Question: Can you please help me answer this for fixed costs as well as calculate the total manufacturing cost for 2018/2017 Thanks in advance. Loucraft, Inc.,

Can you please help me answer this for fixed costs as well as calculate the total manufacturing cost for 2018/2017

Can you please help me answer this for fixed costs as well as calculate the total manufacturing cost for 2018/2017

Thanks in advance.

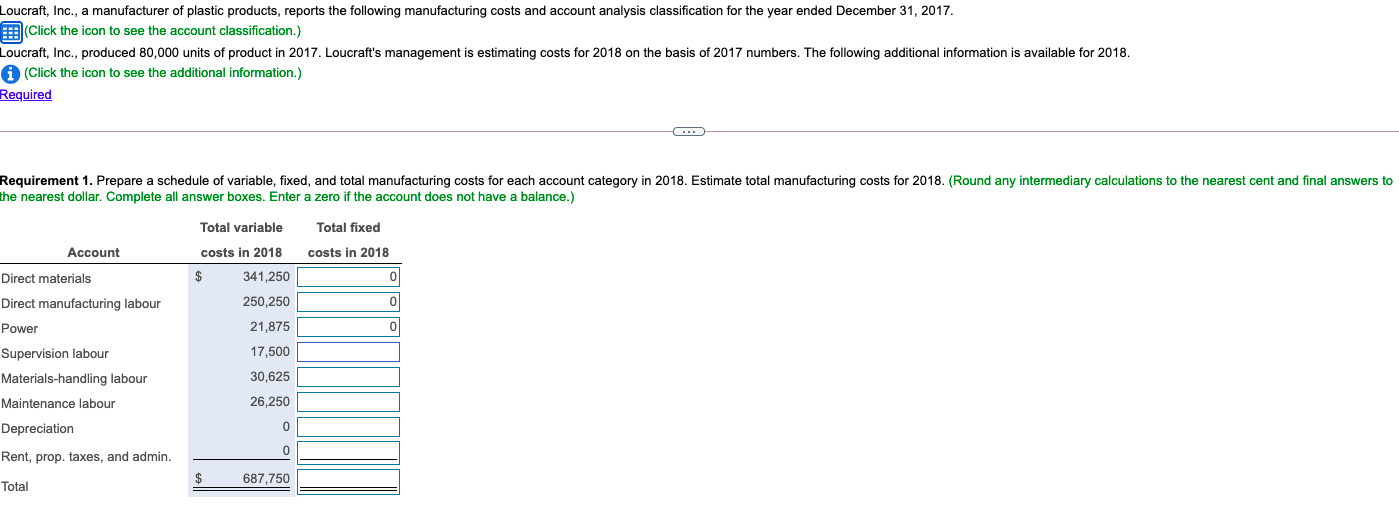

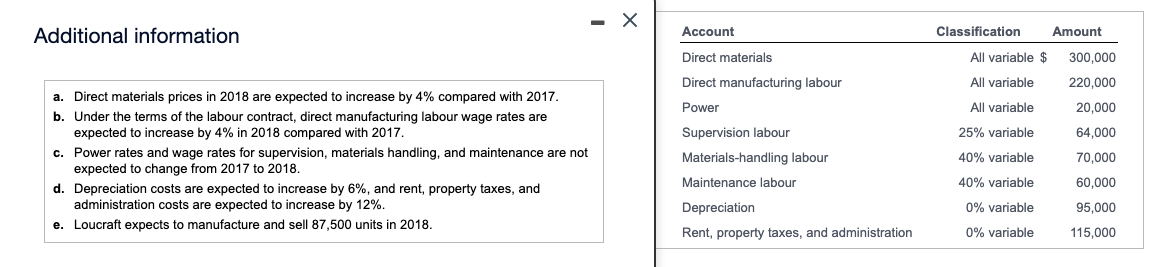

Loucraft, Inc., a manufacturer of plastic products, reports the following manufacturing costs and account analysis classification for the year ended December 31, 2017. (Click the icon to see the account classification.) Loucraft, Inc., produced 80,000 units of product in 2017. Loucraft's management is estimating costs for 2018 on the basis of 2017 numbers. The following additional information is available for 2018. (Click the icon to see the additional information.) Required ... Requirement 1. Prepare a schedule of variable, fixed, and total manufacturing costs for each account category in 2018. Estimate total manufacturing costs for 2018. (Round any intermediary calculations to the nearest cent and final answers to the nearest dollar. Complete all answer boxes. Enter a zero if the account does not have a balance.) Total variable Total fixed Account costs in 2018 costs in 2018 Direct materials $ 341,250 250,250 0 21,875 0 Direct manufacturing labour Power Supervision labour Materials-handling labour Maintenance labour 17,500 30,625 26,250 0 Depreciation Rent, prop, taxes, and admin. 0 $ Total 687,750 - X Additional information Account Classification Amount Direct materials All variable $ 300,000 All variable Direct manufacturing labour Power 220,000 20,000 All variable Supervision labour 25% variable 64,000 a. Direct materials prices in 2018 are expected to increase by 4% compared with 2017 b. Under the terms of the labour contract, direct manufacturing labour wage rates are expected to increase by 4% in 2018 compared with 2017. c. Power rates and wage rates for supervision, materials handling, and maintenance are not expected to change from 2017 to 2018. d. Depreciation costs are expected to increase by 6%, and rent, property taxes, and administration costs are expected to increase by 12%. e. Loucraft expects to manufacture and sell 87,500 units in 2018. Materials-handling labour 40% variable 70,000 Maintenance labour 40% variable 60,000 95,000 Depreciation Rent, property taxes, and administration 0% variable 0% variable 115,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts