Question: Can you please help me solve these equations for my Introduction to Supply Chain Management class. I did solve some of the equations but I

Can you please help me solve these equations for my Introduction to Supply Chain Management class. I did solve some of the equations but I just want to make sure I was doing them correctly. I did not know how to compare the answers in both charts.

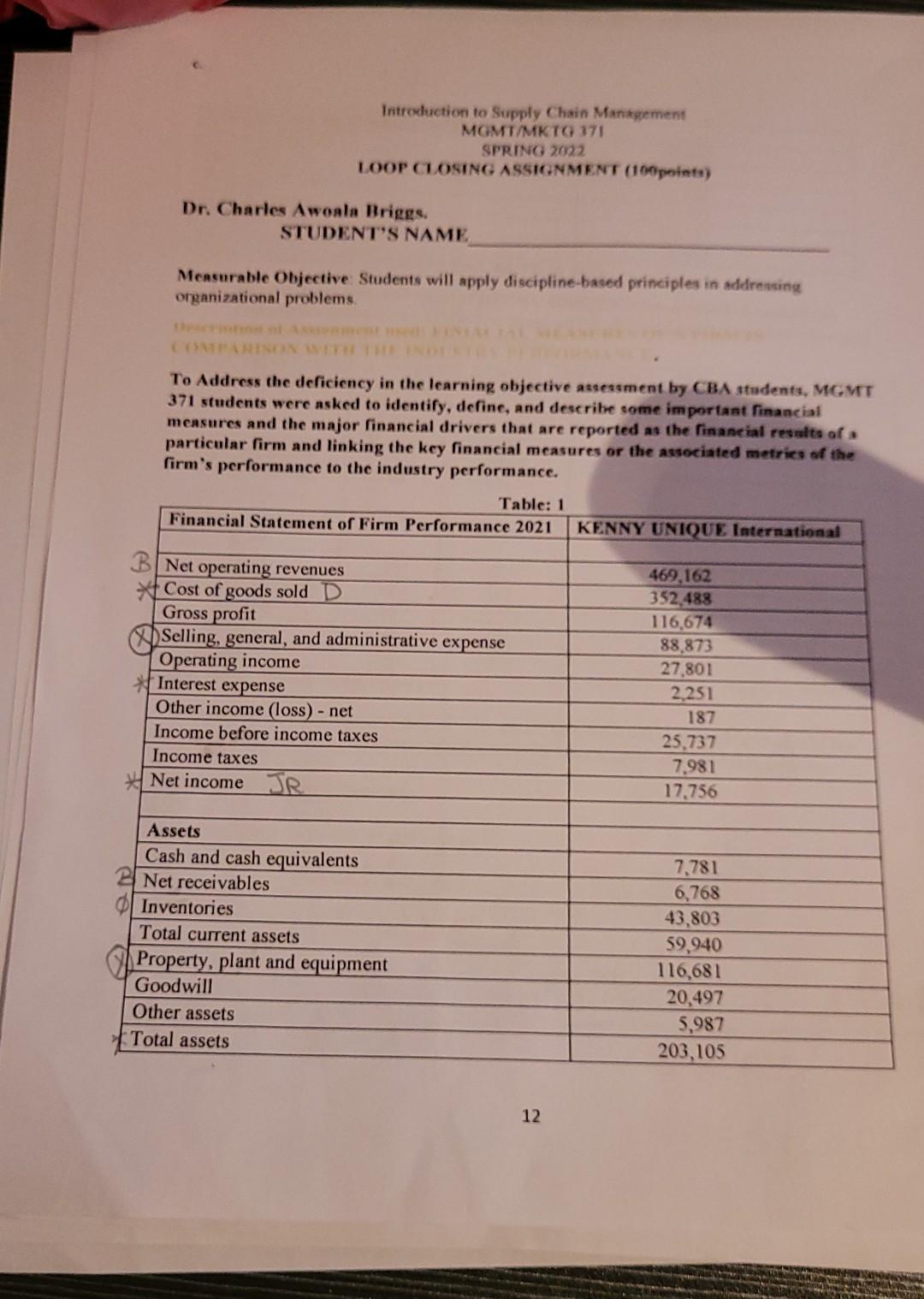

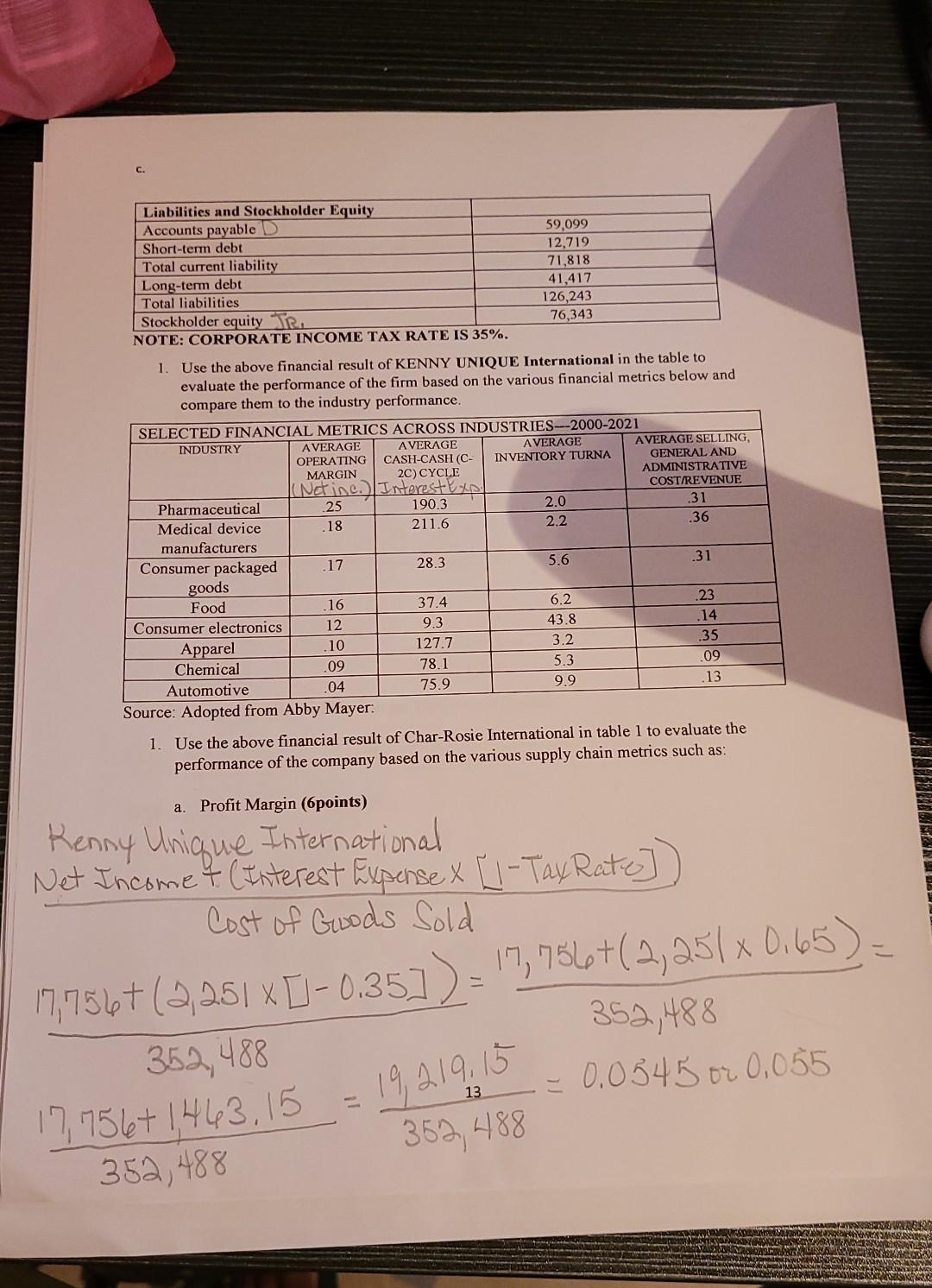

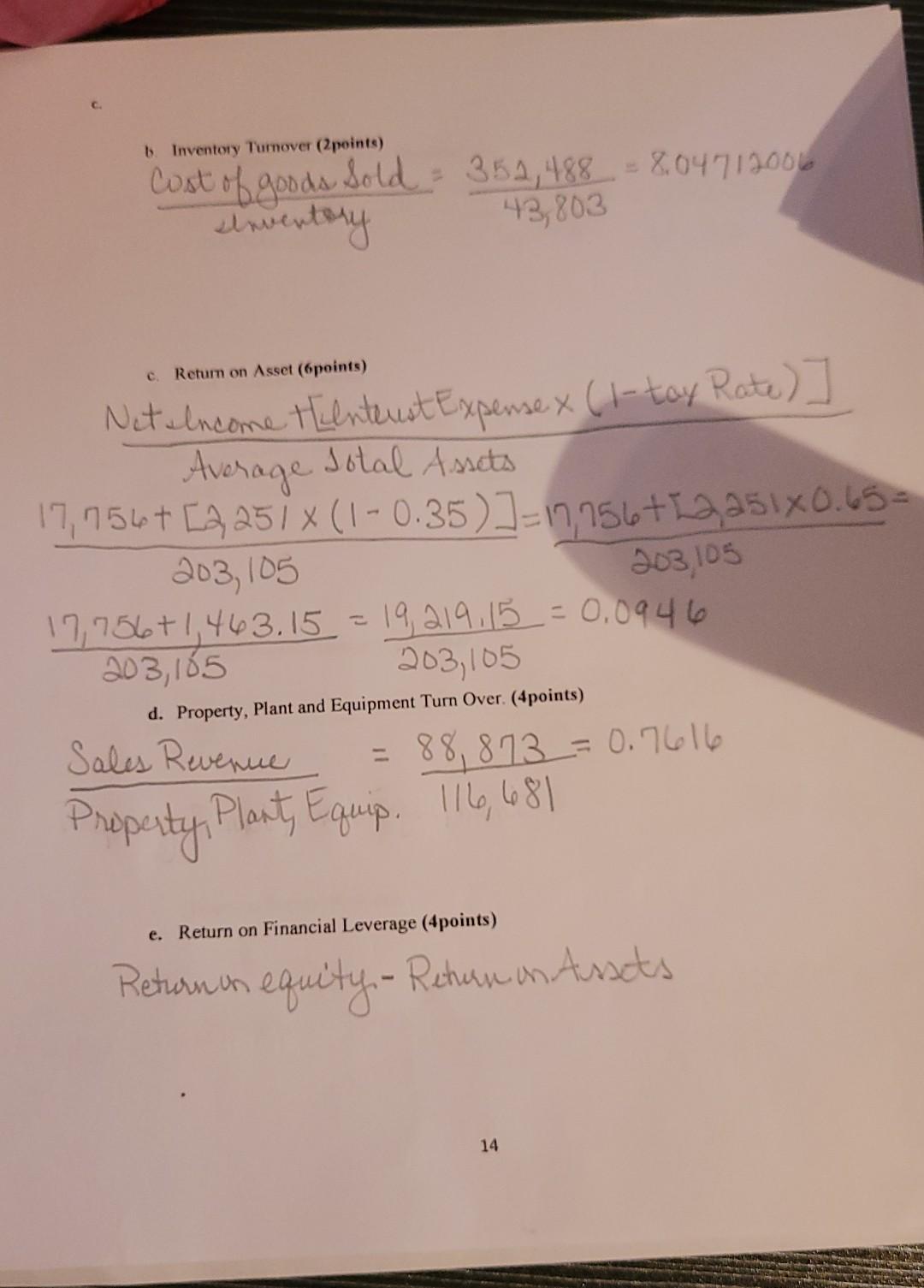

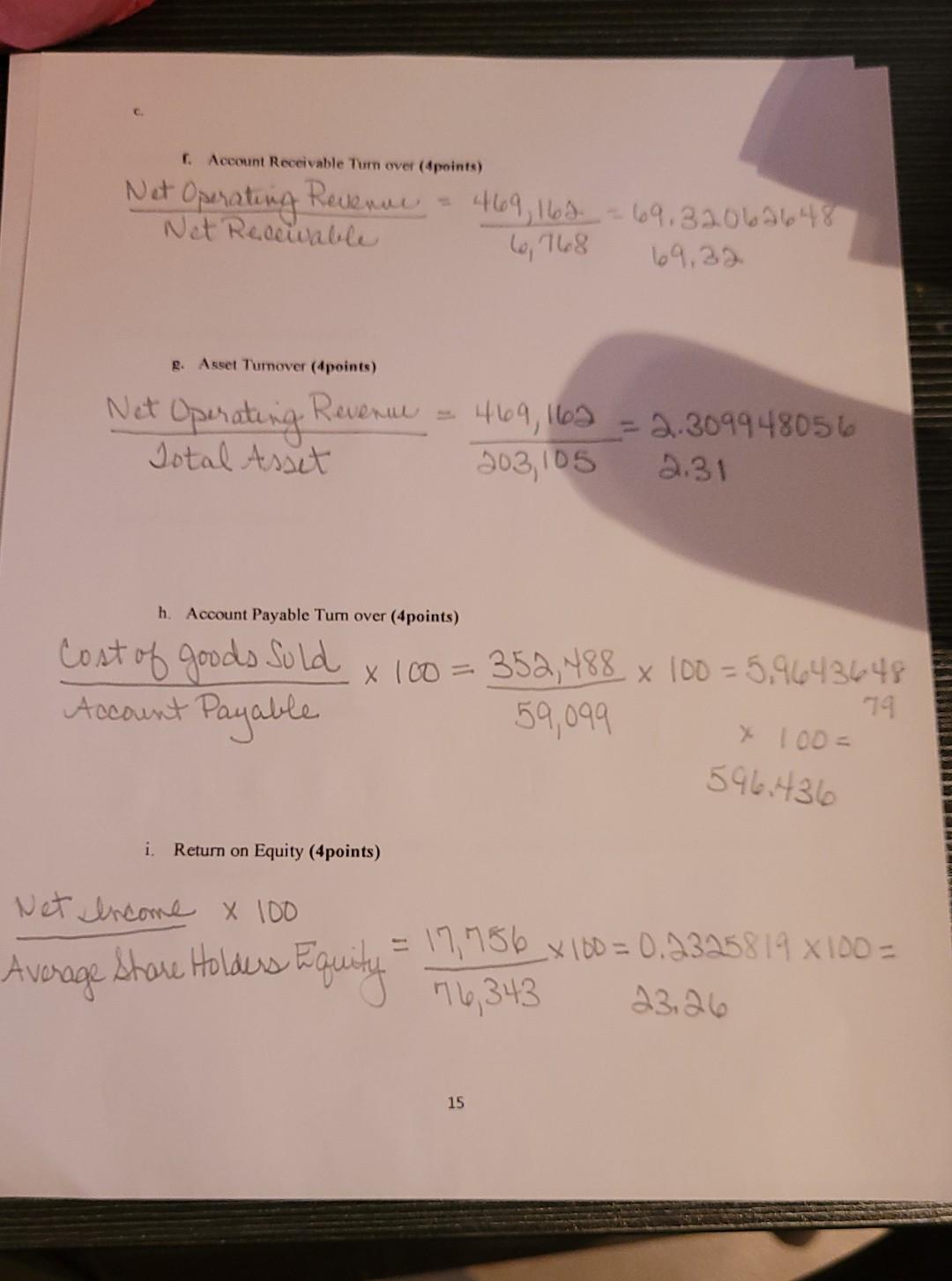

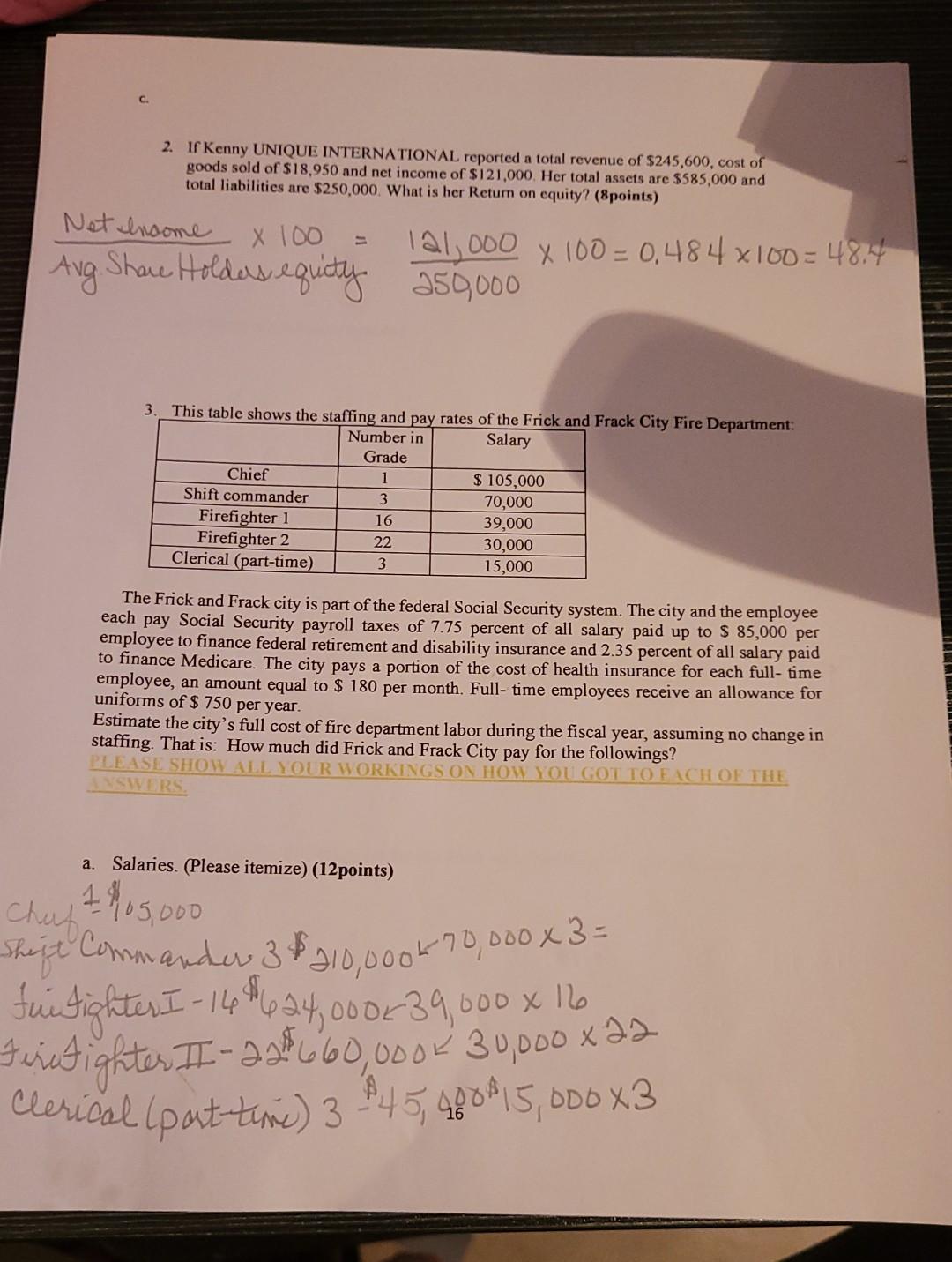

Introduction to Supply Chain Management MGMT/MKTG 371 SPRING 2022 LOOP CLOSING ASSIGNMENT (100 points) Dr. Charles Awoala Briggs. STUDENT'S NAME Measurable Objective Students will apply discipline-based principles in addressing organizational problems To Address the deficiency in the learning objective assessment by CBA students, MGMT 371 students were asked to identify, define, and describe some important financial measures and the major financial drivers that are reported as the financial results of particular firm and linking the key financial measures or the associated metrics of the firm's performance to the industry performance. Table: 1 Financial Statement of Firm Performance 2021 KENNY UNIQUE International B Net operating revenues Cost of goods sold Gross profit Selling, general, and administrative expense Operating income Interest expense Other income (loss) - net Income before income taxes Income taxes Net income JR 469.162 352.488 116,674 88,873 27,801 2.251 187 25.737 7,981 17,756 Assets Cash and cash equivalents Net receivables Inventories Total current assets Property, plant and equipment Goodwill Other assets Total assets 7,781 6,768 43,803 59.940 116,681 20,497 5,987 203,105 12 C. Liabilities and Stockholder Equity Accounts payable D Short-term debt Total current liability Long-term debt Total liabilities Stockholder equity Tr. NOTE: CORPORATE INCOME TAX RATE IS 35%. 59,099 12,719 71,818 41,417 126,243 76,343 OS 1 Use the above financial result of KENNY UNIQUE International in the table to evaluate the performance of the firm based on the various financial metrics below and compare them to the industry performance. SELECTED FINANCIAL METRICS ACROSS INDUSTRIES--2000-2021 INDUSTRY AVERAGE AVERAGE AVERAGE AVERAGE SELLING, OPERATING CASH-CASH (C- INVENTORY TURNA GENERAL AND MARGIN 2C) CYCLE ADMINISTRATIVE (Netine. Interest Exp COST/REVENUE Pharmaceutical 25 190.3 2.0 .31 Medical device 18 211.6 2.2 .36 manufacturers Consumer packaged 17 28.3 5.6 .31 goods Food 16 37.4 6.2 23 Consumer electronics 12 9.3 43.8 14 Apparel .10 127.7 3.2 .35 Chemical 09 78.1 5.3 09 Automotive 04 75.9 9.9 .13 Source: Adopted from Abby Mayer: | | | | NON 1. Use the above financial result of Char-Rosie International in table 1 to evaluate the performance of the company based on the various supply chain metrics such as: . Profit Margin (6points) Renny Unique International Net Incomet (Interest Expensex [ 1 - Tax Rate] Cost of Goods Sold 17,751+ (2,251 x L)-0.35]) = 17,756+(2,251 x 0165) 352, 488 352,488 17, 756 + 1,443,15 = 0.0345 oz 0,055 352,488 352 488 19, 219,15 13 6. Inventory Turnover (2points) Cost of goods sold 352,488 = 8,04712006 sleventory 43,803 c. Return on Asset (6 points) Netalncome Henteust Expensex (1-tay Rate)] Average Total Assets 17,754+ (2 251 x (1 - 0.35)]=1156+12,251X0.45- 203, 105 203105 17,756+1,463.15 = 19, 219,15 = 0,0946 203,165 203,105 d. Property, Plant and Equipment Turn Over. (4 points) Sales Revenue 88,873 = 0.7616 Property, Plant, Equip. 116, 1681 e. Return on Financial Leverage (4points) Return on equity - Return on Assets 14 Account Receivable Turn over (points) Net Operating Revenue - 469,162 - 69.32062648 Net Recewable 69,32 46, 768 g. Asset Tumover (Apoints) Net Operating Revenue = 469,169 = 2.309948056 Total Asset 203, 105 2.31 h. Account Payable Tum over (4points) Cost of goods sold x 100= x 100 = 352,488 x 100 = 5.9643648 Account Payable 59,099 119 * 100- 596.436 i. Return on Equity (4points) Net Income x 100 Average Share Holders Equity = 17756_x100 = 0.2325819 x 100 = 23.26 76,343 15 C. 2. If Kenny UNIQUE INTERNATIONAL reported a total revenue of $245,600, cost of goods sold of $18.950 and net income of $121,000. Her total assets are $585,000 and total liabilities are $250,000. What is her Return on equity? (Spoints) Net Income X 100 = lal,000 x 100 = 0,484 x 100 = 48.4 Aug Share Holders equity 250,000 3 This table shows the staffing and pay rates of the Frick and Frack City Fire Department: Number in Salary Grade Chief 1 $ 105,000 Shift commander 3 70,000 Firefighter 1 16 39,000 Firefighter 2 22 30,000 Clerical (part-time) 3 15,000 The Frick and Frack city is part of the federal Social Security system. The city and the employee each pay Social Security payroll taxes of 7.75 percent of all salary paid up to $ 85,000 per employee to finance federal retirement and disability insurance and 2.35 percent of all salary paid to finance Medicare. The city pays a portion of the cost of health insurance for each full-time employee, an amount equal to $ 180 per month. Full-time employees receive an allowance for uniforms of $ 750 per year. Estimate the city's full cost of fire department labor during the fiscal year, assuming no change in staffing. That is: How much did Frick and Frack City pay for the followings? PLEASE SHOW ALL YOUR WORKINGS ON HOW YOU GOT TO EACH OF THE SWERS . Salaries. (Please itemize) (12 points) Chat 2405,000 Shift Commander 3$210,0006 70,000 x 3 = furtighter I-14496 24,00 or 39.600 x 120 Ferietighter I-230060, 0002 30,000 x 23 Clerical (pat-time) 3.845,480*15, 600 x3 x 22 16 C. b. Social Security Retirement and Disabilities (10points) c. Social Security Medicare (points) d. Health Insurance (Spoints) e. Transportation Insurance points) f. What is the total full operating cost for the Frick and Frack City Fire Department during the fiscal year? (10points) TOTAL POINTS FOR THE LOOP CLOSING ASSIGNMENT 100 points) 17 Introduction to Supply Chain Management MGMT/MKTG 371 SPRING 2022 LOOP CLOSING ASSIGNMENT (100 points) Dr. Charles Awoala Briggs. STUDENT'S NAME Measurable Objective Students will apply discipline-based principles in addressing organizational problems To Address the deficiency in the learning objective assessment by CBA students, MGMT 371 students were asked to identify, define, and describe some important financial measures and the major financial drivers that are reported as the financial results of particular firm and linking the key financial measures or the associated metrics of the firm's performance to the industry performance. Table: 1 Financial Statement of Firm Performance 2021 KENNY UNIQUE International B Net operating revenues Cost of goods sold Gross profit Selling, general, and administrative expense Operating income Interest expense Other income (loss) - net Income before income taxes Income taxes Net income JR 469.162 352.488 116,674 88,873 27,801 2.251 187 25.737 7,981 17,756 Assets Cash and cash equivalents Net receivables Inventories Total current assets Property, plant and equipment Goodwill Other assets Total assets 7,781 6,768 43,803 59.940 116,681 20,497 5,987 203,105 12 C. Liabilities and Stockholder Equity Accounts payable D Short-term debt Total current liability Long-term debt Total liabilities Stockholder equity Tr. NOTE: CORPORATE INCOME TAX RATE IS 35%. 59,099 12,719 71,818 41,417 126,243 76,343 OS 1 Use the above financial result of KENNY UNIQUE International in the table to evaluate the performance of the firm based on the various financial metrics below and compare them to the industry performance. SELECTED FINANCIAL METRICS ACROSS INDUSTRIES--2000-2021 INDUSTRY AVERAGE AVERAGE AVERAGE AVERAGE SELLING, OPERATING CASH-CASH (C- INVENTORY TURNA GENERAL AND MARGIN 2C) CYCLE ADMINISTRATIVE (Netine. Interest Exp COST/REVENUE Pharmaceutical 25 190.3 2.0 .31 Medical device 18 211.6 2.2 .36 manufacturers Consumer packaged 17 28.3 5.6 .31 goods Food 16 37.4 6.2 23 Consumer electronics 12 9.3 43.8 14 Apparel .10 127.7 3.2 .35 Chemical 09 78.1 5.3 09 Automotive 04 75.9 9.9 .13 Source: Adopted from Abby Mayer: | | | | NON 1. Use the above financial result of Char-Rosie International in table 1 to evaluate the performance of the company based on the various supply chain metrics such as: . Profit Margin (6points) Renny Unique International Net Incomet (Interest Expensex [ 1 - Tax Rate] Cost of Goods Sold 17,751+ (2,251 x L)-0.35]) = 17,756+(2,251 x 0165) 352, 488 352,488 17, 756 + 1,443,15 = 0.0345 oz 0,055 352,488 352 488 19, 219,15 13 6. Inventory Turnover (2points) Cost of goods sold 352,488 = 8,04712006 sleventory 43,803 c. Return on Asset (6 points) Netalncome Henteust Expensex (1-tay Rate)] Average Total Assets 17,754+ (2 251 x (1 - 0.35)]=1156+12,251X0.45- 203, 105 203105 17,756+1,463.15 = 19, 219,15 = 0,0946 203,165 203,105 d. Property, Plant and Equipment Turn Over. (4 points) Sales Revenue 88,873 = 0.7616 Property, Plant, Equip. 116, 1681 e. Return on Financial Leverage (4points) Return on equity - Return on Assets 14 Account Receivable Turn over (points) Net Operating Revenue - 469,162 - 69.32062648 Net Recewable 69,32 46, 768 g. Asset Tumover (Apoints) Net Operating Revenue = 469,169 = 2.309948056 Total Asset 203, 105 2.31 h. Account Payable Tum over (4points) Cost of goods sold x 100= x 100 = 352,488 x 100 = 5.9643648 Account Payable 59,099 119 * 100- 596.436 i. Return on Equity (4points) Net Income x 100 Average Share Holders Equity = 17756_x100 = 0.2325819 x 100 = 23.26 76,343 15 C. 2. If Kenny UNIQUE INTERNATIONAL reported a total revenue of $245,600, cost of goods sold of $18.950 and net income of $121,000. Her total assets are $585,000 and total liabilities are $250,000. What is her Return on equity? (Spoints) Net Income X 100 = lal,000 x 100 = 0,484 x 100 = 48.4 Aug Share Holders equity 250,000 3 This table shows the staffing and pay rates of the Frick and Frack City Fire Department: Number in Salary Grade Chief 1 $ 105,000 Shift commander 3 70,000 Firefighter 1 16 39,000 Firefighter 2 22 30,000 Clerical (part-time) 3 15,000 The Frick and Frack city is part of the federal Social Security system. The city and the employee each pay Social Security payroll taxes of 7.75 percent of all salary paid up to $ 85,000 per employee to finance federal retirement and disability insurance and 2.35 percent of all salary paid to finance Medicare. The city pays a portion of the cost of health insurance for each full-time employee, an amount equal to $ 180 per month. Full-time employees receive an allowance for uniforms of $ 750 per year. Estimate the city's full cost of fire department labor during the fiscal year, assuming no change in staffing. That is: How much did Frick and Frack City pay for the followings? PLEASE SHOW ALL YOUR WORKINGS ON HOW YOU GOT TO EACH OF THE SWERS . Salaries. (Please itemize) (12 points) Chat 2405,000 Shift Commander 3$210,0006 70,000 x 3 = furtighter I-14496 24,00 or 39.600 x 120 Ferietighter I-230060, 0002 30,000 x 23 Clerical (pat-time) 3.845,480*15, 600 x3 x 22 16 C. b. Social Security Retirement and Disabilities (10points) c. Social Security Medicare (points) d. Health Insurance (Spoints) e. Transportation Insurance points) f. What is the total full operating cost for the Frick and Frack City Fire Department during the fiscal year? (10points) TOTAL POINTS FOR THE LOOP CLOSING ASSIGNMENT 100 points) 17

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock