Question: Can you please help? d .CO ni wasdown 54. Brice sells a piece of raw land with a basis of 000. 24& = ziend i

Can you please help?

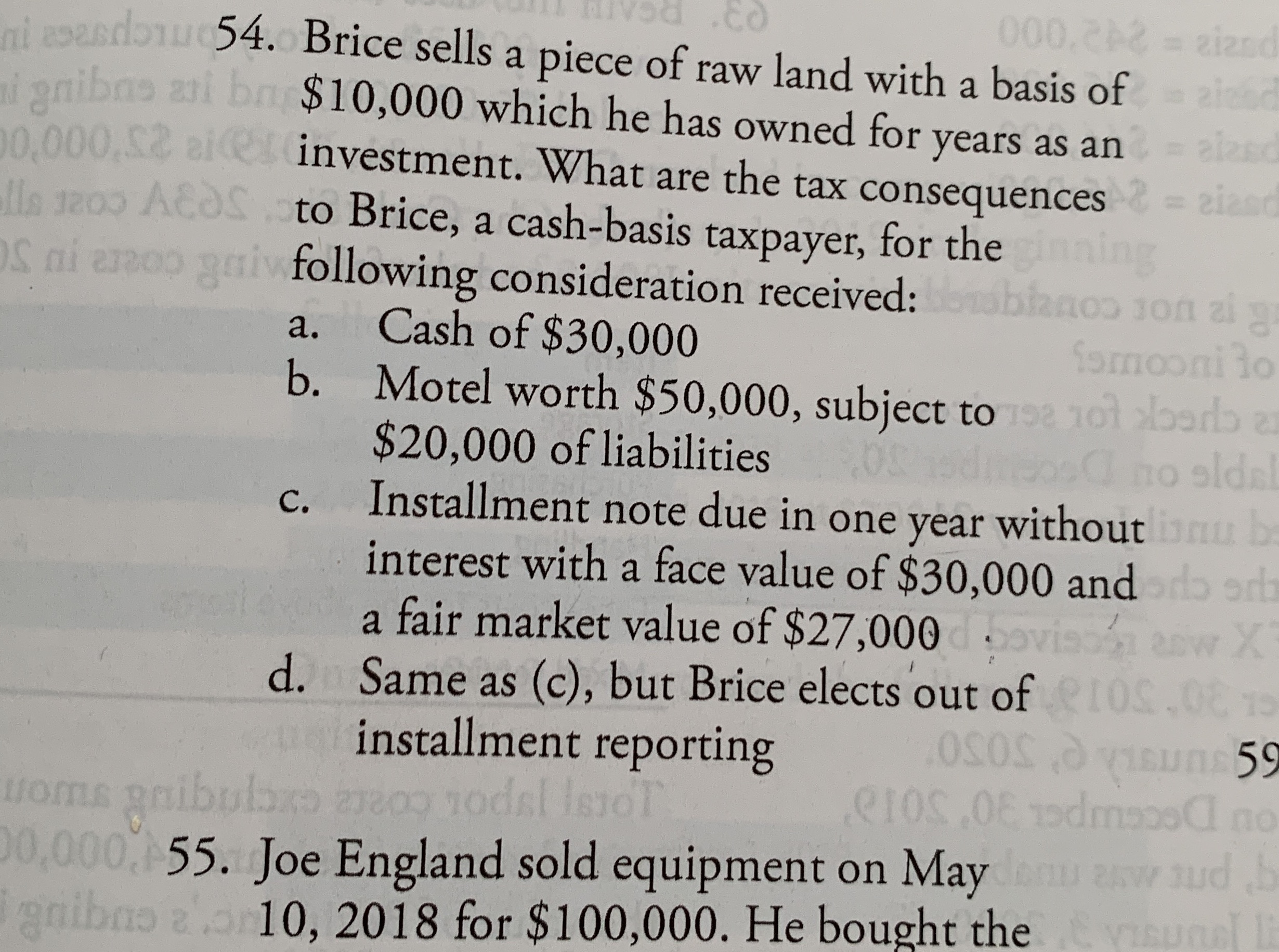

d .CO ni wasdown 54. Brice sells a piece of raw land with a basis of 000. 24& = ziend i gnibno as bay $10,000 which he has owned for years as an 0.000. all investment. What are the tax consequences & = ales lis 1205 ACOS . to Brice, a cash-basis taxpayer, for the ning S ni enco guiv following consideration received: binoo son al g a. Cash of $30,000 Somooni 10 b. Motel worth $50,000, subject to isa 101 >doordo a $20,000 of liabilities MoosO no elds c. Installment note due in one year without nu b interest with a face value of $30,000 and do erb a fair market value of $27,000 davison enw X d. Same as (c), but Brice elects out of IOS , 08 19 installment reporting OSOS didsuns 59 toms gnibulaxo 27209 todel sol PIOS ,08 19dmoosCl no 0,000 55. Joe England sold equipment on May Joneswand ,b gribno 2 3 10, 2018 for $100,000. He bought the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts