Question: can you please help me A convertible bond has a par value of $1,000 but its current market price is $1,025. The current price of

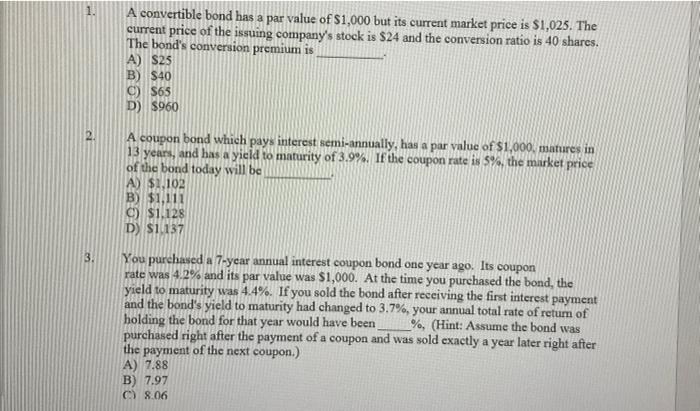

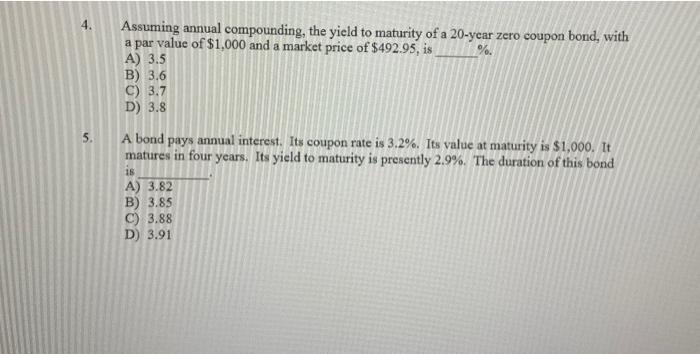

A convertible bond has a par value of $1,000 but its current market price is $1,025. The current price of the issuing company's stock is $24 and the conversion ratio is 40 shares. The band's conversion premium is A) S25 B) $40 C) $65 D) $960 A coupon bond which pays interest semi-annually, has a par value of $1,000, matures in 13 years, and has a yield to maturity of 3.9%. If the coupon rate is 5%, the market price of the bond today will be A.) \$1,102 B) $1,111 C) $1,128 D) S1,137 You purchased a 7-ycar annual interest coupon bond one year ago. Its coupon rate was 4.2% and its par value was $1,000. At the time you purchased the bond, the yield to maturity was 4.4%. If you sold the bond after receiving the first interest payment and the bond's yield to maturity had changed to 3.7%, your annual total rate of retum of holding the bond for that year would have been %, (Hint: Assume the bond was purchased right after the payment of a coupon and was sold exactly a year later right after the payment of the next coupon.) A) 7.88 B) 7.97 C) 8.06 4. Assuming annual compounding, the yield to maturity of a 20y ear zero coupon bond, with a par value of $1,000 and a market price of $492.95, is A) 3.5 B) 3.6 C) 3.7 D) 3.8 5. A bond pays annual interest. Its coupon rate is 3.2%. Its value at maturity is $1,000. It matures in four years. Its yield to maturity is presently 2.9%. The duration of this bond is A) 3.82 B) 3.85 C) 3.88 D) 3.91

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts