Question: Can you please help me get solve the problem step by step? ABC Inc. has issued and outstanding a total of 35,000 shares of $7

Can you please help me get solve the problem step by step?

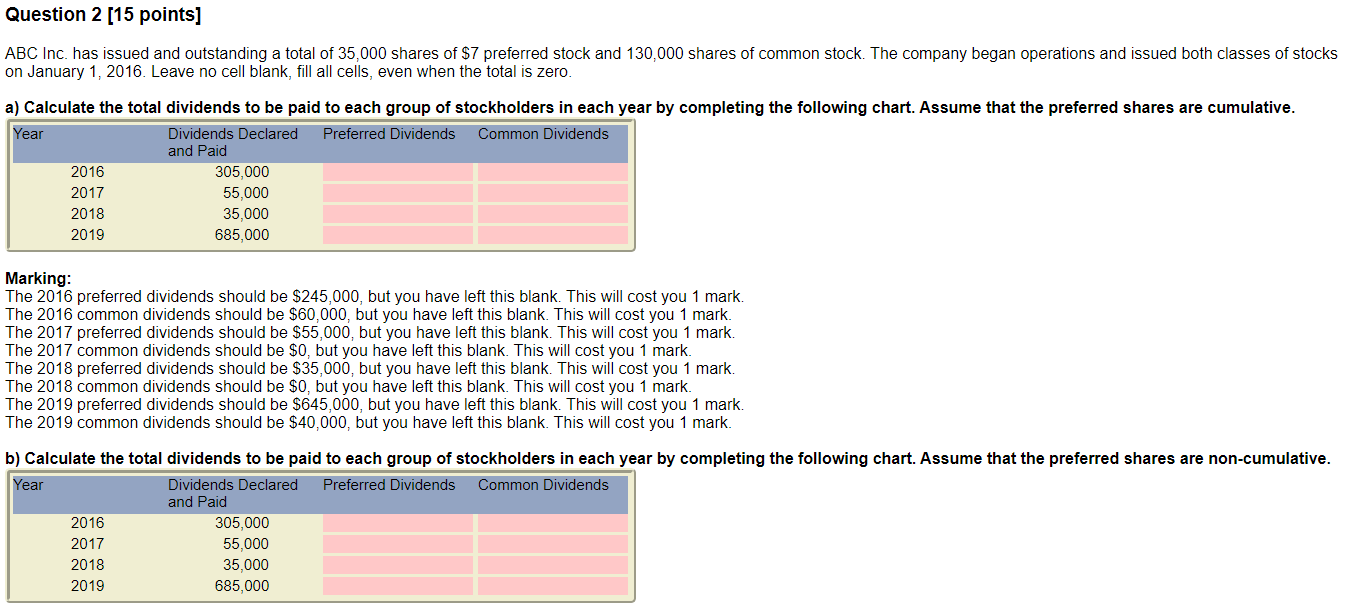

ABC Inc. has issued and outstanding a total of 35,000 shares of $7 preferred stock and 130,000 shares of common stock. The company began operations and issued both classes of stocks on January 1, 2016. Leave no cell blank, fill all cells, even when the total is zero. a) Calculate the total dividends to be paid to each group of stockholders in each year by completing the following chart. Assume that the preferred shares are cumulative. Marking: The 2016 preferred dividends should be $245,000, but you have left this blank. This will cost you 1 mark. The 2016 common dividends should be $60,000, but you have left this blank. This will cost you 1 mark. The 2017 preferred dividends should be $55,000, but you have left this blank. This will cost you 1 mark. The 2017 common dividends should be $0, but you have left this blank. This will cost you 1 mark. The 2018 preferred dividends should be $35,000, but you have left this blank. This will cost you 1 mark. The 2018 common dividends should be $0, but you have left this blank. This will cost you 1 mark. The 2019 preferred dividends should be $645,000, but you have left this blank. This will cost you 1 mark. The 2019 common dividends should be $40,000, but you have left this blank. This will cost you 1 mark. ABC Inc. has issued and outstanding a total of 35,000 shares of $7 preferred stock and 130,000 shares of common stock. The company began operations and issued both classes of stocks on January 1, 2016. Leave no cell blank, fill all cells, even when the total is zero. a) Calculate the total dividends to be paid to each group of stockholders in each year by completing the following chart. Assume that the preferred shares are cumulative. Marking: The 2016 preferred dividends should be $245,000, but you have left this blank. This will cost you 1 mark. The 2016 common dividends should be $60,000, but you have left this blank. This will cost you 1 mark. The 2017 preferred dividends should be $55,000, but you have left this blank. This will cost you 1 mark. The 2017 common dividends should be $0, but you have left this blank. This will cost you 1 mark. The 2018 preferred dividends should be $35,000, but you have left this blank. This will cost you 1 mark. The 2018 common dividends should be $0, but you have left this blank. This will cost you 1 mark. The 2019 preferred dividends should be $645,000, but you have left this blank. This will cost you 1 mark. The 2019 common dividends should be $40,000, but you have left this blank. This will cost you 1 mark

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts