Question: can you please help me Help Save & Exit Submit Check my work During 2021, its first year of operations, Pave Construction provides services on

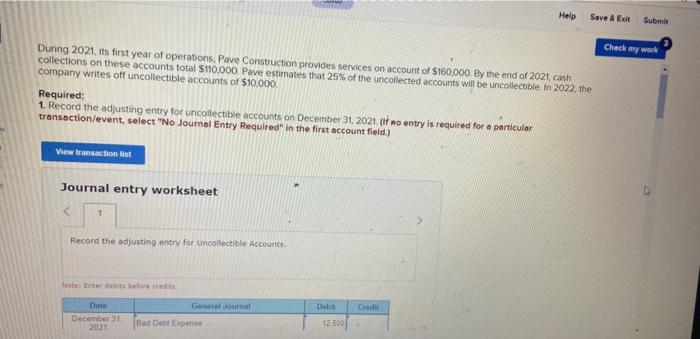

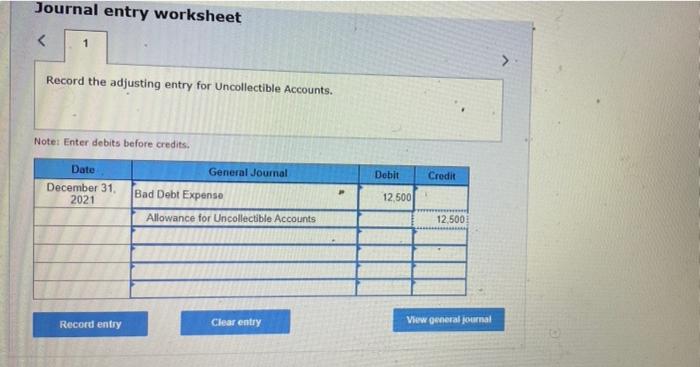

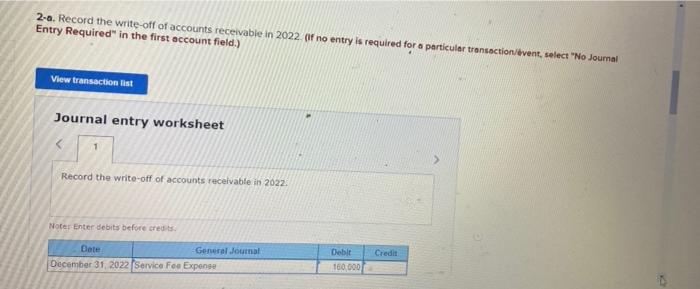

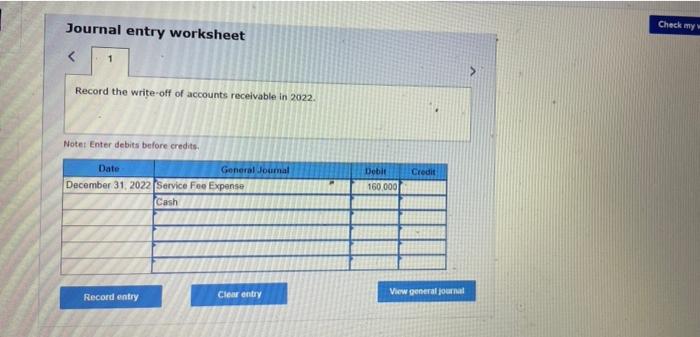

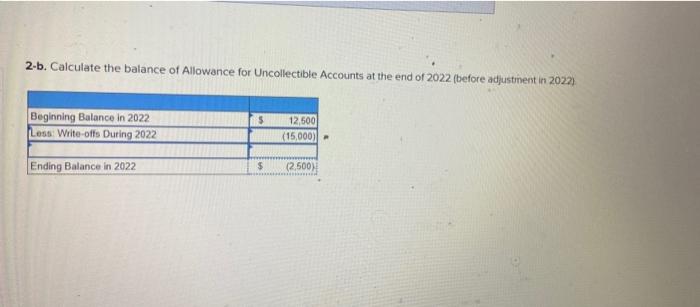

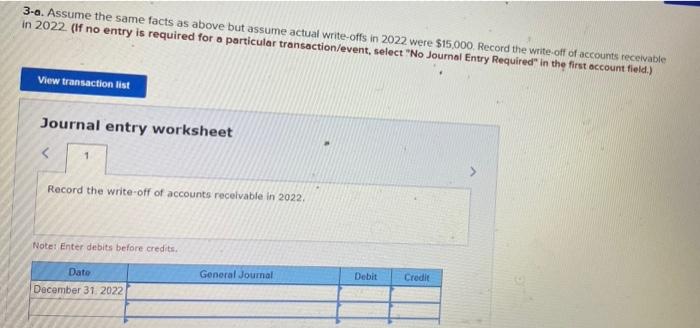

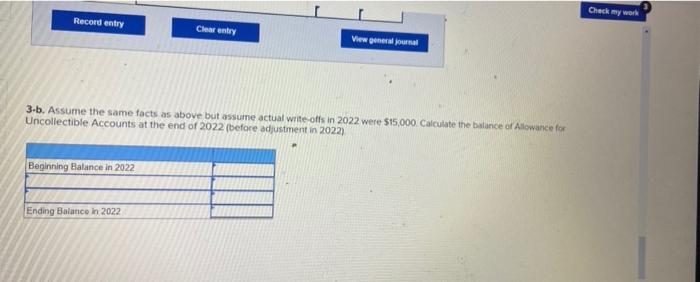

Help Save & Exit Submit Check my work During 2021, its first year of operations, Pave Construction provides services on account of $160.000 By the end of 2021, cash collections on these accounts total $110,000 Pave estimates that 25% of the uncollected accounts will be uncollectible. In 2022, the company writes off uncollectible accounts of $10,000 Required: 1. Record the adjusting entry for uncollectible accounts on December 31, 2021. (if no entry is required for a particular transaction/event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet Record the write-off of accounts recevable in 2022. Noter Enter debits before credits Date General Journal December 31, 2022 Service Fee Expense Credit Debit 160.000 Journal entry worksheet Check my Record the write-off of accounts receivable in 2022. Note: Enter debits before credits Credit Date General Joumal December 31, 2022 Service Fee Expense Cash Debit 160.000 Record entry Clear entry View general journal 2-b. Calculate the balance of Allowance for Uncollectible Accounts at the end of 2022 (before adjustment in 2022) $ Beginning Balance in 2022 Loss: Write-offs During 2022 12,500 (15,000) Ending Balance in 2022 $ (2.500) 3-a. Assume the same facts as above but assume actual write-offs in 2022 were $15,000. Record the write-off of accounts receivable in 2022. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts