Question: Can you please further explain the correct answer (Answer C) 30) The expected return on the market portfolio is 19%. The risk-free rate is 12%.

Can you please further explain the correct answer (Answer C)

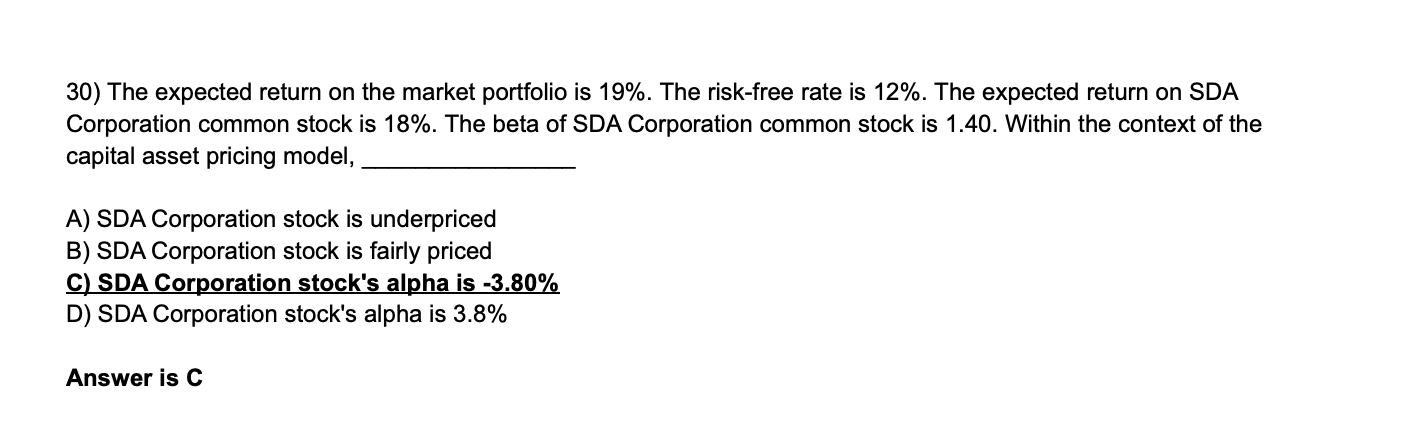

30) The expected return on the market portfolio is 19%. The risk-free rate is 12%. The expected return on SDA Corporation common stock is 18%. The beta of SDA Corporation common stock is 1.40 . Within the context of the capital asset pricing model, A) SDA Corporation stock is underpriced B) SDA Corporation stock is fairly priced C) SDA Corporation stock's alpha is 3.80% D) SDA Corporation stock's alpha is 3.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts