Question: Can you please help me answer the blank part where it says internal rate of return. Brooks Clinic is considering investing in new heart-monitoring equipment.

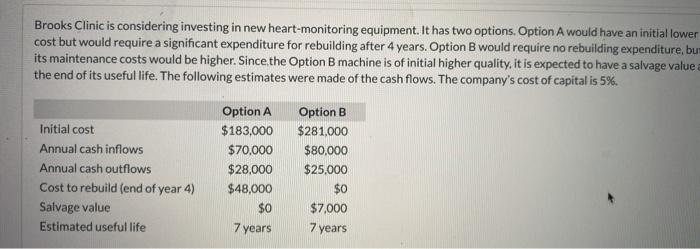

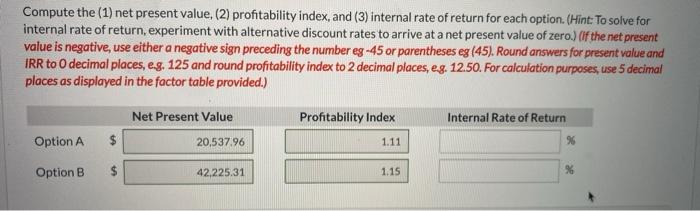

Brooks Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value a the end of its useful life. The following estimates were made of the cash flows. The company's cost of capital is 5%. Initial cost Annual cash inflows Annual cash outflows Cost to rebuild (end of year 4) Salvage value Estimated useful life Option A $183,000 $70,000 $28,000 $48,000 $0 7 years Option B $281.000 $80,000 $25.000 $0 $7,000 7 years Compute the (1) net present value, (2) profitability index, and (3) internal rate of return for each option. (Hint: To solve for internal rate of return, experiment with alternative discount rates to arrive at a net present value of zero.) of the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round answers for present value and IRR to decimal places, eg. 125 and round profitability index to 2 decimal places, eg. 12.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Net Present Value Profitability Index Internal Rate of Return Option A 20,537.96 1.11 Option B $ 42,225.31 1.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts