement field codes. For a complete list of the GIFI codes, refer to Appendix A of Guide RC4088. Non-farming revenue and expenses Non-farming revenue Non-farming expenses - Operating expenses Account description Field Code Account description Field Code Trade sales of goods and services 8000 Advertising and promotion 8520 Investment revenue 309 Advertising 3521 Dividend income 3095 Meals and entertainment 1523 Commission revenue 8120 Amortization of intangible assets 357 Rental revenue 8140 Bad debt expense 8590 Real estate rental revenue 8141 Employee benefits 3620 Realized gains/losses on disposal of assets 8210 Amortization of tangible assets 8670 2 Realized gains/losses on sale of investments 8211 Insurance 8690 Other revenue 8230 Interest and bank charges 8710 Income/loss of subsidiaries/affiliates 3232 Interest on long-term debt 8714 Total revenue 8299 Bank charges 8715 Business taxes 8762 Non-farming expenses - Cost of sales Office expenses 8810 Professional fees 8860 Account description Field Code Accounting fees 3862 Management and administration fees 8871 Opening inventory 8300 Real estate rental 891 Purchases/cost of materials 8320 Equipment rental 3914 Direct wages 8340 Repairs and maintenance 8960 Trades and sub-contracts 8360 Repairs and maintenance - buildings 89615 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde 5 Income State X * Course Hero X C Chat - Learn X + X C File file:///C:/Users/khush/AppData/Local/Temp/e800a9b2-8420-4846-9814-3d6c29151f81_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.f81/t2sch. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboard. Coast Capital Savin. 9 Dashboard | Resum.. > > All Bookmarks Income Statement Information (2010 and later tax years) 3 / 4 - 100% + Account description Field Code Accounting fees 3862 Management and administration fees 387 Opening inventory 8300 Real estate rental 891 Purchases/cost of materials 8320 Equipment rental 8914 Direct wage 3340 Repairs and maintenance 8960 Trades and sub-contracts 3360 Repairs and maintenance - buildings 8961 Other direct costs 8450 Salaries and wages 9060 Freight-in and duty 8457 Management salaries 9065 Closing inventory 8500 Supplies 9130 Cost of sales 8518 Property taxes 18 Gross profit/loss 8519 Travel expenses 9200 Utilities 9220 Telephone and communications 9225 Other expenses 9270 Vehicle expenses 9281 General and administrative expenses 284 Total operating expenses 367 Total expenses 9368 Net non-farming income 9369 2 T2 SCH 125 E (23) Page 3 of 45 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde 5 Income State X * Course Hero X C Chat - Learn X + X C File file:///C:/Users/khush/AppData/Local/Temp/e800a962-8420-4846-9814-3d6c2915181_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.f81/t2sch. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboar Coast Capital Savin.. 9 Dashboard | Resum.. > > All Bookmarks Income Statement Information (2010 and later tax years) 4 100% + Commonly used field codes (continued) The following list contains commonly used GIFI income statement field codes. For a complete listing of the GIFI codes, see Appendix A of Guide RC4088. Farming revenue and expenses Farming revenue Farming expenses Account description Field Code Account description Field Code 2 Grains and oilseeds 9370 Fertilizers and lime 9662 Wheat 9371 Seeds and plants 3664 Barley 9373 Feed, supplements, straw, and bedding 9711 Com 9375 Livestock purchases 9712 Other crop revenues 9420 Veterinary fees, medicine, and breeding fees 3713 Fruit 9421 Machinery fuel 9764 Vegetables 9423 General farm expenses 9790 Cattle 9471 Amortization of tangible assets 979 Poultry 9473 Advertising, marketing costs, and promotion 3792 Milk and cream (excluding dairy subsidies) 9476 Building repairs and maintenance 9795 Program payment revenues 9540 Custom or contract work 3798 3 Other farm revenues/losses 9600 Electricity 9799 ncome 9606 Other insurance premiums 9804 Interest income 9607 Interest and bank charges 9805 Total farm revenue 9659 Professional fees 9809 Property taxes 9810 Rent - land and buildings 981 Salaries and wages 9814 Motor vehicle expenses 9819 Telephone 1824 Net inventory adjustment 9870 Total farm expenses 9898 Net farm income 38995 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde 5 Income State X * Course Hero X C Chat - Learn X + X C File file:///C:/Users/khush/AppData/Local/Temp/e800a9b2-8420-4846-9814-3d6c29151f81_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.f81/t2sch. My claims online LMIA Online : Emple.. Ford Recalls | Ford.. Western Communit. Employer Dashboard. Coast Capital Savin. 9 Dashboard | Resum.. > > All Bookmarks Income Statement Information (2010 and later tax years) 4 100% + Rental income 9606 Other insurance premiums 9804 Interest income 9607 Interest and bank charges 9805 Total farm revenue 3659 Professional fees 9809 Property taxes 981 Rent - land and buildings 981 Salaries and wages 9814 Motor vehicle expenses 9819 Telephone 3824 Net inventory adjustment 9870 2 Total farm expenses 9898 Net farm income 9899 Extraordinary items and income taxes Other comprehensive income Account description Field Code Account description Field Code Extraordinary items 9975 Revaluation surplus 7000 Current income taxes 3990 Defined benefit gains/losses 7002 Future (deferred) income tax provision 9995 Foreign operation translation gains/losses 7004 Net income/loss after taxes and extraordinary items 9999 Equity instruments gains/losses 7006 3 Cash flow hedge effective portion gains/losses 7008 Income tax relating to components of other comprehensive income 7010 Miscellaneous other comprehensive income 7020 Total - other comprehensive income 9998Net Income (Los X Capital Cost Allo x | 5 Shareholder Info X Balance Sheet In X General Index of X Income Stateme x *Course Hero X + X C @ File file:///C:/Users/khush/AppData/Local/Temp/b4d86bc2-da4b-4f71-8ccd-e0583374f45a_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.45a/t2sch. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum.. > > All Bookmarks General Index of Financial Information (GIFI) - Additional Information (.. 1 /2 - 100% + ... Clear Data Canada Revenue Agence du revenu Schedule 141 Agency du Canada Code 2101 General Index of Financial Information (GIFI) - Additional Information Protected B when completed (2021 and later tax years) Corporation's name Business number Tax year-end Year Month Day . Corporations need to complete all parts of this schedule that apply and include it with their T2 return along with their other GIFI schedules. . For more information, see Guide RC4088, General Index of Financial Information (GIFI), and Guide T4012, T2 Corporation - Income Tax Guide. Part 1 - Information on the person primarily involved with the financial information Can you identify the person_ specified in the heading of Part 1? . 111 Yes No If you answered no, go to Part 2. Does that person have a professional designation in accounting? 095 Yes No Is that person connected" with the corporation? . 097 Yes No *A person primarily involved with the financial information is a person who has more than a 50% involvement in preparing the financial information that the T2 return is based on. For example, if three persons prepared the financial information by doing respectively 30%, 30%, and 40% of the work, answer no at line 111. If they did respectively 10%, 20%, and 70% of the work, answer yes at line 111 and complete Part 1 by referring only to the third person. 2 " A person connected with a corporation can be: (i) a shareholder of the corporation who owns more than 10% of the common shares; (ii) a director, an officer, or an employee of the corporation; or (ill) a person not dealing at arm's length with the corporation. Part 2 - Type of involvement Choose one or more of the following options that represent your involvement and that of the person referred to in Part 1: Completed an auditor's report . . . 300 Completed a review engagement report 301 Conducted a compilation engagement . 802Net Income (Los X Capital Cost Allo x | 5 Shareholder Info X Balance Sheet In X General Index of X Income Stateme X *Course Hero X + X C @ File file:///C:/Users/khush/AppData/Local/Temp/b4d86bc2-da4b-4f71-8ccd-e0583374f45a_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.45a/t2sch. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum. > > All Bookmarks General Index of Financial Information (GIFI) - Additional Information (.. 1 /2 100% + Part 2 - Type of involvement Choose one or more of the following options that represent your involvement and that of the person referred to in Part 1: 300 Completed an auditor's report . . . Completed a review engagement report 301 302 000OO Conducted a compilation engagement 303 Provided accounting services . Provided bookkeeping services . 304 Other (please specify) .. 305 Part 3 - Reservations If you selected option 1 or 2 in Part 2 above, answer the following question: Has the person referred to in Part 1 expressed a reservation? 099 Yes No Part 4 - Other information 101 Yes Were notes to the financial statements prepared? No 104 Yes No 2 Did the corporation have any subsequent events? Did the corporation re-evaluate its assets during the tax year? . 105 Yes 10OO 100OOO Yes Did the corporation have any contingent liabilities during the tax year? 106 Did the corporation have any commitments during the tax year? 107 Yes 108 Yes Does the corporation have investments in joint venture(s) or partnership(S)? . . . . . . . . . . . . . . . . . . .Net Income (Los X Capital Cost Allo x | 5 Shareholder Info X Balance Sheet In X General Index of X Income Stateme X *Course Hero X + X C @ File file:///C:/Users/khush/AppData/Local/Temp/b4d86bc2-da4b-4f71-8ccd-e0583374f45a_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.45a/t2sch. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboar Coast Capital Savin.. 9 Dashboard | Resum. > > All Bookmarks General Index of Financial Information (GIFI) - Additional Information (.. 2/2 100% + T2 SCH 141 E (23) (Ce formulaire est disponible en francais.) Page 1 of 2 Canada Clear Data Protected B when completed Part 4 - Other information (continued) Impairment and fair value changes In any of the following assets, was an amount recognized in net income or other comprehensive income (OCI) as a result of an impairment loss in the tax year, a reversal of an impairment loss recognized in a previous tax year, or a change in fair Yes value during the tax year? . . 200 No If yes, enter the amount recognized: In net income In OCI Increase (decrease) Increase (decrease) Property, plant, and equipment 210 211 216 Intangible assets 215 Investment property . Biological assets Financial instruments. 231 236 Other . . 235 2 Financial instruments Yes Did the corporation derecognize any financial instrument(s) during the tax year (other than trade receivables)? . .. . . 250 No Did the corporation apply hedge accounting during the tax year? 255 Yes 0OO No 0OO Did the corporation discontinue hedge accounting during the tax year? . . . .. 260 Yes No Adjustments to opening equity Was an amount included in the opening balance of retained earnings or equity, in order to correct an error, to recognize a 265 change in accounting policy, or to adopt a new accounting standard in the current tax year? . . . . . ... Yes No If yes, you have to maintain a separate reconciliation.Net Income (Los X Capital Cost Allo x | 5 Shareholder Info X Balance Sheet In X General Index of X Income Stateme X *Course Hero X + X C @ File file:///C:/Users/khush/AppData/Local/Temp/b4d86bc2-da4b-4f71-8ccd-e0583374f45a_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.45a/t2sch. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum. > > All Bookmarks General Index of Financial Information (GIFI) - Additional Information (... 2 / 2 100% + If yes, you have to maintain a separate reconciliation. Part 5 - Information on the person who prepared the T2 return If the person who prepared the T2 return has a professional designation in accounting but is not the person identified in Part 1, choose all of the following options that apply: Prepared the T2 retum and the financial information contained therein 310 The client provided the financial statements 311 The client provided a trial balance 312 The client provided a general ledger . 313 Other (please specify) . . . . . . . 314 2Net Income (Los X Capital Cost Allo X | 5 Shareholder Info X Balance Sheet In X General Index of X Income Stateme x| Homework Help X + X C @ File file:///C:/Users/khush/AppData/Local/Temp/540bee15-6eff-4b0b-9be9-39986d764d50_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.d50/t2sc. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit.. Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum.. > > All Bookmarks E Balance Sheet Information (1998 and later tax years) 1 / 2 - 100% + ... Clear Data Canada Revenue Agence du revenu Schedule 100 Agency du Canada Balance Sheet Information Code 0803 Protected B (1998 and later tax years) when completed Corporation's name Business number Tax Year End Year Month Day Welcome home 79812705 202308 19 . Use this schedule to report the corporation's balance sheet information. . For more information, see Guide RC4088, General Index of Financial Information (GIFI) and T4012, T2 Corporation - Income Tax Guide. . If you need more space, attach additional schedules. Assets Liabilities Shareholder equity Field code Amount Field code Amount Field code Amount 1001 6000.00 1060 800.00 2 *3620 36405 Net Income X Capital Cost X Shareholder x Balance Shee X General Inde X Income State X T2 Corporati X * Homework + X + X C File file:///C:/Users/khush/AppData/Local/Temp/b48cb7c9-ccc4-44a0-b791-4e9b8ec8557f_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.57f/t2-fill-. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit... Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum.. > > All Bookmarks =T2 Corporation Income Tax Return (2024 and later tax years) 2 /9 100% + Protected B when completed Attachments Financial statement information: Use GIFI schedules 100, 125, and 141. Schedules - Answer the following questions. For each yes response, attach the schedule to the T2 return, unless otherwise instructed. Yes Schedule Is the corporation related to any other corporations? 150 9 Is the corporation an associated CCPC? 160 23 Is the corporation an associated CCPC that is claiming the expenditure limit? 161 49 Does the corporation have any non-resident shareholders who own voting shares? 151 10 Has the corporation had any transactions, including section 85 transfers, with its shareholders, officers, or employees, other than transactions in the ordinary course of business? Exclude non-arm's length transactions with non-residents 162 11 If you answered yes to the above question, and the transaction was between corporations not dealing at arm's length were all or substantially all of the assets of the transferor disposed of to the transferee? . . 163 44 Has the corporation paid any royalties, management fees, or other similar payments to residents of Canada? . 164 14 Is the corporation claiming a deduction for payments to a type of employee benefit plan? 165 15 Is the corporation claiming a loss or deduction from a tax shelter? . . .. 166 T5004 Is the corporation a member of a partnership for which a partnership account number has been assigned? 167 T5013 Did the corporation, a foreign affiliate controlled by the corporation, or any other corporation or trust that did not deal at arm's length with the corporation have a beneficial interest in a non-resident discretionary trust (without reference to section 94)? .. . 168 22 Did the corporation own any shares in one or more foreign affiliates in the tax year? 169 25 Has the corporation made any payments to non-residents of Canada under subsections 202(1) and/or 105(1) of the Income Tax Regulations? . .. 170 29 171 T106 2 Did the corporation have a total amount over CAN$1 million of reportable transactions with non-arm's length non-residents? For private corporations: Does the corporation have any shareholders who own 10% or more of the corporation's common and/or preferred shares? 173 50 Has the corporation made payments to, or received amounts from, a retirement compensation plan arrangement during the year? 172 Does the corporation earn income from one or more Internet web pages or websites? . 180 Is the net income/loss shown on the financial statements different from the net income/loss for income tax purposes? ...... 201 1 Has the corporation made any charitable donations; gifts of cultural or ecological property; or gifts of medicine? 202 A W N - Has the corporation received any dividends or paid any taxable dividends for purposes of the dividend refund? 203 Is the corporation claiming any type of losses? 204 Is the corporation claiming a provincial or territorial tax credit or does it have a 205 permanent establishment in more than one jurisdiction? 5Net Income (Los X Capital Cost Allo X | 5 Shareholder Info X Balance Sheet In X General Index of X Income Stateme x| Homework Help X + X C @ File file:///C:/Users/khush/AppData/Local/Temp/540bee15-6eff-460b-9be9-39986d764d50_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.d50/t2sc. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit.. Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum. > > All Bookmarks E Balance Sheet Information (1998 and later tax years) 1 / 2 - 100% + * 3620 3640 Retained earnings Field code Amount 2 *2599 *3499 * 3849 This field code must be reported.Net Income (Los X Capital Cost Allo X | 5 Shareholder Info X Balance Sheet In X General Index of X Income Stateme x| Homework Help X + X C @ File file:///C:/Users/khush/AppData/Local/Temp/540bee15-6eff-4b0b-9be9-39986d764d50_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.d50/t2sc. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum. > > All Bookmarks E Balance Sheet Information (1998 and later tax years) 2 /2 100% + Clear Data Commonly used fields codes The following list contains some commonly used GIFI balance sheet field codes. You are not limited to using just these codes. For a complete listing of the GIFI codes, please refer to Appendix A of Guide RC4088. You must complete the bolded field codes Current assets Current liabilities Account description Field code Account description Field code Cash and deposits 1000 Bank overdraft 2600 Cash 1001 Trade payables 2621 Accounts receivable 106 Wages payable 2624 Trade accounts receivable 1062 Bonuses payable 2626 Taxes receivable 1066 Taxes payable 2680 Inventories 120 Due to shareholder(s)/director(s) 2780 Short-term investments 180 Current portion of long term liability 2920 Canadian term deposits 1181 Total current liabilities 3139 Prepaid expenses 1484 Total current assets 1599 Long-term liabilities Capital assets Account description Field code Account description Field code Long-term debt 3140 2 Future (deferred) income taxes 3240 Land 1600 Due to shareholder(s)/director(s) 3260 Buildings 1680 Due to related parties 3300 Accumulated amortization of buildings 1681 Total long-term liabilities 3450 Motor vehicles 1742 Total liabilities 3499 Accumulated amortization of motor vehicles 1743 Computer equipment/software 1774 Shareholder equity Accumulated amortization of computer equipment/software 1775 Furniture and fixtures 1787 Account description Field code Accumulated amortization of furniture and fixtures 1788 Leasehold improvements 1918 Common shares 3500Net Income (Los X Capital Cost Allo X | 5 Shareholder Info X Balance Sheet In X General Index of X Income Stateme x| Homework Help X + X C @ File file:///C:/Users/khush/AppData/Local/Temp/540bee15-6eff-4b0b-9be9-39986d764d50_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.d50/t2sc. My claims online LMIA Online : Emplord Recalls | Ford... Westem Communit. Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum. > > All Bookmarks E Balance Sheet Information (1998 and later tax years) 2/2 100% + Accumulated amortization of furniture and fixtures 786 Leasehold improvements 1918 Common shares 350 Accumulated amortization of leasehold improvements 1919 Preferred shares 3520 Total tangible capital assets 200 Contributed surplus 3541 Total accumulated amortization of tangible capital assets 2009 Retained earnings/deficit 3600 Goodwil 2012 Total shareholder equity 3620 Accumulated amortization of goodwill 2013 Total liabilities and shareholder equity 3640 Incorporation costs 2018 Accumulated amortization of incorporation costs 2019 Retained earnings Long-term assets Account description Field code Retained earnings/deficit - start 3660 Account description Field code Net income/loss 3680 Due from/investment in related parties 2240 Dividends declared 370 Long-term investments 2300 Retained earnings/deficit - 3849 Long-term loans 2360 Total long-term assets 2589 Total assets 2599 2 Page 2 of 2Net Income (Los X Capital Cost Allo X Shareholder Info X 5 Balance Sheet In X | 5 General Index of X Income Stateme x| Homework Help X + X C @ File file:///C:/Users/khush/AppData/Local/Temp/777dae99-a5f2-44e9-b81e-1f9e18a3a5d4_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.5d4/. My claims online LMIA Online : Emplord Recalls | Ford. Western Communit. Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum.. > > All Bookmarks 98% + ... =Shareholder Information (2006 and later tax years) 1 Clear Data I*I Canada Revenue Agence du revenu Agency du Canada Shareholder Information Schedule 50 Code 0602 (2006 and later tax years) Protected B when completed Corporation's name Business number Tax year-end Year Month Day . All private corporations must complete this schedule for any shareholder who holds 10% or more of the corporation's common and/or preferred shares. . Provide only one number (business number, partnership account number, social insurance number or trust number) per shareholder. Name of shareholder Business number or Social insurance Trust Percentage Percentage (after name, indicate in brackets if the shareholder partnership account number number number common preferred is a corporation, partnership, individual, or trust) (9 digits, 2 letters, and 4 digits. (9 digits) (T followed shares shares If not registered, enter "NR") by 8 digits) 100 200 30 350 400 500Net Income (Los X Capital Cost Allo X Shareholder Info X 5 Balance Sheet In X | 5 General Index of X Income Stateme x| Homework Help X + X C @ File file:///C:/Users/khush/AppData/Local/Temp/777dae99-a5f2-44e9-b81e-1f9e18a3a5d4_T2%20Forms%20and%20Notes-20240819%20%20ACCt031.zip.5d4/. My claims online LMIA Online : Emple.. Ford Recalls | Ford.. Western Communit. Employer Dashboar Coast Capital Savin.. 9 Dashboard | Resum. > > All Bookmarks Shareholder Information (2006 and later tax years) 98% + 100 200 300 350 400 500 T2 SCH 50 E (19) (Ce formulaire et disponible en francais.) Canada5 Net Income (Los X Capital Cost Allo X Shareholder Info X Balance Sheet In X | General Index of X Income Stateme x Homework Help X + X C @ File file:///C:/Users/khush/AppData/Local/Temp/1956a03d-c473-4669-89ee-a422c107380a_T2%20Forms%20and%20Notes-202408 19%20%20ACCt031.zip.80a/.. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum.. > > All Bookmarks Capital Cost Allowance (CCA) (2021 and later tax years) 1 / 5 75% + Clear Data Canada Revenue Agence du reveru Schedule 8 Agency du Canada Code 2102 Capital Cost Allowance (CCA) Protected B (2021 and later tax years) when completed Corporation's name Business number year end Year Month Day For more information, see the section called "Capital Cost Allowance" in Guide T4012, 72 Corporation - Income Tax. Unless otherwise stated, all legislative references are to the federal Income Tax Act. Is the corporation electing under subsection 1101(5q) of the Income Tax Regulations? 101 |Yes No Part 1 - Agreement between associated eligible persons or partnerships (EPOPs) Are you associated in the tax year with one or more EPOPs with which you have entered into an agreement under subsection 1104(3.3) of the Regulations? ....... 105 Yes No If you answered yes, fill out Part 1. Otherwise, go to Part 2. Enter a percentage assigned to each associated EPOP (including your corporation) as determined in the agreement. This percentage will be used to allocate the immediate expensing limit. The total of all the percentages assigned under the agreement should not exceed 100%. If the total is more than 100%, then the associated group has an immediate expensing limit of nil. For more information about the immediate expensing limit, see note 12 in Part 2. 2 Name of EPOP Identification number Percentage assigned under the agreement 2 Note 1 110 115 120 Total 3 Immediate expensing limit allocated to the corporation (see Note.2) 125 Note 1: The identification nu ber of the EPOP. Note 2: Multiply 1.5 million by the percentage assigned to your corporation in column 3. If the total of column 3 is more than 100%, enter "0".5 Net Income (Los X Capital Cost Allo X Shareholder Info X Balance Sheet In X | General Index of X Income Stateme x Homework Help X + X C @ File file:///C:/Users/khush/AppData/Local/Temp/1956a03d-c473-4669-89ee-a422c107380a_T2%20Forms%20and%20Notes-202408 19%20%20ACCt031.zip.80a/.. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum. > > All Bookmarks Capital Cost Allowance (CCA) (2021 and later tax years) 2/5 75% + Clear Data Protected B when completed - Part 2 - CCA calculation 5 Class Undepreciated capital Cost of acquisitions Cost of acquisitions from Adjustments and transfers (show Amount from column 5 Amount from column 5 Proceeds of number cost (UCC) at the during the year (new column 3 that are amounts that will reduce the that is assistance hat is repaid during the dispositions beginning of the year property must be designated immediate undepreciated capital cost in received or receivable year for a property. Note 3 available for use) expensing property (DIEP) brackets) g the year for a subsequent to its Note 9 property, subsequent to disposition Note 4 Note 5 Note 6 its disposition Note & Note 7 200 201 203 232 205 221 222 207 9 10 11 12 13 14 15 16 2 Proceeds of UCC UCC of the DIEP Immediate expensing | Cost of acquisitions on | Cost of acquisitions from Remaining UCC Proceeds of disposition available dispositions of the (column 2 plus (enter the UCC remainder of Class column 13 that are (column 10 minus to reduce the UCC of AllP and DIEP (enter amount column 3 plus or amount that relates to Nate 12 column 3 minus accelerated investment column 12) property included in Classes 54 from column & that minus column 5 the DIEP reported in column 12) incentive properties (AlIP) (if negative, enter "0") to 56 (column 8 plus column 6 relates to the DIEP minus column 8) column 4) or properties included in minus column 13 plus reported in column 4) Classes 54 to 58 column 14 minus column 7) Note 10 Note 11 (if negative, enter "0") Note 13 234 23 238 225 3 Totals5 Net Income (Los X Capital Cost Allo X Shareholder Info X Balance Sheet In X | General Index of X Income Stateme x Homework Help X + X C File file:///C:/Users/khush/AppData/Local/Temp/1956a03d-c473-4669-89ee-a422c107380a_T2%20Forms%20and%20Notes-202408 19%20%20ACCt031.zip.80a/.. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum. > > All Bookmarks Capital Cost Allowance (CCA) (2021 and later tax years) 3 / 5 75% + - Part 2 - CCA calculation (continued) 17 18 19 20 21 22 23 24 Net capital cost UCC adjustment for AllP and UCC adjustment for property acquired CCA rate % Recapture of Terminal loss CCA UCC at the end additions of AllP and property included in Classes 54 to 56 during the year other than AllP and CCA for declining balance of the year property inclu acquired during the year (column 17 property included in Classes 54 to 56 Note 16 Note 18 method, the result of (column 10 Classes 54 to 56 multiplied by the relevant factor) (0.5 multiplied by the result of Note 17 column 15 plus column 18 minus acquired during the column 13 minus column 14 minus minus column 19, column 23) year (column 14 Note 14 column & plus column 7 minus multiplied by column 20, or minus column 16) column 8) a lower amount, plus [if negative, enter "0") (if negative, enter "0") column 12) Note 15 Note 19 224 212 213 21 217 220 Totals Enter the total of column 21 on line 107 of Form T2 SCH 1, Net Income (Loss) for Income Tax Purposes. Enter the total of column 22 on line 404 of Form T2 SCH 1. 2 Enter the total of column 23 on line 403 of Form T2 SCH 1. Nole 3: If a class number has not been provided in Schedule Il of the Income Tax Regulations for a particular class of property, use the subsection provided in Regulation 1101. Note 4: Include any property acquired in previous years that has now become available for use, net of any government assistance received or entitled to be received in the year from a government, municipality or other public authority, or a reduction of capital cost after the application of section 80. This property would have been previously excluded from column 3. List separately any acquisitions of properly in the class that are not subject to the 50% rule. See Income Tax Folio S3-F4-C1, General Discussion of Capital Cost Allowance, for exceptions to the 50% rule. Do not include any amount in column 3 in respect of property included in column 5 (see note (). See Guide T4012 for more information about the cost of acquisitions during the year. Note 5: A DIEP reported in column 4 is a property acquired after April 18, 2021, by a corporation that was a Canadian-controlled private corporation (CCPC) throughout the year, which became available for use in the lax year (before 2024) and was designated as such on or before the day that is 12 months after the filing due date for the tax year to which the designation relates. It includes all capital property subject to the CCA rules, if certain conditions are met, other than property inclu ses 1 to 6, 14.1, 17, 47, 49, and 51. A properly can only qualify as DIEP in the year in which it becomes available for use. See subsection 1104(3.1) of the Regulations for more information. Nole 8: Enter in column 5, "Adjustments and transfers," amounts that increase or reduce the UCC (column 10). Items that increase the UCC include amounts transferred under section 85, or transferred on amalgamation or winding-up of a subsidiary. Items that reduce the UCC (show amounts that reduce the UCC in brackets) include assistance received or receivable during the year for a property subsequent to its disposition, if such assistance would have decreased the capital cost of the properly by virtue of paragraph 13(7.1)(1). See Guide T4012 for other examples of adjustments and 3 transfers to include in column 5. Also include properly acquired in a non-arm's length transaction [other than by virtue of a right referred to in paragraph 251(5)(b)] if the property property acquired by the transferar at least 384 days before the end of your tax year and continuously owned by the transferor until it was acquired by you. Note 7: Include all amounts of assistance you received (or were entitled to receive) after the the capital cost of the property by virtue of paragraph 13(7.1)(1) if received before the disposition.5 Net Income (Los X Capital Cost Allo X Shareholder Info X Balance Sheet In X | General Index of X Income Stateme x Homework Help X + X C @ File file:///C:/Users/khush/AppData/Local/Temp/1956a03d-c473-4669-89ee-a422c107380a_T2%20Forms%20and%20Notes-202408 19%20%20ACCt031.zip.80a/. My claims online LMIA Online : Emplord Recalls | Ford.. Western Communit. Employer Dashboar Coast Capital Savin. 9 Dashboard | Resum.. > > All Bookmarks Capital Cost Allowance (CCA) (2021 and later tax years) 4/5 75% + Clear Data - Part 2 - CCA calculation (continued) Note 8: Include all amounts you have repaid during the year for any legally required repayment, made after the disposition of a corresponding property, of: 2 . assistance that would have otherwise increased the capital cost of the property under paragraph 13(7-1)(d) and an inducement, assistance, or any other amount contemplated in paragraph 12(1)(x) received, that otherwise would have increased the capital cost of the property under paragraph 13(7.4)(b) Include the UCC of each property of a prescribed class acquired in the course of a corporate reorganization described under paragraph 56(3)(b) (also known as "butterfly reorganization") or include properly acquired in a non-arm's length transaction [other than by virtue of a right referred to in paragraph 251(5)(b)] if the property was a depreciable property acquired by the transferor less than 364 days before the end of your tax year and continuously owned by the transferor until it was acquired by you. Nole 9: For each properly disposed of during the year, deduct from the proceeds of disposition any outlays and expenses to the extent that they were made or incurred for the purpose of making the disposition(s). The amount reported in respect of the properly cannot exceed the property's capital cost, unless that property is a timber resource properly as defined in subsection 13(21). If the cost of a zero emission pa ssenger vehicle (or a passenger vehicle that was, at any time, a DIEP) exceeds the prescribed amount and it is disposed of to a person or partnership with which you deal at arm's length, the proceeds of disposition will be adjusted based on a factor equal to the prescribed amount as a proportion of the actual cost of the vehicle. The actual cost of the vehicle will be adjusted for payment or repayment of governme Nole 10: If the amount in column 5 (as shown in brackets) reduces the undept ed capital cost, you must subtract it for the purposes of the calculation. Otherwise, add the amount in column 5 for the purposes of the calculation. Note 11: The amount to enter in column 11 must not exceed the amount in column 10. If it do

Step by Step Solution

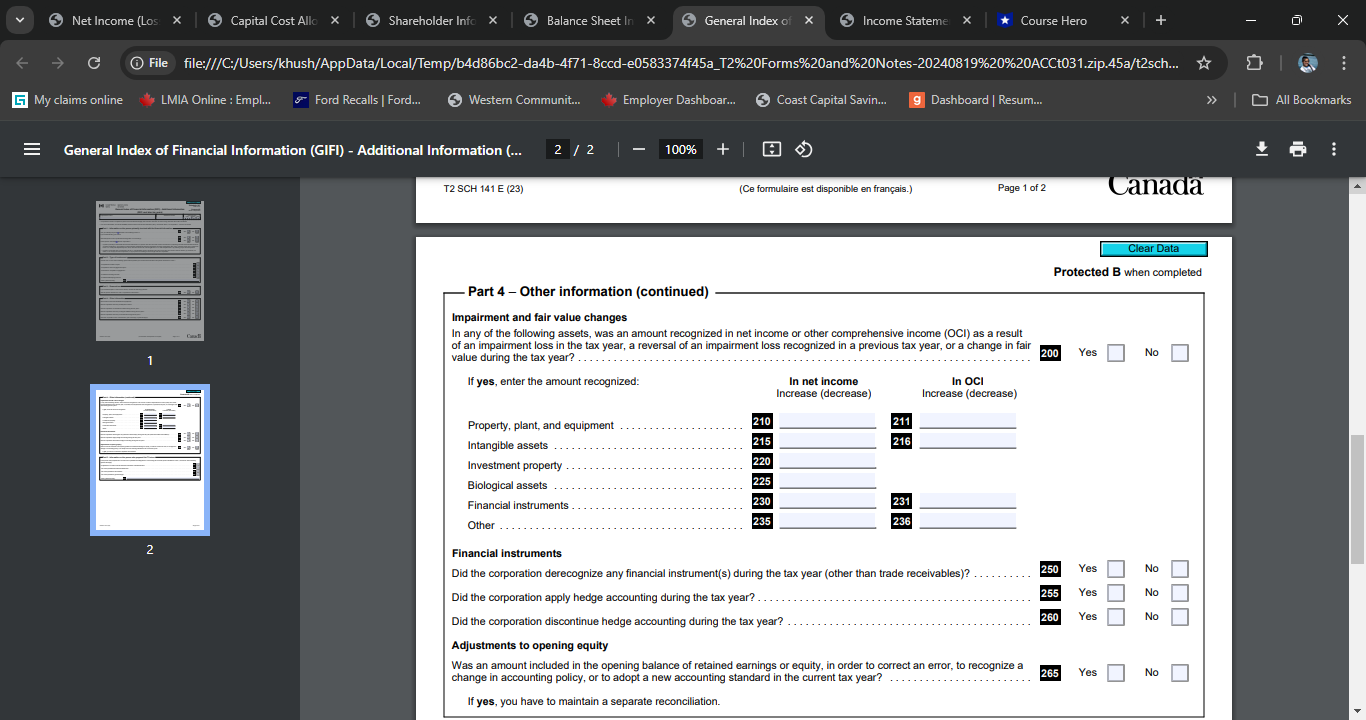

There are 3 Steps involved in it

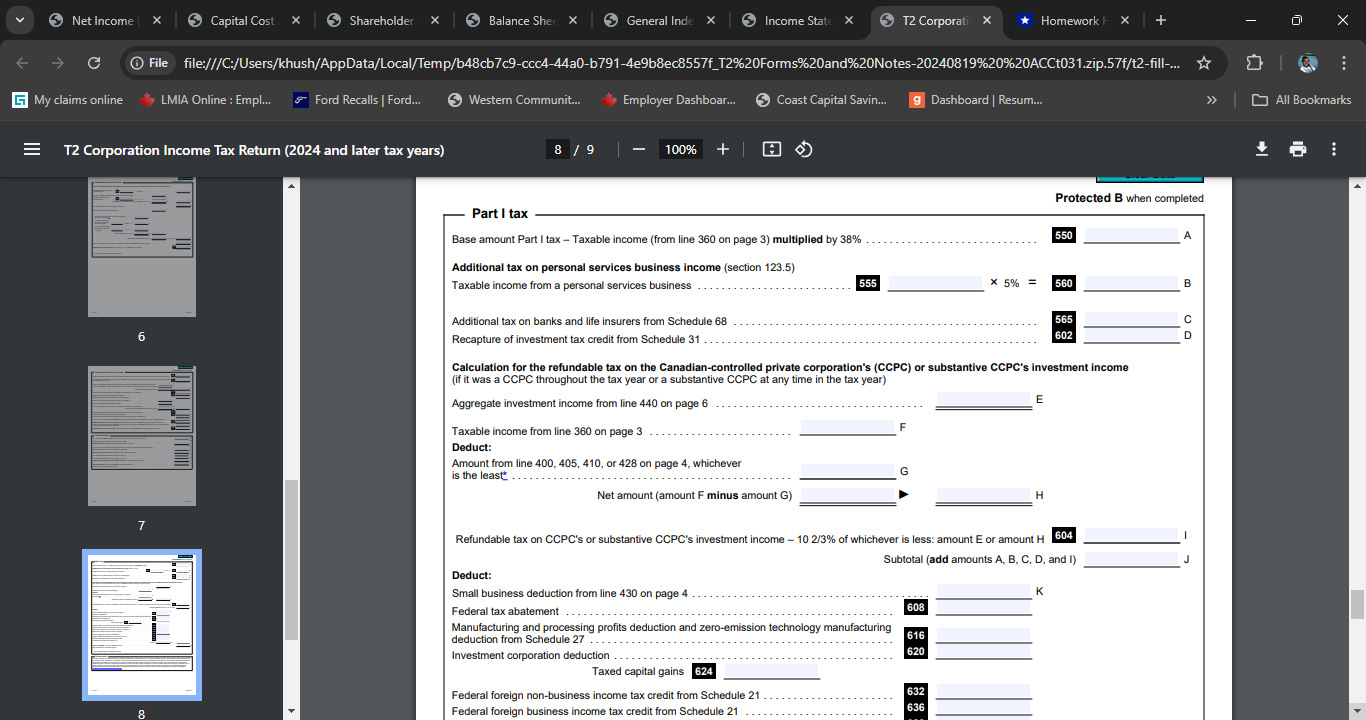

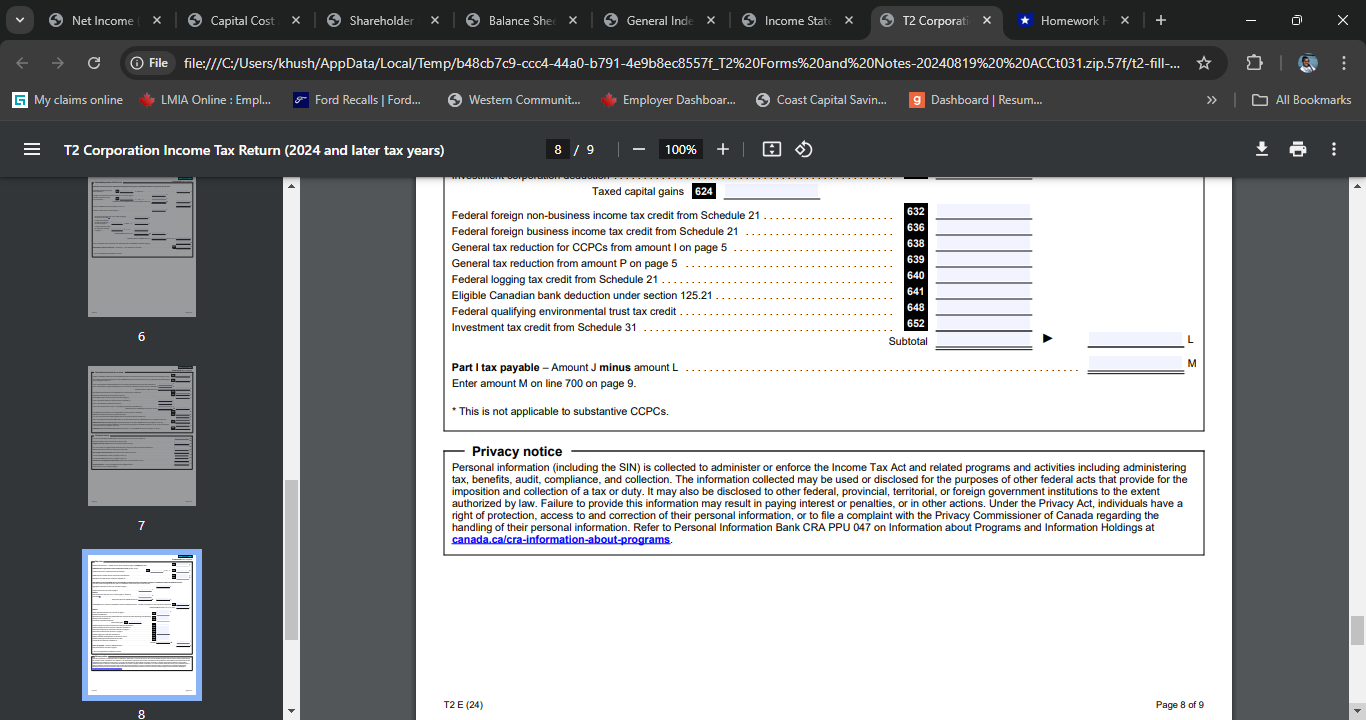

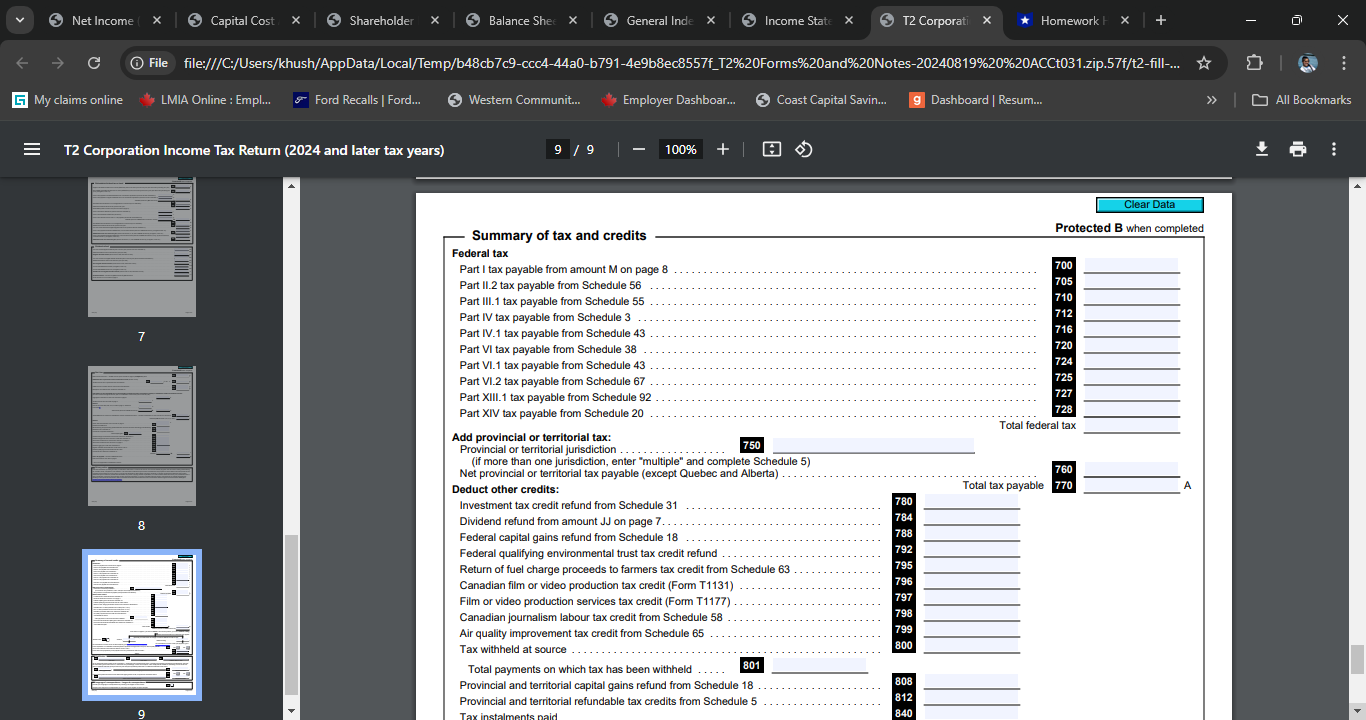

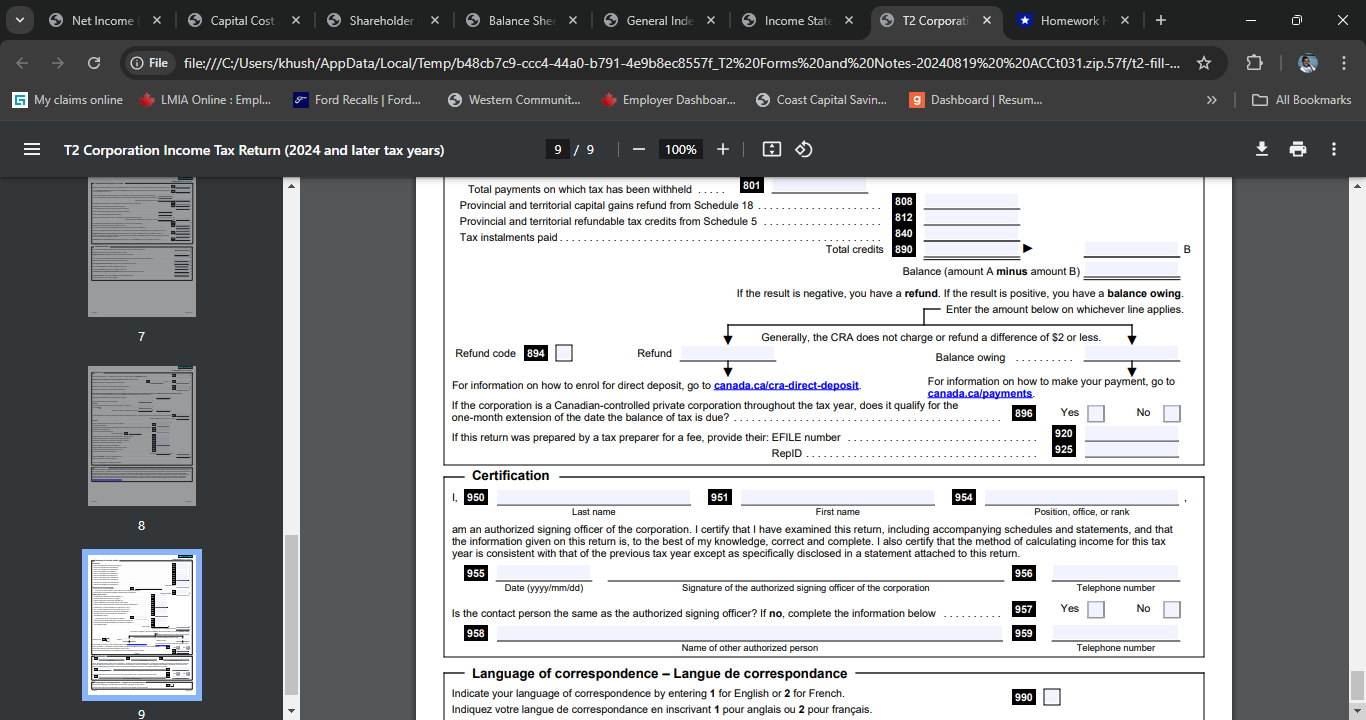

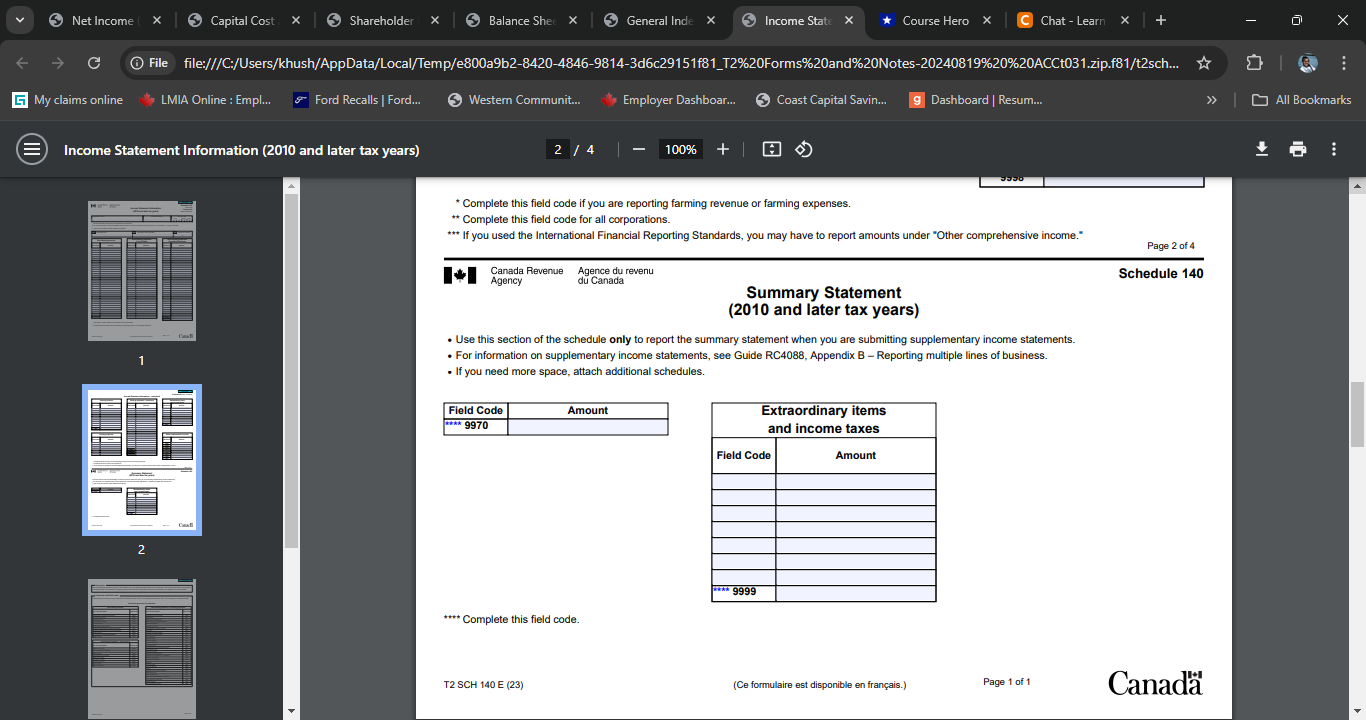

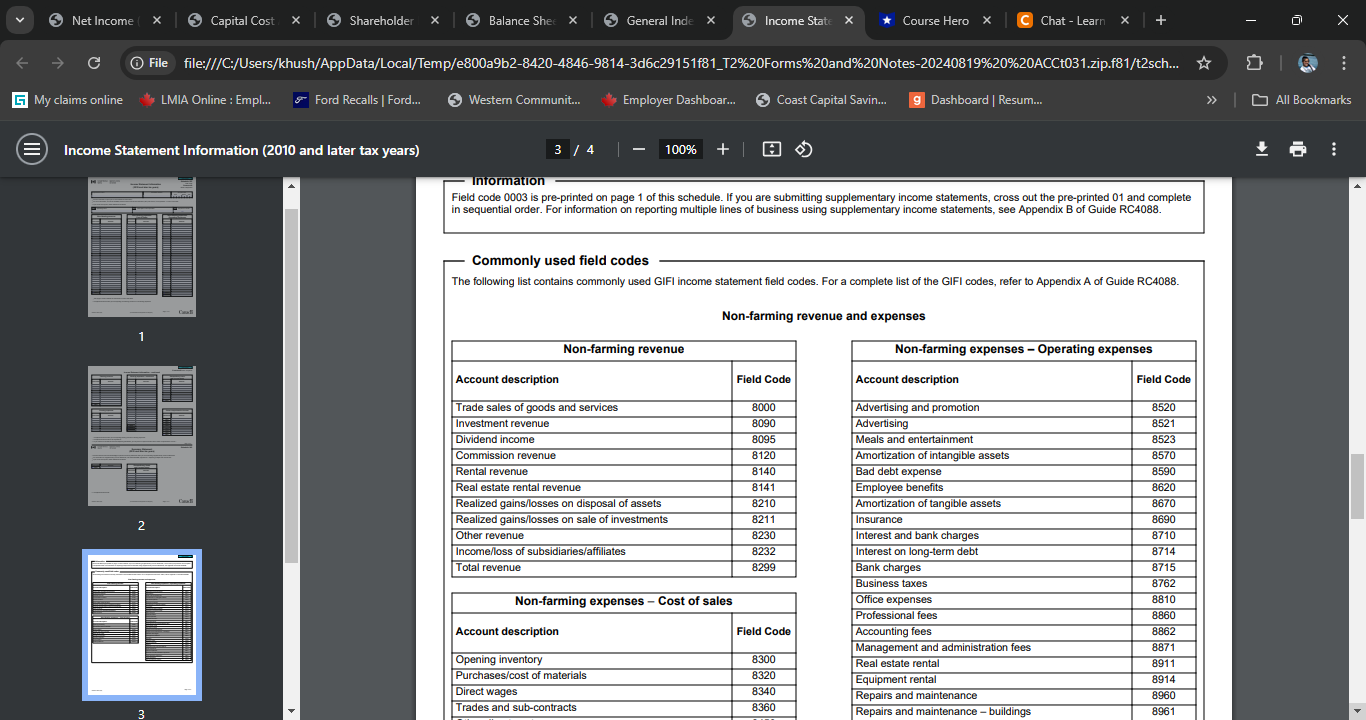

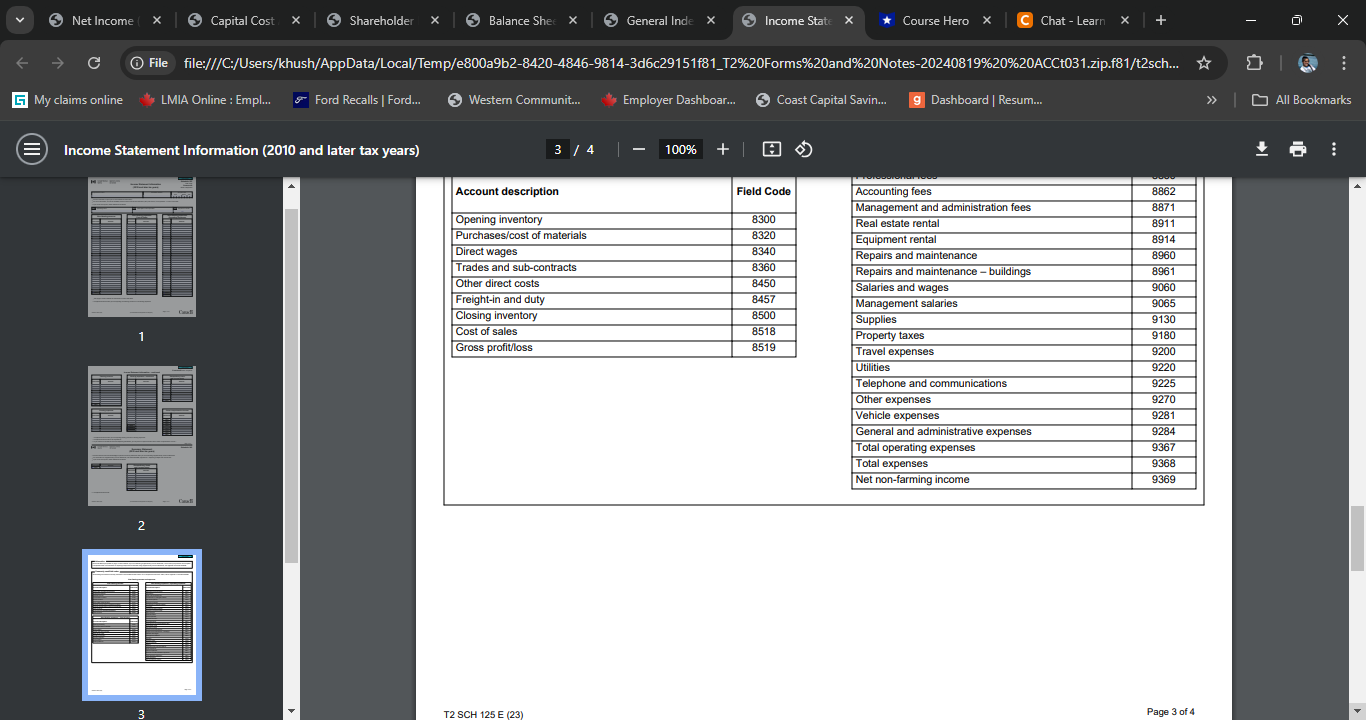

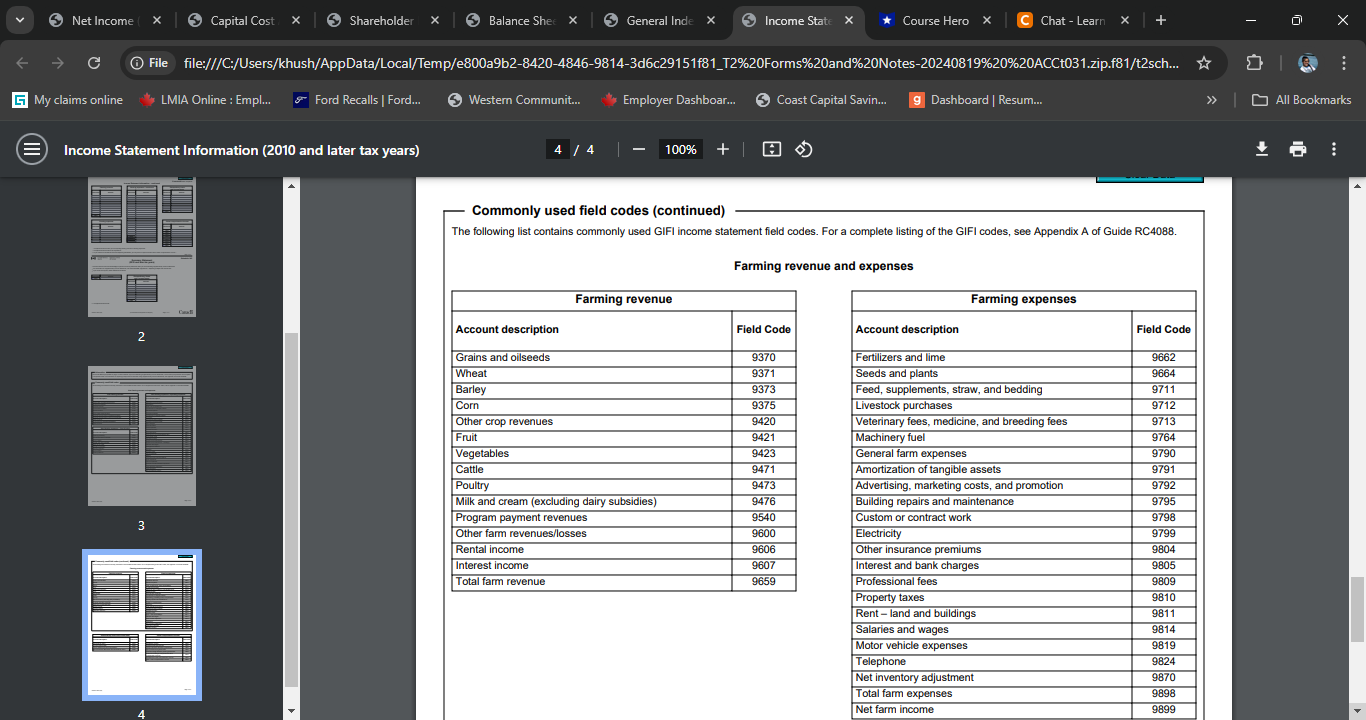

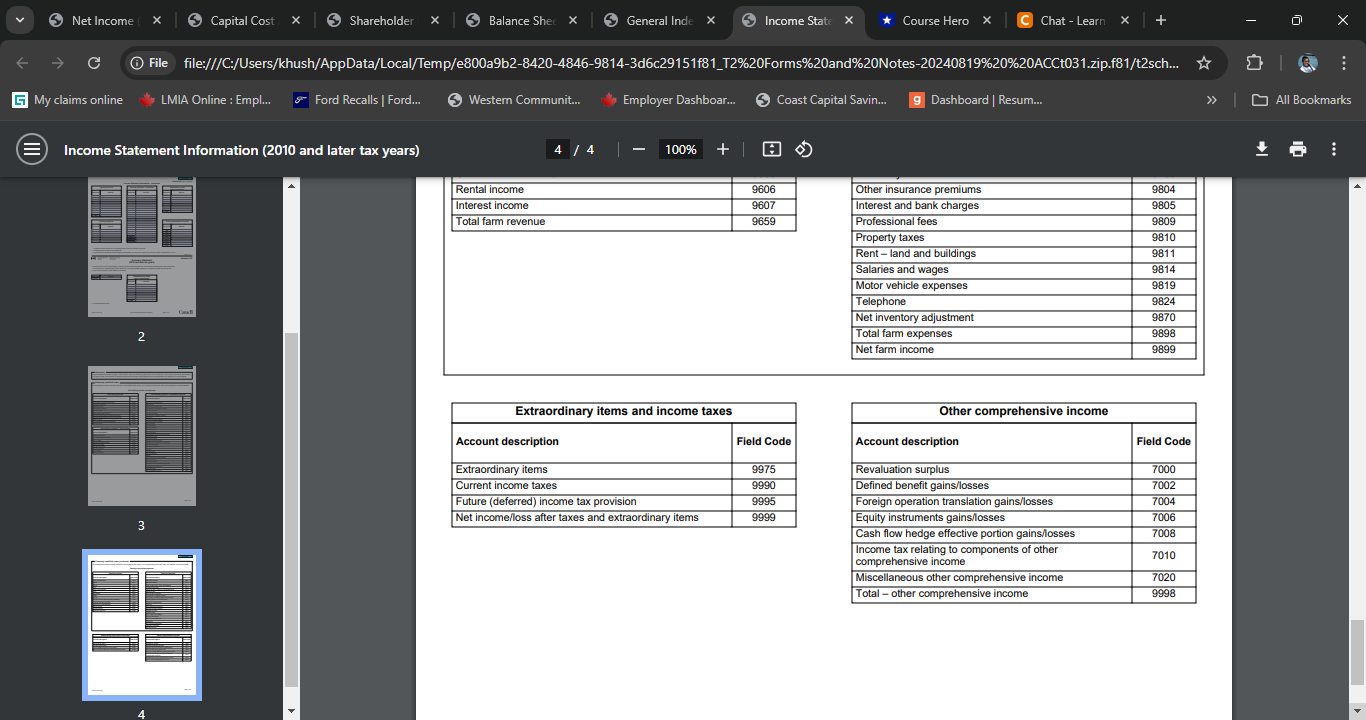

Get step-by-step solutions from verified subject matter experts