Question: CAN YOU PLEASE HELP ME SOLVE THIS Indicate whether each of the following statements is true or false. a) The amount of federal tax withheld

CAN YOU PLEASE HELP ME SOLVE THIS

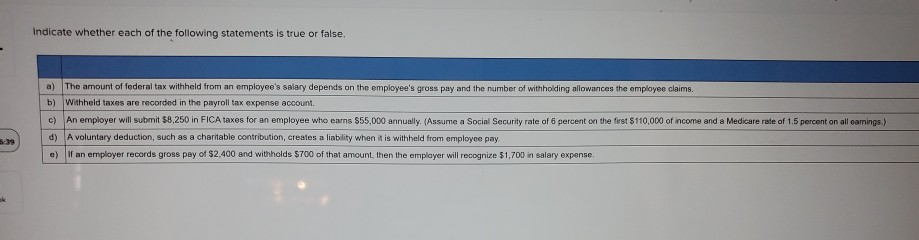

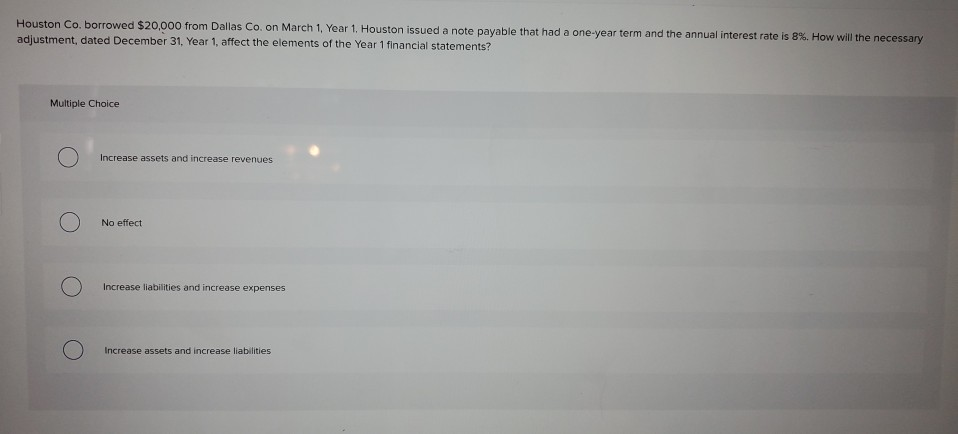

Indicate whether each of the following statements is true or false. a) The amount of federal tax withheld from an employee's salary depends on the employee's gross pay and the number of withholding allowances the employee claims. b) Withheld taxes are recorded in the payroll tax expense account. c) An employer will submit $8,250 in FICA taxes for an employee who earns $55,000 annually. (Assume a Social Security rate of 6 percent on the first $110,000 of income and a Medicare rate of 1.5 percent on all earings.) d) A voluntary deduction, such as a charitable contribution, creates a liability when it is withheld from employee pay e) If an employer records gross pay of $2.400 and withholds $700 of that amount, then the employer will recognize $1,700 in salary expense. Houston Co. borrowed $20,000 from Dallas Co. on March 1, Year 1. Houston issued a note payable that had a one-year term and the annual interest rate is 8%. How will the necessary adjustment, dated December 31, Year 1, affect the elements of the Year 1 financial statements? Multiple Choice ) Increase assets and increase revenues No effect Increase liabilities and increase expenses ) increase assets and increase liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts