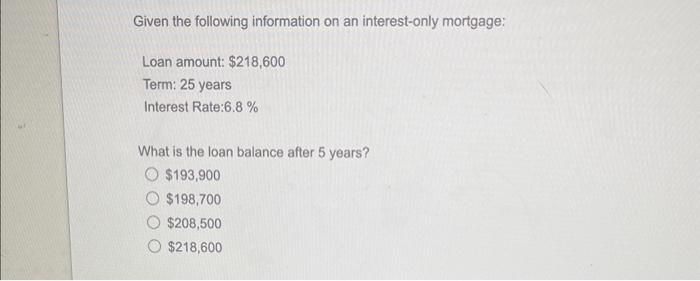

Question: Can you please help me solve these two questions! Given the following information on an interest-only mortgage: Loan amount: $218,600 Term: 25 years Interest Rate:6.8%

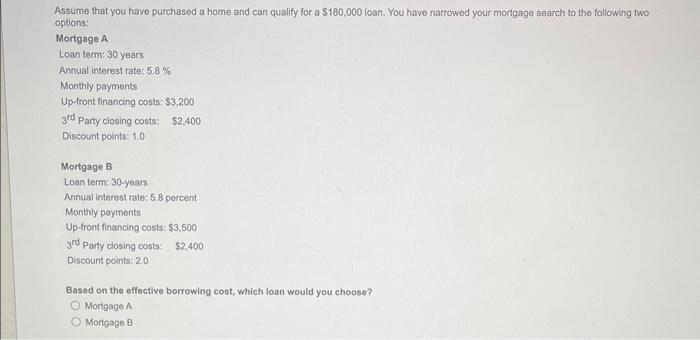

Given the following information on an interest-only mortgage: Loan amount: $218,600 Term: 25 years Interest Rate:6.8\% What is the loan balance after 5 years? $193,900 $198,700 $208,500 $218,600 Assume that you have purchased a home and can qualify for a $180,000 loan. You have narrowed your mortgage search to the following two options: Mortgage A Loan term: 30 years Annual interest rate: 5.8% Monthly payments Up-front financing costs: $3,200 3rd Party closing costs: $2,400 Discount points: 1.0 Mortgage B Loan term: 30-years Annual interest rate: 5.8 percent Monthly payments Up-front financing costs: $3,500 3rd Party closing costs: $2,400 Discount points: 2.0 Basod on the effective borrowing cost, which loan would you choose? Mortgage A Mortgage B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts