Question: can you please help me make a MARKET SECURITY MODEL (SML) AND JUSTIFY whether or not to sell the shares, pleae also the P/E Ratios

can you please help me make a MARKET SECURITY MODEL (SML) AND JUSTIFY whether or not to sell the shares, pleae also the P/E Ratios of each share together with Multifactor Model if possible

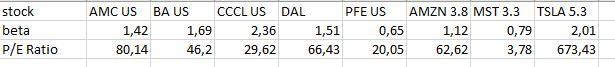

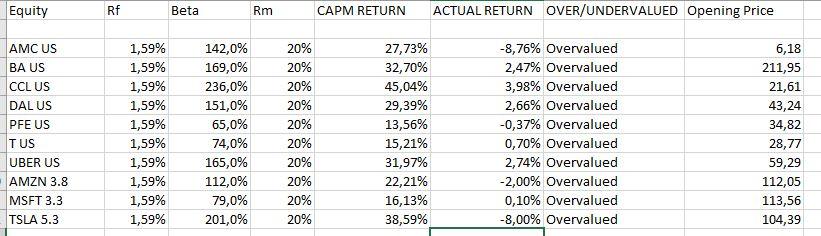

stock beta P/E Ratio AMC US BA US CCCLUS DAL PFE US AMZN 3.8 MST 3.3 TSLA 5.3 1,42 1,69 2,36 1,51 0,65 1,12 0,79 2,01 80,14 46,2 29,62 66,43 20,05 62,62 3,78 673,43 Equity RF Beta Rm CAPM RETURN ACTUAL RETURN OVER/UNDERVALUED Opening Price AMC US BA US CCLUS DALUS PFE US TUS UBER US AMZN 3.8 MSFT 3.3 TSLA 5.3 1,59% 1,59% 1,59% 1,59% 1,59% 1,59% 1,59% 1,59% 1,59% 1,59% 142,0% 169,0% 236,0% 151,0% 65,0% 74,0% 165,0% 112,0% 79,0% 201,0% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 27,73% 32,70% 45,04% 29,39% 13,56% 15,21% 31,97% 22,21% 16,13% 38,59% -8,76% Overvalued 2,47% Overvalued 3,98% Overvalued 2,66% Overvalued -0,37% Overvalued 0,70% Overvalued 2,74% Overvalued -2,00% Overvalued 0,10% Overvalued -8,00% Overvalued 6,18 211,95 21,61 43,24 34,82 28,77 59,29 112,05 113,56 104,39 stock beta P/E Ratio AMC US BA US CCCLUS DAL PFE US AMZN 3.8 MST 3.3 TSLA 5.3 1,42 1,69 2,36 1,51 0,65 1,12 0,79 2,01 80,14 46,2 29,62 66,43 20,05 62,62 3,78 673,43 Equity RF Beta Rm CAPM RETURN ACTUAL RETURN OVER/UNDERVALUED Opening Price AMC US BA US CCLUS DALUS PFE US TUS UBER US AMZN 3.8 MSFT 3.3 TSLA 5.3 1,59% 1,59% 1,59% 1,59% 1,59% 1,59% 1,59% 1,59% 1,59% 1,59% 142,0% 169,0% 236,0% 151,0% 65,0% 74,0% 165,0% 112,0% 79,0% 201,0% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 27,73% 32,70% 45,04% 29,39% 13,56% 15,21% 31,97% 22,21% 16,13% 38,59% -8,76% Overvalued 2,47% Overvalued 3,98% Overvalued 2,66% Overvalued -0,37% Overvalued 0,70% Overvalued 2,74% Overvalued -2,00% Overvalued 0,10% Overvalued -8,00% Overvalued 6,18 211,95 21,61 43,24 34,82 28,77 59,29 112,05 113,56 104,39

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts