Question: Can you please follow this method to solve the question Can you please follow this method to solve the question Henry and Janice are married

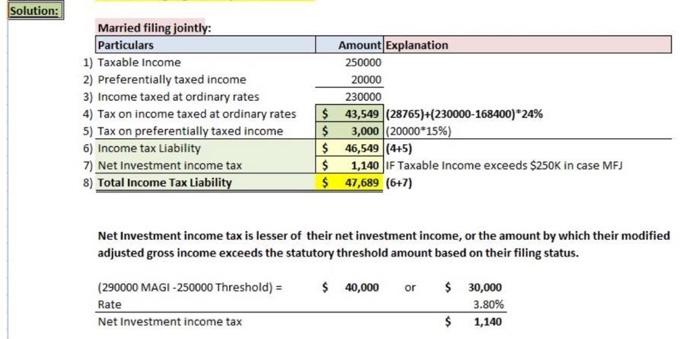

Henry and Janice are married and file jointly. They have an AGI (and modified AGI) of $290,000, which includes $90,000 of salary, $170,000 of active business income, $10,000 of interest income, $15,000 of dividends, and $5,000 of long-term capital gains. What is Henry and Janice's net investment income tax liability this year? O True O False Solution: Married filing jointly: Particulars 1) Taxable income 2) Preferentially taxed income 3) Income taxed at ordinary rates 4) Tax on income taxed at ordinary rates 5) Tax on preferentially taxed income 6) Income tax Liability 7) Net Investment income tax 8) Total Income Tax Liability Amount Explanation 250000 20000 230000 $ 43,549 (28765)+(230000-168400)* 24% $ 3,000 (20000*15%) $ 46,549 (4+5) $ 1,140 F Taxable income exceeds $250K in case MFJ $ 47,689 (6+7) Net Investment income tax is lesser of their net investment income, or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status. (290000 MAGI-250000 Threshold) = $ 40,000 $ 30,000 Rate Net Investment income tax $ 1,140 or 3.80%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts